Gary Gensler, the chair of the United States Securities and Exchange Commission, believes staff at its agency could benefit from greater use of artificial intelligence.

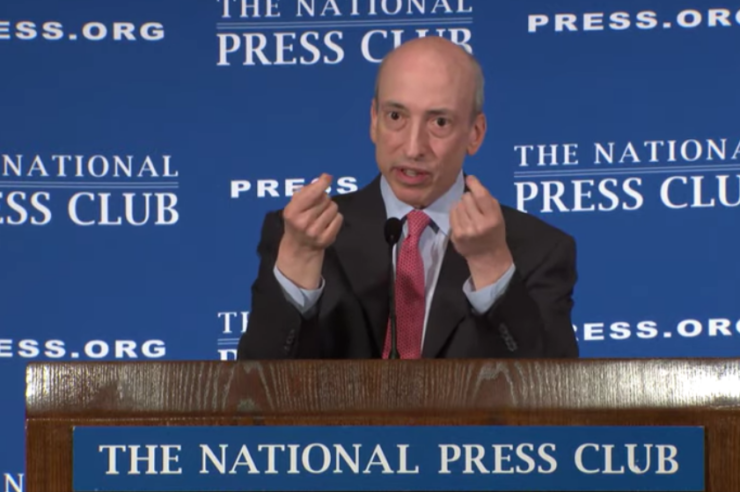

During a July 17 speech before the National Press Club, where he later broke his silence about the recent Ripple court ruling, Gensler listed several potential use cases of AI that could assist the regulator in its role as securities watchdog.

“We at the SEC also could benefit from staff making greater use of AI in their market surveillance, disclosure review, exams, enforcement, and economic analysis,” he said.

The SEC has hit up at least 54 cryptocurrency firms with enforcement actions between 2018 and the first half of 2023. The collapse of FTX in November was followed by a dramatic increase in the rate of these actions.

While Gensler didn’t provide more detail on how the agency could use AI, the SEC Chair spoke highly of the technology and the positive impact that it can have on humanity on financial markets:

“AI opens up tremendous opportunities for humanity, from healthcare to science to finance. As machines take on pattern recognition, particularly when done at scale, this can create great efficiencies across the economy.”

“I believe it’s the most transformative technology of our time, on par with the internet and mass production of automobiles,” Gensler added.

Issues with AI still linger, says Gensler

Despite the overall positive sentiment, Gensler highlighted that many AI systems are filled with bias and deception, infringe on privacy rights and present several conflicts of interest.

On the issue of bias, Gensler said some predictive AI models reflect historical biases which makes the system less accurate and in some cases, lead to an entirely false prediction.

Gensler highlighted that he was even a victim of misinformation when a fake AI-generated text of his resignation began circulating on the internet.

Related: Breaking: Judge rules XRP is not a security in SEC’s case against Ripple

Gensler added that conflicts of interest could arise when AI systems are trained to take into account the interests of the company as opposed to the interests of the customer. He added:

“That’s why I’ve asked SEC staff to make recommendations for rule proposals for the Commission’s consideration regarding how best to address such potential conflicts across the range of investor interactions.”

He also believes the emergence of a few AI monopolies may shake up the economy and potentially play a role in a “future financial crisis.”

Read my full remarks from @PressClubDC‘s Headliners Luncheon:

— Gary Gensler (@GaryGensler) July 17, 2023

In a follow up interview with Yahoo Finance on July 17, Gensler said that the regulator will enforce action against culprits who use AI to defraud investors:

“Fraud is fraud. If a bad actor uses artificial intelligence to try to deceive the public, we’re authorized but also mandated by Congress to go after that,” he said.

“AI is already very much embedded in our capital markets,” SEC Chair @GaryGensler says, later adding: “These are rapidly changing times.” pic.twitter.com/i0xuBNO2WE

— Yahoo Finance (@YahooFinance) July 17, 2023

Magazine: AI Eye: ‘Biggest ever’ leap in AI, cool new tools, AIs are the real DAOs

Comments (No)