Crypto giant Coinbase seems to be strategically steering its ship amid constant crypto industry turbulence in 2023. The company recently unveiled its lending platform for institutional investors, aiming to fill the void left behind by major players during 2022’s crypto winter, when firms such as Celsius Network, BlockFi and Genesis went bankrupt.

The move comes after the company shut down its Borrow service for retail customers in May amid regulatory scrutiny. The service allowed certain customers to use crypto as collateral to receive a cash loan. The new lending solution, however, focuses on institutional investors — companies or organizations investing on behalf of their clients, such as mutual funds and pension plans.

Coinbase’s new venture amassed millions in capital within a few days of launching, documents filed with the United States Securities and Exchange Commission (SEC) show. Despite headwinds and uncertainty, the service debut indicates that crypto lending among high-profile investors is still in demand in the United States.

This week’s Crypto Biz also explores Marathon Digital’s latest Bitcoin mining report, Hana Bank’s move to offer crypto custody and Google’s new crypto ads policy.

Coinbase launches crypto lending platform for U.S. institutions

Crypto exchange Coinbase has rolled out a crypto lending service for institutional investors in the U.S., which reportedly seeks to capitalize on massive failures in the crypto lending market. According to a filing with the SEC, Coinbase customers have already invested over $57 million in the lending program since the first sale occurred on Aug. 28. In another headline, Coinbase’s recently released Base network reached over 700,000 nonfungible tokens (NFTs) minted in August. The tokens minted were part of the launch’s strategy to spur adoption. Base’s launch, however, has not been flawless. The network suffered an outage on Sept. 5 when its sequencer stopped producing blocks. Several scams have also been promoted on the network, including a $6.5 million rug-pull by Magnate Finance.

Marathon’s Bitcoin mining rate fell 9% in August

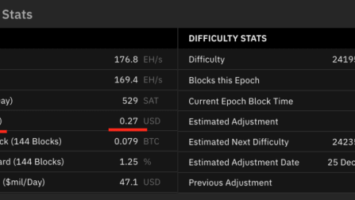

Crypto mining operator Marathon Digital Holdings produced 1,072 Bitcoin in August — 9% less than in July. According to the company, the smaller production resulted from increased curtailment activity in Texas due to record-high temperatures. The term curtailment refers to the reduction of electricity generated to maintain a balance between demand and supply. The temporary shutdowns more than offset the progress made by the company to increase its operational hash rate and optimize operations, according to its CEO, Fred Thiel. Marathon increased its U.S. operational hash rate by 2% month-over-month to 19.1 exahashes in August. The performance increase is attributed to the upgrade of Bitmain Antminer S19j Pro miners to the more efficient S19 XP models.

Google will allow ads for NFT games starting Sept. 15

Google has updated its cryptocurrency advertising policy to allow for blockchain-based NFT gaming advertisements as long as they don’t promote gambling or gambling services. The new policy will continue to ban advertisements for games that allow players to wager or stake NFTs against other players or for rewards. NFT casino games offering players to wager or play for prizes — such as NFTs, cash or cryptocurrency — will also continue to be banned. Google previously banned all cryptocurrency-related advertising across its platforms in March 2018.

NFT gaming advertisements will soon be welcome on Google’s Search platform as long as they don’t promote any form of gambling. https://t.co/gSVeHxxkjx

— Cointelegraph (@Cointelegraph) September 6, 2023

South Korean Hana Bank enters crypto custody business with BitGo

One of the largest South Korean banks, KEB Hana Bank, is moving to offer digital asset custody services through a new partnership with cryptocurrency custody firm BitGo Trust Company. According to local media reports, KEB Hana Bank signed a strategic business agreement with BitGo to jointly establish digital asset custody in South Korea. The commercial bank has a network of 111 branches with local banking assets of nearly $10 billion and equity of $490 million. Together, Hana Bank and BitGo plan to launch their joint cryptocurrency custody venture in the second half of 2024.

Crypto Biz is your weekly pulse of the business behind blockchain and crypto, delivered directly to your inbox every Thursday.

Comments (No)