Banking giant JPMorgan said in a note Wednesday that bitcoin and cryptocurrencies are now among its preferred “alternative” investments, Markets Insider reported.

Assets deemed as risky, which often includes bitcoin in the minds of professional and institutional investors, have plunged in 2022 amid tighter monetary policies and multiple decades-high inflation numbers in the U.S. and around the world.

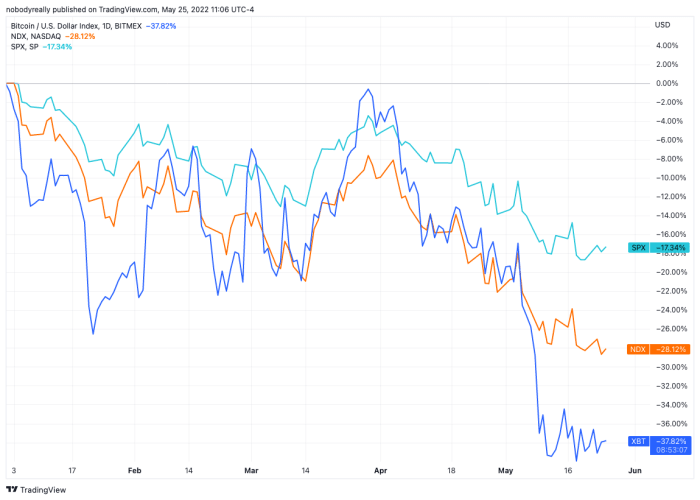

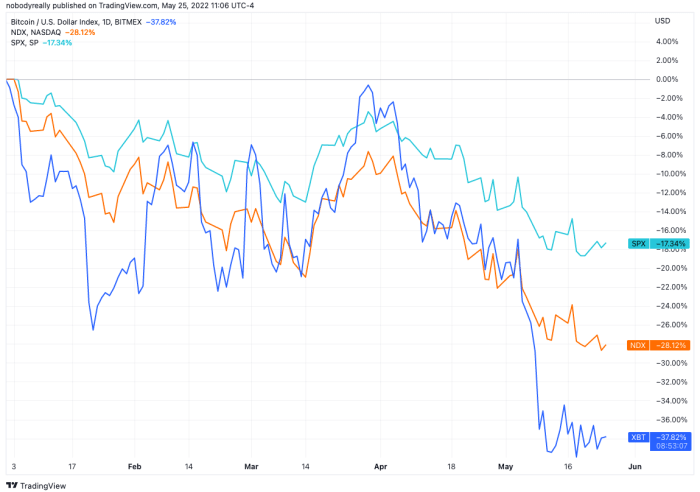

Bitcoin and equities have broadly tumbled so far this year against a backdrop of less liquidity on the market and low prospects for the Russian-Ukrainian war to come to a close anytime soon. Image source: TradingView.

However, Bitcoin’s steep sell-off, as well as that of other cryptocurrencies, has been more profound that in other alternative investments such as private equity, private debt, and real estate, JPMorgan reportedly said. Therefore, the bank envisions more room for rebound in the “digital assets” class than in other alternative assets.

“We thus replace real estate with digital assets as our preferred alternative asset class along with hedge funds,” the bank’s strategists wrote, per the report.

JPMorgan’s strategists reportedly said in the note that the bank was sticking to its view that $38,000 was a fair price for bitcoin – about 27.5% higher than its $29,798 price at press time on Wednesday morning. Bitcoin’s discounted valuation is part of the reason why the bank has a more optimistic outlook for the digital currency going forward.

“The past month’s crypto market correction looks more like capitulation relative to last January/February and going forward we see upside for bitcoin and crypto markets more generally,” the note said, per the report.

Despite the greater attractiveness of the sector, JPMorgan reportedly said in the note that it has switched Bitcoin and cryptocurrencies from an “overweight” ranking to a “underweight” one – meaning that the bank is now less keen on the asset class and recommends a lower exposure in an investment portfolio.

Comments (No)