Professional services giant Deloitte is set to boost its clients’ blockchain-tracking capabilities following a strategic alliance with crypto analytics firm Chainalysis.

Announced during a Chainalysis conference in Washington DC on July 25, the tie-up will see Chainalysis’ blockchain datasets, analytics software and training programs assist Deloitte’s clients with their crypto forensic, investigative and compliance needs.

A Chainalysis spokesperson told Cointelegraph that the alliance had been in the works for years, with the aim of helping more organizations to adopt blockchain technology.

Our alliance with @Deloitte, announced today at #TraceDC, will provide public and private organizations with bespoke solutions and specialized services related to risk, compliance, and investigations. Read more:https://t.co/NqbPPA6HYb pic.twitter.com/I48lKhhInb

— Chainalysis (@chainalysis) July 25, 2023

Thomas Stanley, president and chief revenue officer of Chainalysis said the collaboration is aimed at their mutual clients, including law enforcement agencies, regulators and financial institutions.

“We’re starting with a focus on regulators, law enforcement, and financial institutions given where they are at in their adoption of this technology and the unique overlap of our customer base,” the spokesperson added, noting that it will be introduced United States first.

“We’re initially rolling this out in the United States, but it is something that other markets can readily adopt. It’s our belief that other global markets will follow suit.”

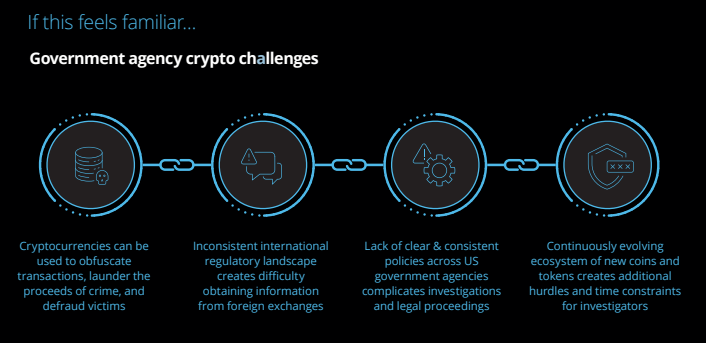

In a document outlining the alliance, Deloitte said some of the challenges faced by government agencies include when cryptocurrencies are used to obfuscate transactions and launder the proceeds of crime, while the international regulatory landscape creates difficulty obtaining information from foreign exchanges.

Deloitte said the partnership with Chainalysis could help “identify the actors behind the keyboard and effectively prosecute them,” including tracing the flow of funds to high-risk or sanctioned entities.

Related: How the IRS seized $10B worth of crypto using blockchain analytics

“Chainalysis will work with Deloitte’s blockchain and digital assets practice across cryptocurrency and digital asset risk, analytics, investigation, anti-money laundering/know your customer (AML/KYC), and regulatory compliance,” added Chainalysis.

Deloitte, known as one of the world’s Big Four accounting firms, recently posted over 300 job listings for cryptocurrency-related roles, 97 of which were based in the United States.

In late February, Deloitte announced a partnership with Web3 platform Vatom to provide immersive experiences to different industries, from using virtual reality for events, meetings and employee training to brands focused on building community engagement with metaverse experiences.

Magazine: Tornado Cash 2.0 — The race to build safe and legal coin mixers

Comments (No)