Bitcoin (BTC) is both the first and the most prominent cryptocurrency in the world when it comes to market capitalization as well as trading volume. These factors are quite significant, considering that all cryptocurrencies trade against Bitcoin and Bitcoin’s dominance can actually serve as a valuable indicator when trading all different types of cryptocurrencies.

This post will offer insight on how to trade cryptocurrency while utilizing the Bitcoin dominance indicator and how to read the Bitcoin dominance index chart overall.

What is the BTC dominance chart?

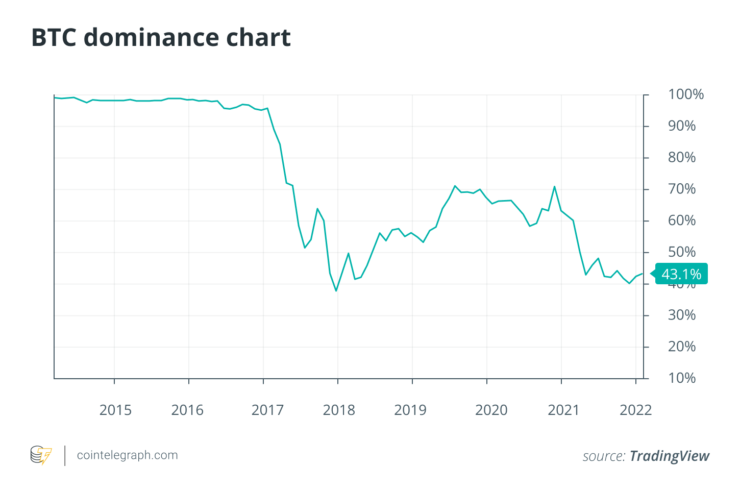

Bitcoin dominance is uncovered by comparing Bitcoin’s market capitalization to the capitalization of the entire crypto market. The higher Bitcoin’s market capitalization the more Bitcoin dominance is at play, and we have the answer to the question: What percentage of the crypto market is Bitcoin?

The BTC dominance TradingView chart showcases these numbers in a clear percentage format where one can take a quick glance and understand if BTC dominance is at 40% or 60%, for example.

That said, users can also view the Real Bitcoin Dominance Index, which calculates BTC dominance only against proof-of-work (PoW) coins aiming to become a form of money.

The logic behind the Real Bitcoin Dominance Index is that many altcoins such as stablecoins aren’t aiming to compete with Bitcoin and, so, it may paint a more realistic long-term view on Bitcoin’s dominance.

This indicator even gives users the option to exclude Ethereum, as it’s debatable whether or not Ether (ETH) is meant to be a currency rather than a utility token.

How does BTC dominance affect altcoins?

BTC dominance can directly affect altcoins, as it showcases how much of the market’s trading volume is in BTC vs. how much of the trading volume is in altcoins.

Generally, if Bitcoin dominance is up, then traders recommend one has more of their crypto holdings in BTC than in altcoins. If BTC dominance is down, traders recommend one holds more altcoins than they do Bitcoin.

While it’s wrong to say Bitcoin dominance is an exact representation of a bear or bull market, there are correlations between these definitions. For example, bull markets might lead to lower BTC dominance, as funds are typically pouring into altcoins at that time.

Conversely, bear markets might see higher BTC dominance, as traders may be pulling their funds out of altcoins and putting money into Bitcoin since it’s more of a reliable asset.

Some enthusiasts might say that lower Bitcoin dominance is a good thing, as it means the crypto market is expanding and funds are flowing through all sorts of projects instead of just Bitcoin. But, it’s also worth noting that the total crypto market capitalization will take pre-mined and forked coins into its value, meaning altcoin counts might be artificially inflated.

One should also consider the fact that Bitcoin dominance can decrease even when the asset’s price increases. This can occur when money is pouring into the crypto market with Bitcoin included, though more money might be moving into altcoins than the world’s largest cryptocurrency.

The point is, while Bitcoin dominance might paint the crypto market a certain way on a surface level, there are various factors to consider to gather an informed view.

Sometimes dominance might be down due to a short-term altcoin boom while other times, the entire market might be bleeding money. It’s always best to do additional research before making an investment decision.

How to trade Bitcoin dominance?

There are multiple factors to consider when attempting to trade Bitcoin dominance. First, understand that Bitcoin dominance can go down if interest is high in even one altcoin. This interest in a single altcoin doesn’t mean that every altcoin will experience upward trends. The market may take some time to correct itself.

It’s also best to consider the intent of some popular altcoins and whether or not that intent will translate into a lasting impact on the altcoin market. For example, we might see a stablecoin experience a significant uptick in volume for the time being.

However, users might invest in said stablecoin simply to move those funds over to Bitcoin, as stablecoins can be an easy way to onramp funds into the crypto industry.

As a result of this activity, Bitcoin’s dominance could quickly drop and rebound, impacting short-term trades negatively. Another factor that could lead to unpredictable short-term drops or rises in Bitcoin dominance is fear of missing out (FOMO).

New coins enter the crypto market all of the time. Some of these new altcoins entering the market generate a ton of hype that results in hundreds of thousands of dollars flowing into the altcoin side of things and disproportionately lowering Bitcoin’s dominance.

However, many new altcoin projects often lose their hype or even end up being a scam, causing users to pull out their holdings as fast as they input them. In that case, Bitcoin’s dominance might rise back to its original place.

One should also consider the extremes of Bitcoin’s dominance ratio. For example, Bitcoin’s dominance used to be at over 90% before altcoins entered the market. However, enthusiasts note that Bitcoin’s dominance is unexpected to hit that number again due to the prevalence of altcoins in today’s market. But, it’s impossible to say for sure, as if countries follow El Salvador implement Bitcoin as legal tender BTC’s dominance may rise once again.

In fact, Bitcoin’s dominance is much more likely to hit new lows than new highs as altcoin projects continue to gain popularity across the mainstream.

As a result, traders should note when Bitcoin dominance is trending toward an all-time high, as that could mark a good threshold in which BTC dominance may see resistance. Conversely, users should keep an eye on BTC dominance reaching toward new lows and how the altcoin market is reacting as a result.

What happens when Bitcoin dips?

Bitcoin’s price dip could mean a lowered dominance in that users are moving funds away from BTC into other altcoins, but a price dip can also have little to do with dominance as a whole. If Bitcoin dominance drops, users might certainly expect an altcoin bull run and can trade accordingly.

That said, a Bitcoin price dip could occur if users are pulling funds out of all cryptocurrencies, resulting in a lower crypto market capitalization overall. In this case, Bitcoin dominance may remain at a certain percentage despite traders’ anticipation of a potential bear market.

This example is an essential reminder that Bitcoin dominance shouldn’t be the only tool at a trader’s disposal, rather one of many to examine before making a trade.

The impact of a Bitcoin crash on the crypto market

Dominance aside, a significant Bitcoin price crash has historically often led to an overall market crash, though few exceptions exist. This correlation between Bitcoin and a market crash is simply because Bitcoin is the world’s first cryptocurrency and all crypto assets trade against it.

Look at it this way: If a country considers banning Bitcoin and the price drops significantly as a result, traders and speculators might lose confidence in altcoins as well and pull their funds from these alternative investments.

That said, a Bitcoin crash doesn’t always mean an overall market crash. There are multiple occasions where Bitcoin suffers a significant price drop while Ether remains more stable. It’s important to remember that different assets serve different purposes, and the downtrend of one may not correlate to the downtrend of another.

In fact, as time goes on and altcoins break into the mainstream consciousness, future Bitcoin crashes might have less and less of an effect on the overall market. Bitcoin dominance matters now because it’s still the most popular cryptocurrency in the world. If other coins begin to take that mantra away from Bitcoin, dominance will matter less and less.

Comments (No)