Bullish cryptocurrency traders hoping that the market was on a path higher received a dose of reality on June 29 as the price of Bitcoin (BTC) dipped below $20,000 again during intraday trading.

Data from Cointelegraph Markets Pro and TradingView shows that the top cryptocurrency fell under pressure in the early trading hours on June 29 with bears managing to drop BTC to a daily low of $19,857 before price was bid back above the $20,000 mark.

Here’s a look at what several analysts are saying comes next for Bitcoin as it struggles to gain momentum and break free of the current price range.

Prepare for a choppy summer

A word of warning for traders looking to enter the market at these levels was offered by analyst and pseudonymous Twitter user IncomeSharks, who posted the following chart showing one possible path that BTC could take in the months ahead.

IncomeSharks said,

“More people end up losing money in chop zones than the big drop zones. I’m bullish mid term for a lot of reasons. This summer is about swing trading and accumulation. I will derisk/sell majority end of November/December.”

The possibility of a stronger pullback was also noted by Twitter user Altcoin Sherpa, who posted the following chart citing the importance of the $20,000 level.

Altcoin Sherpa said,

“Around 20K will be a pretty important area on lower timeframes; lose that and we see a move to the range lows around 17K again IMO. If this area is the bottom, I expect to see 17-18K tested again to be honest.”

Price could pullback to $16,400

According to Rekt Capital, the recent price action mirrors other bear markets and could provide some clues on where the bottom will be.

During the week of June 20, Bitcoin saw a similar buy-side volume as it experienced during the 2018 bear market bottom, near the 200-week moving average (MA).

Rekt Capital said,

“During the formation of the 2018 bottom however, that buyer volume preceded extra -20% downside. If $BTC were to drop an extra -20% soon, price would reach ~$16,400.”

Related: Bitcoin holds $20K as ECB warns inflation may never return to pre-COVID lows

Consolidation leads to accumulation

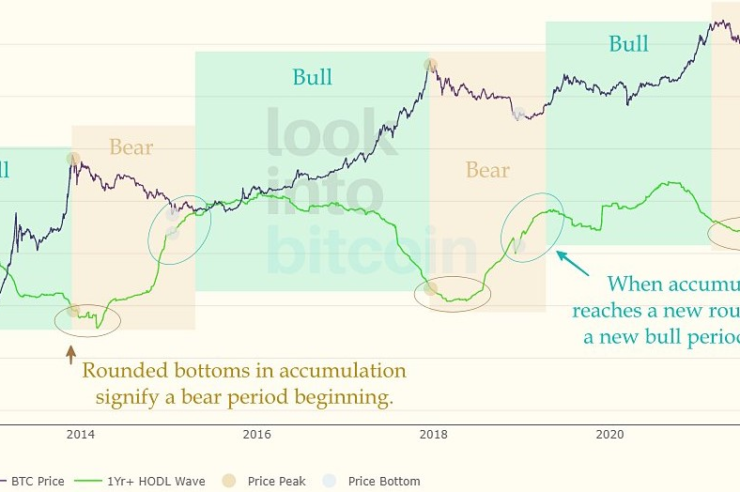

A more positive outlook was offered by Twitter user Miles J Creative, who posted the following chart supporting the thesis that a “bull phase is coming.”

The analyst said,

“In Bitcoin’s history it has only had the current accumulation structure when exiting not entering bear markets. Perhaps this time is different but accumulation is saying a bull phase is coming.”

The overall cryptocurrency market cap now stands at $897 billion and Bitcoin’s dominance rate is 42.7%.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Comments (No)