Fears are spreading in the NFT community, as BendDAO, a crypto lending company using NFTs as collateral, faces liquidation . Now, there is talk of wide-spread fire-sales of Bored Ape Yacht Club NFTs. However, there’s more to the plan than that. Apparently, there’s a stack of Doodles, Azuki and RTFKT NFTs too.

So what is happening with BendDAO, and how can you get your hands on a Blue-chip bargain?

What is BendDAO?

BendDAO is a lending system through which you can borrow ETH using your Blue-chip NFTs as collateral. So as the owner of a Blue-chip NFT, you can access ETH instantly. Then, those lending ETH get instant interest. It’s basically a win-win for users. In order to avoid losses caused by the market fluctuations, the borrower will have a 48-hour liquidation protection period to repay the loan.

Why is BendDAO liquidating assets?

Liquidation is happening for a few different reasons. Firstly, due to the dropping floor-prices of some Blue-chip NFTS. When this happens, ‘health factor’ of the NFT-backed loan is dropping below 1. For example – taking out a loan when BAYC is 100eth, you can instantly borrow 40eth. But if the floor price of BAYC drops to 44eth, this triggers the 48 hour liquidation protocol. This is to ensure that the lender recoups their loan plus interest. We have seen this happening this week with BAYC #533 (used as collateral against a 66.95 ETH loan) being listed for auction.

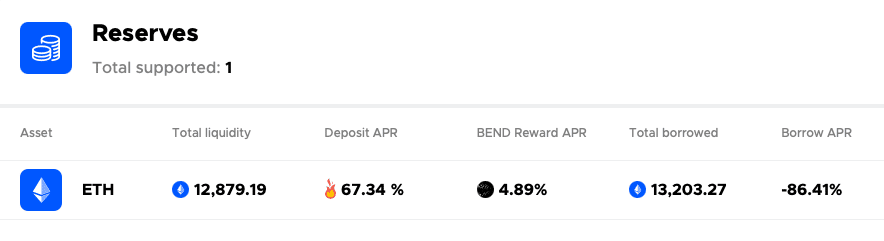

Secondly, BendDAO has found itself in a difficult situation. They have only 12.8 WETH left in their contract. Therefore, those provided loans via BendDAO cannot retrieve their money. There is approximately 13,000 ETH lent at time of writing, so the ETH left in their contract is lower than the total loaned ETH. As a result, the ‘debt’ against the NFTs is quickly rising.

How can you pick up a bargain Blue-chip NFT?

With the proposed changes there could be some amazing deals on Blue-chip NFTs coming over the next month. If the proposal passes, they will auction off a lot of previously unlisted NFTs. By reducing the threshold for asset liquidation, BendDAO is ensuring that NFTs can be auctioned off before the floor drops to catastrophic levels.

If you want to watch the auction activity and try to pick up a Blue-chip bargain, keep an eye on the BendDAO ‘Loans in Auction’ page to begin bidding.

What about the defaulted NFTs?

Well, these are up for auction, but the majority of NFTs auctioned do not have any bids. Only 4 of the 17 MAYC currently up for auction have bids. The bids are lacking because BendDAO requires bids to be above the amount of debt AND above the OpenSea floor price. Debt can be higher than floor, and so most people do not want to buy them. Additionally, to open a bid you have to lock up your eth for 48 hours, and this is a risk many are not willing to take.

So, with no-one bidding on defaulted NFT loans, the DAO is left holding them with a higher debt than they are currently worth. The DAO needs to find a way to retrieve the ETH from these NFTs to pay the lenders.

To mitigate this, BendDAO is proposing changes to lending protocol. One proposed change is that auctions will last only 4 hours rather than 48, eliminating the risk of having your ETH tied up for two days. Another change is that the minimum starting bid could be the total debt on the NFT rather than 95% of the floor price. This means that the gap between the floor and starting price will be much larger, incentivising more bidders.

In conclusion, BendDAO is giving us a lesson on preparing for the bear market in the bull market. While it may feel comfortable using NFTs as collateral in a bull market, the model behind many NFT loan companies are still too primitive. That being said, many in the NFT community are looking forward to the sale. After all, who doesn’t love a bargain blue-chip NFT?

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investment.

Comments (No)