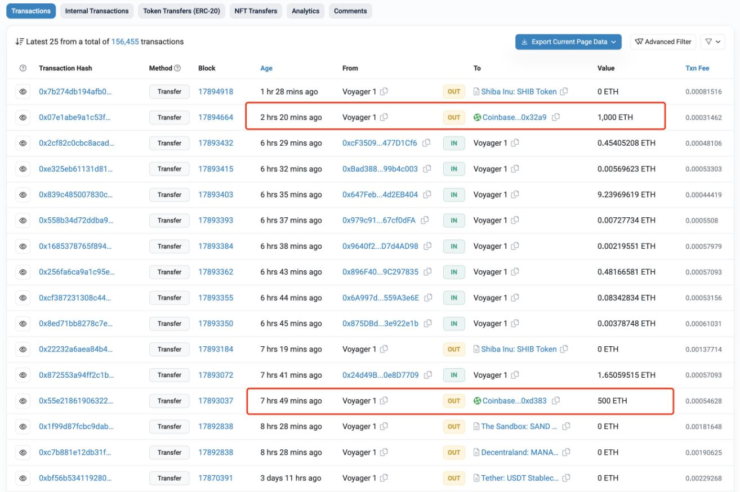

Bankrupt cryptocurrency lender Voyager Digital transferred 1,500 Ether (ETH), worth around $2.77 million and an additional 250 billion Shiba Inu (SHIB), worth roughly $2.7 million, to crypto exchange Coinbase on Aug.11, according to Etherscan.

The motive behind the transactions has triggered speculation within the broader crypto community. One theory suggests a probable sell-off, given that the transfers have diminished the distressed crypto lender’s wallet holdings to $81.63 million of digital assets.

The transactions occurred at one-hour intervals, according to Etherscan. The abrupt movement of the tokens has triggered discussions regarding a possible liquidation. However, some sources say that Voyager is consolidating all tokens from various addresses into a primary address.

The speculation of a sell-off is further supported by Voyager’s ongoing divestment of its SHIB holdings since the start of 2023. In February, the company executed transfers of nearly $10 million worth of digital assets to multiple cryptocurrency exchanges in a single day.

The tokens moved include 270 billion SHIB, worth $3.2 million; 4.9 million Voyager Token (VGX), worth $2.1 million; 3,050 ETH, worth $3 million; and 221,000 Chainlink (LINK), worth $1.5 million.

Related: Voyager customers targeted by scammers during 30-day withdrawal period: Report

Following Binance.US’s court-sanctioned acquisition of the lender’s assets, blockchain analysis platform Lookonchain disclosed that Voyager liquidated digital holdings exceeding $56 million across three cryptocurrency exchanges. Approximately three months later, the insolvent exchange engaged in various transactions involving the transfer of around 350 billion SHIB tokens.

Magazine: Deposit risk: What do crypto exchanges really do with your money?

Comments (No)