Koinly, a platform that helps to calculate crypto tax with reports from over 20 countries, including the US, UK, Brazil, and most EU countries, has announced a new integration with Terra. Users of the platform will be able to input their Terra wallet address for tax reports, alongside 50 other wallets such as MetaMask, Trezor, and Ledger already supported by the platform.

Transfers between all accounts are included in the tax calculations and Koinly plans to continue expanding support for wallets to become a true one-stop-shop for crypto tax tracking and reports.

“The release of Koinly’s integration of Terra finally allows users of the protocol to accurately track their transactions and tax obligations easier. LUNA holders now have a more hands-off approach with increased accuracy for their Terra taxes,” says Tony Dhanjal, Head of Taxation at Koinly.

Disclosing the correct transaction history

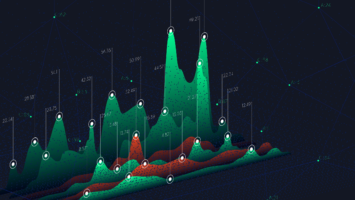

Now that crypto transactions are beginning to come under closer inspection, more and more crypto holders are getting familiar with their tax obligations. Disclosing the correct information is imperative to avoid being overtaxed. Koinly is helping to collate data and calculate the tax based on crypto income.

Currently working with 350 exchanges to facilitate accurate tax reporting with over 6 years of crypto transactions, Koinly has positioned itself as a leading crypto tax platform.

Koinly is built for both crypto newbies and long-term investors. It simplifies otherwise complex transaction history into an easy-to-read report. Within the Koinly platform, users can track their assets, income, and capital gains to watch their portfolio grow over time and understand their crypto tax implications as they trade throughout the tax year.

A timely integration with Terra

The Terra integration with Koinly tax software is a welcome announcement to LUNA holders as the cryptocurrency has raised in popularity since the beginning of the year. Earlier this year Koinly did a survey, which showed that 46.8% of crypto holders don’t know how and where to file their crypto tax while 81% did not know there are crypto tax platforms available.

“The skyrocketing increase in the popularity of Terra has left many holders and users of LUNA without a way to accurately track and record their transactions to meet their tax obligations. We are proud that Koinly is among the first platforms to react to the changing space, helping its users accurately track and report on their crypto tax,” said Robin Singh, the founder and CEO of Koinly.

According to Cryptoslate data, cryptocurrency LUNA has rallied positively in recent weeks and is up over 8.3% in the last 7 days alone. The Terra LUNA community is strong and LUNAtics have been busy in the last week expressing delight at the recent sponsorship announcement of the National stadium.

HEY #LUNAtics!

🔴 Checkout @TerraBitesPod now LIVE at @Nationals Park discussing @terra_money and the future of real-world integration! 🌕$UST $LUNA https://t.co/qx9w2iN3o1

— JQuantAnalytics (🌕,🔥) (@JQuantAnalytics) April 22, 2022

Reporting DeFi transactions can be a particular headache without the help of software. Prior to the Koinly’s Terra integration, LUNA holders had to rely on third-party tools to get their translation details integrated into their Koinly accounts. Koinly’s integration with Terra removes the need for these labor-intensive tasks, allowing users to track their LUNA transactions and taxable gains in real-time throughout the tax year.

Comments (No)