Ethereum co-founder Vitalik Buterin proposed a new “multidimensional” approach to gas fees this week. By charging different gas prices depending on the resource used, he thinks users will benefit from optimal gas costs.

High Ethereum gas fees have been a persistent problem since DeFi took off in the summer of 2020. And it’s not uncommon to hear of people paying hundreds of dollars to use the network.

As expected, the uproar over this situation forced devs to act, and they did with the rollout of EIP 1559, which went live on August 5, 2021.

EIP 1559 brought in several changes, but primarily it shelved the auction bidding system in favor of a moving base fee system. In other words, gas fees would not be driven by users bidding higher to have their transactions processed first.

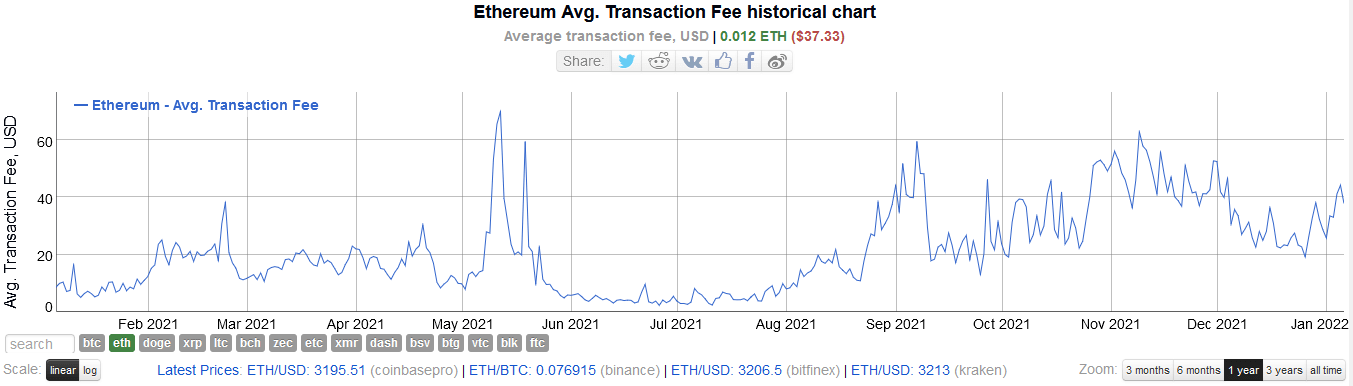

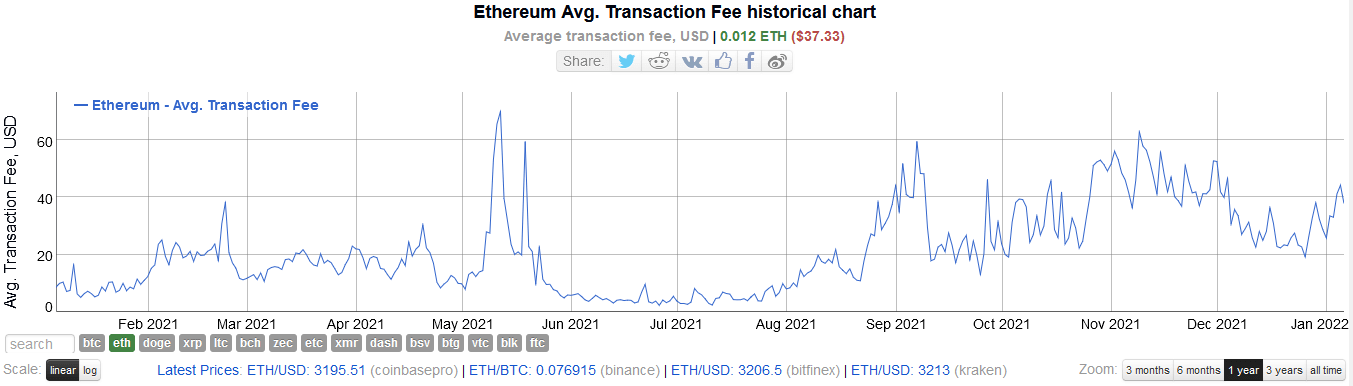

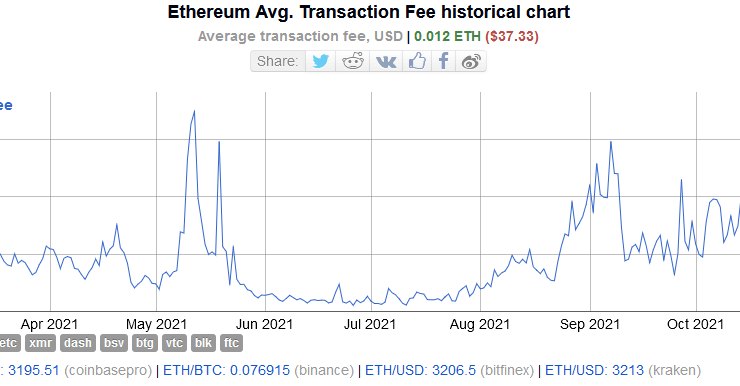

Analysis of average gas fees in dollars shows June 2021 to August 2021 as a period of (relatively) low gas costs, hovering around $6/$7. But post-EIP 1559, gas fees have shot up, peaking at $62.84 on November 9, 2021. As of today, the average fee comes in at $37.33.

With that in mind, some would argue EIP 1559 was a failure because the most significant factor in determining gas fees is network capacity (or lack of in this case), not the method used to ascribe an individual user’s transaction cost.

As such, will a “multidimensional” approach to the problem be any different?

Was Ethereum Improvement Proposal (EIP) 1559 a failure?

Based on the raw numbers above, EIP 1559 did not lower gas fees, making it unsuccessful in that respect.

However, proponents of EIP 1559 say it was never meant to lower gas fees, only to make fees more transparent and predictable.

The thinking here is that users would know upfront how much it would cost to put through a transaction. That way, they could decide whether or not to go ahead.

At present, ConsenSys’ vision of a “world computer” in the Ethereum network does not tally with the general user experience.

Some would argue that Ethereum is a victim of its own success and will eventually nail the gas fee problem as a work in progress.

What is Buterin’s new “multidimensional” approach?

In another attempt to solve the problem, Buterin noted that different Ethereum Virtual Machine (EVM) resources have different gas usage demands.

Expanding further, he differentiates “burst capacity,” how much capacity we could handle for one or a few blocks, and “sustained capacity,” how much capacity we would be comfortable having for a long time.

“The scheme we have today, where all resources are combined together into a single multidimensional resource (“gas”), does a poor job at handling these differences.”

The revised “multidimensional EIP 1559” would use a mathematical formula to adjust the ratio of burst and sustained capacities. From that, Buterin puts forward two options:

The first is to calculate the gas fees for resources by dividing the base fee for each unit of resource by the total base fee. This would derive a base fee that is fixed per block.

Alternatively, the base fee is set for using resources but incorporates burst limits on each resource. There would are also “priority fees” paid to the block producer.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)