The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Bitcoin’s Correlation With Volatility

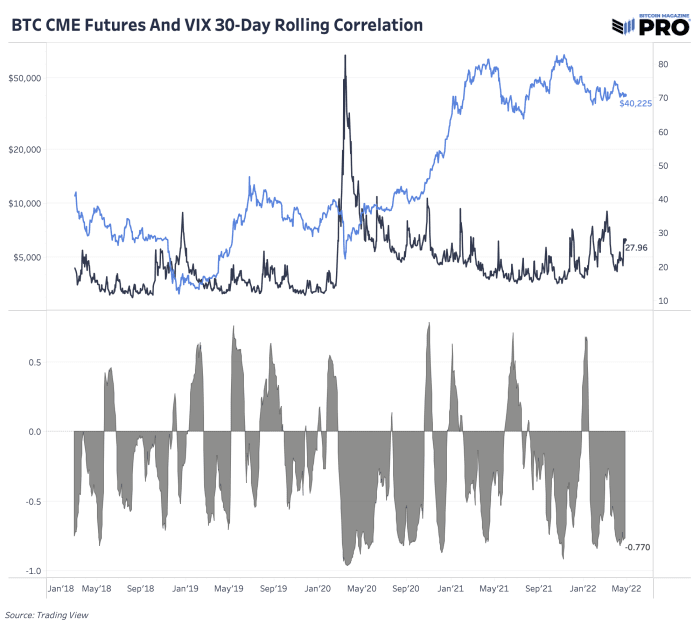

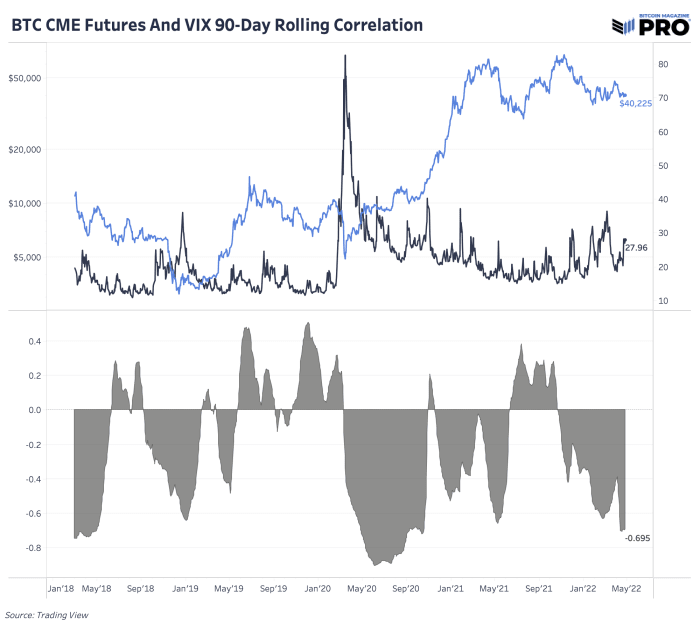

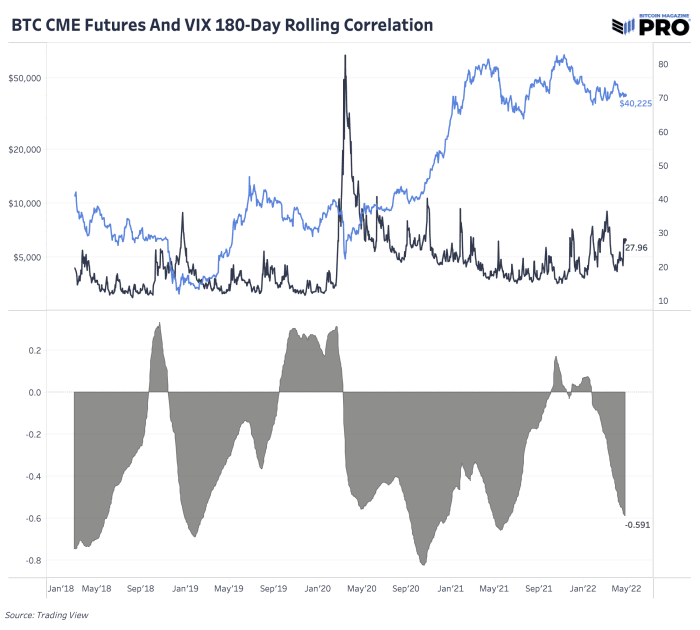

Bitcoin is much more than an “inverse VIX” but that doesn’t stop the market from trading it as such. (“VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange’s CBOE Volatility Index, a popular measure of the stock market’s expectation of volatility based on S&P 500 index options.”)

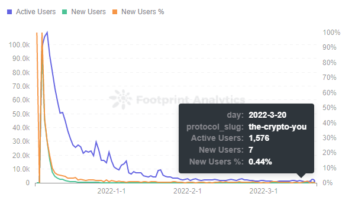

As Bitcoin’s education, adoption and monetization carries on, fundamentals and network growth will be the more important driver of price appreciation. But in the current environment, risk-off market signals and broader market volatility are in the driver seat.

We can roughly quantify this bitcoin and volatility relationship by looking at the Chicago Mercantile Exchange bitcoin futures and VIX rolling correlations across 30-day, 90-day and 180-day timeframes over the last few years.

On the other hand, March 2020 gave us an interesting example of how bitcoin may perform post market crash, massive volatility spike and increased debt monetization across monetary and fiscal policies to help rescue the market and economic conditions. Bitcoin is now 716% up from its March 2020 bottom of $4,930. Bitcoin’s correlation to the VIX is bad now during a credit unwind, but it’s a positive attribute during reflationary periods and falling volatility.

From a broader macroeconomic perspective, this is why we remain bullish on bitcoin on a longer time horizon post another scenario crash in risk assets. If we’re to see this scenario play out and when the dust settles, bitcoin will be primed to outperform almost every other asset in our view based on its adoption curve, fundamentals and as a superior monetary network.

Comments (No)