The ebb and flow of crypto regulations have been a fixture since the very beginning of the DeFi ecosystem. From the most liberal to the most stringent, every country and its regulators have constantly grappled with streamlining the market. In the United Kingdom, this dialogue has taken a pivotal turn, with the latest guidelines introduced by the Financial Conduct Authority (FCA) set to commence on the 8th of October.

As prominent exchanges announce their withdrawal from the UK, it might seem like the tides are turning unfavorably for the UK’s crypto enthusiasts. Yet, amidst the uncertainty, an underdog emerges as an exchange and a cornerstone of stability for those seeking continuity.

A Changing Tide: What are the New FCA Rules?

It’s essential first to understand the changing dynamics of the FCA regulations. The new rule’s primary focus is crypto exchange marketing activities. Aimed at protecting consumers from misleading promotions and ensuring financial stability, these rules represent a drive towards more accountability.

Moreover, one significant highlight is the ’24-hour cooling-off period’. This period entails that any new customer who deposits an exchange after the 8th of October will face a grace period during which they won’t be allowed to deposit. This ruling is dual-edged – while it provides a cushion for impulsive decisions, it also poses a challenge for those eyeing real-time market opportunities.

In addition to focusing on marketing activities and introducing the ’24-hour cooling-off’ period, the new FCA rules bring another major change. Influencers and Key Opinion Leaders (KOLs) are barred from sharing ‘refer-a-friend’ links or guiding people to cryptocurrency exchanges. Their role is now strictly restricted to providing unbiased and educational content.

Lucy Castledine, Director of Consumer Investments, shed light on the reason behind these changes:

“From this October, crypto firms must market to UK consumers clearly, fairly, and honestly… We are concerned by the failure of many overseas and unregulated crypto firms to engage with us on the new rules.”

The ambiguity surrounding these rules has unrestrained users, experts, and exchanges. Their extensive and ever-changing nature has rendered most exchanges wary of potential legal issues.

The entire landscape of crypto promotion is about to change. The intricate and dynamic nature of the new rules has left many exchanges in trepidation, fearing potential legal repercussions. This stress is further evidenced by significant players retreating from the UK market.

Major Exchanges: The Departure and The Gap

The decision to withdraw from the UK market came unexpectedly for numerous users of prominent cryptocurrency exchanges. A significant gap is formed as these leading platforms decide to pull out. A vast number of investors who previously relied on these exchanges will now be on the lookout for a dependable alternative.

The CEOs of some of these exchanges have hinted at potential discussions with regulators. Nonetheless, reports have suggested a total remission of some exchanges’ operations in the UK after a specified date. Challenges have been prevalent for these exchanges over the past years, with certain platforms facing restrictions. The decision to withdraw impacts countless users, with some exchanges offering a limited period for users to settle their positions.

Binance: Navigating the Complex Waters of Compliance

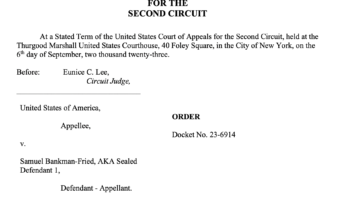

Binance, the world’s predominant cryptocurrency exchange, finds itself in increasingly stormy seas, navigating the ever-evolving and convoluted world of global regulatory compliance.

Binance’s journey through the intricate global regulatory compliance maze symbolizes the broader challenges cryptocurrency exchanges face. Their proactive approach, from cooperating with regulators to strategically exiting markets, highlights the industry’s need to adapt swiftly to a rapidly changing regulatory landscape.

- Global Regulatory Scrutiny: Binance confronts increased oversight, with countries from the U.S. to Nigeria intensifying regulations, primarily fueled by concerns like money laundering linked to cryptocurrency.

- Strategy Revamp Post SEC Lawsuits: The U.S. Securities and Exchange Commission (SEC) lawsuit has significantly influenced Binance’s regulatory approach. To safeguard its relationship with mainstream banks and avert potential damage, Binance emphasizes operating within regulated environments.

- The Nigerian Challenge: Despite regulatory hurdles in Nigeria, Binance remains determined to clarify its position with the Nigerian SEC, emphasizing its operations are distinct from the mentioned entity in the SEC notice.

- French Regulatory Spotlight: Binance recently faced an investigation in France, making headlines. However, Binance’s founder, Zhao, referred to the scrutiny as routine for businesses like theirs in France.

- Tactical Market Exits: With looming international standards, Binance has strategically retreated from markets like Cyprus, Canada, and the Netherlands. In Canada, newly introduced guidelines played a pivotal role in their decision.

- UK Market Dynamics: In the UK, Binance’s subsidiary withdrew its registration with the Financial Conduct Authority (FCA), noting this doesn’t hinder their UK operations as they hadn’t launched any crypto business there.

- Middle Eastern Foray: Amid challenges elsewhere, Binance is marking its presence in the Middle East, securing initial approvals in Abu Dhabi and obtaining operational licenses in both Dubai and Bahrain.

As Binance stands unparalleled in trading volume, solidifying its position as the primary exchange, the evolving landscape prompts a pivotal question for investors: In a rapidly changing crypto world, where should they anchor their trust?

ByBit: Facing Their Last Stand?

ByBit, a prominent Dubai-based cryptocurrency exchange, has announced the cessation of its services for UK users in light of looming regulations by the UK’s Financial Conduct Authority. The phased shutdown includes an initial halt to new UK accounts from October 1 and a subsequent stoppage of deposits, new contracts, and position changes from October 8. The pivotal backdrop to this decision lies in the UK’s newly introduced rules for crypto-marketing and stringent measures for investor protection.

- Swift Strategic Response: ByBit’s choice to exit the UK market represents a swift and proactive response to the regulatory shifts. This move is particularly striking considering ByBit had, only a week prior, expressed intent to navigate the evolving UK landscape. The sudden pivot suggests the exchange may have assessed the regulatory landscape as too inconvenient or potentially detrimental to their operational model.

- Embracing Regulatory Changes: The company’s decision to “embrace the regulation proactively” signals a potential strategy to prioritize long-term sustainability over short-term gains. ByBit might be anticipating further stringent regulations in other markets and could be preparing to adapt its business model accordingly.

- Ripple Effect on the Industry: ByBit is not alone in its reactive measures. Notable players like Binance and PayPal have recalibrated their operations after the FCA’s directives. The industry seems to be moving toward a phase of increased compliance and self-regulation.

- Implications for UK Investors: The departure of ByBit from the UK market prompts a pressing concern for existing investors: Where to next? The absence of such a significant player will undoubtedly create a void, potentially driving UK investors to seek alternatives that are compliant or to more decentralized platforms.

The regulatory tide in the UK is reshaping the crypto landscape, compelling exchanges like ByBit and Binance to adapt or retreat. With investor protection at the heart of the FCA’s initiatives, crypto businesses and investors alike are at a crossroads, tasked with navigating an evolving, yet uncertain financial ecosystem.

Bitget: Standing Firm Amidst the Waves

While the market experiences a reconfiguration, Bitget showcases its resilience and commitment to its user base. But what is Bitget, and why should users consider it?

Bitget’s inception during the 2018 bear market is a testament to its resilience in volatile scenarios.

The exchange has firmly emerged as a powerhouse in the cryptocurrency world, securing its spot as the fourth-largest CEX in crypto trading volume. Notably, amidst the turbulence caused by FTX’s collapse, Bitget remained resilient, highlighted by research firm Nansen as the sole exchange to see an increase in futures trading volume.

Bitget’s performance is further underscored by the success of its internal token, Bitget Token (BGB), which achieved a high of US$0.513378, marking it as the best-performing CEX token in 2023.

Boasting a vast compliance team, Bitget liaises continually with global regulators. Their transparency is evident through quarterly reports on GitHub, and a proof of reserves at 208%. With a protection fund valued at $350 million – double their users’ funds – Bitget emphasizes safety and even promises to maintain this fund for at least three years.

- A Sturdy Foundation: Bitget boasts a robust infrastructure designed to handle a vast influx of new users, ensuring the platform remains stable and efficient even as it scales.

- Transparent Operations: One of Bitget’s hallmarks is its transparent mode of operation. Users can access clear trading data, ensuring they always have the information to make informed decisions.

- Unwavering Regulatory Compliance: Bitget has always prioritized aligning its operations with the regulatory standards of the regions it serves.

- Consumer-Centric Features: Bitget is not just about trading; it’s about enhancing the user experience. With features aimed at both novice and experienced traders, Bitget ensures inclusivity.

Disclaimer: Bitget is an advertising partner of CryptoSlate.

OKX: A Global Crypto Contender

Born in 2017, OKX quickly scaled the heights of the crypto landscape, now extending its services across 100 countries. With diverse offerings beyond conventional trading, from the Web3 Yield platform to the NFT Marketplace, OKX caters to a wide spectrum of crypto enthusiasts. The platform also champions a flexible and cost-effective trading experience, featuring over 85 cryptocurrencies purchasable with GBP, and potential fee reductions with the OKB utility token.

OKX’s market reach isn’t just confined to popular tokens. It boasts a list that flits between the prominent ones, such as Bitcoin and Ethereum, to the lesser-known, ensuring its user base has ample diversity in its crypto portfolio. Additionally, the exchange offers competitive fee structures, ensuring that both low-volume and high-volume traders find a suitable tier.

Despite its global repute, OKX has had its share of hurdles, like the 2020 fund-freezing incident. However, its expansive offerings, regulatory mindfulness, and unwavering security measures position it as a notable player in the crypto domain.

- Mobile Integration: A user-friendly mobile app ensures trading on the go for iOS and Android users.

- Regulatory Vigilance: OKX stays attuned to global regulatory shifts, evident in their recent VARA license procurement in Dubai.

- Steadfast Security: Measures like two-factor authentication and a transparent proof of reserves, supported by a $700 million asset risk reserve fund, cement OKX’s commitment to user security.

KuCoin: An Advanced Trading Epicenter

Delving into the dynamic universe of cryptocurrency trading, experienced traders will find KuCoin an enthralling haven. With its rock-bottom fees and an extensive roster of over 600 cryptocurrencies — including mainstream champions like Bitcoin and Ethereum — it’s no wonder the platform attracts a considerable slice of the global crypto community.

Representing 1 in 4 crypto holders globally, its vast user base ensures liquidity and a bustling community. Though a 2020 security incident involving hot wallets raised eyebrows, KuCoin’s swift, insured response showcased their commitment to trust and transparency.

While KuCoin offers many advantages for seasoned traders, its platform might be a tad overwhelming for beginners. Its vast coin range, low fees, and advanced trading tools position it favorably, but like all crypto ventures, it demands cautious navigation.

- Volume & Variety: With a staggering repository of over 600 cryptocurrencies, traders have a vast horizon to explore. This includes the market leaders, Bitcoin and Ethereum, and many lesser-known coins ripe for discovery.

- Economical Trading: KuCoin’s fee structure is a trader’s delight. Minimal trading fees, zero monthly account charges, and competitive withdrawal fees make it a cost-effective choice.

- Earning Opportunities: ‘KuCoin Earn’ transforms passive holdings into active earnings. With interest rates between 8% and 12%, it surpasses traditional banking savings accounts by a mile.

- Sturdy User Base: Claiming 1 in 4 crypto holders worldwide, KuCoin offers both liquidity and an active community for traders.

- Safety Record: While its commitment to cold storage is commendable, KuCoin faced security challenges in 2020 with some hot wallets. Their swift and transparent response, fortified by insurance, helped regain trust.

The 24-hour Cooling Off Period: Challenge or Opportunity?

The impending ‘cooling-off’ rule is stirring discussions in the cryptocurrency community. While it presents challenges, especially for traders keen on quick market moves, its primary goal is to protect consumers. Savvy exchanges are turning this regulatory twist into an advantage by providing robust educational resources and market analyses.

This approach encourages users to view the mandatory 24-hour waiting period as a strategic planning window rather than a mere pause. While existing users of these platforms before the 8th of October won’t feel the effects of this rule, those considering joining post this deadline might face missed market chances. Hence, it’s wise for UK users to register with alternative exchanges ahead of this regulatory shift.

A Fresh Start

For those users feeling the vacuum left behind by other major exchanges, Bitget, OKX, and KuCoin offer a refreshing start. With their faithful presence, regulatory compliance, and consumer-first approach, these platforms stand out as an optimal choice.

In this dynamic environment, crypto enthusiasts can find solace in alternative exchanges that understand the importance of stability and actively ensure it.

Comments (No)