The relatively lackluster performance of nine new Ethereum futures exchange traded funds (ETFs) has prompted analysts at K33 Research to urge a “rotate back” into Bitcoin (BTC).

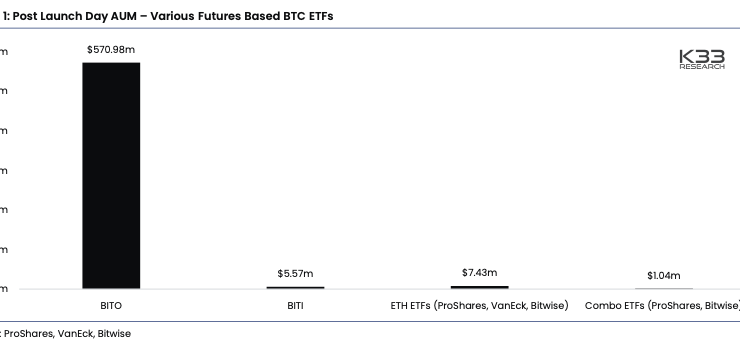

In an Oct. 3 market report, analysts Anders Helseth and Vetle Lunde said that it’s “time to pull the brakes on ETH and rotate back into BTC,” with the initial trading volume of Ether futures ETFs only accounting for 0.2% of what the ProShares Bitcoin Strategy ETF (BITO) amassed on its first day of trading in Oct. 2021.

While the analysts noted that no one expected to see initial trading volume on the Ether futures ETFs “come anywhere close” to that of the Bitcoin futures ETFs — launched amid a raging bull market — the underwhelming first-day numbers “strongly” missed expectations.

This lack of institutional appetite for Ether ETFs caused Lunde to walk back on his previous advice of increasing ETH allocation to best capitalize on the ETF hype.

“The ETH futures ETF launch provides an important lesson for evaluating the impact of easier access to crypto investments for traditional investors: increased institutional access will only create buying pressure if significant unsatiated demand exists,” wrote Lunde.

“This is not the case for ETH at the moment.”

In the section of the report titled “more chop ahead,” Lunde explained that the vast majority of the crypto market lacks any meaningful short-term price catalysts and will most likely continue on its sideways trajectory for the foreseeable future.

Related: Bitcoin bull market awaits as US faces ‘bear steepener’ — Arthur Hayes

In Lunde’s view, this landscape is only really favorable for Bitcoin, which has a potential spot for ETF approval to look forward to early next year, as well as the halving event which is currently on track for mid-April.

“The gravitational pull in crypto for the time being stays in BTC, with a promising event horizon down the line, still favoring aggressive accumulation.”

Ben Laidler, global markets strategist at eToro, charted a similar path ahead for crypto assets, albeit with a slightly more bearish sentiment.

In emailed comments to Cointelegraph, Laidler pointed to current macro trends as a potential downward trigger for prices of mainstay crypto assets like Bitcoin.

“The Fed and oil prices have been consistently powerful macro influencers on the crypto market in the past couple of years,” wrote Laidler. “At the late stage of the rate hike cycle we’re in, the market is looking for further good news to push on, but with oil prices rising again, this could have a cooling effect on sentiment.”

Magazine: Blockchain detectives — Mt. Gox collapse saw birth of Chainalysis

Comments (No)