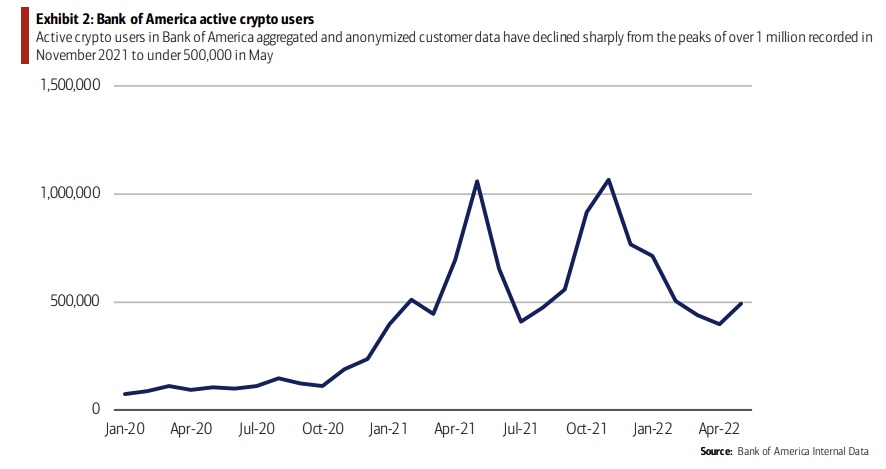

Bank of America has revealed that the number of its customers who are active crypto users has declined more than 50% from its peak in November last year. In addition, the bank said its data “shows that outflows to crypto platforms have fallen sharply,” indicating that “consumers are pulling back on their net investment into crypto platforms.”

Bank of America’s Active Crypto Users

Bank of America published a report last week showing a steep decline in the number of active cryptocurrency users from its peak in November last year. The bank explained:

Anonymized Bank of America internal customer data shows a sharp, greater than 50%, decline in the number of active crypto users from the peak of over 1 million users in November 2021 to below 500,000 in May.

“We also found that ‘first time’ users, customers who made a transaction with a crypto platform having not made one previously, have also fallen very sharply,” the report adds.

Bank of America further noted that there were only around 33,000 clients who transacted in crypto for the first time in May, which was an 87% decline compared to the 267,000 first-time users in October last year.

In addition, the Bank of America report details:

Our data also shows that outflows to crypto platforms have fallen sharply as well and are now broadly equal to inflows, indicating that consumers are pulling back on their net investment into crypto platforms.

“In dollar terms outflows peaked around $2.9 billion in late 2021, before dropping back to around $1 billion in May 2022,” the bank said.

In June, Bank of America released the results of a survey showing that 91% of more than 1,000 current and prospective U.S. crypto investors plan to buy more digital assets in the next six months. Moreover, nearly 40% of respondents revealed that they use cryptocurrency as a means of payment.

The bank’s research team noted at the time: “Overall, our findings suggest that despite the sharp correction in crypto valuations, consumer interest in the sector remains strong.”

What do you think about Bank of America’s data on active crypto users? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Comments (No)