Hybrid computing platform Boba Network has joined the “crypto unicorn” rankings after raising $45 million in Series A funding, underscoring the investment appeal of Ethereum layer-2 scaling solutions.

The funding round had participation from several crypto-focused venture funds including Infinite Capital, Hypersphere, 10X Capital, Hack VC, GBV, Sanctor Capital, Shima Capital, Kinetic Capital, IOST and ROK Capital. Contributions also came from the Will Smith-led Dreamers VC, Paris Hilton’s M13 and several crypto industry founders from projects such as Origin Protocol, The Graph, FEI Labs and exchange giants Crypto.com and Huobi.

The Series A valued Boba Network at $1.5 billion, giving the company the unique distinction of being labeled a unicorn. In the startup world, a unicorn is a company that attains a valuation of at least $1 billion. The crypto industry crowned dozens of unicorns in 2021 as venture funds spent over $25 billion acquiring equity in emerging blockchain companies.

Boba Network was built by Enya, a decentralized infrastructure provider, and launched in 2018. The project largely flew under the radar until the launch of its mainnet and BOBA governance token in September 2021. The BOBA token is intended to further the network’s evolution as a decentralized autonomous organization, or DAO.

Mainnet live, $BOBA token, Boba DAO – huge day for @bobanetwork @BobaCommunity! https://t.co/8jSbVZWP3D

— Alan Chiu (,) (@alanchiu) September 20, 2021

Related: Former Polychain GP unveils $125M crypto fund with DAO governance ambitions

Boba is described as a next-generation Ethereum Layer-2 scaling solution that aims to solve many of Ethereum’s biggest pain points while also expanding its smart contract capabilities. Boba’s developers said the funding will go toward expanding internal capacity and investing in ecosystem projects that leverage the expertise of Web3 industry leaders.

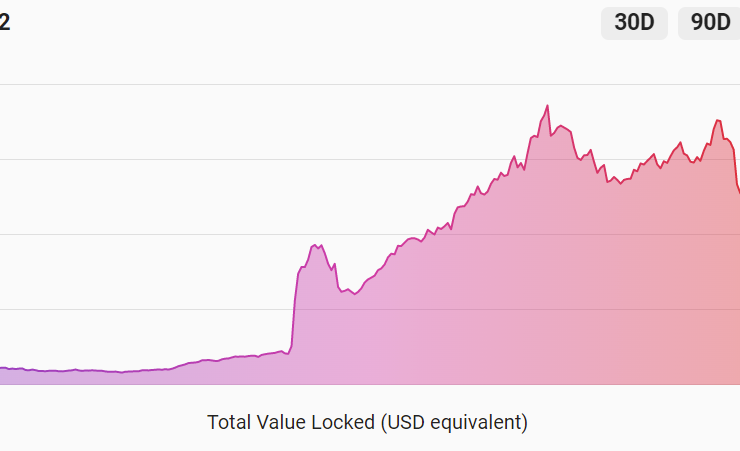

While digital asset prices remain well off their previous highs, Ethereum layer-2 networks are gaining significant traction. The total value locked, or TVL, on such networks recently surpassed $7.2 billion, which is a new all-time high, according to L2 Beat. The sector’s TVL was less than $1 billion in September 2021. By comparison, the DeFi sector’s TVL has yet to reclaim its all-time high from November.

Comments (No)