The International Monetary Fund stated in their blog that “financial stability risks could soon become systemic in some countries.” In this discussion of “crypto assets” and “associated products,” the IMF stated their opinions on the stability of the markets, the establishment of global oversight to take the reins where nation-states are failing to halt the progress of the rising asset class, licensing, and authorization to operate in the space, closing off the markets with liquidity requirements, and what they call “cryptoization” — because apparently no one knew how to properly explain hyperbitcoinization to them. However, there’s one point I want to hit before dissecting the information in this blog post.

International Monetary Fund Credentials

If you were to visit the IMF blog yourself, you would find that much like Bitcoin Magazine, the IMF has guest contributions. This is how they describe the authors of their content.

“IMFBlog is a forum for the views of the International Monetary Fund (IMF) staff and officials on pressing economic and policy issues of the day.” – IMF Blog Home

That being said, you’ll typically find a guest disclaimer at the bottom of a post when it is not of an official staff member of the IMF, or unrepresentative of the organization. Let it be known that there is no such disclaimer at the bottom of the article in discussion in which all quotes, unless otherwise noted, are from, “Global Crypto Regulation Should Be Comprehensive, Consistent, And Coordinated“.

These are the authors of this particular article:

· Tobias Adrian – “Financial Counsellor and Director of the IMF’s Monetary and Capital Markets Department”

· Dong He – “Deputy Director of the Monetary and Capital Markets Department (MCM) of the International Monetary Fund”

· Aditya Narain – “Deputy Director in the IMF’s Monetary and Capital Markets Department”

If it hasn’t been made abundantly clear at this point, this article is 100% representative of the official position of the International Monetary Fund. Now, let’s begin.

Regulation And Global Risk

“Crypto assets and associated products and services have grown rapidly in recent years. Furthermore, interlinkages with the regulated financial system are rising. Policy makers struggle to monitor risks from this evolving sector, in which many activities are unregulated. In fact, we think these financial stability risks could soon become systemic in some countries.”

In typical end-of-financial-times fashion, the IMF is “concerned” about unregulated digital assets. This isn’t new or a change of opinion, this is right on par with the norm from them, but they are clearly growing more concerned with the actions of policymakers and their idea of destabilization in certain countries as a result.

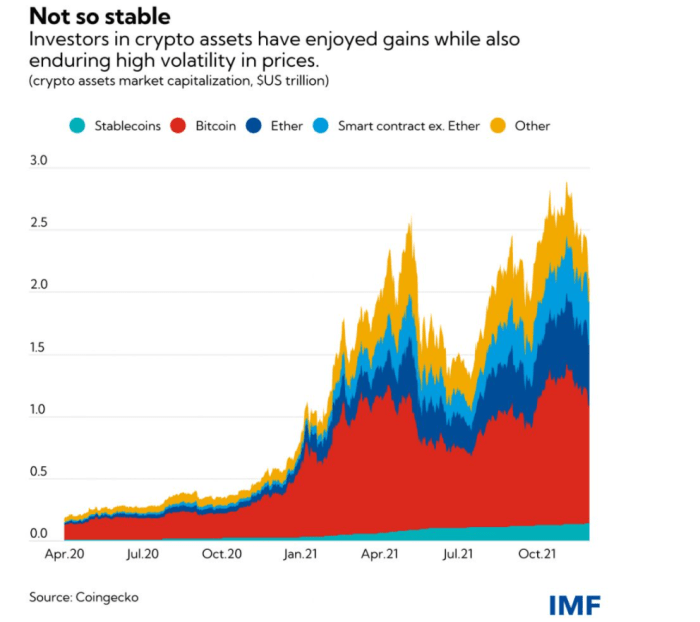

In this chart sourced by Coingecko, they try to represent the failure of crypto assets to stabilize, but the picture is painted with a dollarized brush.

While there is high volatility in some crypto assets, most Bitcoiners will explain that bitcoin is not volatile. One bitcoin remains worth one bitcoin, no matter the price.

This is entirely determined by your unit bias, or what unit you base the determination of value on. If you value Bitcoin in dollars, the dollar as a medium of exchange is highly volatile with an infinite number of units, meaning you will value your bitcoin as if it is volatile. If you value Bitcoin in bitcoin, or sats, then one bitcoin is always one bitcoin, and a more stable asset has never existed. Bitcoiners rarely measure the value of a bitcoin by its dollarized caricature.

“Cryptoization” And Global Action

“Moreover, in emerging markets and developing economies, the advent of crypto can accelerate what we have called “cryptoization”—when these assets replace domestic currency, and circumvent exchange restrictions and capital account management measures.”

I’m going to be honest; I’d never heard the term “cryptoization” before reading this blog. Hyperbitcoinization? Sure, I’m confident most people in the Bitcoin space, or other crypto asset spaces with Ethereum and their “flippening,” we have all heard those terms before. I genuinely want to know if this is just how out-of-the-loop these writers are on a constant basis, or if these are just small gut-punches they throw out every now and then to Bitcoiners.

Notice the anger they denote towards the circumvention of “exchange restrictions” and “account management measures.” This would be the equivalent of a cryptocurrency platform saying you can’t day trade without $25,000 in the bank, you know, like stockbrokers. These are the standard methods to keep the lower-class where they want them: broke and reliant on the system, otherwise why would they want to keep it around? They simply want those that have to have more, and those without to need more from the system.

“The Financial Stability Board, in its coordinating role, should develop a global framework comprising standards for regulation of crypto assets.”

China couldn’t ban it and take it down, Turkey failed to do the same, and Iran went after mining before changing their mind.

These are hardly the only examples, but the point remains that none of these actions has led to unsustainable damage. In fact, they make the network stronger as those who operate within the network in places that allow legislation like this to happen tend to migrate to places where they are more welcome.

If this framework cannot be achieved at the nation-state level, then a global initiative is required.

“The objective should be to provide a comprehensive and coordinated approach to managing risks to financial stability and market conduct that can be consistently applied across jurisdictions, while minimizing the potential for regulatory arbitrage, or moving activity to jurisdictions with easier requirements.”

“Market conduct” meaning they want to control who is allowed to enter the market. “Minimizing the potential for regulatory arbitrage” means putting conditions in place that allow for controlled arbitrage that benefits the system, and “moving activity to jurisdictions with easier requirements” means when China says they want to ban Bitcoin, they want to punish you for running miners.

“Countries are taking very different strategies, and existing laws and regulations may not allow for national approaches that comprehensively cover all elements of these assets. Importantly, many crypto service providers operate across borders, making the task for supervision and enforcement more difficult. Uncoordinated regulatory measures may facilitate potentially destabilizing capital flows.”

Nation-states have failed and there will not be a national approach that works well enough to make a dent. Exchanges and service providers operate across borders, making it hard for one nation to prosecute. The absence of a global crypto asset dominance will destabilize the dollar. Translated well enough? Let’s keep moving.

Three-Part Global Regulatory Framework

1. “Crypto asset service providers that deliver critical functions should be licensed or authorized. These would include storage, transfer, settlement, and custody of reserves and assets, among others, similar to existing rules for financial service providers. Licensing and authorization criteria should be clearly articulated, the responsible authorities clearly designated, and coordination mechanisms among them well defined.”

The IMF wants to be Oprah with licenses. “You get a license! And you! And you over there mining your Bitcoin, you get a license too!”

· “Storage” meaning wallet providers or custodial services.

· “Transfer” meaning the creation or mining of a block that facilitates a transfer of funds, or being a Layer 2 operator that transfers funds.

· “Settlement” which could be the validation process, the process of running a node for the network which finalizes transactions, or possibly custodial settlement for exchanges.

· “Custody Reserves” is just a custodial service.

Does the language seem ambiguous? That’s because it is. The intention is to be open-ended, so while it might seem like those words are being stretched to meet a definition, that’s absolutely their intent.

What does adding licensing to open a node or a single miner do to the ecosystem? Correct, it centralizes toward those who can afford licensing (and are willing to surrender their rights to privacy), adding more barriers of entry, keeping people out.

2. “Requirements should be tailored to the main use cases of crypto assets and stablecoins. For example, services and products for investments should have requirements similar to those of securities brokers and dealers, overseen by the securities regulator. Services and products for payments should have requirements similar to those of bank deposits, overseen by the central bank or the payments oversight authority. Regardless of the initial authority for approving crypto services and products, all overseers — from central banks to securities and banking regulators — need to coordinate to address the various risks arising from different and changing uses.”

Notice the use of legacy financial institutional terminology to bridge comparisons between crypto assets. The IMF is very clearly lining out how to control this global market, just like they have been since 1944, by using the system they already know. They want every central banking system, regulator, and market maker working together to control the market that they have openly admitted has the opportunity to destabilize the current system.

3. “Authorities should provide clear requirements on regulated financial institutions concerning their exposure to and engagement with crypto. For example, the appropriate banking, securities, insurance, and pension regulators should stipulate the capital and liquidity requirements and limits on exposure to different types of these assets, and require investor suitability and risk assessments. If the regulated entities provide custody services, requirements should be clarified to address the risks arising from those functions.’’

Regulate engagement to cryptocurrency. “Stipulate the capital and liquidity requirements,” “require investor suitability and risk assessments.”

They cannot make it clearer that they simply want to control who can and cannot play in the space. Money is only for those that have already, and they want to set the rules in order to make sure that you cannot play.

“Some emerging markets and developing economies face more immediate and acute risks of currency substitution through crypto-assets, the so-called cryptoization. Capital flow management measures will need to be fine-tuned in the face of cryptoization. This is because applying established regulatory tools to manage capital flows may be more challenging when value is transmitted through new instruments, new channels and new service providers that are not regulated entities.”

“New instruments”. What could that mean? Well the IMF wasn’t happy with the decision of El Salvador to adopt Bitcoin. Since there has only been one nation-state to take this level of adoption, we have to infer that on a certain note, they are talking about El Salvador. So, a “new instrument” could be the Chivo wallet: a government-operated custodial crypto wallet.

“New channels” is probably referring to the Lightning Network, a Layer 2 application built on top of Bitcoin that allows for instant transfer of value, which broadcasts all transactions on-chain once the channel is closed, that is accepted by the Chivo wallet.

“New service providers” pick one. My money is they are talking about platforms like Strike.

In Closing

“There is an urgent need for cross-border collaboration and cooperation to address the technological, legal, regulatory, and supervisory challenges. Setting up a comprehensive, consistent, and coordinated regulatory approach to crypto is a daunting task. But if we start now, we can achieve the policy goal of maintaining financial stability while benefiting from the benefits that the underlying technological innovations bring.”

The IMF just wants to make sure THEY are the ones benefiting from cryptocurrency gains and adoption, as well as allowing all of their friends that already control the largest portions of wealth in the world to come and stick their fat faces into this rising digital pie.

Go check out why the IMF and World Bank are basically Shaggy & Scooby Doo in this other article about the IMF hating Bitcoin.

This is a guest post by Shawn Amick. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Comments (No)