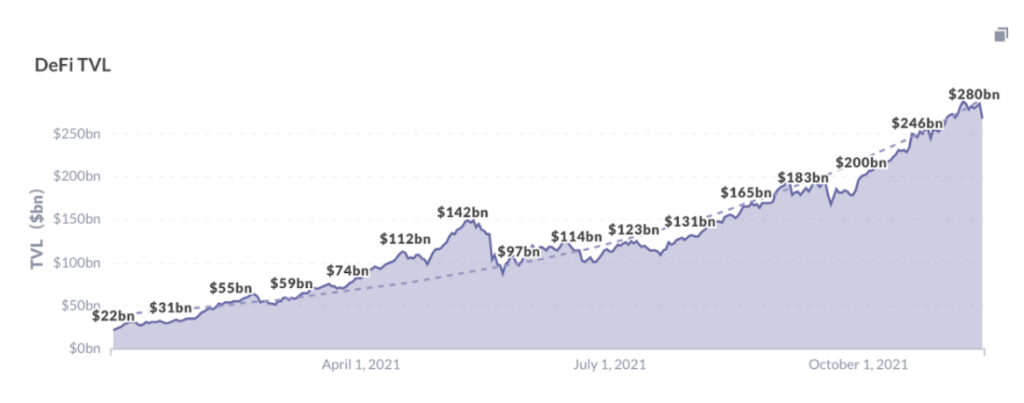

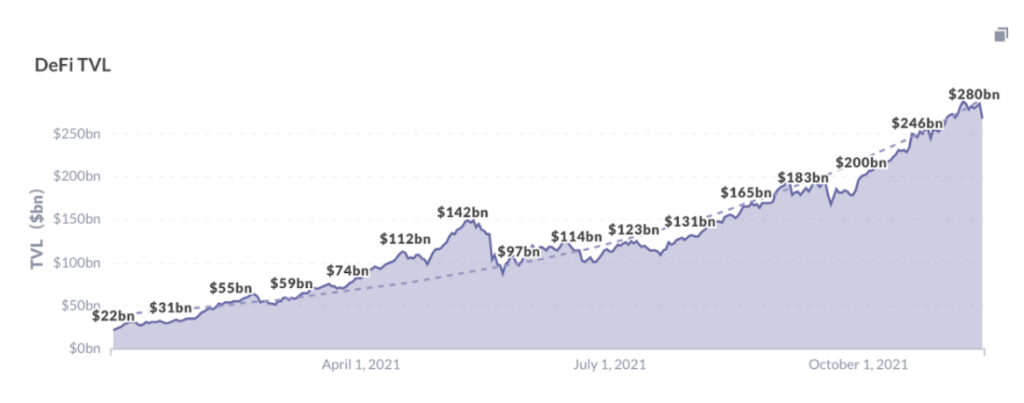

DeFi TVL exceeded $280 billion in November, according to the blockchain data analytics platform Footprint Analytics. One of the main reasons for a large amount of money going to the DeFi market is its attractive APY.

However, high APY comes with high risk. The nature of DeFi leaves it vulnerable or unregulated compared to traditional finance.

Investors need to think twice when considering an investment in DeFi projects.

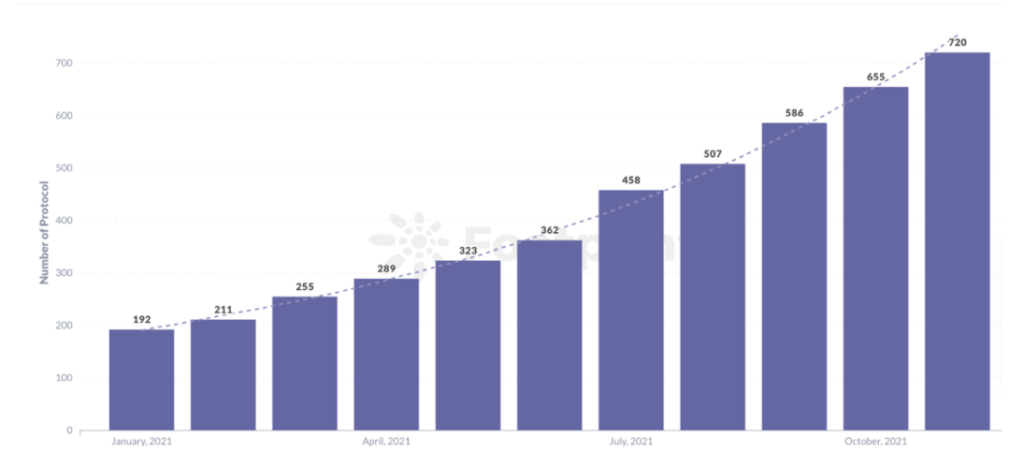

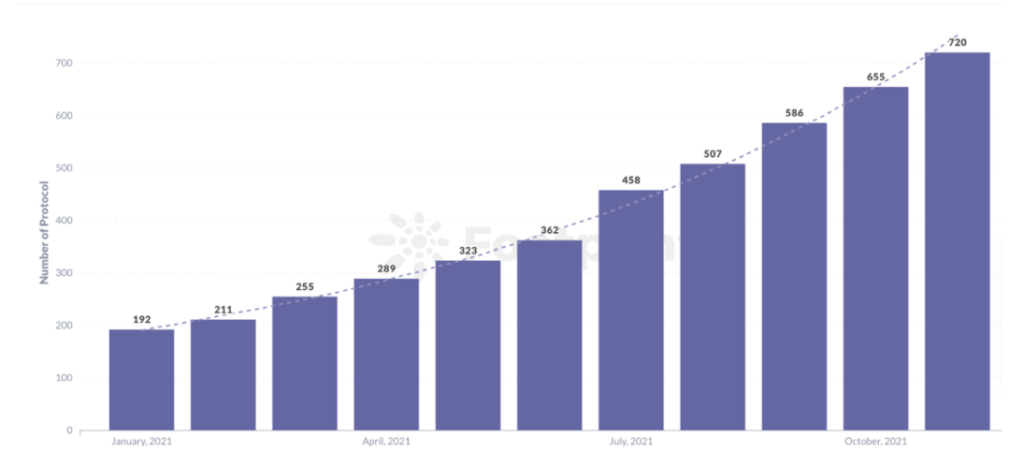

According to Footprint data, the current number of DeFi projects is over 700. How should we choose from so many projects?

I. What kind of investor you are

Cryptocurrencies are highly volatile in price. Investing in them is much riskier than traditional financial investments.

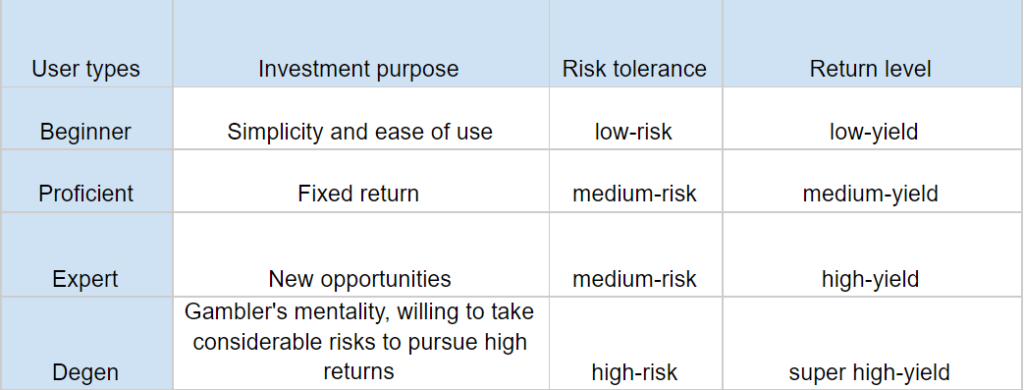

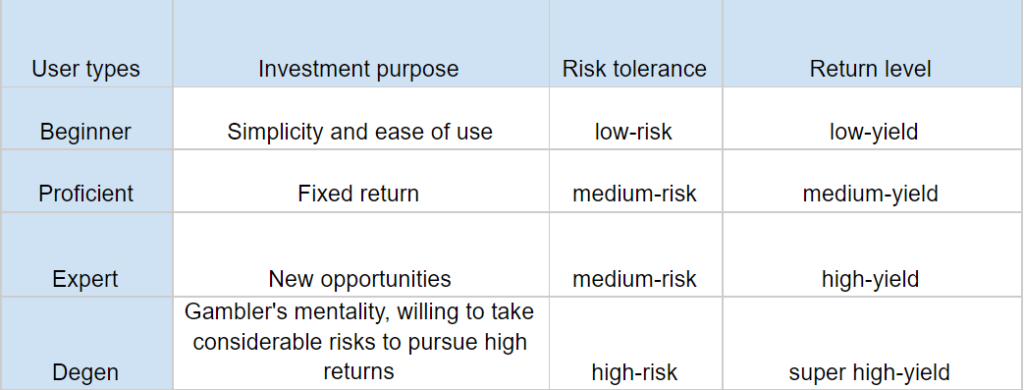

Before choosing a project, three things you need to know are the investment purpose, the degree of your risk tolerance, and your required return level.

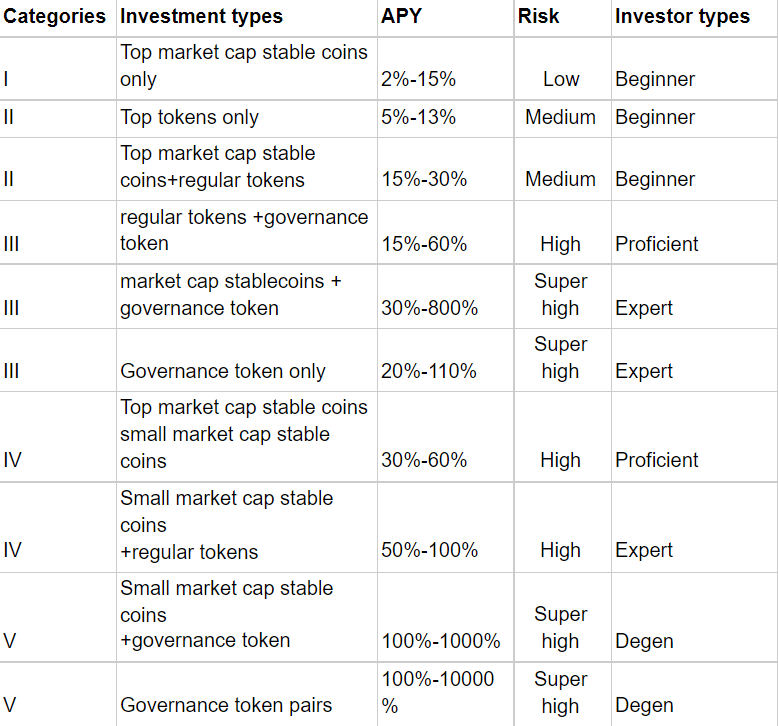

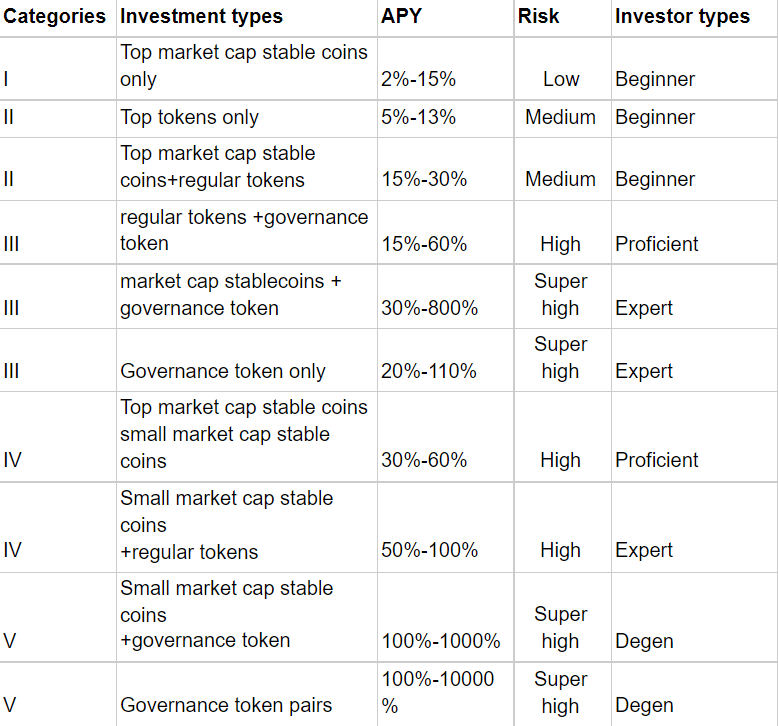

Four types of investors are categorized as per my personal experience.

Note the above classification of investors for people who already notice the volatile risk of digital currency investments themselves.

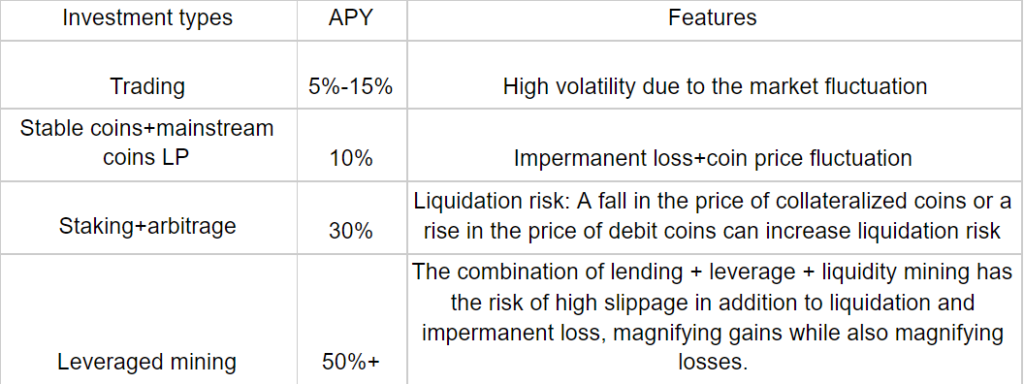

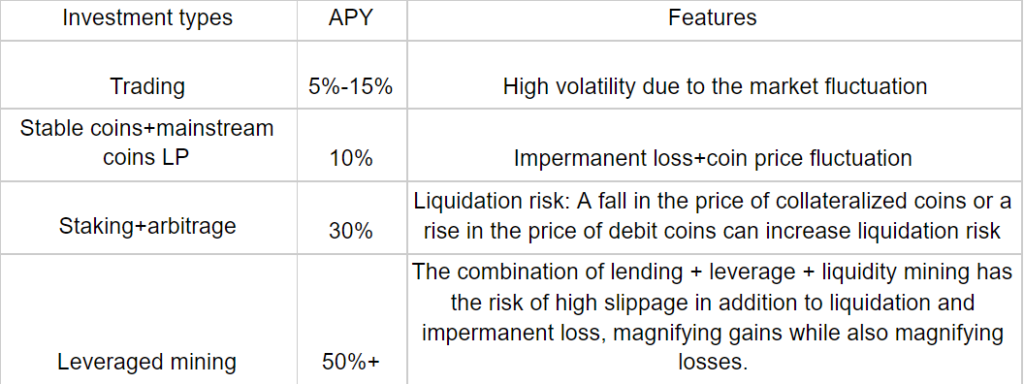

II. Investment categories

In terms of tokens invested, there are three types of DeFi investment categories as per the token type.

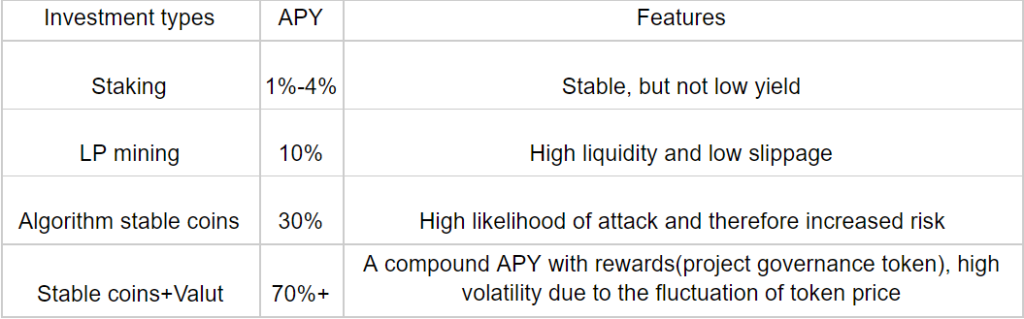

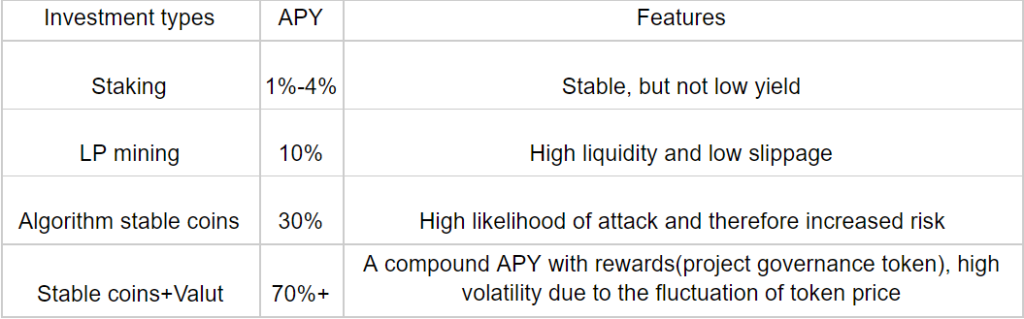

1) Stable Coins: A comparison of different stablecoin investment methods and returns

There is no impermanent loss in stable coin LP mining. However, the combined return of stablecoin LP ranges from 5-15%, which is a relatively low rate of return. Many platforms are willing to provide extra returns to attract users for providing liquidity, but the risk is also elevated.

Risk: failure in being pegged of stablecoins + the collapse of the protocol

2) Regular tokens: BTC, ETH

Though multiple risks exist, regular tokens are suitable for beginners to have a try and earn experience by making some small position trading. HODL is also a popular trading strategy in the crypto market.

Risk: Market fluctuation + impermanent loss +Liquidation

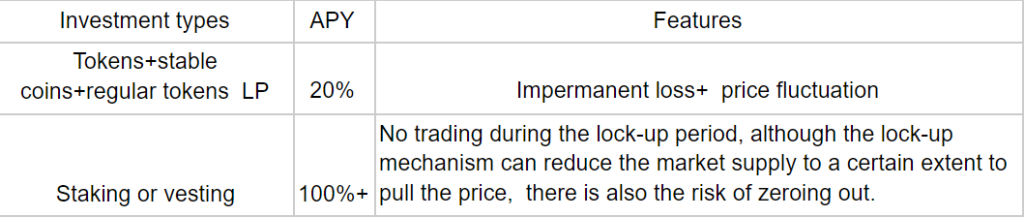

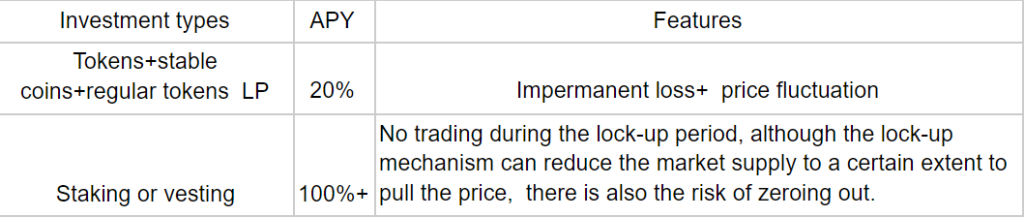

3) Governance tokens

Most DeFi projects issue platform tokens as part of the ecosystem with yields up up to a hundred or thousand times. While some tokens do not support actual business scenarios and are extremely risky to invest in.

Risk: Project risk + token price volatility

III. How to choose your investment?

Now we can select a suitable investment after knowing the risk preference with a basic knowledge of DeFi investment.

Note: Small market cap coin refers to a market cap below 100 million.

DeFi is considered a new trend in the development of the Internet. Compared with traditional finance, DeFi has advantages in inclusive finance, financial rights, asset convenience, financial costs, and privacy.

However, it is also at an early stage and still takes time to develop. Many projects are built for speculation without any innovation for the DeFi ecosystem. Before investment, you need to do more research and understand the project background as well as its business model.

Disclaimer: The contents of this article represent personal views and are for informational purposes only, and do not constitute any investment advice.

This report was brought to you by Footprint Analytics.

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Comments (No)