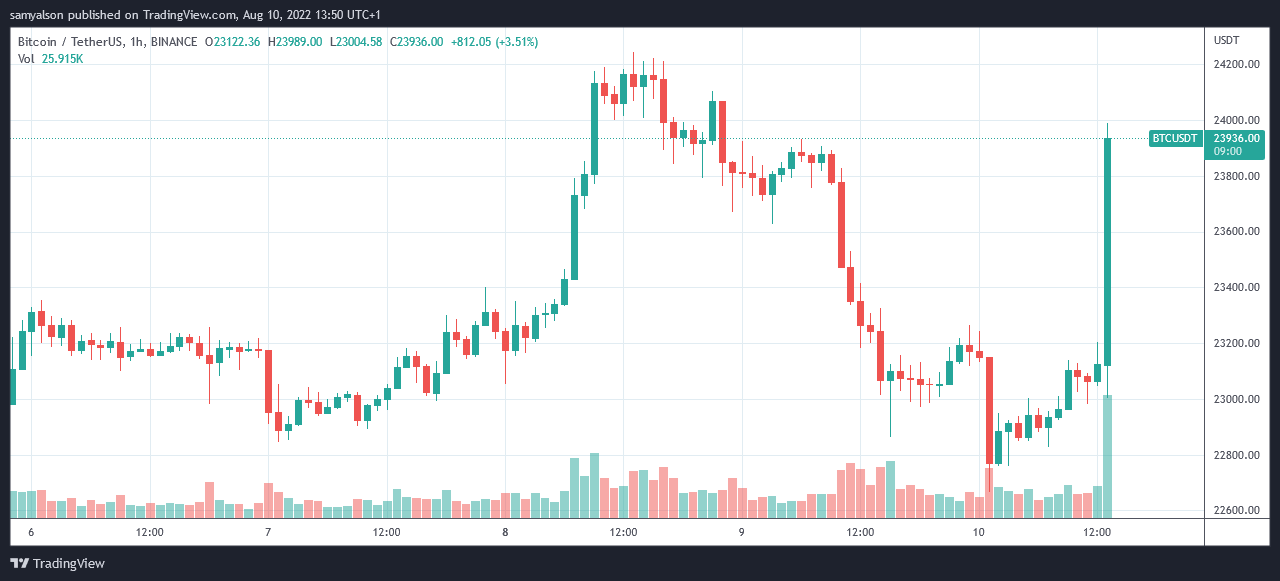

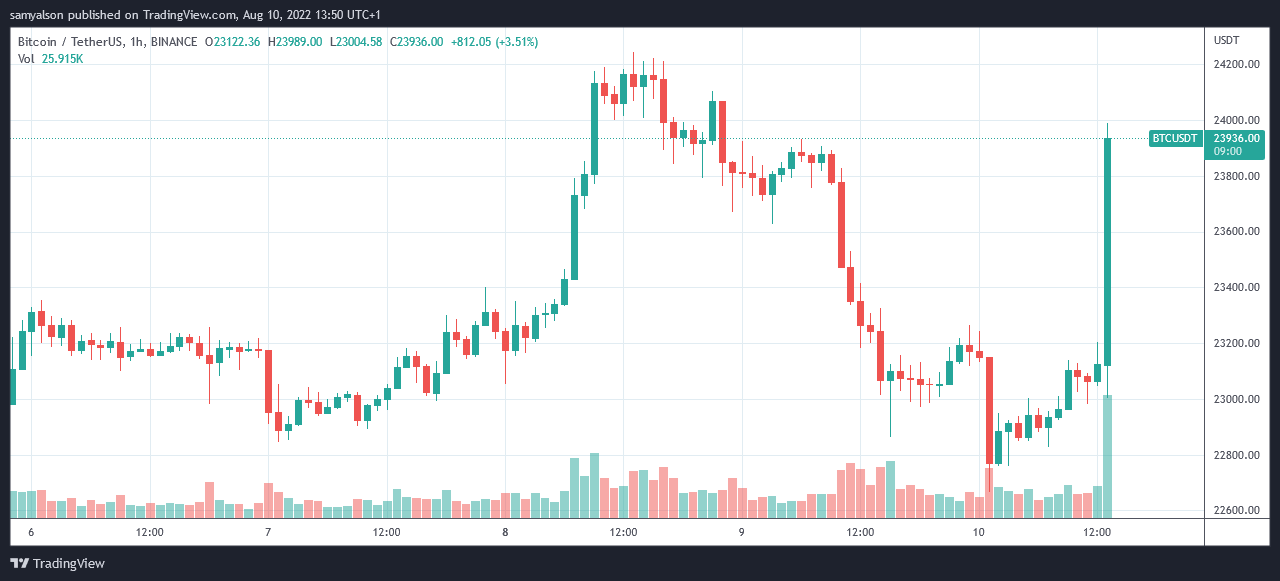

The price of Bitcoin moved higher following the release of Consumer Price Index (CPI) data by the U.S. Bureau of Labor Statistics (BLS), showing no change in July.

In anticipation of the data, Bitcoin rose from a local bottom of $22,600 on August 10 as investors awaited the inflation report. On the release of the information, BTC’s initial reaction saw a spike to $24,000.

Crypto markets and equities had taken a slight dip the day before, as investors exhibited caution ahead of the BLS announcement — despite CPI estimates of 8.7% being lower than the previous month at 9.1%.

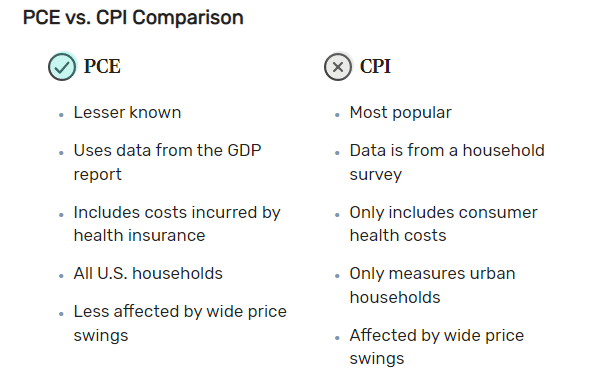

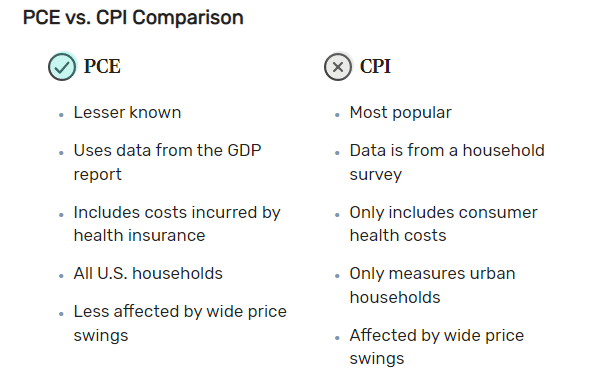

CPI vs. PCEPI?

Fed officials announced a second consecutive 75 basis point hike following the last FOMC meeting on July 27 – giving a range of 2.25% to 2.5%.

The next FOMC meeting will occur on September 20 – 21, with speculation mounting that the Fed will be forced to impose another significant hike to combat a red hot labor market and the jump in Average Hourly Earnings.

In the U.S., there are two official measures of inflation:

- CPI inflation – measures the monthly change in prices paid by U.S. consumers. The Bureau of Labor Statistics (BLS) calculates the CPI as a weighted average of prices for a basket of goods and services representative of aggregate U.S. consumer spending.

- The Personal Consumption Expenditures Price Index (PCEPI) measures household goods and services price changes. Increases in this index warn of inflation, while decreases indicate deflation.

Federal and state governments and businesses use the CPI. In contrast, the PCEPI informs the FOMC of its inflation policy.

Attention turns to the FOMC meeting in September

Analysts expect higher core inflation (PCEPI) to increase from 5.9% to 6.1%, piling pressure on the Fed to enact a significant rate hike in September. However, the CPI data suggests recent rate hikes are working to cool the economy.

Nonetheless, spurred by robust employment figures and higher than expected wage growth, Citigroup economists said another 75 basis point hike is likely. But the potential for a 100 basis point increase is also on the cards if core inflation presents higher than expected.

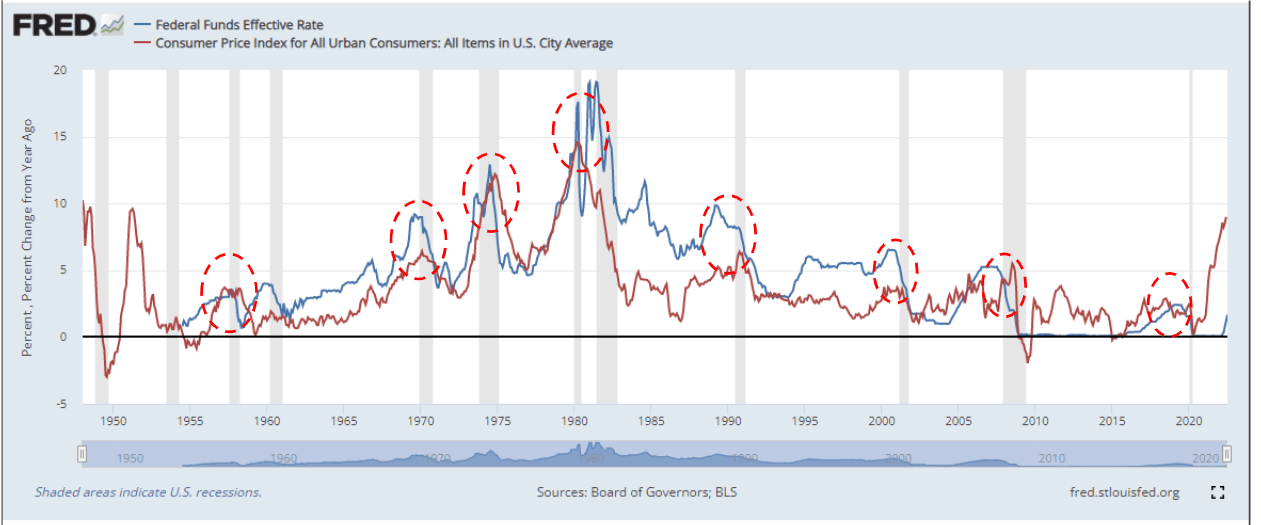

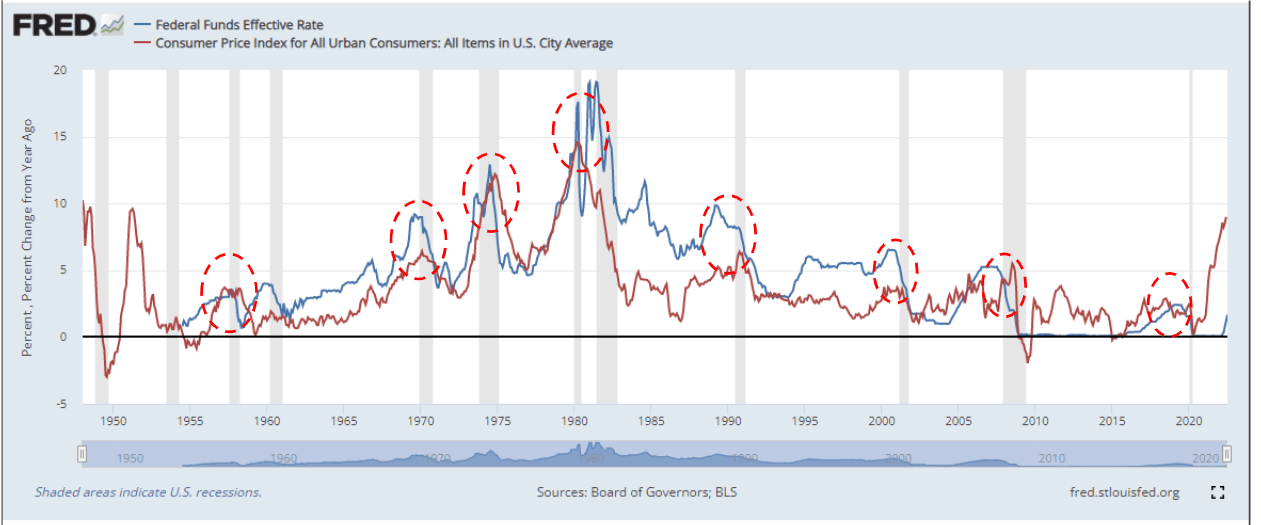

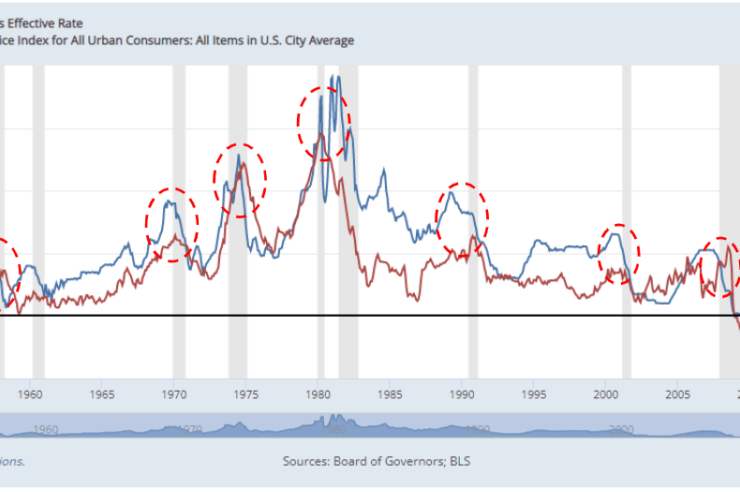

Investor Stanley Druckenmiller pointed out that “Inflation has never come down from above 5% without Fed funds rising above CPI,” which is currently running at 9%.

With that in mind, if the Fed is serious about reigning in inflation, a funds rate of 9% is required.

With that in mind, if the Fed is serious about reigning in inflation, a funds rate of 9% is required.

Comments (No)