Governmental policies in money and energy underpin most of today’s food shortages and soaring prices across consumer goods and services, at least according to bitcoin mining company Cathedra Bitcoin.

While the Bank for International Settlements (BIS), the central banks’ central banker, blames 40-year-high U.S. inflation levels on pandemic-induced supply chain bottlenecks, Cathedra has laid out an alternative view in its latest annual letter to shareholders.

“We believe the root causes of these issues are quite simple: unsound money and unsound energy infrastructure,” the letter reads.

Unsound Energy

Cathedra argues that much of the current mainstream line of thought is influenced by a Malthusian approach, which purports that progress is “zero sum” and resources are finite, thereby leading experts and governments to tilt favorably for policies that judge human action by whether it disturbs the natural world.

However, the bitcoin miner subscribes to Prometheanism — the belief that progress is “positive sum” and human creativity and technology allow resources to be employed in novel ways that preserve the natural world while benefiting the human species. Prometheans evaluate human action by its ability to trigger human flourishing, a line of thought that guides all of Cathedra’s business decisions.

Energy abundance is necessary. While different energy sources bring different benefits and tradeoffs to the table, a cohesive plan to enable maximum energy throughput is a necessity for any nation to thrive. Short-sighted policies that subsidize intermittent renewables and shutter stable forms of generation lead to energy insecurity and higher energy costs, Cathedra outlines in its letter.

“This is the underlying logic of these ‘net-zero’ policies: make energy more expensive so that we use less of it,” per the letter. “In fact, economists advising the European Central Bank view rising energy costs (‘greenflation’) as a feature, not a bug — a necessary consequence of the energy transition.”

While every human being needs energy to survive, rising energy costs asymmetrically favor those who thrive in society while punishing people with low incomes who spend much of their paychecks on basic necessities. The higher the energy price, the higher the price for every product and service and the higher the toll on economic growth.

“Rising energy prices are a regressive tax on the least well-off in society,” Cathedra’s letter reads. “Energy is the key input for every other good and service in the economy, and over time accounts for all wealth in an economy. To the extent energy gets more expensive, so does everything else (including and especially food), making society poorer.”

“This is the Malthusian approach to energy,” it adds. “Expensive ‘green’ energy that the elites can afford, while the unwashed masses bear the brunt of those rising costs.”

The U.S. has spiraled into a deep push for renewable energy sources under the Biden administration. However, instead of allowing electric grid adjustments in the short-to-medium term by maintaining “old” power generation plants, President Biden’s administration has opted for a complete overhaul.

Biden canceled the Keystone XL pipeline on his first day in office over concerns that burning oil and crude could make climate change worse and harder to reverse. The pipeline would have channeled 830,000 barrels of oil per day from Canada to refineries on the U.S. Gulf Coast, and the move led to rising tensions between U.S. and Canada. Biden’s worries about climate change have also led him into a legal battle to pause new oil and gas leases.

Similar U.S. efforts have occurred at the state level. Over the past two years, New York has banned fracking and closed a nuclear power plant that supplied a quarter of the state’s energy needs as it eyes hydropower. However, that maneuver is also meeting resistance as environmentalists argue hydropower’s inevitable flooding of some areas would lead to carbon emissions. Progress on other renewable energy sources, like solar, also have been hindered.

“The result is more unreliable energy and less baseload generation, which ultimately raises the cost of energy across the board,” Cathedra CEO A.J. Scalia told Bitcoin Magazine, referring to governmental subsidies for renewable energy.

“In the absence of these government incentives, capital and entrepreneurs would pursue ventures that satisfy genuine consumer preferences,” he added. “Renewables would be forced to compete with other forms of generation on their own merits, and renewable energy entrepreneurs would have to develop long-term, profitable, sustainable business models that don’t rely on the largesse of government.”

Nearly all energy sources will present environmental challenges in one way or the other. Cathedra advocates for “low-entropy” options, which it says are needed to maintain order and advance the development of civilization.

“The story of civilizational progress is one of humanity improving its ability to harness highly ordered sources of energy and therefore our capacity for shedding entropy,” Scalia said. “A half century of government subsidies and declining interest rates has steered capital towards high-entropy renewables, jeopardizing our ability to preserve order in the future, thereby bringing us closer toward thermodynamic equilibrium (read: civilizational collapse).”

“With its immutable monetary policy, Bitcoin preserves the information contained in prices and will allow humanity to flourish through more efficient, decentralized allocation of resources, improving our ability to resist the influence of entropy in the physical world,” he added.

Unsound Money

The current global fiat monetary standard, based on bilateral agreements between the U.S. and oil-producing countries in the “petrodollar” system, backs the U.S. dollar as the world reserve currency through energy and debt. However, central bank monetary policies of recent have started to crack this foundation, Cathedra said.

“A half-century of irresponsible fiscal and monetary policy has pushed sovereign and private sector debt to the brink of unsustainability and fragilized financial markets,” per the company’s letter. “The once steady foreign demand for treasuries is evaporating, forcing the Fed to begin monetizing U.S. deficits at an increasing rate. The U.S.’s share of global GDP is waning, and the role of the dollar in key trading relationships is diminishing. Even the once-mighty U.S. military — on whose supremacy the entire petrodollar system was predicated — shows signs of degeneration.”

To this bitcoin miner, Bitcoin is the answer to fix record-low interest rates, supply chain disruptions and asset price and consumer price inflation.

“We believe the next global monetary system will be built atop Bitcoin — with bitcoin the asset and Bitcoin the network working together to offer final settlement in a digitally native, fixed-supply reserve currency on politically neutral rails,” the Cathedra letter reads. “Bitcoin uniquely enables this value proposition, and game theory and economic incentives will compel nation-states to take notice amid the collapsing monetary order.”

The company notes that competition to Bitcoin may emerge, promising even more control, which would appeal to Malthusian leaders. However, Cathedra remains “cautiously optimistic” that the U.S. will favor Bitcoin over dystopian technologies like a central bank digital currency (CBDC). However, the U.S. government doesn’t seem to be leaning that way.

Biden signed an executive order (E.O.) on Wednesday tapping “urgent” development of a Federal Reserve CBDC. The E.O. outlines federal efforts to research and develop specific guidelines for the use of bitcoin, alternative cryptocurrencies and a possible digital dollar as the country seeks to remain at the core of the global financial system.

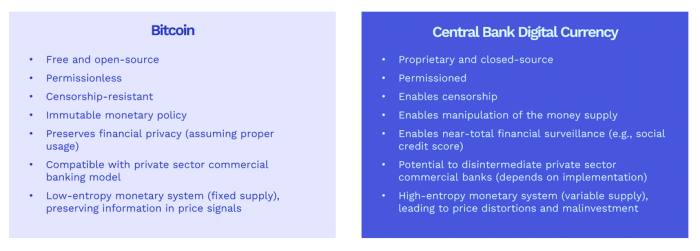

While Bitcoin empowers an open, freedom-based economy, CBDCs foster a permissioned and censorable financial system underpinned by control from institutions over the people. Image source: Cathedra Bitcoin.

“The U.S. is ceding control of the unipolar, dollar-based monetary system; 50 years of irresponsible fiscal and monetary policy has made this a certainty,” Cathedra President and COO, Drew Armstrong, told Bitcoin Magazine. “The only choice we have at this point is how to respond. If America wants to extend its economic leadership in a post-Bretton Woods III monetary order, the path of least resistance would be to lean into its dominant position in the Bitcoin industry.”

A Bitcoin Mining Company Focused On Hyperbitcoinization

“Our macro views on energy and money inform everything we’re doing at Cathedra,” the letter reads. “Chief among them is the belief that sound money and cheap, abundant, highly ordered energy are the fundamental ingredients to human flourishing. Our company mission is to bring both to humanity, and so lead mankind into a new Renaissance — one led by Bitcoin and the energy revolution we believe it will galvanize.”

The bitcoin miner rebranded from Fortress Technologies to Cathedra Bitcoin in December to reflect its aspirations in building a “bold, ambitious, long-term” project — in the spirit of history’s gothic cathedrals — with energy and Bitcoin, not “crypto,” at its core.

“Our long-term plan is to vertically integrate to own everything from the energy resource, to the mining data center, to the mining machines hashing inside the data center,” Scalia said. “Once Cathedra is a scaled, low-cost producer of bitcoin and energy, we’ll also be uniquely positioned to deliver a suite of ancillary products and services across the financial and energy sectors as well.”

Another aspect of Cathedra’s long-term play involves off-grid mining, which the company believes will trump the current popular practice of on-grid mining. To help achieve this vision, the miner has begun producing proprietary modular data centers made to function even under harsh environmental conditions, called “Rovers,” to house over 5,000 bitcoin mining machines that Cathedra expects to receive this year.

Armstrong told Bitcoin Magazine that the advantages of off-grid mining relate mostly to the cheap energy costs. The chief executive highlighted how, by leveraging energy that would otherwise go to waste, the miner wouldn’t compete with other customers as in on-grid mining.

“First, by mining off grid, we’re necessarily pursuing sources of energy that are non-rival,” Armstrong said. “Because there’s no other demand for the energy, we’re able to buy it for cheaper than we otherwise would — and in some cases, can even get paid to consume it.”

Cathedra mines bitcoin leveraging otherwise-wasted energy sources. Pictured are bitcoin mining containers built by a third party that enables Cathedra to monetize flared gas in a North Dakota facility while contributing to the security of the Bitcoin network. Photo courtesy of Cathedra Bitcoin.

Mining off-grid also enables Cathedra to cut down many costs associated with power transportation, transmission, and distribution.

“Finally, by vertically integrating to design, manufacture, and operate our Rovers, we’re able to remove additional layers of margin and realize savings on the capex side as well,” Armstrong added. “As we achieve scale, we’ll benefit from volume discounts on materials, greater bargaining power with suppliers, etc., driving down our cost to produce each Rover.”

Cathedra also is dedicated to accumulating bitcoin on its balance sheet. The company said in its letter that it leverages financing opportunities to keep as much of the bitcoin it mines as possible, a long-term vision that it says will produce outsized results as companies with big BTC holdings get a head start in an eventual Bitcoin standard.

Comments (No)