Accounts monitoring blockchains for major mints, trades and token transfers have flagged a $1 billion authorization of USDT in Tether’s Treasury that is set to provide near term USDT liquidity for the Tron network.

Blockchain tracker WhaleAlert highlighted the $1 billion authorization on X (formerly Twitter), which drew a quick fire response from Tether CTO Paolo Ardoino who said that the USDT tokens would be used as inventory to “replenish” the Tron network.

Ardoino added that the event was an authorization and not an actual issuance, with the allocated amount set to serve as inventory for upcoming issuance requests and chain swaps from the Tron network.

PSA: 1B USDt inventory replenish on Tron Network. Note this is a authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps.https://t.co/Y1bqxZglgR

— Paolo Ardoino (@paoloardoino) September 19, 2023

As per Tether’s official FAQ page, “authorized but not issued” USDT are required to secure the creation and issuance process of tokens:

“By creating “authorized but not issued” USDT, Tether limits the number of times Tether’s signers need to access their authorization private keys, thereby reducing their exposure to security threats.”

Authorizing USDT in the Tether treasury allows the company to issue USDT instantaneously once customer funds are received to ensure that the issuer maintains 100% of its reserves.

As Cointelegraph previously reported, USDT tokens issued on the Tron blockchain hit all-time highs in 2023. The network accounts for $42.8 billion USDT tokens in circulation while the Ethereum blockchain has around $39 billion USDT circulating on-chain.

Tether’s CTO recently explained similarly significant USDT authorizations that have been flagged by blockchain trackers, with a $1 billion USDT mint to support Ethereum chain-swaps taking place in June 2023.

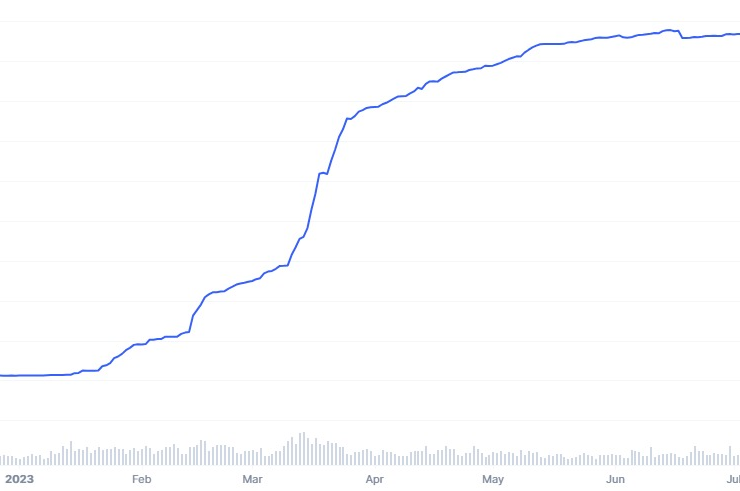

Tether has seen its market capitalization tip past $83 billion in 2023, having minted some $16 billion in USDT since January. USDT remains the leading US Dollar pegged stablecoin by market capitalization.

In contrast, Circle’s USDC stablecoin has seen its market cap decline from $50 billion at the start of 2023 to $26 billion at the time of publication.

The collapse of Silicon Valley Bank (SVB) is cited to have influenced USDC’s drop in market cap, with Circle having $3.3 billion tied up in the institution at the time of its collapse in March 2023.

Magazine: Deposit risk: What do crypto exchanges really do with your money?

Comments (No)