The price of Bitcoin fought its way up 2.9% during the past 24-hours, while general market sentiment remains in the zone of ‘extreme fear.’

To give this sentiment some wider context–the announcement of the Federal Reserve planning to raise interest rates to curb inflation came accompanied by the International Monetary Fund (IMF) warning about a growing connection between crypto and equity markets threatening financial stability.

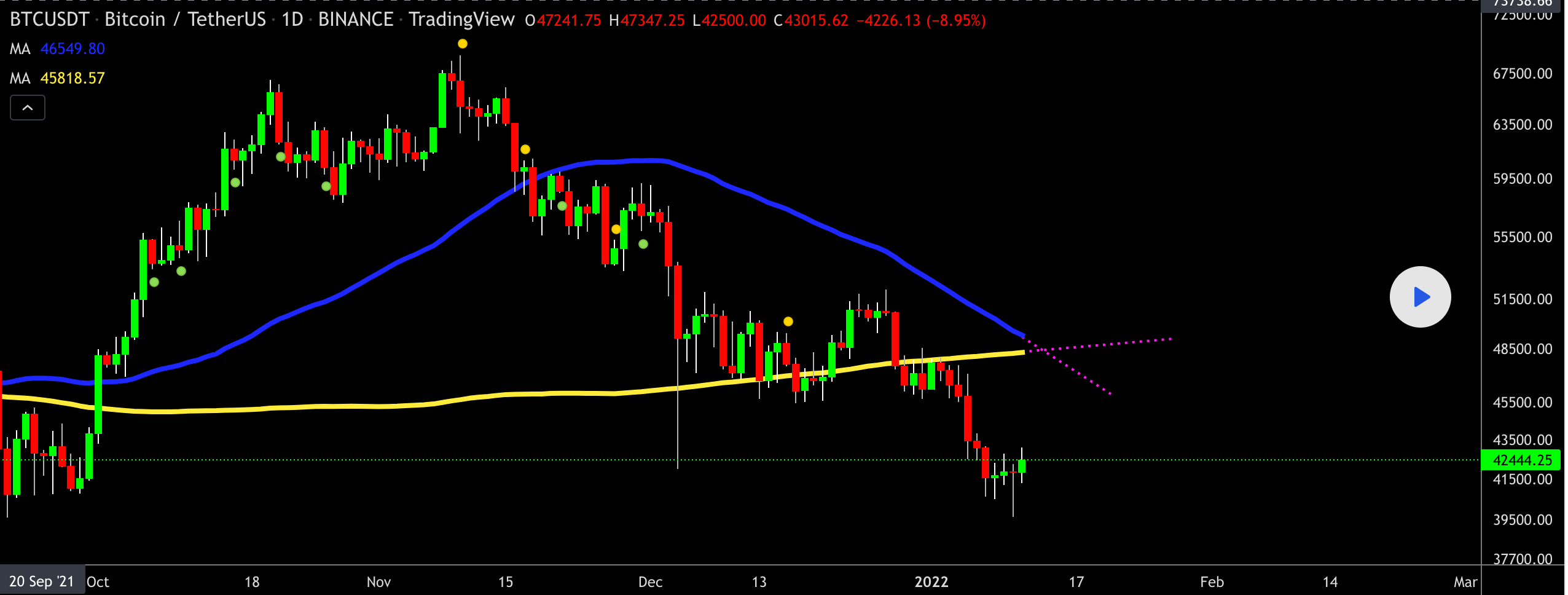

Meanwhile, market analysts are anticipating Bitcoin hitting the ‘death cross’ soon, but what is the technical chart pattern’s predictive potential when it comes to future price action, remains to be unraveled.

The ‘death cross’

The Bitcoin price is currently changing hands at around $43.7, after dropping as low as $39.7 on January 10.

And while Bitcoin is heading for the ‘death cross,’ market analysts are not convinced that the technical omen necessarily spells dread for Bitcoin.

This particular technical pattern looming over the Bitcoin price chart forms when the 50-day moving average (MA) intersects the 200-day MA–forming a cross, and is broadly considered as a bearish market omen.

Its anticipation is unsettling, especially while investors are worried, which seems to be the case judging by the Bitcoin fear and greed index which is dwelling in red for weeks now.

Bitcoin Fear and Greed Index is 22 – Extreme Fear

Current price: $42,843 pic.twitter.com/kdPFLdhV3V— Bitcoin Fear and Greed Index (@BitcoinFear) January 12, 2022

Looking at Bitcoin’s death-cross formations in the past, however, doesn’t exactly simplify the interpretation.

Could Bitcoin avoid forming the death cross?

The last time MAs made a death cross was in June 2021– with prices falling almost 20% before bottoming a month later.

Just a quick reminder–this major market downturn should be remembered in a wider context, as the Bitcoin hash rate dropped drastically with China enforcing its ban.

However, a previous bearish death cross in March 2020 occurred after the price bottomed–presenting no obstacle to gains. In fact, it turned higher and formed a ‘golden cross’ two months later.

Mati Greenspan, founder of Quantum Economics, told CryptoSlate:

“At this point it seems inevitable. The respective MAs are on a collision course and will likely intersect this later this week or early next.”

But according to Greenspan, this doesn’t necessarily portend a bear market.

“As with all technical indicators and charting information, what we’re seeing is past data and is not an indication of what will happen in the future,” he concluded.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)