The week was filled with several new project developments and key updates from leading decentralized applications (DApps) and decentralized finance (DeFi) protocols. Fireblocks has expanded its institutional access to Terra’s DeFi ecosystem and Solana partnered with the Notifi network to improve the abysmal participation rates in governance votes.

We will also look into the Cointelegraph research into the Terra ecosystem’s future and see if it can sustain the current growth. Samson Mow, the former executive at Blockstream, questions the decentralized aspect of the DeFi ecosystem.

Top DeFi tokens saw another week of bearish price action despite several new developments and barring a few, the majority of the tokens in the top-100 registered double-digit losses over the past week.

Fireblocks expands institutional access to Terra’s DeFi ecosystem

Fireblocks, a digital asset custody platform, announced that it has enabled institutional decentralized finance access to Terra, the second-largest DeFi protocol by total value locked (TVL). As per the announcement, Fireblocks users can now securely access all the decentralized applications built on the Terra blockchain.

The launch is in response to Fireblocks’ early access program users, who invested over $250 million into the Terra DeFi ecosystem within the first 72 hours of its integration going live.

‘DeFi is not decentralized at all,’ says former Blockstream executive

Samson Mow, former chief strategy officer at Blockstream and founder of JAN3, is convinced that most decentralized finance protocols can’t compete with Bitcoin (BTC) when it comes to providing an effective monetary network because of their lack of decentralization.

As Mow pointed out, DeFi projects are governed by entities that can modify the protocol at will.

“Bitcoin, at the fundamental level, is money, and it should be immutable,” explained Mow. “If you can change it at will, then you’re no better than a fiat currency governed by the Fed.”

Solana DAOs can now bug you to vote with phone calls and texts

The Notifi Network is banking on this concept to help improve the abysmal participation rates in governance votes. Launching with Solana decentralized autonomous organizations, or DAOs, it combines popular centralized methods used by the Web3 community such as Telegram and Discord pings with more traditional and harder to ignore notifications like phone calls, text messages or emails.

Backed by crypto venture capital firms Race Capital and Hashed, on April 24, Notifi applied its notification service to all DAOs that launched on the Solana Realms DAO platform.

Can Terra blockchain sustain its growth? Research report digs deeper

Cointelegraph Research fundamentally evaluates Terra in its 50-page report to provide an in-depth analysis of its recent updates, including Columbus-5, the Bitcoin acquisition and others.

Decentralized algorithmic stablecoins, blockchain integration in real-world payments and 20% annual percentage yields (APYs) on DeFi protocols — what is all of this, and is it really doing this? The team of experienced cryptoanalysts from the Big Four and the best universities worldwide dives deep into the blockchain’s ecosystem, community and underlying technology, assessing the potential regulatory, market and technological risks.

DeFi market overview

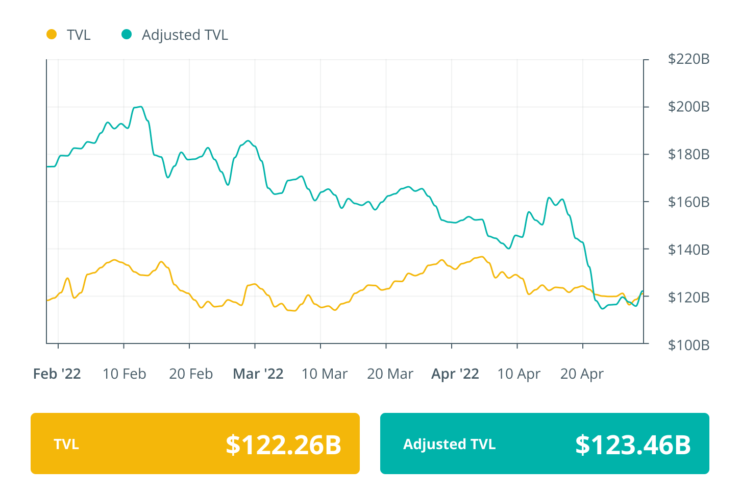

Analytical data reveals that DeFi’s total value locked dipped by one billion dollars, falling to $123.08 billion. Data from Cointelegraph Markets Pro and TradingView reveals that DeFi’s top 100 tokens by market capitalization registered a week filled with volatile price action and constant bearish pressure.

Majority of the DeFi tokens in the top-100 ranking by market cap traded in red, barring a few. Kyber Network Crystal v2 (KNC) was the biggest gainer with a 25% rise over the past week, followed by Kava (KAVA) at 17% and Curve DAO Token (CRV) at 8%.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us again next Friday for more stories, insights and education in this dynamically advancing space.

Comments (No)