In The United States

A great question.

I mean, if you haven’t sold any of your stack yet, and probably haven’t incurred a taxable transaction, then why would you need to consult a professional tax advisor? You’re a HODLer; you have diamond hands. You’ll never sell. So, do you need to involve a tax pro?

Short answer: Yes. Mainly because you don’t know what you don’t know.

Purchasing, or receiving, Bitcoin has tax implications. Most everyone who buys Bitcoin dreams of selling it someday for a huge stack of fiat dollars. That’s right, converting it back to fiat, even if it’s just to diversify the portfolio. And in that case, you’ll need to have good records at your disposal. Records of your cost basis, in order to compute your capital gains.

Here are four potential situations that will make you happy you consulted that tax professional early on:

- You’re earning interest yield on your Bitcoin. Most crypto exchanges offer an option to earn yield on your bitcoin, at rates ranging from 1% to 12%. The exchanges will pay your interest yield in bitcoin, not in fiat currency, so does that constitute taxable income? Yep. You need to claim that on your tax return when you earn the yield. Exchanges also offer rewards and token drops, and these are taxable immediately as well.

Some exchanges will produce an IRS form 1099-MISC, showing you exactly how much interest you need to claim as income. However, you need to know where to look to find these tax forms. Go to your crypto exchange site, look for tax information and see if there are 1099 forms available for your current tax year.

- You’re buying and accumulating Bitcoin. As briefly mentioned above, you will eventually need to produce good records of your cost basis in your Bitcoin, so consulting a tax professional who is proficient in the tax laws involving cryptocurrencies is a good idea. No, actually, it is essential. If you don’t know what records to gather or even where to start, consult a professional.

Many crypto exchanges won’t send you a nice, tidy tax form at the end of each year, detailing your purchases and sales, your cost basis or anything else that needs to go into your tax return. Unlike a stock brokerage account, crypto exchanges don’t produce 1099-B forms, detailing every sale, so you need to keep good records. Some used to send out 1099-K forms, showing proceeds of stock sales if they totalled over $20,000, but most have discontinued that practice. So, for your records, I’m thinking a nice Excel spreadsheet will do the trick. All purchases, cost, sales, interest, every transaction.

Your tax professional will love you.

- You’re mining Bitcoin. If you’re mining crypto, you’ve entered a whole new tax realm. Unlike purchasing bitcoin, where you aren’t taxed until you sell it, bitcoin earned through mining is taxed immediately. This is where record-keeping gets really tricky. Technically, every day that your rig produces bitcoin, you have taxable income equal to the fair market value of those sats, on that day. Picturing a 365-day spreadsheet each year? Yeah.

(This is where the US tax code is inconsistent. When purchasing and selling Bitcoin, it is treated as property, resulting in a capital gain or loss. But, when mined, Bitcoin is taxed immediately, as if you’ve produced currency.)

Besides keeping records of bitcoin earned through mining, you’ll need to keep track of expenses. Oh yeah, electricity costs — pretty significant. And the cost of those mining rigs.

This is where you’ll definitely need a tax professional to file your return. Deciding things like how to write off (or depreciate) your hardware, how to apportion your electricity usage, what other expenses to deduct, that’s the domain of a tax professional.

NOTE: Good news. When you claim income for the bitcoin you’ve mined, you then have a cost basis to use against your eventual selling price. Again, consult a tax pro.

- You receive Bitcoin from a customer or client. You may never encounter this situation, but then again, if you are self-employed you may. I have received crypto for services provided, and have held onto it. You will probably not receive a 1099 form to use for your taxes, so keep track of it in terms of its value at the time you receive it.

It is ordinary income, and you must claim it when you receive it. Disclose all this to your tax preparer and make sure you both keep track of it, since, as in the situation above, you’ve established a cost basis to use against a future sale.

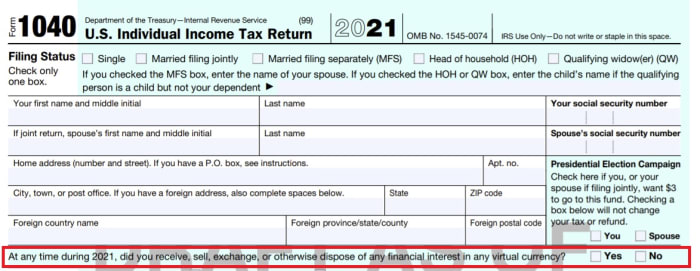

- You have to answer “The Question.” Every single U.S. taxpayer has to answer the following question on Form 1040, a question that has been around for a few years, but has been tweaked a bit for the 2021 filings:

“At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency?”

We’ve discussed above situations where you’ve received, bought or mined bitcoin, but have not yet sold any. In addition, you need to be aware that disposing of bitcoin may also be a taxable transaction. If you’ve spent bitcoin, that’s a taxable event — an event where you need to figure out the cost basis and the capital gain.

Look, even if your crypto exchange isn’t reporting your purchases and sales to the tax man, you need to do the right things. Report income. Keep records. Be ready in the unlikely event that you get audited. (In the U.S., in recent years, only .45% of taxpayers with incomes between $75,000 and $200,000 were audited.) But, if you answer “Yes” to “The Question”, then: who knows? Be prepared.

The bottom line is, if you’re invested in Bitcoin, then you really need to consult a tax professional. For the uninformed, there are just too many landmines waiting to trip up crypto investors. Talk with a tax pro who’s experienced with crypto. And, keep good records, early and often.

In The United Kingdom

Bitcoin is essentially taxed as a form of property in the U.K. Individuals should take advice appropriate to their own circumstances, but at present there are two taxes most likely to apply:

i) Capital Gains Tax (CGT) may be due on gains to bitcoin’s value.

For an individual this is currently 10% or 20% (depending on their personal income tax circumstances). This is only payable on chargeable gains above the current “Annual Exempt Amount” for capital gains, which is currently £12,300 per year (and HMRC — Britain’s tax authority — has signalled that it intends for this threshold to remain constant over the next few years).

By way of example for CGT, a higher-rate taxpayer who bought one bitcoin in 2020 for £10,000 and sold it in its entirety today for £30,000, (and with no other capital gains to take into account in that tax year), would be liable to pay (30,000 – 10,000 – 12,300)*20% = £1,540 in CGT.

Given this base treatment and the ability to time sales over different tax years, it’s unlikely that small-to-medium holders of bitcoin will end up paying huge amounts of CGT.

A couple of notes. Firstly, these calculations generally use an “average cost basis,” so if in the above example the bitcoin was purchased gradually over several years, it would be the overall average cost of the bitcoin that would be used for the calculation. Secondly, it’s worth noting that most actions count as a disposal for CGT purposes — be that gifting bitcoin to others, trading it for other digital assets or direct spending on goods and services.

Those trading frequently and with other crypto assets thrown into the mix may find their calculations become complicated. HMRC has a wealth of further information on tax treatment in various circumstances.

The second tax which may apply, for bitcoin holders lending their bitcoin out in exchange for a yield, is income tax. It’s worth stressing that Bitcoin itself offers no risk-free yield, and I would urge Bitcoiners to consider carefully if the yield on offer fairly compensates for the credit risk they are taking on. Not your keys, not your coins! As far as tax goes, any yield generated may be liable for income tax at an individual’s marginal income tax rate for the tax year in question.

How about tax-exempt arrangements? Currently the situation in the U.K. concerning Bitcoin and tax is simplified by the fact it is not possible for an individual to hold bitcoin directly within an individual savings account (ISA) or pension arrangement, both of which offer tax advantages generally. Those who want to gain some bitcoin exposure within these arrangements are limited to investment by proxy, for example by investing in companies that hold bitcoin on their balance sheet, such as MSTR, or in publicly listed Bitcoin miners or exchanges.

This article does not constitute provision of legal advice, tax advice, accounting services, investment advice or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with a tax or legal professional. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all pertinent facts relevant to your particular situation.

This is a guest post by Rick Mulvey and BitcoinActuary. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Comments (No)