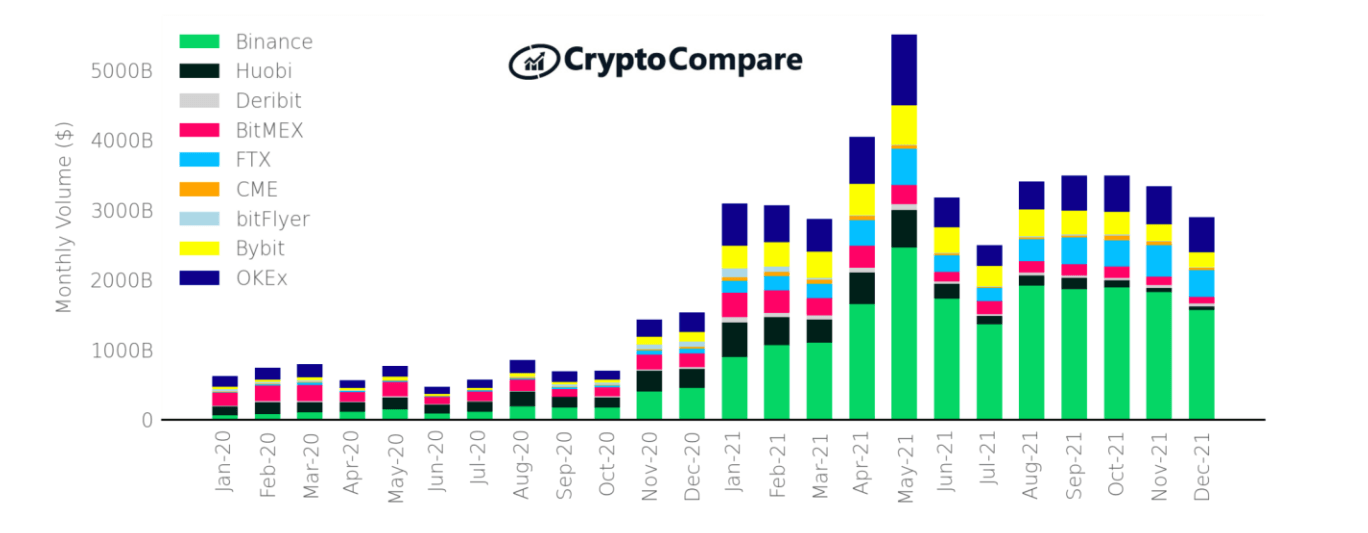

In January, crypto exchanges saw spot volumes reach their lowest level since December 2020, CryptoCompare’s recent market data analysis report revealed.

While spot volumes fell 30.2% month-on-month, derivatives market volumes remained steady and reached an all-time high (ATH) market share of 61.2%–suggesting crypto investors turned to hedging and speculation.

Spot trading volumes took a severe hit last month

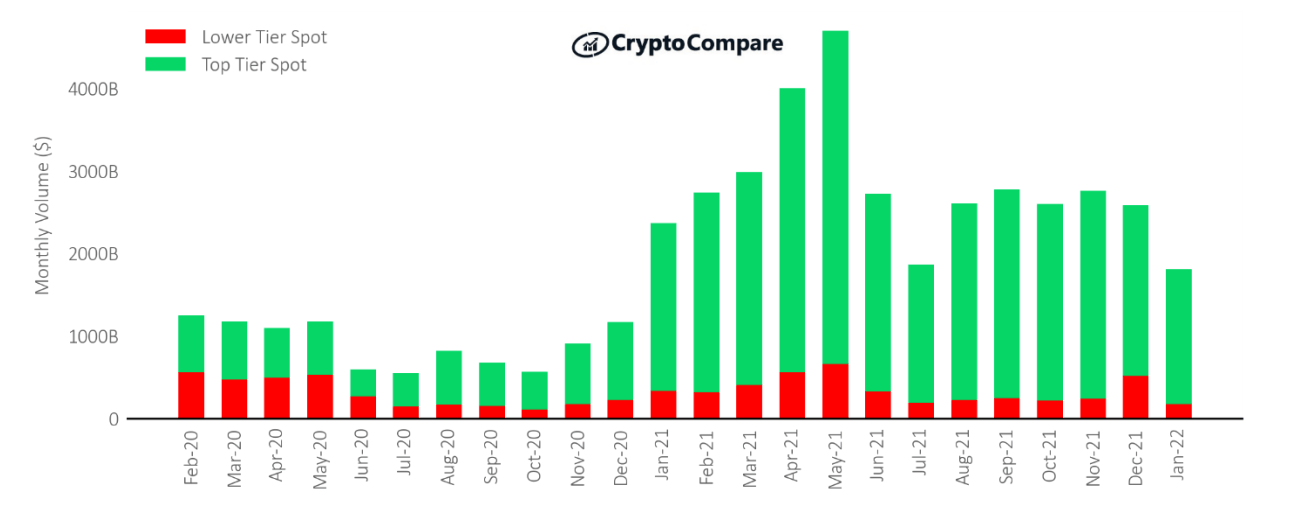

In January, spot volumes on centralized exchanges fell to $1.81 trillion, down 30.2% month-on-month–reaching their lowest level since December 2020 ($1.17 trillion).

This retraction consisted of a 21.2% drop in top-tier exchange volumes and a 66.3% drop in lower-tier exchange volumes.

According to the report, top-tier exchanges now make up for 90.3% of all spot volumes.

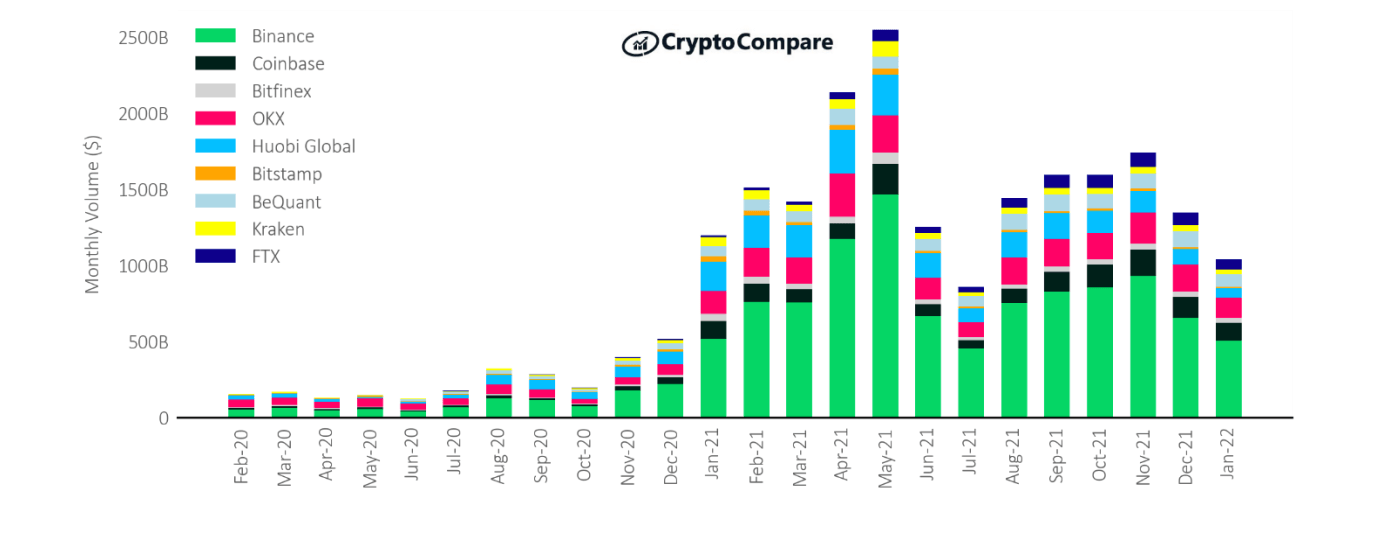

In January, Binance (trading $504 billion), OKEx (trading $131 billion), and Coinbase (trading $120 billion) were the top players in terms of spot volume.

Spot volumes also recorded the lowest intra-month high since December 2020.

Zooming in, the report revealed that daily total spot volume hit an intra-month high of $91.1 billion on January 24th–down 47.5% compared to the previous month.

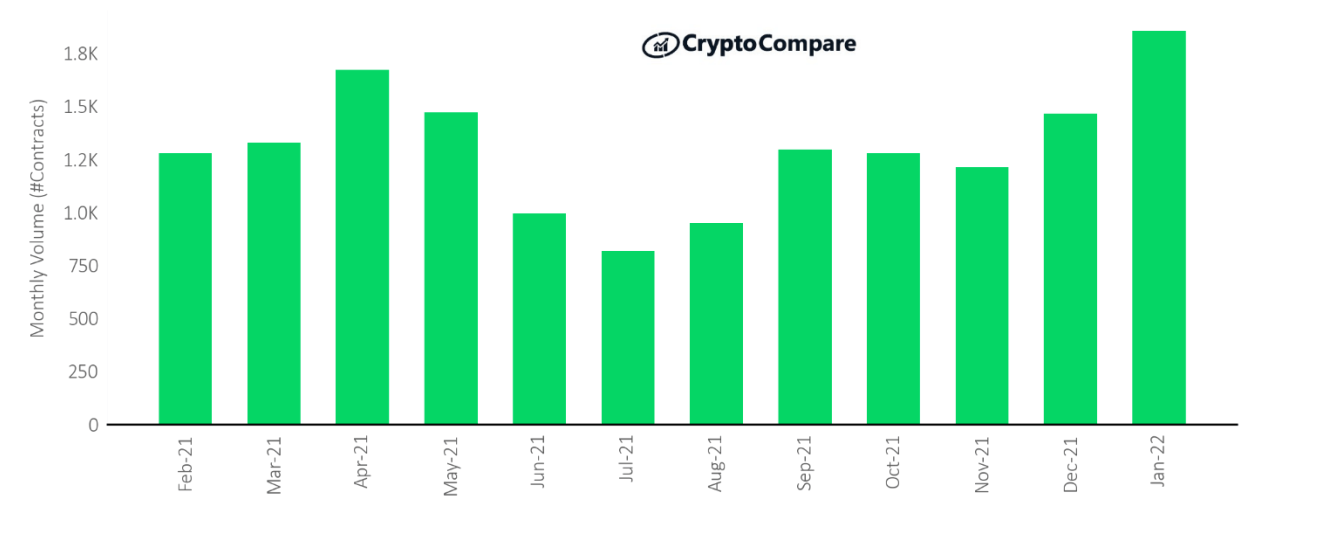

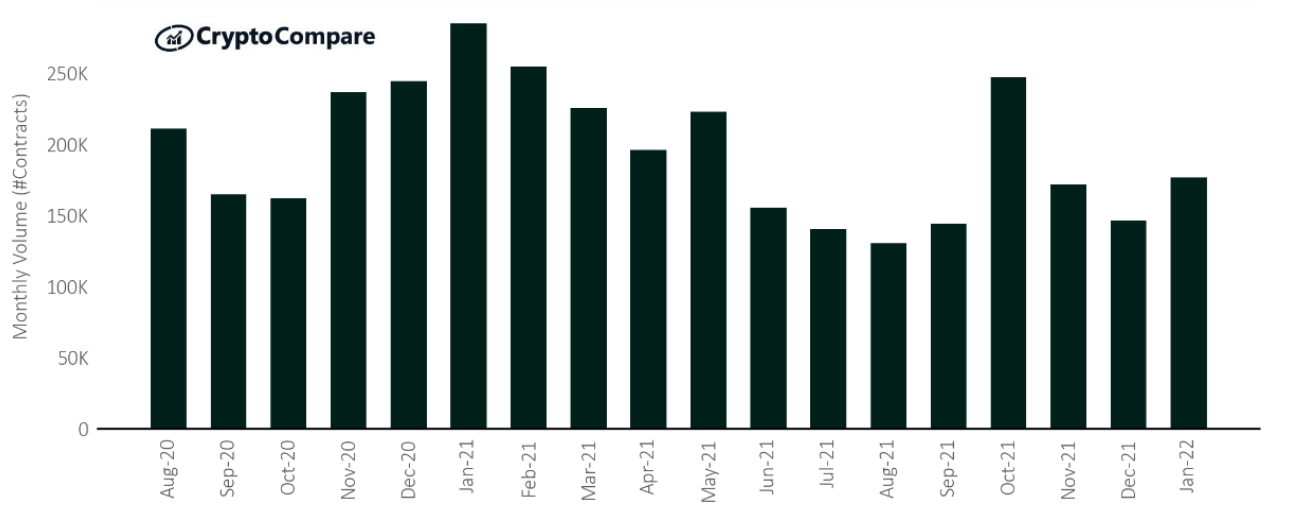

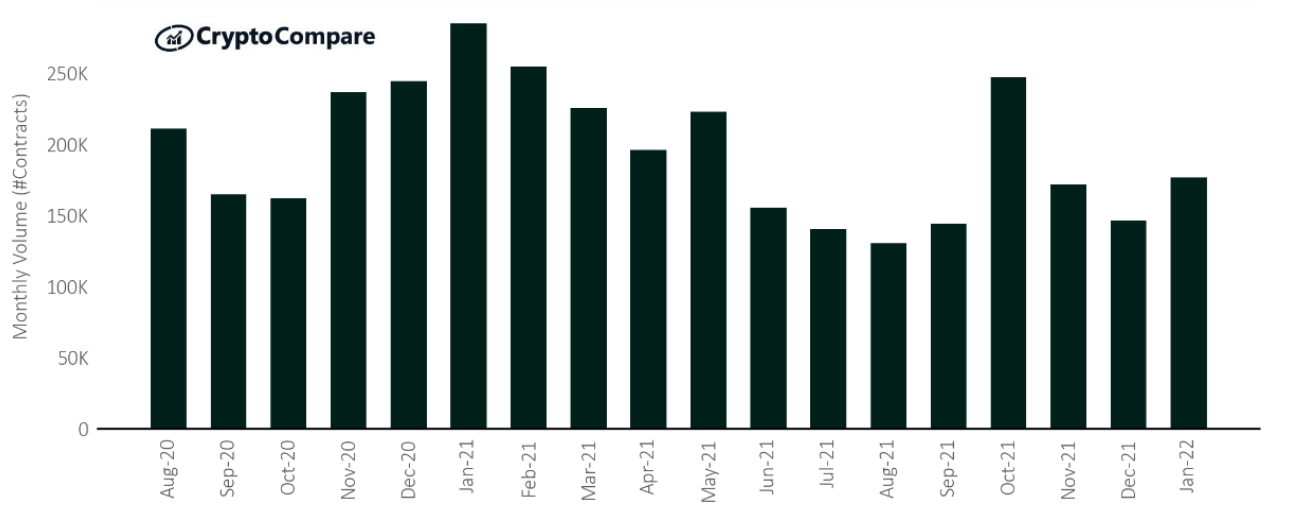

Derivative markets remain steady–reach an ATH market share

Meanwhile, derivatives market volumes remained steady and only recorded a marginal decrease–down 0.4% month-on-month to $2.86 trillion.

Consequently, derivative markets reached an ATH market share of 61.2%, breaking the previous record of 57.3% in November 2020.

The report concluded:

“This suggests an increase in hedging and speculation in cryptocurrency markets in the month of January, as participants shift to trading futures and options,”

However, CryptoCompare noted that January derivatives market volumes remain significantly below the ATHs recorded in May 2021($4.96 trillion).

As for crypto exchanges–Binance dominated the derivative markets in January, with 51.6% of total volumes, followed by OKEx (19.6%) and FTX (12.1%).

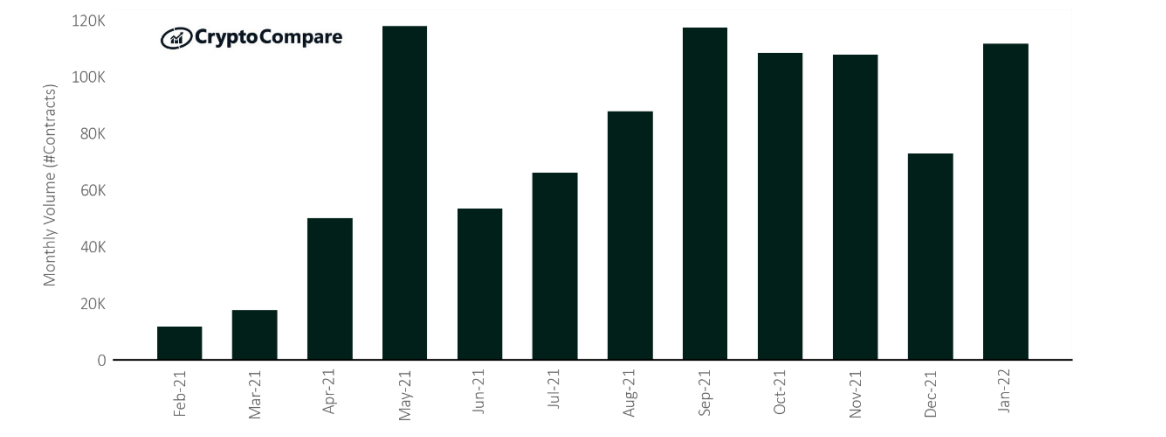

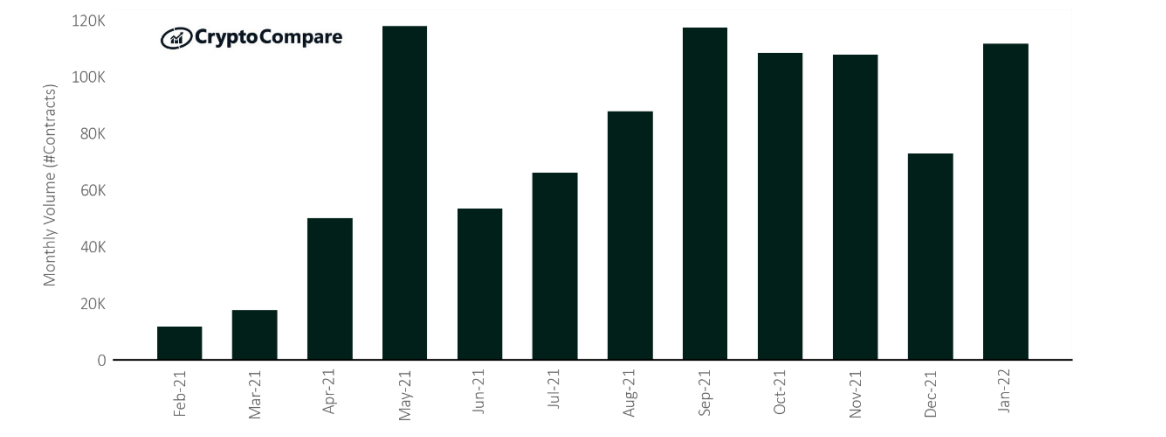

Zooming in, the report revealed 1.882 BTC option contracts were traded in the CME in January, up 28.6% month-on-month, reaching the highest amount of BTC options traded since December 2020 (3.749).

Meanwhile, BTC futures contract volumes were up 23.9%, while ETH futures contract volumes increased 59.4%.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)