Bitcoin rose as much as 3% today as the chair of the Federal Reserve, Jerome Powell, directly addressed the American people, declaring that “inflation is much too high” and “we have the tools to bring inflation down.”

Powell also gave the market some guidance as to what can be expected for the rest of the year, saying,

“50 basis point increases should be on the table at the next couple of meetings.”

The crypto market reacted positively to the news, with Bitcoin testing the $40k resistance within the hour of the meeting and Ethereum threatening $3k. Market analyst and YouTuber Kevin Paffrath commented,

“This is the most comfortable, optimistic, & realistic #FOMC Powell I’ve heard so far. Very clear guidance: It’s not going to be easy, but trying to get a “softish” landing by bringing inflation down w/ rates. 50bp now, 50bp next 2, 25 thereafter while we watch for disinflation.”

As crypto continues to hold steady amidst wider financial sell-offs, it is perhaps unsurprising that Bitcoin often cited as an inflation hedge, rose on the confirmation that inflation is running too hot. Further, the assurance that higher interest rate hikes above 50bp are unlikely will appease crypto investors.

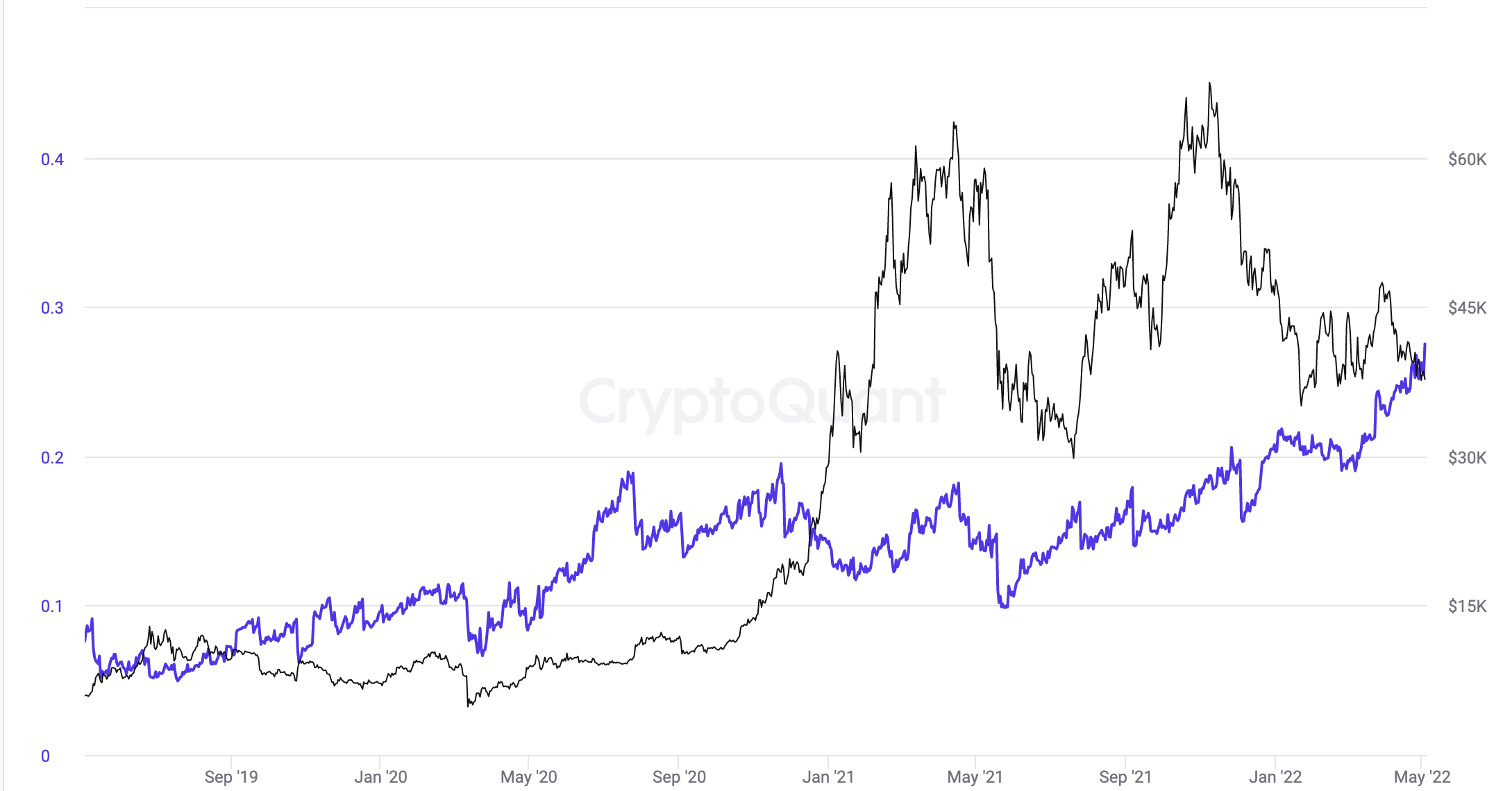

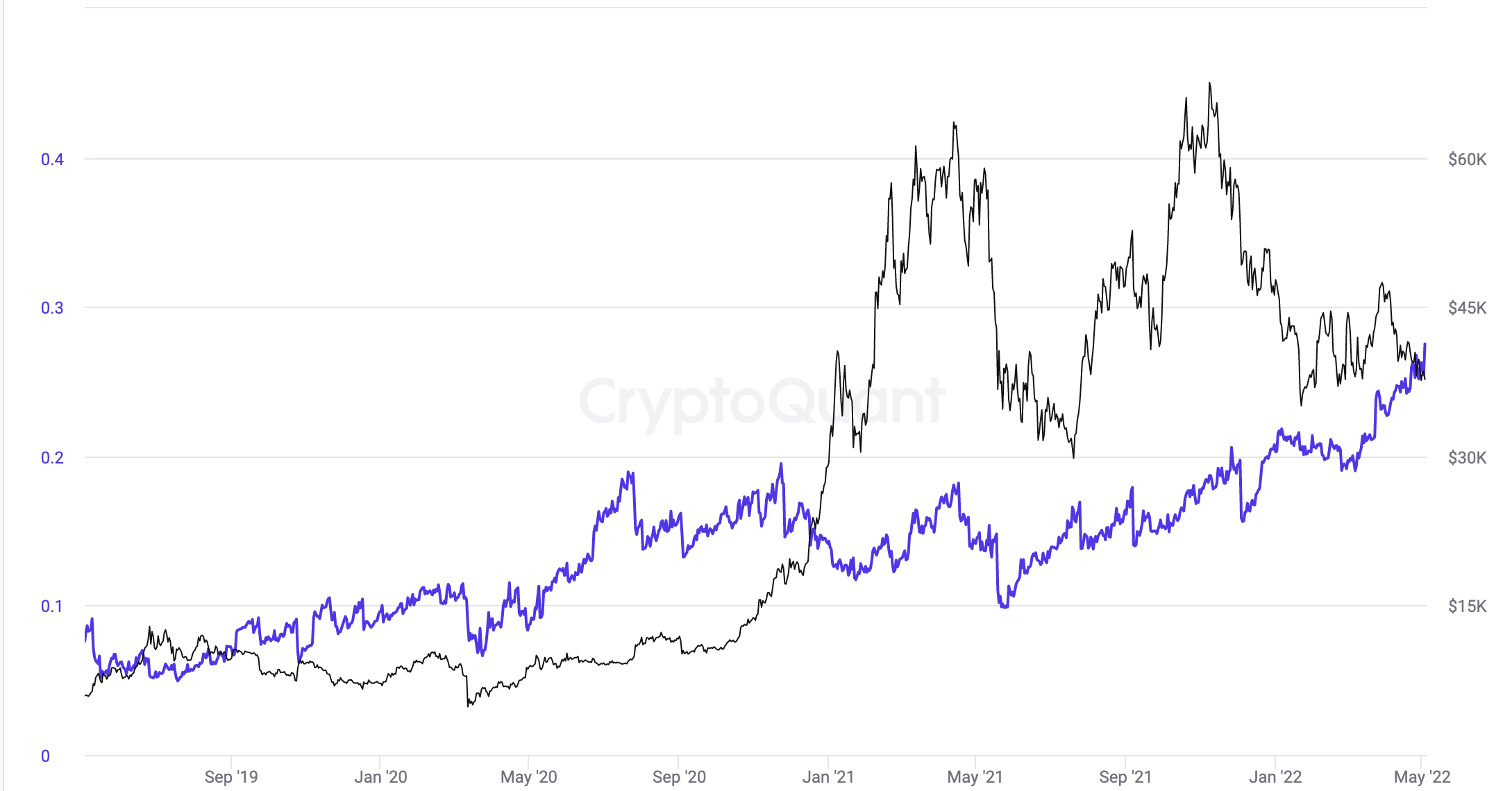

The leverage ratio for Bitcoin is at an all-time high. With more investors than ever using leverage to invest in Bitcoin, the confirmation that interest rates will not spike beyond expectation will be reassuring. In the short term, this does mean that the cost to buy Bitcoin on leverage may increase. However, the upside potential may outweigh the cost for many.

Comments (No)