DeFi platform Bridgesplit has announced a $4.25 million seed round today. In short, the startup company builds products that make it easier to buy, sell and lend NFTs. Big investment firms, CoinFund and Jump Capital led the seed round.

CoinFund and Jump Capital Lead $4.25 Million Seed Round For Bridgesplit

The seed round boasts a number of high profile names, with CoinFund and Jump Capital leading the charge. CoinFund is the leading blockchain-focused investment firm. In contrast, Jump Capital is an established venture investment firm that has more recently added a focus on crypto companies.

Clearly both companies have a lot of faith in what Bridgesplit is building. In the press release announcing the seed round, Saurabh Sharma, a partner at Jump Capital, voiced this belief, saying that the products Bridgesplit is building will “help unlock the true potential of NFTs.” CoinFund CEO Jake Brukhman added, “The Bridgesplit team is rapidly advancing the state of the art in this space.”

To be sure, the two firms aren’t the only big names that took part in the seed round. Indeed, Solana Labs and Coinbase Ventures also invested in Bridgesplit. What’s more, the list of angel investors includes crypto analysts, Anthony Pompliano and Packy McCormick, and NFL legend, Joe Montana.

What Problems Are Bridgesplit Hoping To Solve?

But what exactly is Bridgesplit? Well the best way to answer that is to look at the problems the company is tackling. To that end, NFT Evening sat down for an interview with Bridgesplit co-founder, Luke Truitt.

For one thing, Truitt explains how hard it can be for NFT owners to sell their NFTs. “You have a situation where, every individual asset needs to find its unique individual buyer. And there could be 1000 buyers out there, there could be one buyer – but you need to figure out who that buyer is and how much they’re willing to pay.

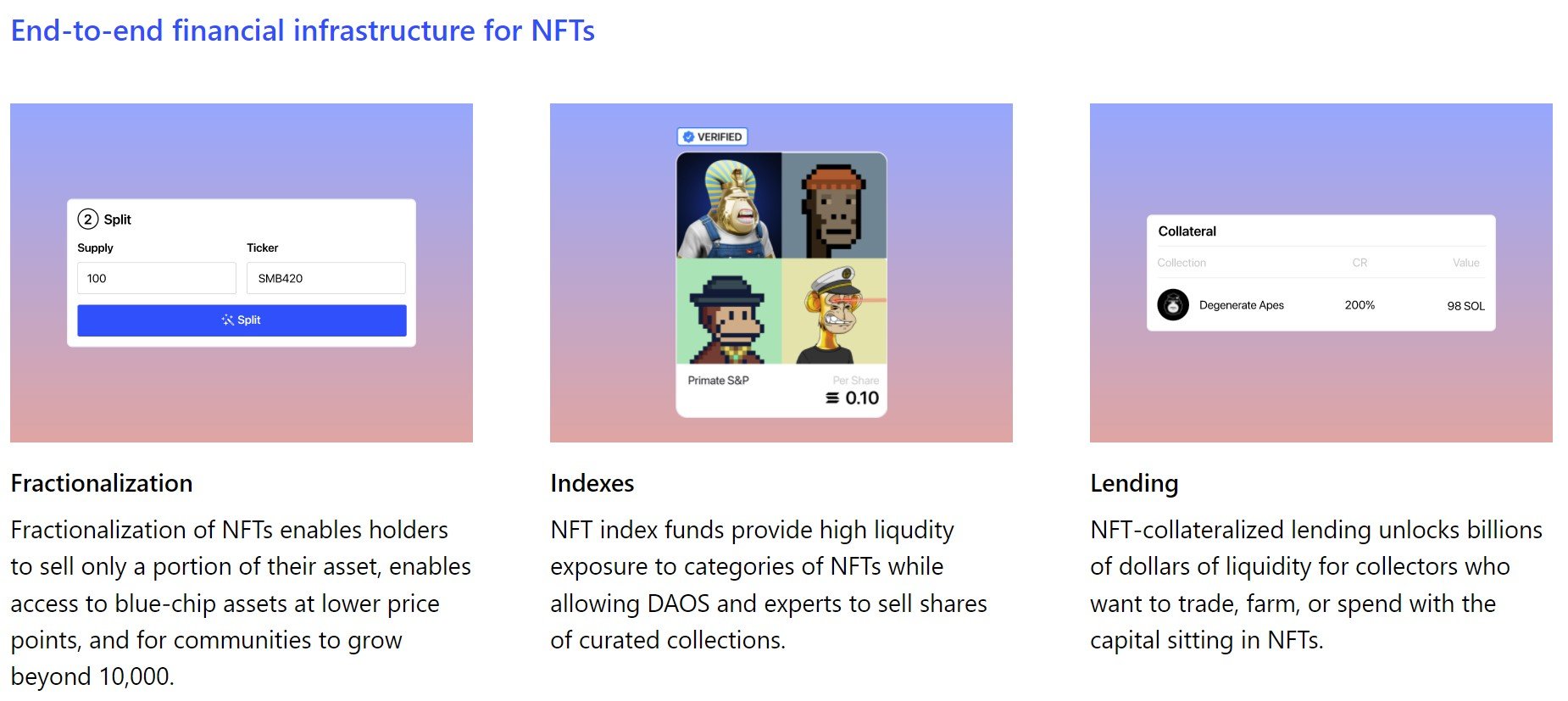

In light of this problem, Bridgesplit is working on products for NFT fractionalization, index funds, curated NFT pools and even NFT-collateralized lending. As a matter of fact, Bridgesplit recently launched a permissioned Alpha to demo their fractionalization platform in partnership with MonkeDAO. The launch features a Solana Monkey Business NFT, appropriately named DAO Jones.

Choosing To Build On Solana Over Ethereum

Another key point from the interview with Truitt was the reasons he gave for building on Solana, as opposed to Ethereum.

“Seeing how Ethereum works, it’s very clear that that’s not where the future of this stuff is going from a lot of different perspectives. For some things, sure, but for most things, I don’t think so. And so, that got us really excited about Solana.”

Even though Truitt sees the same issues with Ethereum that many others do, that doesn’t mean that Bridgesplit is ignoring that network. On the contrary, Bridgesplit intends on being a cross-chain platform. In other words, they want users to be able to use their platform on many blockchains – not just Solana.

“We want to keep Solana as the infrastructure layer because of how superior it is, from a technology perspective. But from a user perspective, you could have assets on 10 chains, and you still can be using Bridgesplit in the exact same way.”

Bridgesplit Is Growing Fast… And Hiring!

To conclude, Truitt mentioned at the end of our interview that the company is indeed looking to hire at the present time.

“If anybody that’s reading this is excited about working on the future of NFTs, we’re looking for help in marketing, engineering, and business development.” Anyone interested in joining the team can learn more at bridgesplit.com.

Are you tired of missing important NFT drops?

Just check out our NFT Calendar !

Subscribe to our hot social media and don’t miss anything else

If you’re old school :

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investments.

Owners, holders, fans, community members, whales… Want to boost this article by featuring it on top of the Homepage? ==> Contact us!

Comments (No)