Philippines-based fintech company PayMaya launched a new feature that allows users to buy, trade, cash in, and spend cryptocurrencies using their accounts within the app for free.

The new feature aims to provide a full-suite crypto experience for its users. It will work within the PayMaya app and will not require separate registration to crypto exchanges, creating a wallet, or going through KYC processes.

Acknowledging the rise in popularity of crypto, PayMaya President Shailesh Baidwan said:

“With the PayMaya e-wallet already a part of their everyday life for daily purchases and transactions, our customers now want to be able to buy and earn crypto smartly and seamlessly. That is why we are making it an integrated feature in our e-wallet app.”

For now, the app supports Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), Chainlink (LINK), Uniswap (UNI), Solana (SOL), Quant (QNT), Polkadot (DOT), Polygon (MATIC), and Tether (USDT). According to PayMaya, the number of supported assets will grow progressively.

PayMaya also added that the app would offer information about crypto assets so its users can easily learn how to use and invest in crypto.

Crypto in the region

According to Gemini’s 2022 Global State of Crypto report, the Asia-pacific region has one of the highest crypto adoption rates. 82% of the region sees crypto as a store of value, while 56% say trading crypto assets is a good way to achieve profits.

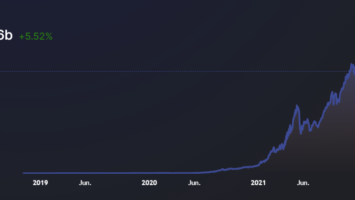

The Philippines is one of the recent high adopters in the region. The Central Bank of the Philippines’ data shows that in the first half of 2021, crypto transaction volumes increased by 362%, reaching $20 million. About 28% of the adults say they own cryptocurrency, while an average Filipino investor holds 5% of their assets in crypto.

PayMaya is licensed by the Philippines Central Bank and has more than 44 million users. Commenting on the popularity of their platform and the high crypto adoption rates, Baidwan said:

“Being at the forefront of digital payments and financial services, expanding into crypto is part of our roadmap as we build the Philippines’ most accessible end-to-end money platform,”

Comments (No)