SpiritSwap, a decentralized exchange (DEX) on Fantom, will no longer shut its doors in September after having treasury funds stuck on troubled cross-chain protocol Multichain.

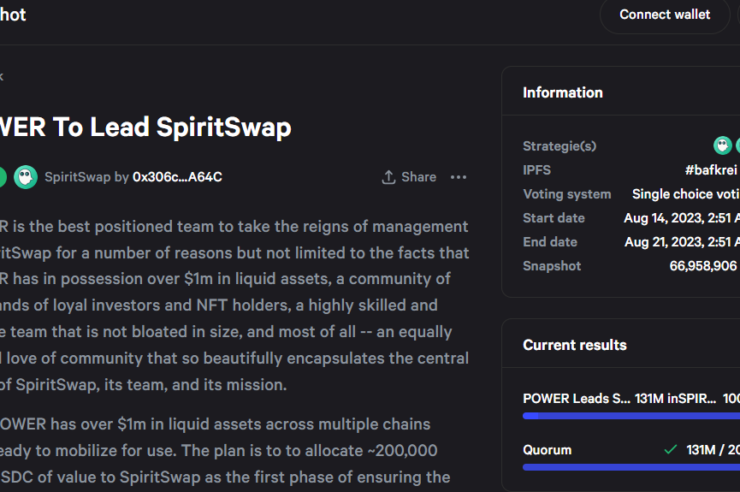

In an Aug. 16 community vote, SpiritSwap users passed a resolution to transfer the project to Power, a fellow nonfungible token platform and DEX that is also based on Fantom. In consideration, Power will deploy 200,000 USD Coin (USDC) into the SpiritSwap treasury.

“Initially, I had requested a deposit of 20-30K to the treasury to cover the essential costs of SpiritSwap. However, the Power team is willing to go above and beyond by depositing 200,000 USDC,” wrote Nzaru, head manager at SpiritSwap, who announced that he would depart the DEX after receiving a new job offer. “On the 30th, I will finalize the new team and conduct orientation sessions to prepare for the upcoming month,” he said.

Prior to the acquisition, Power developers stated: “We have the means and the desire to inherent SpiritSwap. This would be a direct benefit to the PNFT holders, the POWER community, and the SpiritSwap community.”

On Aug. 9, SpiritSwap said it would wind down operations by Sept. 1 if it could not find a team to take over after the Multichain exploit drained its entire treasury. Interestingly, Power was also exposed to the Multichain fiasco but only suffered “small” losses, as its treasury assets were not bridged to Multichain.

After months of speculation, Multichain’s developers disclosed in July that co-founder and CEO Zhanojung He was arrested by Chinese police back in May on undisclosed charges. He allegedly held all access to Multichain private keys and servers for the $1.5 billion protocol when he was detained. Despite a lack of information on his detention, funds belonging to Multichain and its users have been swapped for stablecoins as well as private coins and transferred out of the protocol. Some victims have since alleged that the Chinese police are involved in an elaborate embezzlement scheme involving users’ funds.

Magazine: China’s risky Bitcoin court decision, is Huobi in trouble or not?

Comments (No)