On-chain analysis conducted by Kraken exchange suggests bullish momentum for the leading crypto tokens “remains low.”

“It’s tough to confidently determine what’s ahead for the crypto markets. However on-chain data paints a slightly bearish picture.”

This is despite the market leader Bitcoin breaking a 12-week downtrend in early February. And Monday’s price spike, to $43,300, off the back of Russian-Ukrainian demand.

The report focused on Bitcoin and Ethereum, examining exchange flow, miner uncertainty, and spent output profit ratio in determining its conclusions.

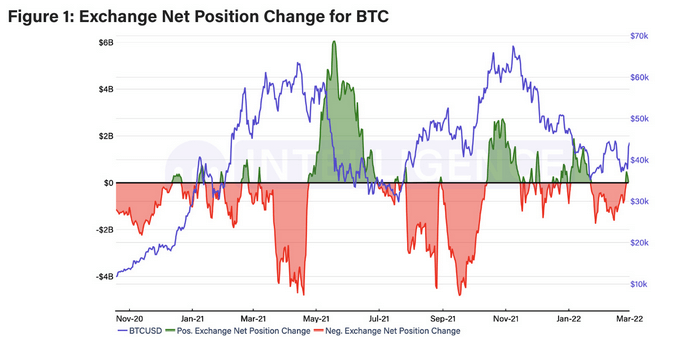

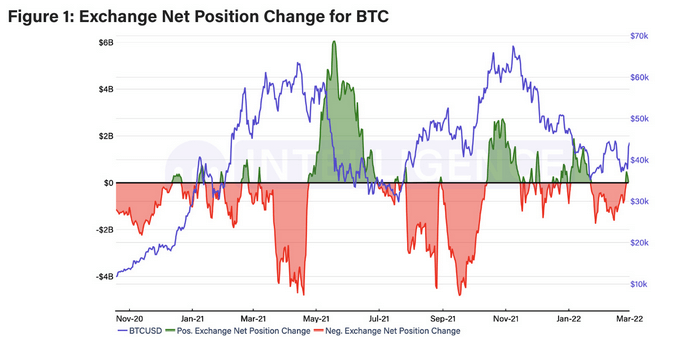

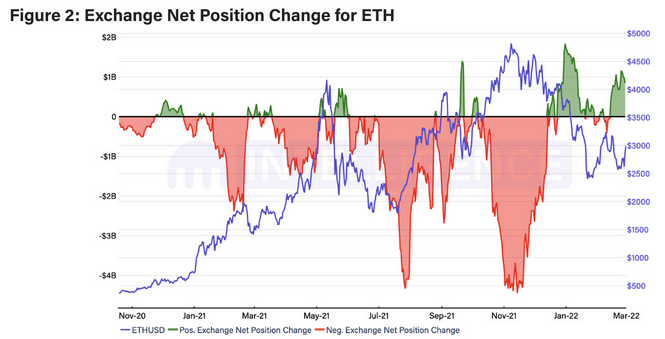

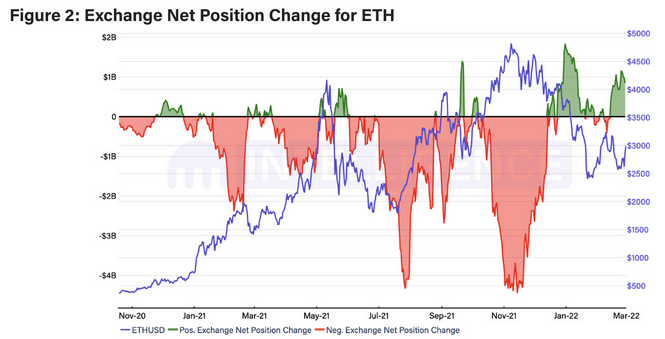

Exchange net position change

Exchange net position change examines whether there is an overall inflow or outflow to centralized exchanges at a given time.

This metric doesn’t give a definitive indication of sentiment because the reasons why a user would send or withdraw tokens to/from an exchange vary.

Some say market cycle bottoms are usually accompanied by outflows, as holders withdraw tokens for storage. Whereas inflows typically happen during price rallies, as holders send their tokens to the exchange to take profits.

The chart below shows net Bitcoin inflows for most of January. But this position flipped in the following month to bottom at just below -$2 billion. The start of March saw a (mini) reversal, with the net position coming in at +$13.5 million.

Ethereum exchange net flows have mostly been positive for 2022, with a current net position change of +$847.5 million. Kraken concludes that Ethereum sentiment is more bullish than Bitcoin.

Miner uncertainty

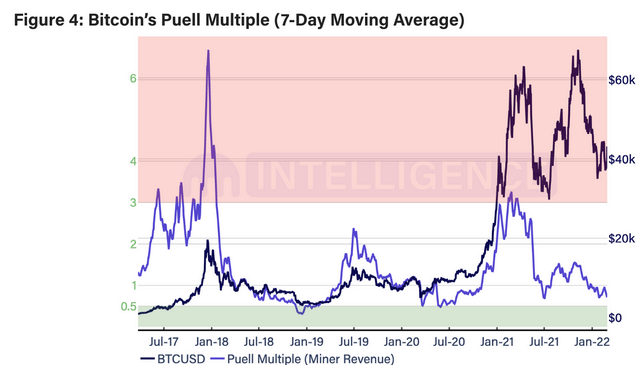

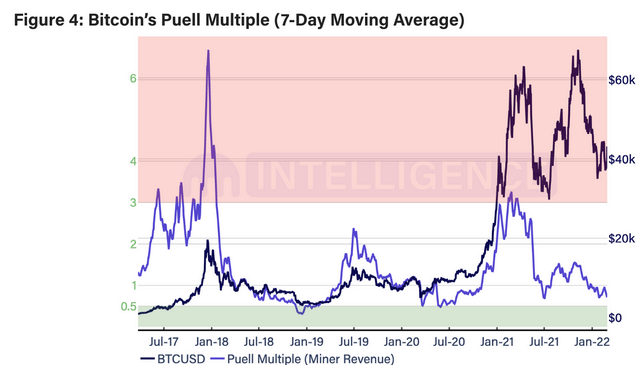

The Puell Multiple measures the level of sell pressure coming from miners. This is calculated by dividing the USD value of daily BTC miner revenue by the USD value of the 365-moving average of daily miner revenue.

A score below 0.5 signals profitability has fallen below sustainable levels, whereas a score higher than 3 signals prime profit-taking opportunity.

The Puell Multiple has been down-trending since February 2021. While mid-February this year saw a climb to 0.95, recent weeks have seen this metric continue trending lower.

Kraken says, based on this, miners are continuing to hold onto their Bitcoin revenue, rather than sell into the market.

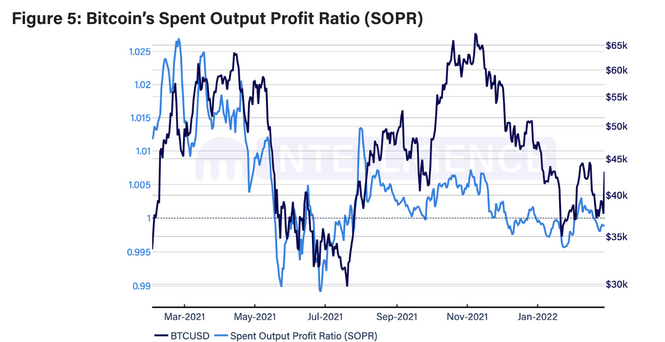

The Spent Output Profit Ratio (SOPR)

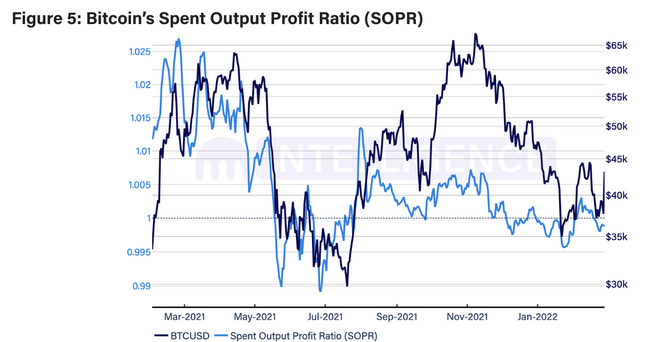

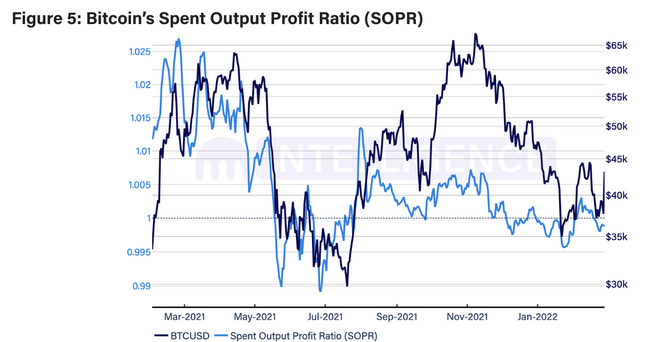

The SOPR examines the profit ratio of the whole market by looking at the value of outputs at the spent time versus the created time. In other words, using SOPR, it’s possible to estimate whether the distribution of spent transaction output is in profit or not.

SOPR greater than 1 means holders are selling mostly at a profit, less than 1 means selling at a loss, whereas exactly 1 equates to selling at break even.

The current Bitcoin SOPR is below 1 suggesting bearish sentiment. Kraken concludes that if this metric stays below 1 while the BTC price falls we may be entering a bear market.

The recent rally back above $40,000 nullifies this point to some extent. But the other on-chain metrics covered in the report still point to indecision.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)