Bitcoin (BTC) rose above $23,000 again into Aug. 6 as new analysis predicted a potential surge of 20% or more.

Daily chart gives trader $30,000 target

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing overnight to once again sit near the top of its established trading range.

After multiple attempts to break out above range resistance at $23,500, the pair appeared still stuck in limbo at the time of writing, but hopes of bullish continuation were already there.

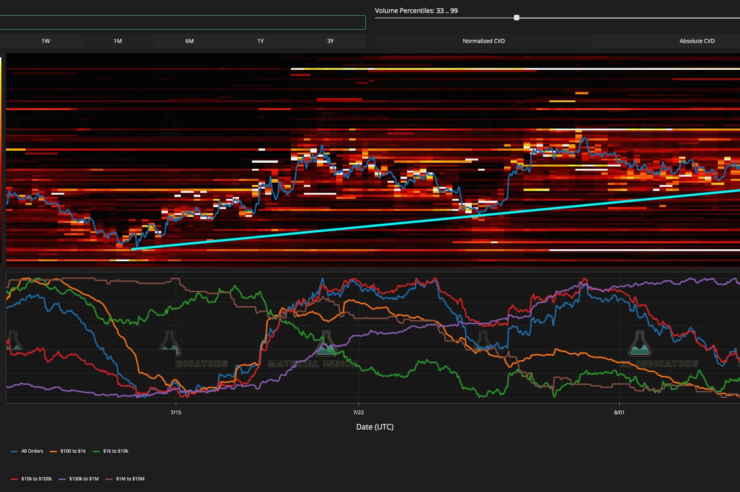

“Expecting more volatility over the wknd,” on-chain monitoring resource Material Indicators wrote in part of its latest Twitter update on Aug. 5.

“If the Bear Market Rally can push BTC above 25k there isn’t much friction to 26k – 28k range. Losing the trend line would be bad for bullish hopes and dreams.”

$28,000 would be over 20% higher than current spot price, and would represent a near two-month high.

Material Indicators included a chart showing the trendline mentioned sitting at $22,000 — around Bitcoin’s current realized price.

The chart further showed bid support increasing immediately below spot, while major resistance lay at $24,500.

Weekend trading traditionally sparks more volatile price action thanks to a lack of liquidity on exchange order books, which are dominated by retail traders while institutions and professionals stay away until the new trading week.

Analyzing the daily chart, meanwhile, popular trading account CROW entertained even higher levels, revealing plans to take profits only at $30,000 as long as Bitcoin continued making higher highs and higher lows.

$BTC

Keeping it simpleThe market structure is bullish, and I’ll stay bullish as long as we’re making Higher Lows and Higher Highs.

$30k is my main area of interest to take profit.#Bitcoin pic.twitter.com/LGGyW5whB4

— CROW (@TheCrowtrades) August 6, 2022

“Weekend is all about range trading due to the fake outs,” trader Crypto Tony added.

“I like to identify the range and then play accordingly Ranges are effective at identifying true breakouts, or fake outs. You can play both of them.”

Monthly RSI hints BTC price comeback is beginning

Turning to on-chain data, PlanB, creator of the Stock-to-Flow family of Bitcoin price models, again flagged relative strength index (RSI) performance flipping bullish.

Related: ‘Insane evidence’ Bitcoin has capitulated in past 2 months — analysis

RSI is a core metric which shows how comparatively overbought or oversold BTC is at a certain price, and in June hit its lowest levels ever.

Now rebounding, RSI could even signal an end to the 2022 bear market, PlanB suggested.

#bitcoin Relative Strength Index (RSI) bounced back in June. Bear market over? pic.twitter.com/hsb6S6aW0n

— PlanB (@100trillionUSD) August 6, 2022

In a previous post on Aug. 3, meanwhile, PlanB acknowledged that BTC/USD was still “far below” the stock-to-flow daily estimate, this being $83,475 for Aug. 6 according to automated calculator S2F Multiple.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Comments (No)