Crypto assets within the Cosmos ecosystem have been on a run since the start of 2022, thanks to an intensified focus on brokering cross-chain compatibility with other blockchains. One decentralized finance (DeFi) protocol that has benefited from the current expansion plans is Osmosis (OSMO).

Osmosis is the first decentralized exchange (DEX) servicing projects connected through the Interblockchain Communication Protocol (IBC) and data from Cointelegraph Markets Pro show OSMO price surged 123% from a low of $4.05 on Dec. 17 to a new all-time high at $9.24 on Jan. 7.

Three reasons for the price growth seen in OSMO include a surge in trading volume on the DEX, a record high in the total value locked on the protocol and the release of cross-chain bridges that connect the Cosmos (ATOM) ecosystem with other Ethereum (ETH) Virtual Machine (EVM) compatible networks.

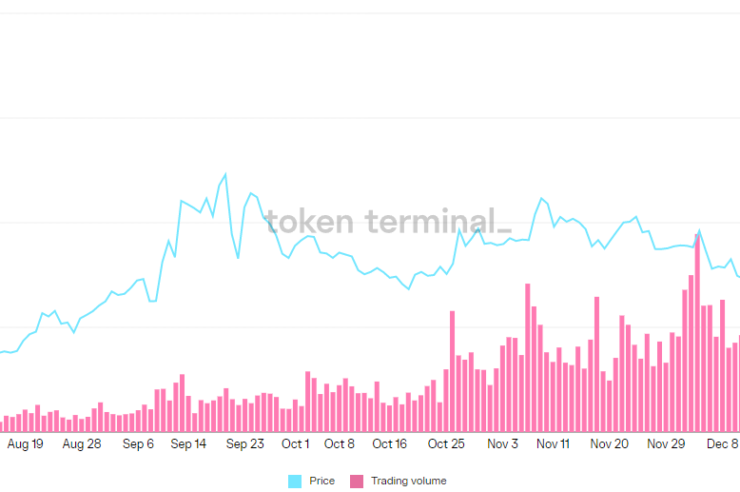

Trading volume surges

One of the biggest factors helping drive the price of OSMO has been the significant increase in trading volume on the exchange. According to data from Token Terminal, trading volume hit a record high of $186.8 million on Jan. 7 and a new all-time high was set on the same day.

The spike in trading volume and token price briefly resulted in Osmosis becoming the third ranked DEX by market capitalization as highlighted in the following tweet from Twitter user Jimmy Yang.

3rd largest DEX token is a @Cosmos DEX $OSMO $ATOM pic.twitter.com/UbBNur2Dsr

— Jim Yang is hiring (@proofstake) January 6, 2022

Other factors that have helped bolster the price of OSMO as trading volume increased include the fact that more than 81 million OSMO are currently staked on the network, according to data from SmartStake. Furthermore, a large portion of the supply is also being used to provide liquidity in the various liquidity pools offered on Osmosis.

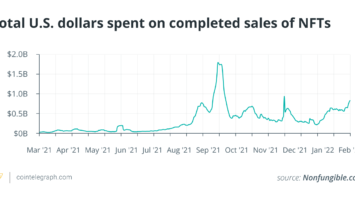

Total value locked on the rise

A second development laying out the bullish case for OSMO has been the steady increase in total value locked on the protocol, which hit a record $1.21 billion on Jan. 11, according to data from Defi Llama.

The climbing TVL comes as multiple tokens in the Cosmos ecosystem hit new highs. Notably, ATOM, which is the most recognizable asset from Cosmos, hit a daily high of $43.64 on Jan. 7, which is just a dollar below its all-time high. Osmosis’ second native token, ION, also hit a new high at $16,500 on Jan. 11.

Related: 3 reasons why Cosmos (ATOM) price is near a new all-time high

Cross-chain ease the burden for traders

A third reason for the bullish turn in OSMO is the increased attention Cosmos has directed toward EVM compatibility and cross-chain bridges.

Evmos is a current project in development that is working on becoming the first IBC-compatible EVM-based chain and it is currently supporting ERC-20 tokens on its testnet.

IBC-enabled ERC20 tokens

Now live on @EvmosOrg’s incentivized testnet!#IBCGang @cosmosibc @cosmos https://t.co/0knQk4gf9G

— Federico Kunze Küllmer (@fekunze) December 22, 2021

Injective, a L1 protocol, has also revealed that is developing cross-chain bridges for Cosmos-based projects and it is currently working on support for OSMO.

Sneak peek at the latest Injective Bridge IBC integration @osmosiszone ⚛️ @InjectiveLabs

The @cosmos IBC ecosystem is growing stronger everyday! pic.twitter.com/rVoRdQxjh0

— Injective (@InjectiveLabs) January 4, 2022

As cross-chain bridges come online and allow tokens from other EVM-compatible networks to bridge into the Cosmos Hub, Osmosis has the potential to see further increases in trading volume and TVL simply because it is the main DEX for the Cosmos ecosystem at this time. If this were to occur, there’s also the possibility that OSMO price could appreciate further.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Comments (No)