Ethereum continues to trade close to its support level of $3,000 on Good Friday, as some financial markets were closed for the holiday weekend. Volatility has slightly eased as a result, with BTC also hovering near its floor around $40,000 during today’s session.

Bitcoin

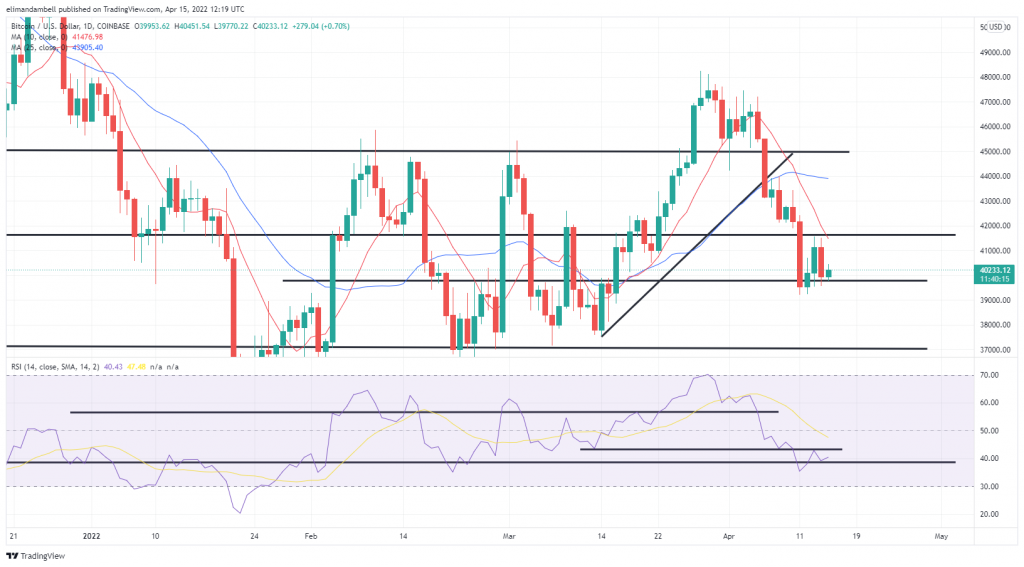

Bitcoin was trading lower during Friday’s session, as volatility in crypto markets somewhat eased as a result of the Easter break.

Following a high of $41,245.49 on Thursday, BTC/USD is down by 2%, dropping to a low of $39,695.74 in the process.

Today’s drop pushed prices closer to the long-term floor of $39,600, however BTC bounced back, with the move now appearing to be a false breakout.

Now trading around $40,200, bulls remain set on keeping prices above $40,000, despite the momentum of the 10-day and 25-day moving averages mainly being bearish.

The 14-day RSI also continues to track in oversold territory, after failing to break out of the 42.65 resistance level earlier this week.

Looking at the chart, we may continue to see more price consolidation, until a breakout occurs on either the floor of 38, or ceiling of 42 on the RSI indicator.

Ethereum

Like bitcoin, ethereum also traded near its long-term support point of $3,000 on Friday, following a failed attempt to move past a key resistance level.

Thursday saw ETH/USD fail to break out of its ceiling at $3,150, which then resulted in prices falling back towards support of $3,000.

As a result of this, ETH dropped to an intraday low of $2,988.44 earlier in Friday’s session, and is currently down 1.5% on the day.

Since this bottom, bulls have helped to re-capture the $3,000 floor, and this comes as the 14-day RSI indicator seems to have also found support.

This floor is the 44 level, where price strength has remained since yesterday, as seen by the sideways trend on the chart.

Despite this, there are likely some traders that could look to take advantage of the relatively quiet session, by trying to swing momentum on either side of the current support levels.

Will we see any sustained price movement over the coming days? Leave your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Comments (No)