On-chain data analysis from Glassnode shows that Bitcoin investors are hedging out risks in order to stay protected against Federal Reserve interest rate hikes in March.

Glassnode’s The Week On-Chain newsletter from Feb. 14 indicates that the most significant trend in Bitcoin (BTC) right now is the flat futures term structure through March. This is strongly attributed to “investor uncertainty regarding the wider economic impact of a tighter US dollar.”

The rate hike is already priced in to spot markets, according to Cointelegraph contributor Michaël van de Poppe, but the longer term effect it will have is still unclear. As a result, Glassnode observed that investors are taking steps to protect themselves from the potentially low downside risk.

“It appears that investors are deleveraging and utilizing derivatives markets to hedge out risk, and buy downside protection, with a keen eye on the Fed rate hikes expected in March.”

While the data clearly shows an objective flat area on the futures term structure curve, it suggests somewhat more subtly that investors are not expecting a significant bullish breakout through the end of 2022. The annualized premium on futures is only at 6% right now.

Annualized premium is the value above a dollar that a person will pay for the risk of a futures contract. A higher premium indicates a higher risk appetite.

On-chain data analysis from Glassnode shows that Bitcoin investors are hedging out risks in order to stay protected against Federal Reserve interest rate hikes in March.

More evidence of a lack of investor confidence is the slow but steady deleveraging through voluntary closure of futures positions. Such de-risking has resulted in what Glassnode sees as a decline in total futures open interest from 2% to 1.76% of the total crypto market cap. This trend hints at a “preference for protection, conservative leverage, and a cautious approach to storm clouds on the horizon.”

Fundstrat managing partner Tom Lee agrees that there are hard times ahead for traditional investments like bonds. He told CNBC on Feb. 14 that due to an interest rate reversal, “for the next 10 years, you’re guaranteed to lose money owning bonds… that’s almost $60 trillion of the $142 trillion.”

However, Lee noted that the $60 trillion is likely to go into crypto where investors can continue to earn yield that matches or may even outperform the yields they earned from bonds. He said:

“I think what is more likely is a lot of speculative capital from equities… it’s really going to be tracing its roots to a rotation out of bonds and it’s going to eventually flow into crypto.”

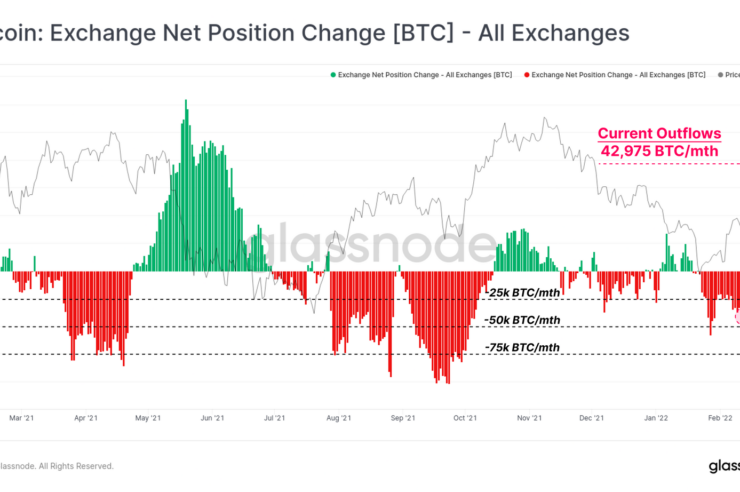

Exchange outflows continue

Despite market participants clearly shedding risk ahead of the Fed rate hike, Bitcoin outflows from exchanges are still vastly outweighing inflows. For the past three weeks, net outflows have reached a rate of 42,900 BTC per month. This is the highest rate of outflow since last October as the price of BTC led up to a new all-time high of around $69,000 in November.

Long-term holders of Bitcoin (those that have kept their Bitcoin dormant for at least 156 days) are maintaining steady control over the circulating supply by holding about 13.34 million BTC. Since the October 2021 high, long-term holders have relinquished only 175,000 BTC, showing support for the recent $33,000 low and demand for more coins.

Related: Bitcoin price consolidates in critical ‘make or break’ zone as bulls defend $42K

Bitcoin is currently up 4.19% over the past 24 hours and trading at $43,552 according to Cointelegraph.

Comments (No)