Bitcoin (BTC) investment vehicle, the Grayscale Bitcoin Trust (BTC), now trades at just 17% below BTC price parity.

The latest data from monitoring resource CoinGlass confirms that as of Sep. 9, GBTC shares traded at 17.17% less than BTC/USD.

GBTC retraces nearly two years of losses

Bitcoin’s largest institutional investment vehicle, GBTC has seen its fortunes improve significantly since news that BlackRock, the world’s largest asset manager, said that it planned to file an application for the United States’ first Bitcoin spot price-based exchange-traded fund (ETF).

This was music to the ears of Grayscale executives, who were already in the middle of a legal battle with U.S. regulators over turning GBTC itself into a spot ETF.

The U.S. Securities and Exchange Commission (SEC) has yet to approve a single spot ETF application, recently delaying a decision on multiple projects.

Despite this, Grayscale last month won a key face-off with the SEC, securing a welcome industry boost, which further buoyed GBTC price performance.

GBTC shares’ discount to the Bitcoin price — once a surplus referred to as the “GBTC Premium,” was just 17.17% on Sep. 9, marking its best levels since December 2021.

The premium has been negative, known as a discount to net asset value (NAV), ever since. At one point it reached nearly 50%.

No joy for Bitcoin bulls

GBTC has thus begun to diverge from BTC price strength, with the latter still sloping downhill as it retests levels rarely seen over the past six months.

Related: Double top ‘likely’ confirmed — 5 things to know in Bitcoin this week

BTC price traded at under $25,500 at the time of writing, data from Cointelegraph Markets Pro and TradingView showed, with the Wall Street open adding fuel to an already limp market.

As Cointelegraph reported, September tends to be a weak month for BTC/USD, which often loses up to 10%.

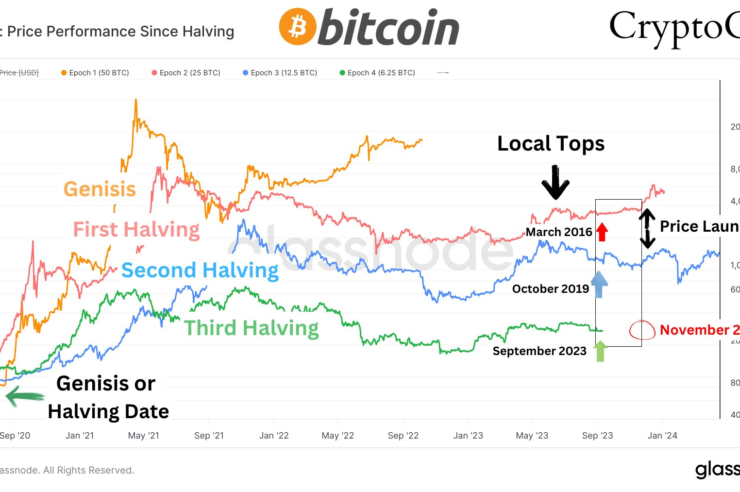

“September is historically a pretty bad month for Bitcoin, that’s just the facts. October is historically very bullish,” popular trader and analyst CryptoCon told X followers in part of commentary on the day.

CryptoCon added a chart flagging late November as a key time to watch for signs of life on Bitcoin during pre-halving years.

This echoes an existing theory, which specifically gives Nov. 28 as the “bull run launch” date for Bitcoin price once every four years.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Comments (No)