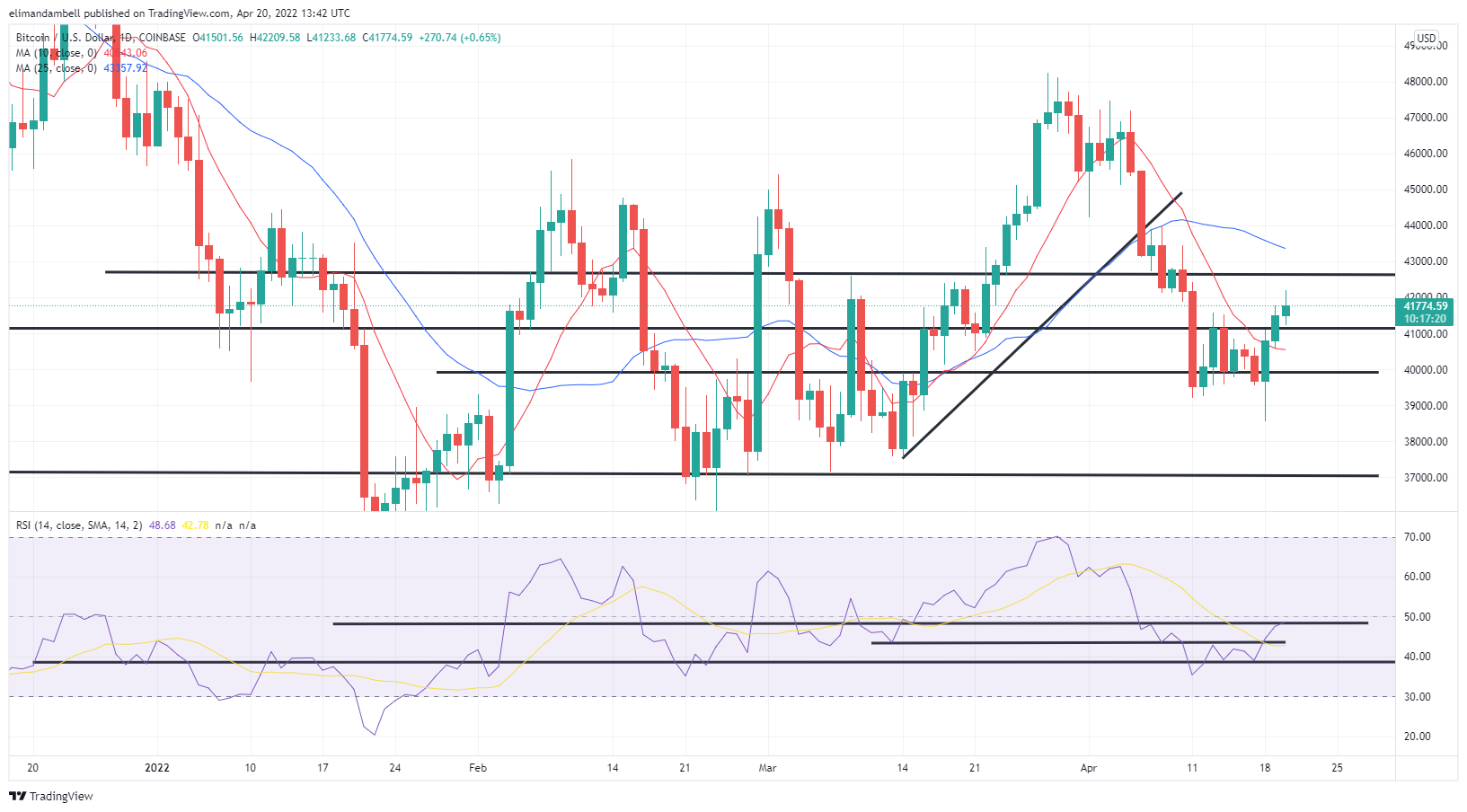

Bitcoin and ETH both rose to nine-day highs on Wednesday, as bulls continued to push prices higher following yesterday’s rebound. BTC moved into the $42,000 level after breaking a key resistance point, while ETH also climbed beyond its own ceiling of $3,150.

Bitcoin

BTC rose for a third session on Wednesday, as bulls continued to push prices higher, following a selloff during the Easter weekend.

The world’s largest cryptocurrency is now up by over $3,000 since Monday’s low of $38,551, and as of writing, is over 3% higher on the day.

Today’s price surge raced to an intraday peak of $42,126.30, which is its highest point since April 11.

This follows on from yesterday’s bottom of $40,575, and comes as the long-term resistance of $41,175 was broken.

Looking at the chart, the 10-day moving average has begun to shift direction, following a recent downward trend.

If this momentum has finally shifted, we could start to see more and more bulls return, and potentially push price towards the upcoming resistance of $42,600.

Ethereum

In addition to BTC, ethereum also gained for a third consecutive session, as price continues to move away from the recent support of $2,950.

Following a low of $3,054.56 on Tuesday, ETH/USD surged to an intraday high of $3,157.89 during today’s session.

This high saw the world’s second-largest cryptocurrency move past its recent price ceiling of $3,150, hitting its highest level since last Monday as a result.

Looking at the chart, resistance of 49.90 within the Relative Strength Index (RSI) was also broken, with price strength now tracking at a ten-day high.

Price strength is now tracking at 51, with bulls looking to potentially take this to the ceiling of 55, which could turn out to be a two-week high.

If this were to occur, it is likely that we will see ETH/USD trading at $3,300.

Can ETH hit this resistance prior to the end of the week? Leave your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Comments (No)