In a recent survey conducted by Trezor, nearly 75% of respondents expressed concerns over the potential control the U.K. government could have over access to funds via its proposed Central Bank Digital Currency (CBDC).

Further responses suggested a strong degree of public concern about their implementation, including worries about imposing time limits on holdings.

Trezor commissioned market research firm Obsurvant to carry out the survey – which was informed by the responses from 1,037 U.K.-based people completing the poll online.

Central Bank Digital Currency concerns

The Bank of England (BoE) launched a public consultation on the digital pound in February, giving Brits the opportunity to engage with the process. The consultation closed on June 30.

Although the BoE stated that no decision had been made on rolling out the digital pound, it also said a CBDC is likely needed in the future.

The general sentiment towards CBDC, according to survey respondents, is one of caution. For example, investor George Gammon recently raised concerns over the Bank of International Settlement’s latest economic report, specifically the section titled “Blueprint for the future monetary system: Improving the old, enabling the new.”

Sharing his take, Gammon said he had the “horrifying realization” that a “unified ledger,” and the tokenization of all private property on that ledger, could mean outlawing particular assets simply by refusing to add them to the system.

“So they don’t have to make #bitcoin, gold, silver, cash illegal they just won’t transfer legal ownership of property unless it’s paid for with money that has been tokenized and operates within the ecosystem of their unified ledger.“

Similarly, former Member of the European Parliament Ben Habib called CBDCs “the antithesis of Bitcoin and cryptocurrencies,” in that all transactions within a CBDC system would be subject to government surveillance and potential intervention.

“This Central Bank Digital Currency is the ultimate in a regulated currency. Every single currency unit will be registered in your name at the BoE, and they will know precisely what you did with it, and they can do with that unit of currency whatever they wish.”

However, Jan3 CEO Samson Mow believes the issue isn’t as draconian as assumed, recently implying that Bitcoin holders will have a choice on whether to participate.

Digital pound survey results

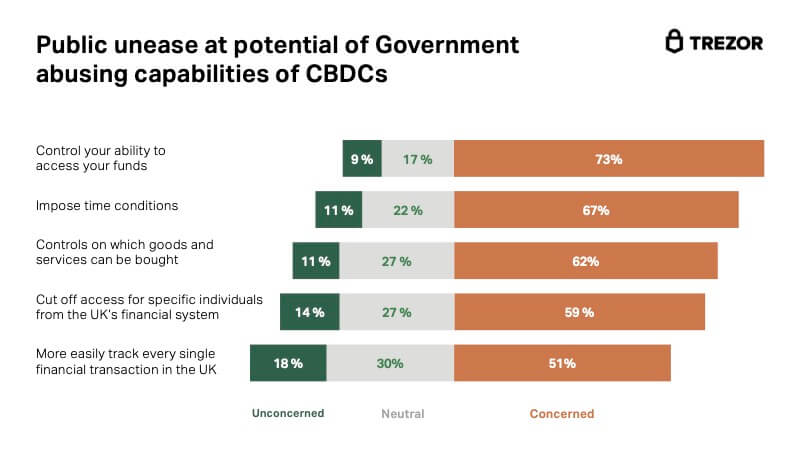

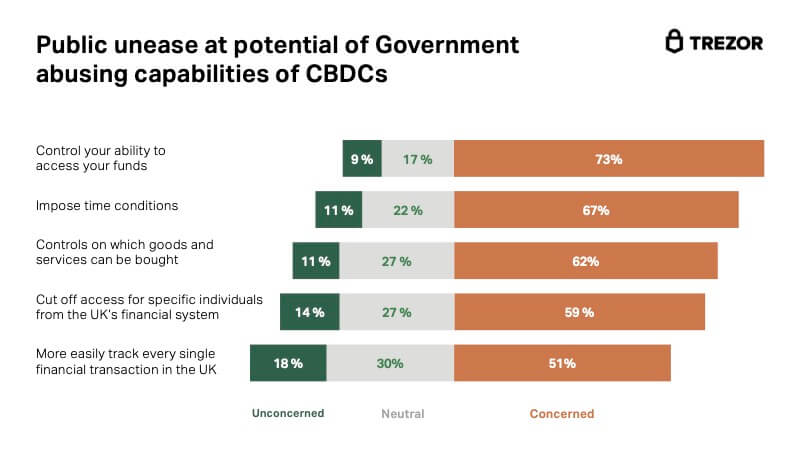

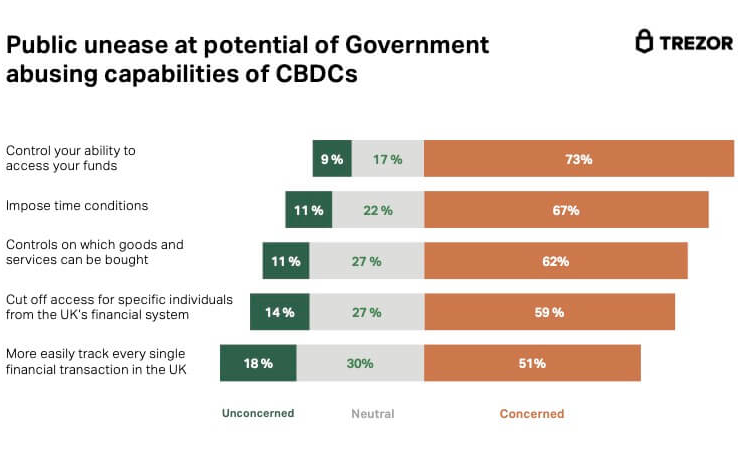

The results of the Trezor-Obsurvant survey echoed the general apprehension towards CBDCs and their potential misuse by governments and financial authorities.

It revealed that 73% of respondents are worried about U.K. authorities controlling access to their funds. In addition, 67% expressed unease over the potential to impose time conditions on spending, and 59% believe that U.K. authorities would likely use a digital pound to block specific individuals from using money – all of which suggest a strong degree of public concern about CBDCs.

The survey also revealed that 46% of respondents were not confident the U.K. government could safeguard the pound’s value and living standards over the next three years – whereas 31% believe authorities could achieve those goals.

Commenting on the findings, an analyst at Trezor, Josef Tětek, said:

“Before the UK, or any other country for that matter, goes too far down the path to roll-out, we need a comprehensive, society-wide debate with ordinary people being made aware of the long-term implications of what the introduction of programmable, trackable, government-controlled money could mean.”

Comments (No)