Yes, Metcalfe’s Law can help explain Bitcoin’s price formation — to some extent. It is relevant to Bitcoin since it implies that the value and utility of the Bitcoin network rise exponentially with its number of users and participants (holders, investors and traders).

The adoption of Bitcoin has been accompanied by a positive feedback cycle in which increased users have resulted in a rise in BTC’s value, drawing even more players. Bitcoin had a small user base in the early days, and its value was relatively low.

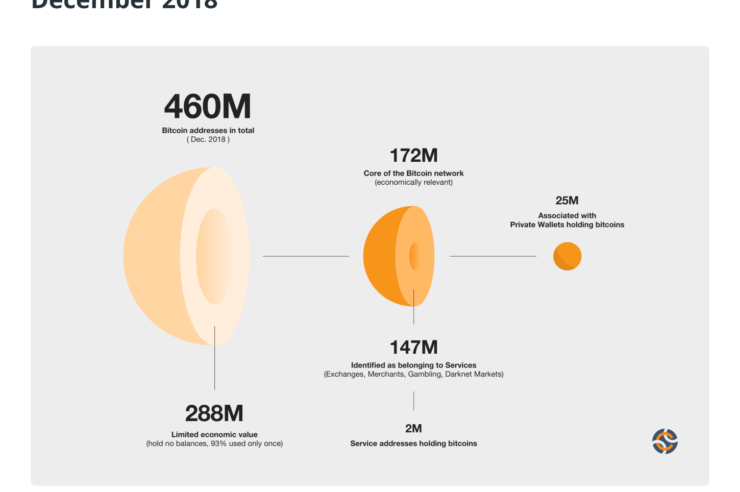

However, when more individuals became aware of and began using the digital currency, its usefulness increased, and the network effect started to take hold. The number of Bitcoin users (wallet addresses) crossed 400 million globally in December 2018 — almost a decade after its inception — illustrating the extent of its acceptance.

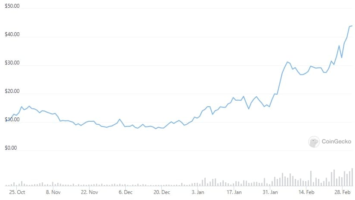

The rise in the price of Bitcoin during the 2017 bull run is one of the ideal instances of Metcalfe’s Law in action. More people entered the market as public and media interest in cryptocurrencies grew, which helped to drive up the number of people using BTC. A rise in demand resulting from this increased adoption drove the price of Bitcoin to all-time highs.

The security network effect also significantly impacted how Bitcoin’s price developed. The security of the blockchain improved with more network participation from miners, which raised user and investor confidence. This, in turn, increased trust in the digital asset, encouraging further adoption and price growth.

Despite its applicability, Metcalfe’s Law falls short of fully describing the intricate dynamics of Bitcoin’s pricing. Numerous elements, such as market sentiment, governmental changes, macroeconomic trends and technology improvements, impact the cryptocurrency market. Additionally, because of Bitcoin’s volatility, speculation can greatly impact short-term price changes.

Therefore, potential drawbacks of Metcalfe’s Law for cryptocurrencies, including oversimplifying network value, ignoring connection quality and neglecting external factors, may influence a digital asset’s price. It might not take into consideration ventures with cutting-edge technology but low acceptance. On the other hand, temporary bubbles with inflated valuations may lead to price speculation, implying that one must exercise caution while applying Metcalfe’s law to cryptocurrencies.

Comments (No)