Bitcoin (BTC) whale buying and selling in 2023 is mostly from speculative investors, new data reveals.

In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode shows that contrary to popular belief, opportunistic entities are the most active whales.

The birth of the Bitcoin “short-term holder” whale

Since BTC price action returned to $30,000, a shift has taken place among Bitcoin traders.

As Glassnode shows, so-called short-term holders (STHs) — investors holding coins for a maximum of 155 days — have become significantly more common.

As it turns out, the largest-volume investor cohort, the whales, is also composed of large numbers of STHs.

“Short-Term Holder Dominance across Exchange Inflows has exploded to 82%, which is now drastically above the long-term range over the last five years (typically 55% to 65%),” Glassnode states.

“From this, we can establish a case that much of the recent trading activity is driven by Whales active within the 2023 market (and thus classified as STHs).”

Interest in trading short-timeframe moves on BTC/USD was already evident before May. Since the FTX meltdown in late 2022, speculators have been increasingly eager to tap volatility both up and down.

The results have been mixed: Realized profits and losses have routinely spiked in line with volatile price moves.

“If we look at the degree of Profit/Loss realized by Short-Term Holder volume flowing into exchanges, it becomes evident that these newer investors are trading local market conditions,” Glassnode continues.

“Each rally and correction since the FTX fallout has seen a 10k+ BTC uptick in STH profit or loss, respectively.”

Whales show “elevated inflow bias” to exchanges

Closer to the present, whales have ramped up exchange activity, at one point in July accounting for 41% of total inflows.

Related: Biggest mining difficulty drop of 2023? 5 things to know in Bitcoin this week

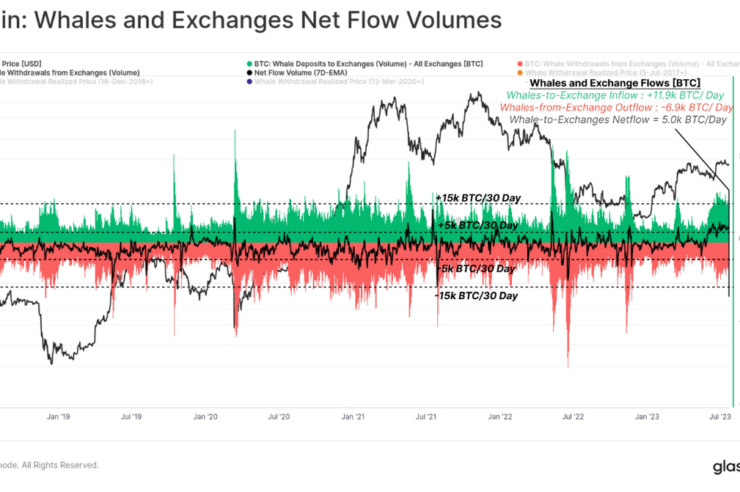

“Analysis of the Whale Netflow to Exchanges can be used as a proxy for their influence on the supply and demand balance,” The Week On-Chain comments on the topic.

“Whale-to-exchange netflows have tended to oscillate between ±5k BTC/day over the last five years. However, throughout June and July this year, whale inflows have sustained an elevated inflow bias of between 4.0k to 6.5k BTC/day.”

As Cointelegraph reported, whales are not the only forces at work when it comes to BTC sales.

Mining pool Poolin hit the headlines with its transactions destined for Binance, while miners potentially hedging profits also contributed to sell-side activity.

Magazine: Tokenizing music royalties as NFTs could help the next Taylor Swift

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Comments (No)