The 2022 tax season is coming to an end without many challenges. For the first time in three years, the Internal Revenue Service (IRS) will be able to meet the scheduled deadline, April 18. The agency managed to process millions of individual returns despite the lingering complications from the COVID-19 pandemic.

Previously, the IRS officials warned taxpayers to brace for a challenging and frustrating experience rife with delays and customer-service shortages.

Commenting on what has been mostly a seamless tax season, Mark Jaeger, the VP of Tax Operations at tax-prep software company TaxAct, said,

“For most taxpayers who have fairly simple taxes, and they e-file and they choose direct deposit, that process — for the most part — has been very smooth.”

However, filing the returns of day traders leveraging platforms like Robinhood proved a bit challenging. Nicole Rosen, a Washington-based tax preparer, pointed out that she witnessed a sharp uptick in the number of clients using services like Robinhood to buy and sell stock.

According to her, trading stocks requires additional forms that complicate the returns filing process. Rosen specified that the time needed to complete filing such returns is about four hours, while normal filings take approximately two hours.

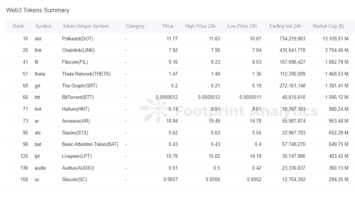

IRS continues pushing for crypto taxation

While the filing process went smoothly, the IRS caught many taxpayers by surprise by requiring them to report crypto acquisitions and sales. According to Mike Greenwald, a partner at Friedman LLP, this requirement was especially surprising to new crypto owners.

He added,

“It requires a conversation that clients weren’t expecting to have. They don’t think about digital currencies the same way the IRS does.”

This news comes as the IRS continues trying to find the best approach to tax the crypto sector. For instance, the agency is adamant about taxing Proof-of-Stake (PoS) mining rewards as income.

However, Joshua Jarrett took the IRS to court in 2019 over the matter, arguing that the rewards should be considered newly created property and should not be taxed until he sells them. Jarett also demanded a refund, which the IRS initially denied until it appeared to be losing the case.

After the agency agreed to issue the refund, Jarett declined the offer, saying accepting the refund would not exempt him from further taxation in the future. By refusing the refund, he left the case open, hoping that the court would compel the IRS to offer clear guidance on the matter.

Comments (No)