Today marks the 13th year since Bitcoin (BTC) creator Satoshi Nakamoto mined the genesis block or block 0 of the Bitcoin network, and for the first time mined a reward of 50 BTC back on Mon, 2009. Fast-forward to 2022, the BTC network shows no signs of slowing down by reaching a new all-time high hash rate of 207.53 million tera hashes per second (TH/s).

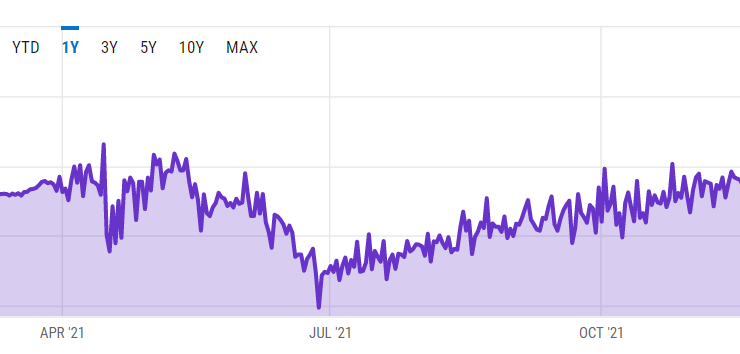

The Bitcoin hash rate, which correlates to the strength of the network based on the number of active miners, saw a temporary downfall after China banned citizens and businesses from pursuing crypto mining and trading activities. As a direct result of China’s blanket ban on crypto a sudden shortage of miners, the Bitcoin hash rate fell to 58.46 million TH/s.

As evidenced by the above graph, the Bitcoin hash rate saw an eventual comeback as Chinese miners began migrating to friendly jurisdictions. On Jan. 1, 2022, the Bitcoin network recorded a new all-time high of 207.53 million TH/s, reclaiming the network’s security by increasing the mining difficulty.

At the time of writing, the Bitcoin network hash rate stands at 190.64 million TH/s, down 8.14% from its all-time high.

Related: Bitcoin holdings of public companies have surged in 2021

BTC holdings of private corporations have significantly increased in the previous year, as revealed by on-chain analyst Willy Woo.

Since MicroStrategy’s “Bitcoin for Corporations” conference in Feb 2021, public companies* holding significant BTC have gained market share from spot ETFs** as a way to access BTC exposure on public equity markets.

* MicroStrategy & public mining companies

** Mainly Grayscale pic.twitter.com/e18OEfgiEW— Willy Woo (@woonomic) January 2, 2022

A Cointelegraph report on the matter highlights that purchases made by Michael Saylor’s MicroStrategy exceed $6 billion in crypto assets. In December alone, the firm purchased a further 1,914 BTC worth $94 million.

Comments (No)