IT-services company MicroStrategy continues its strategy to add bitcoin (BTC) to its balance sheet. With just hours left of the year, the company CEO Michael Saylor announced on Twitter yet another purchase of the leading cryptocurrency by market cap. This time, MicroStrategy purchased 1,914 BTC during the period between December 9th and December 29th for approximately $94.2 million in cash, at an average price of approximately $49,229 per bitcoin.

Given that the price of bitcoin hovers around $47,500 at the time of writing, this particular buying spree comes at a loss for the time being.

Company now holds 124,392 bitcoin

According to the published Form 8-K, as of the 29th of December 2021, MicroStrategy holds approximately 124,391 bitcoins that were acquired at an aggregate purchase price of $3.75 billion and an average purchase price of approximately $30,159 per bitcoin. This means MicroStrategy has made approximately $2.16 billion off its bitcoin holdings.

Given the maximum supply of bitcoin at 21 million, MicroStrategy now owns approximately 0.6 percent of all theoretical bitcoin. Counting on a loss of about three million bitcoin due to lost wallets, the company currently holds approximately 0.7 of all bitcoin that will ever be available, or about one percent of all current bitcoin.

Third purchase in a month

MicroStrategy keeps buying bitcoin steadily; it was only three weeks ago that the company bought 1,434 bitcoin at an average price of $57,477 per coin. Before that, on the 29th of November, MicroStrategy purchased an additional 7,002 BTC for $414.4 million in cash for an average price of around $59,187 per BTC.

CryptoSlate Newsletter

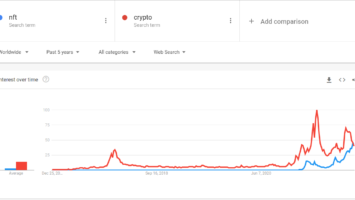

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)