A technical analysis tool called Bollinger Bands uses price volatility to provide probable entry and exit opportunities in trading. They are made up of two outer bands or lines and a centerline (the simple moving average for a 20-day period), which enlarges and contracts in response to changes in price. For thorough market analysis, they are frequently utilized in conjunction with other technical indicators.

Bollinger Bands, explained

Bollinger Bands were created by John Bollinger in the 1980s. They are a useful technical analysis tool used in cryptocurrency trading and other financial markets to evaluate price volatility, pinpoint probable reversal points, and make trading decisions.

The three bands that help construct a Bollinger Band include:

Upper band

The upper band is created by multiplying the middle band by the price’s standard deviation. A price’s volatility is quantified by the standard deviation. Traders often use a multiplier of 2 for the standard deviation (SD), but this can be changed depending on the state of the market and personal preferences.

Middle band (SMA)

The middle band typically represents the price of the asset over a given period as a simple moving average (SMA). It serves as the axis and depicts the average price of the cryptocurrency within the selected time frame.

Lower band

From the middle band, a multiple of the standard deviation is subtracted to determine the lower band.

The purpose of Bollinger Bands in cryptocurrency trading

In cryptocurrency trading, Bollinger Bands serve as a crucial technical analysis technique that allows traders to:

Assess price volatility

Traders can assess the degree of price volatility in the cryptocurrency market using Bollinger Bands. When the bands widen, there may be trading possibilities because it suggests higher volatility. On the other hand, a contraction of the bands denotes less volatility and the potential for price consolidation or trend reversals.

Identify overbought and oversold conditions

Bollinger Bands are used to detect possible overbought and oversold scenarios, helping traders identify them. A potential sell opportunity arises when the price reaches or exceeds the upper band, which is a sign that the price is overbought. On the other hand, if the price reaches or drops beneath the lower band, it can be considered oversold, indicating a potential purchase opportunity.

Determine trend direction

Traders may use Bollinger Bands to ascertain the prevailing trend direction. The price may indicate an uptrend if it constantly moves along the top band. On the other hand, if it frequently touches or remains close to the lower band, it can be a sign of a downtrend.

Generate reverse signals

Bollinger Bands can be used to create reversal signals, which are indicators of possible trend reversals. For instance, a possible reversal from an overextended condition may be indicated when the price moves outside the bands and then reenters (below the lower band for a downtrend or above the upper band for an uptrend).

How are Bollinger Bands constructed?

The simple moving average and standard deviation are the two basic building blocks of Bollinger Bands and are used in their construction. These bands offer insightful information on price volatility and possible trading opportunities in the cryptocurrency markets.

Here’s a step-by-step guide to constructing Bollinger Bands:

Step one: Calculate the SMA

Depending on their trading technique, traders choose a particular time frame for analysis, such as daily, hourly or another timeframe. For the selected time frame, previous closing prices for the cryptocurrency under examination are gathered. Since it indicates the last traded price at the conclusion of each time period, the closing price is frequently employed.

By adding up the closing prices for the chosen time period and dividing the total by the number of data points, the SMA is calculated. For instance, if traders were examining a cryptocurrency’s daily closing prices over a 20-day period, they would add up the closing prices from the previous 20 days, divide by 20, and then find the SMA for that day.

Step two: Calculate the SD

Traders determine the standard deviation of the closing prices during the same time period after computing the SMA. The standard deviation, which is crucial for assessing price volatility in cryptocurrency markets, quantifies the dispersion or variability of prices from the SMA.

Step three: Construct the upper and lower Bollinger Bands

The higher Bollinger Band is created by multiplying the SMA by the standard deviation. A typical multiplier is 2, although (as mentioned) this can be changed depending on the preferences of the traders and the state of the market. The same multiple of the SD is subtracted from the SMA to arrive at the lower Bollinger Band.

Step four: Plotting the Bollinger Bands on a price chart

Traders can plot the SMA, standard deviation, upper Bollinger Band and lower Bollinger Band on a price chart after calculating them. The centerline of the Bollinger Bands and the SMA is represented by the middle line. Plotting the upper and lower bands above and below the SMA creates a channel that encircles the price chart.

Step five: Interpretation

To understand how to use Bollinger Bands to trade cryptocurrencies, it is vital to interpret the price signals. For instance, when the price reaches or swings outside the upper band, it may signal an overbought condition and an opportunity to sell.

On the other hand, if the price touches or swings outside the lower band, it can be a sign that the market is oversold, presenting a potential buying opportunity. The bands’ breadth provides information on market volatility; broader bands denote higher volatility, while narrower bands denote lesser volatility.

Crypto trading strategies with Bollinger Bands

Various crypto trading strategies using Bollinger Bands used by traders include:

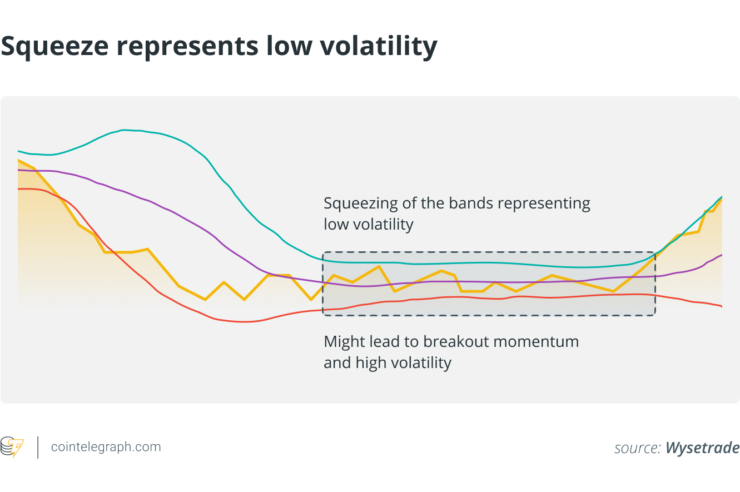

The Bollinger Band Squeeze strategy for crypto

The Bollinger Band Squeeze approach is based on the idea that times of low volatility in crypto prices (referred to as a “squeeze”) are frequently followed by periods of high volatility (referred to as an “expansion”). It works as follows:

- Find the squeeze: Watch for times when the Bollinger Bands narrow and move in closer proximity, a sign of decreased price volatility.

- Prepare for a breakout: After a squeeze, traders expect a strong price change. They don’t foresee the breakout’s direction, but they do get ready for it.

- Entry points: Traders enter positions following price breakouts from Bollinger Bands (above upper band for up, below lower band for down), often using additional confirmation indicators, such as volume.

- Stop-loss and take-profit: Implement stop-loss orders to limit potential losses if the breakout fails to hold and set take-profit levels according to one’s trading strategy.

Bollinger Bands for setting entry and exit points in crypto trades

When trading cryptocurrencies, whether for short-term investments or day trading, Bollinger Bands can be utilized to find the best entry and exit points.

Entry points

When the price reaches or breaks below the lower Bollinger Band, indicating an oversold scenario, traders might seek buy signals. In contrast, they view overbought conditions as sell signals when the price reaches or exceeds the upper Bollinger Band. However, it could be necessary to do more technical investigation and validation.

Exit points

Bollinger Bands can be used by traders to determine when to close out a position. For instance, it may be an indication to take profits if traders are long on a cryptocurrency, and the price is approaching the upper band. In contrast, it might be time to close out the trade if they are short, and the price is getting close to the lower band.

Combining Bollinger Bands with other trading indicators

Bollinger Bands are frequently used by traders together with other indicators to complement their trading strategies.

Bollinger Bands and RSI

Combining Bollinger Bands and the relative strength index (RSI) might aid traders in spotting probable reversals. A probable slump may be indicated, for instance, if the price is nearing the upper Bollinger Band and the RSI shows overbought circumstances.

Volume analysis

Bollinger Bands and analysis of trading volume can be used to corroborate price fluctuations. An increase in volume during a Bollinger Band breakout might strengthen the signal’s validity.

Bollinger Bands and moving averages

Moving averages are used in combination with Bollinger Bands by traders to add more context to trend analysis. Bollinger Bands and a moving average crossover approach, for instance, can support the confirmation of trend changes.

Limitations of Bollinger Bands for crypto traders

Bollinger Bands are a useful tool for cryptocurrency traders, but they also have some drawbacks. Firstly, they might produce false signals during times of minimal volatility or in markets that are moving strongly, which could result in losses. Secondly, traders must utilize other indicators or analysis techniques to confirm trend direction since they do not provide directional information on their own.

The efficacy of Bollinger Bands might also vary across different cryptocurrencies and timeframes. Additionally, unexpected market news or occurrences may result in price gaps that aren’t necessarily reflected in the bands, which may catch traders off guard.

Risk management strategies when using Bollinger Bands

As with any technical indicator, Bollinger Bands must be used by cryptocurrency traders in conjunction with thorough risk management and analysis. To reduce possible losses in the event that transactions go against them, traders should set up explicit stop-loss orders.

Position sizing is also essential; to avoid overexposure, traders should also allocate a certain amount of their cash to each trade. Moreover, risk can be reduced by diversifying among different cryptocurrencies and limiting the percentage of one’s entire capital that can be lost in a single trade.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Finally, Bollinger Bands should always be used in conjunction with other indicators for confirmation, as well as larger market patterns. Long-term success with Bollinger Bands depends on maintaining discipline and following a clear risk management strategy.

Comments (No)