Bitcoin (BTC) stayed near two-month lows at the Aug. 18 Wall Street open as markets came to terms with extreme liquidations.

“Drying liquidity” costs BTC price key support

Data from Cointelegraph Markets Pro and TradingView showed BTC price action tracking sideways after a single daily candle spawned 8% losses.

The largest cryptocurrency saw a cascade of liquidations across derivatives markets, with these accounting for an “outsized” majority amid relatively slack spot selling.

“In Deribit it is likely that a large account got wiped, considering the immense short liquidation that occured together,” trading firm QCP Capital wrote in a market update sent to Telegram channel subscribers on the day.

QCP, like others, noted that the market reaction to the alleged trigger — a write-down of SpaceX’s $373 million BTC holdings — appeared exaggerated.

“This brought back the 2021 and 2022 ghosts of Elon-driven tops and bottoms, and we certainly hope the market will not revert back to those times again,” it continued, referring to previous Bitcoin sales and accompanying comments from Elon Musk, joint CEO of SpaceX and Tesla.

Total liquidations challenged those seen in the immediate aftermath of the FTX exchange meltdown — the event which resulted in BTC/USD dipping to two-year lows of $15,600 in November 2022.

“This feels like yet another sign of the drying liquidity markets have seen over the last few weeks,” financial commentary resource The Kobeissi Letter added in part of its own reaction.

Analyst: Spot sell volume still 50% below 2023 high

As BTC price drifted slowly toward $26,000, market participants diverged over the true nature of the situation and its future implications.

Related: How low can the Bitcoin price go?

For popular trader and analyst Rekt Capital, the picture was bleak — a double top formation for BTC/USD in 2023, and a complete lack of support from trend lines and moving averages during the breakdown.

“BTC formed its Higher High at ~$31000 on inclining volume. But price formed the second half of its Double Top on declining volume,” he wrote in part of multiple X posts.

An accompanying chart showed trading volume on daily timeframes, as Rekt Capital warned that capitulation had likely not yet matched previous sell-offs.

“Though there was a small breakout in seller volume on this crash… It’s still nowhere near the Seller Exhaustion volume levels (green box) of previous BTC reversals (yellow circles),” he explained.

“In fact, current Seller Volume would need to probably double to reach those Seller Exhaustion volume levels that prompted price reversals in early & late March as well as mid-June.”

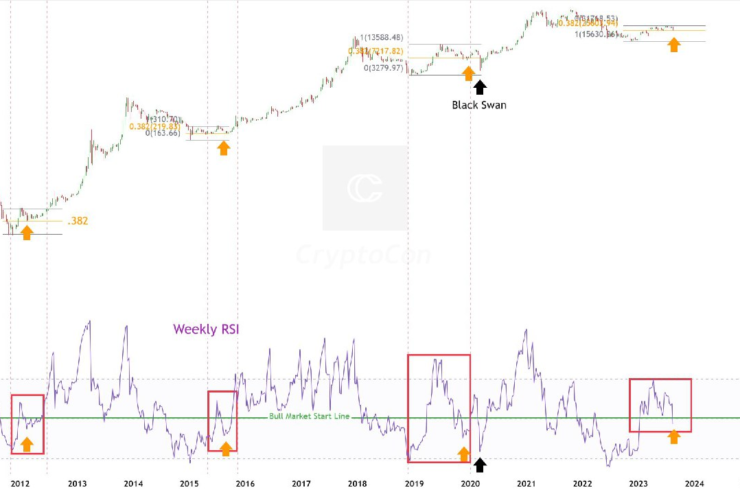

Others were more optimistic, including trader CryptoCon, who identified key two completed tasks common to successful BTC price rebounds during bull market retracements.

These involved relative strength index (RSI) values bouncing at the 0.382 Fibonacci retracement level.

“Every cycle, the Weekly Bitcoin RSI experiences a fake out of the bull market start line, some lasting longer than others,” he explained.

“And every one of them makes a revisit to the .382 Fibonacci retrace of the move. With the latest drop, both of those things are now complete.”

Rekt Capital noted that daily RSI was now at its most “oversold” since June 2022, with only two episodes in Bitcoin’s history, both in bear markets, beating it.

Looking ahead, QCP meanwhile flagged next week’s commentary from Jerome Powell, Chair of the United States Federal Reserve, as the next potential source of volatility.

“We believe that a lot now rests on Powell’s speech at Jackson Hle next week,” it concluded.

Magazine: Should we ban ransomware payments? It’s an attractive but dangerous idea

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Comments (No)