The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

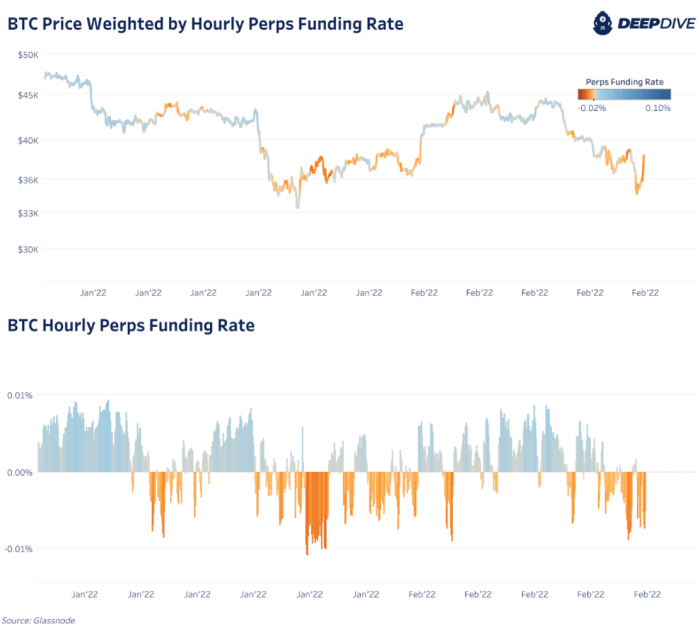

Bitcoin continued to behave like a high beta, risk-on asset similar to most of the overvalued tech sector. As Russia’s announcement of military intervention was proliferating across financial markets, U.S. equity markets reached as far down as -3% in the night session, with bitcoin also plummeting to a low of $34,300, before bottoming and aggressively rebounding to a high of $40,000 in a large short squeeze.

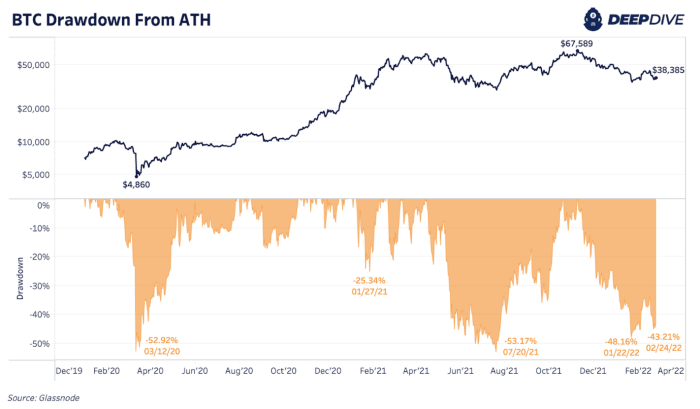

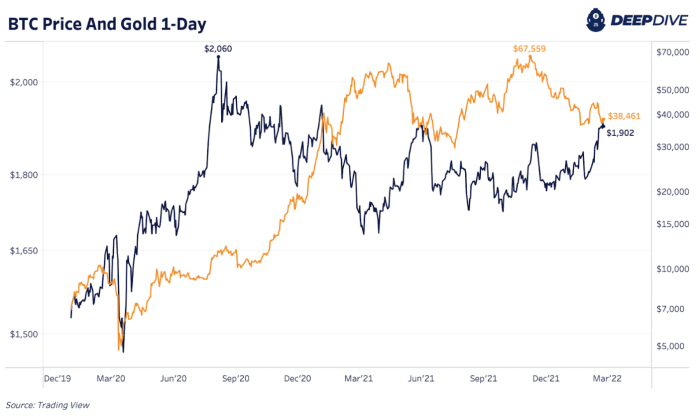

At the time of writing bitcoin is down 43% from its highs from November, and 12% off the lows set late last night. At the close of the day the Nasdaq closed an outstanding 3.4% in the green in the daily session, as risk assets traded as if maximum fear and uncertainty were priced in shortly after the war declarations. Gold initially popped and hit over a one-year high, touching $1974 an ounce before dropping sharply, in an inverse pattern from U.S. equity markets and bitcoin.

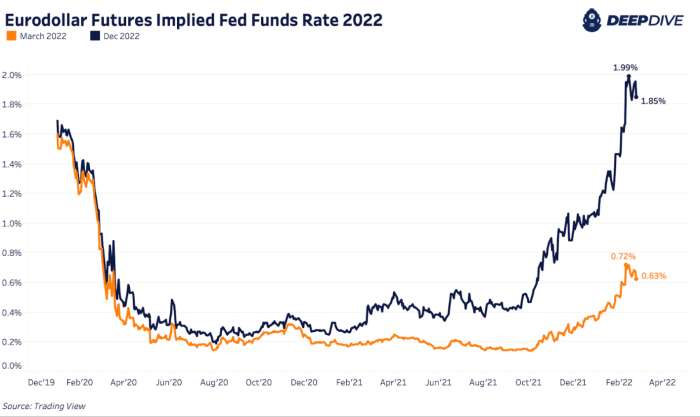

As a result of the conflict, the markets have quickly priced in lower Federal Reserve Board rate hikes for 2022. Looking at the eurodollar futures market, the implied federal funds rate has now dropped over 10 bps for March and slightly more for the rest of the year.

A development that will be important to watch is if the Fed walks back the timeline for tightening monetary policy due to the outbreak of war in Ukraine. If history is any precedent, this could very well be the case as central banks cherish the opportunity to deflect responsibility for policy error and continue to ease markets.

Comments (No)