The below is a free, full excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The purpose of this issue will be twofold:

The first will be an in-depth look at the Celsius platform, and breakdown the design of the business/ecosystem to understand what went wrong.

The second is to detail the events that have transpired over the recent weeks with Celsius “yield generation” strategies, and update subscribers on the state of the market, with potentially big ramifications on the horizon.

The following is written by Bitcoin Magazine’s Namcios, detailing Celsius’s core business operations.

Celsius: Design And Assumptions

This section takes a deep look at the inner workings of the project itself, as per its white paper, including some red flags in its design and backboning assumptions that could’ve served as a warning to investors – and can hopefully be applied to other projects to prevent similar losses in the future.

“As more people join the Celsius ecosystem, the more everyone benefits,” per the white paper.

Throughout its white paper, Celsius conflates terms and assumptions, pushing forward design decisions that don’t necessarily play along. One example of this is naming itself Celsius “network” while having an entire section dedicated to showing an “executive team.” It can be argued that networks don’t have executive teams, though Celsius has a few founders, a CEO, a COO and a CTO, as well as marketing and development departments. It also repeatedly refers to a “community” it seeks to create with its network, though the user can be certain that the executive team will almost always preserve its own self-interests instead of the community’s – which is what happened on Sunday as withdrawals were halted in the platform. (The withdrawal issue will be explored in length in a subsequent section.)

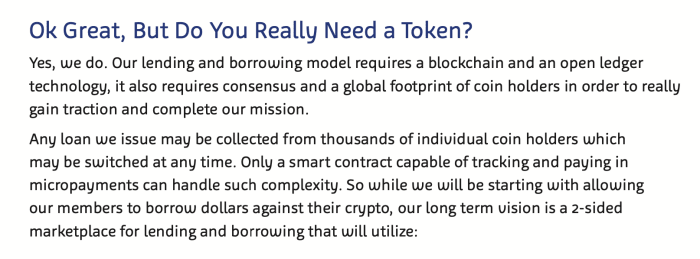

Celsius fails to provide a proper explanation for why its project needs a token, as seen in the image above. The white paper simply states that its “lending and borrowing model requires a blockchain and an open ledger technology,” citing that such needs come “in order [for the project] to really gain traction.”

Both can hardly be seen as factual responses to that question. In fact, the white paper in its entirety is more akin to a marketing deck or a pitch to investors than what a white paper should really be: a technical document explaining the engineering decisions behind the project’s design.

Moreover, complex trading platforms exist in the world that handle very complex structures and settlement orders, meaning that a smart contract is also not a strong enough reason for a blockchain.

Indeed, the real reason as to why Celsius needs a blockchain and an open ledger technology is to issue its CEL tokens – for which it built an ecosystem around to generate enough “traction.” Moreover, the CEL tokens also allowed the team to raise money from investors to build out the platform and wallet. Still, the issuance of credit could’ve been done without a blockchain, but in that case the team would’ve lacked an important motto for generating hype nowadays – “crypto,” “decentralized” and “blockchain.”

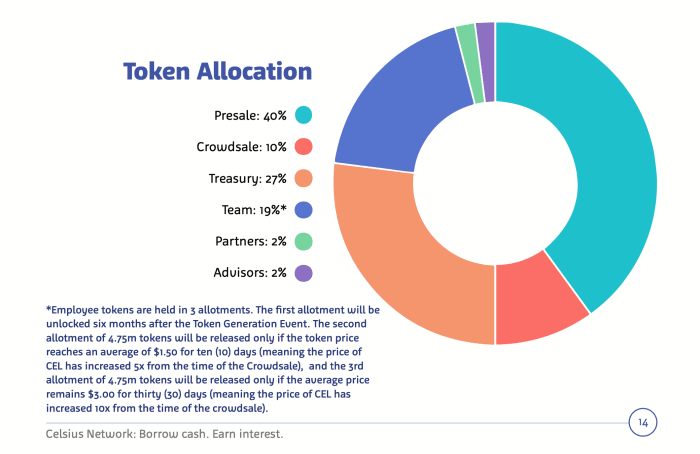

The white paper demonstrates that Celsius performed a presale of CEL tokens (amounting to 40% of the total number of CEL tokens) at $0.20 per token and later did a crowdsale (amounting to 10% of the total number of CEL tokens) at $0.30 per token. While the presale occurred in Q4 2017, the crowdsale began in March 2018.

Celsius details in its white paper how big of a role CEL plays in the project. In fact, all of the platform’s functionality – borrowing and lending – would only come into effect after the tokens were issued.

CEL is an ERC-20 token, meaning that it is a fungible token deployed with a smart contract on Ethereum, that seeks to “create a value-driven lending and borrowing platform for all our members,” as per the white paper.

Ownership of the token allowed users to join the Celsius platform, deposit cryptocurrency into the Celsius wallet, apply for dollar loans and pay interest on those loans at a discounted rate at launch. The document also outlined that after launch, the token would eventually enable users to lend cryptocurrency to gain interest, get rewards on cryptocurrency lent out and achieve “seniority” in the platform. Seniority sought to reward those opting to use CEL with better rates – a self-enforcing feedback loop of incentives that seek to generate more demand for CEL.

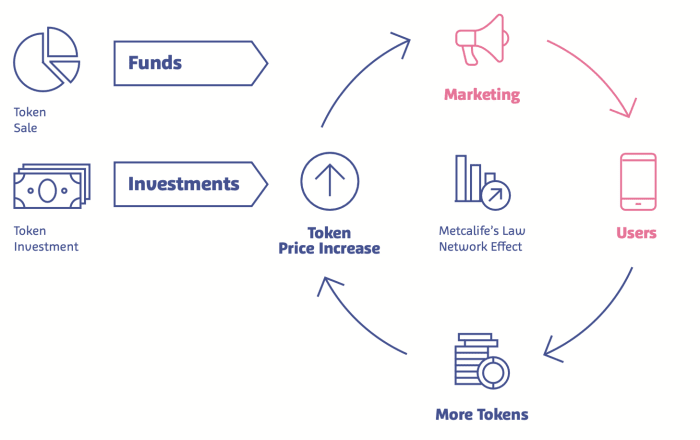

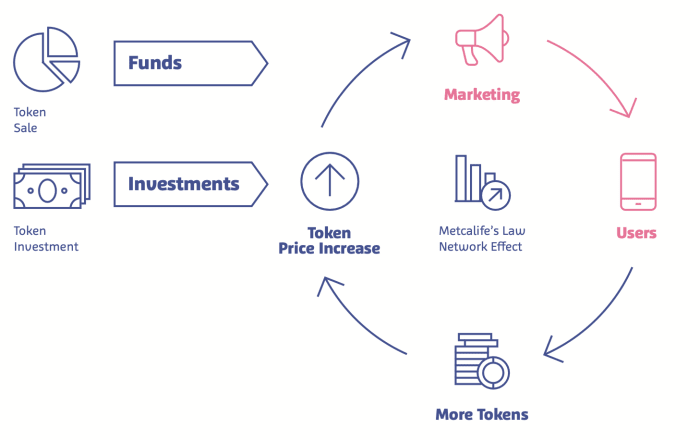

This feedback loop extends beyond this dynamic to play a key role in the user acquisition and retention strategies for Celsius. In short, Celsius’ token dynamics assume that borrowers bring fees, which are converted into CEL tokens that get paid out to lenders after a fee cut, attracting more retail investors who are willing to put up their cryptocurrency as collateral to gain some of those fees, hence increasing the demand for CEL – driving up the price and allowing Celsius to spend more money on marketing and advertising to attract more users.

Celsius’ white paper details the feedback loop based on the CEL token. Image source: Celsius network white paper.

“The system also creates a supply and demand cycle of the Celsius token (CEL),” the white paper states, referring to the platform composed of borrowers, lenders and the orchestrating Celsius service.

All in all, Celsius’ design involves a mix of traditional and burgeoning technologies to market yields much higher than those available in traditional financial systems. The complex web of different moving parts was tentatively glued together with confluent incentives derived from the CEL token – which based itself on a reinforcing economy of issuance and distribution for the acquisition and retention of users.

Play-by-Play Of Celsius Missteps

Late Sunday evening, crypto exchange Celsius announced they were halting all withdrawals, transfers, and asset swaps on the platform. The platform, which offers users yield on their crypto assets, as well as the ability to borrow against, had been the subject of much scrutiny in recent weeks/months over their apparent yield-generation strategies.

Throughout 2021, there were multiple arbitrage strategies that offered traders “risk-free return.” These strategies were the GBTC arbitrage, and the futures market contango. These strategies, which took advantage of pricing dynamics between spot market bitcoin and select derivatives (in this case the Grayscale Bitcoin Trust and bitcoin futures contracts) allowed for market neutral arbitrage, and for many individuals, funds and companies to capitalize on the massive “yield.”

Many companies capitalized on this dynamic by offering native yield products, where they put on these trades with customer funds, and profited on the difference that was harvested against what was paid to customers. When the music was playing, this sort of strategy could be maintained, but as demand for yield products grew and the arbitrage in both the futures market and with GBTC disappeared, the ability to generate yield did also.

This dynamic caused Celsius to turn to increasingly exotic and risky instruments to generate “yield” for depositors. On May 3, before the LUNA/UST collapse, on-chain analysts documented Celsius sending funds into the anchor protocol.

Following the LUNA/UST collapse, rumors began to fly as to which companies/counterparties had been hit, and whether insolvencies were a worry, with Celsius being a key focus.

Given the opaque nature of the company’s operations, there wasn’t any way to know for certain whether the company was insolvent from an asset/liability standpoint, but merely the potential for such a situation made the risk/reward of using the platform’s yield products a bad trade-off.

Aside from depositing user funds on the Anchor protocol for yield, it was uncovered that Celsius also had a large stake in stETH. stETH, a liquid derivative, allows users to stake their ETH in anticipation of the merge to proof-of-stake, while still having liquid access to their capital in the form of stETH. Similar to the GBTC redemption mechanism, once ETH is staked for stETH, it cannot be unstaked until “the merge” is successful.

While this issue won’t delve deep into the weeds of Ethereum’s proof-of-stake system and the exotic derivatives complex that has been built around it, the purpose of mentioning stETH is to highlight another yield-generation strategy that went wrong for Celsius, as the stETH<>ETH exchange rate began to break from 1.0.

With Celsius holding a large amount of stETH that was falling from its alleged peg, illiquidity worries increased further, with the market to buy ETH for stETH not nearly liquid enough for Celsius’ massive position to exit without sustaining massive losses. With an increasing number of users withdrawing their funds from the platform, and with cryptocurrency markets already selling off meaningfully over the weekend, Celsius announced they were pausing all withdrawals, swaps, and asset transfers on the platform.

We are taking this necessary action for the benefit of our entire community in order to stabilize liquidity and operations while we take steps to preserve and protect assets. Furthermore, customers will continue to accrue rewards during the pause in line with our commitment to our customers.

We understand that this news is difficult, but we believe that our decision to pause withdrawals, Swap, and transfers between accounts is the most responsible action we can take to protect our community. We are working with a singular focus: to protect and preserve assets to meet our obligations to customers. Our ultimate objective is stabilizing liquidity and restoring withdrawals, Swap, and transfers between accounts as quickly as possible. There is a lot of work ahead as we consider various options, this process will take time, and there may be delays.

The biggest problem with Celsius’ operations was that it was increasingly obvious that the firm was taking extreme risk with user funds that were often not able to be properly quantified. Thus, when thinking of native “yield” on crypto assets, specifically with bitcoin which is absolutely scarce, it is important to understand that it’s not yield, but rather shorting extreme tail risk.

Now, with the price of bitcoin trading at $23,100 at the time of writing, Celsius is on the verge of a margin call on 17,900 wBTC (wrapped bitcoin on Ethereum).

The liquidation price level was at $20,272 before Celsius topped off the vault with additional collateral, pushing the liquidation price to $18,300. The main concern is that this liquidation level is completely transparent, and opportunistic speculators are currently indiscriminately selling to force Celsius to sell (either willingly covering or through forced liquidation).

You can check the status of the vault here with live updates to liquidation levels.

Market Implications

Either way, the market is in a precarious position over the short term, with a likely partially-insolvent exchange doubling down on a margin position. If the history of bitcoin (and financial markets) have shown anything, it is that doubling down on a leverage position likely never ends well, with the worst part being that user funds are what’s being put at risk.

With this in mind, the probability of a volatile wick to the downside looks likely. Short-term traders/speculators should be watching the status of the Celsius loan vault closely, as a liquidation would bring a couple hundred million dollars of selling pressure in short order.

Lessons Learned

As of late, novel narratives have been employed to drive retail customers to believe in the power of “blockchain technology” and “cryptocurrency” as drivers for a revamped financial system. However, as argued before, blockchain serves a very specific purpose – solve the double spending problem to port cash (peer-to-peer money) into the digital realm. This was achieved by Satoshi Nakamoto, who, after decades of research by many scientists and mathematicians, arrived at the design of Bitcoin – published in a proper white paper in 2008.

From the point of view of users, three lessons can be learned.

First, beware of self-reinforcing ecosystems. This was true for Terra’s UST project and is also true for Celsius. Terra and the Luna Guard Foundation have repeatedly said things along the lines of “generate enough demand” for the survival of UST, while Celsius’ white paper repeatedly makes the case that the more people join, the better it is for everyone. Notably, in the case of Celsius, the case that a lending and borrowing platform needs its own token is a hard one to make. (Hodl Hodl, for instance, allows truly peer-to-peer bitcoin-backed loans without the usage of a token – it only leverages an escrow system.)

Second, if something seems too good to be true, it probably is. Celsius ported itself as an impossible-to-fail system that was secure and cared for its users while offering one of the highest yields and lowest rates on the cryptocurrency lending market. Celsius CEO Alex Mashinsky made the case that users could always withdraw funds from his platform, though on Sunday announced nobody was able to withdraw funds. The platform cited this decision had users’ best interests in mind, but that is hardly the case.

Lastly, and this one is getting old – hold your own keys. If you don’t have full control over your bitcoin, meaning you can’t transact with whoever you want, whenever you want, you don’t own your bitcoin – someone else does. Depositing bitcoin into Celsius for some “risk-free” yields seemed like a good idea, until it wasn’t. If in doubt, always custody your own coins. Withdraw your bitcoin from exchanges and walk yourself through a self-custody solution that only you know the key to. Moreover, be extra careful when keeping a significant amount of your net worth in credit of a newly-founded company such as Celsius (CEL token). They can go under – just like Terra. As always, do you own research.

Comments (No)