Riot, a key player in the Bitcoin mining sector, reported overall revenue of $76.7 million in its financial results for the quarter ending June 30, 2023.

This result underscores Bitcoin miner resilience in an unpredictable market, with a significant part of its achievement attributed to a 27% increase in Bitcoin production, as opposed to the value of Bitcoin itself.

Riot reduces the cost of BTC mining.

The company reduced the average cost to mine Bitcoin to $8,389 in Q2 2023 from $11,316 in Q2 2022. This is despite Bitcoin prices averaging lower at $28,024 per Bitcoin in Q2 2023, compared to $33,083 in Q2 2022.

Jason Les, CEO of Riot, said,

“Riot’s core business is Bitcoin mining, and the scale of our vertically integrated operations and financial strength allowed us to execute on our power strategy at unmatched scale this quarter.”

For instance, the company’s partnership with Midas Immersion is set to transform Riot’s Corsicana Facility into the largest and most advanced immersion cooling deployment for Bitcoin mining globally.

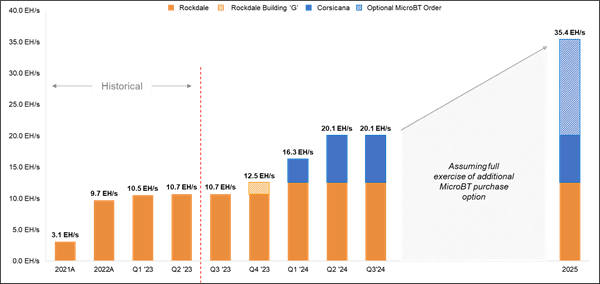

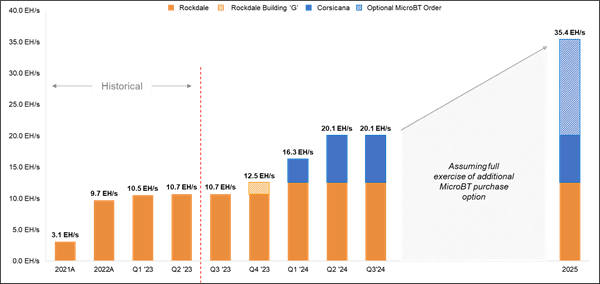

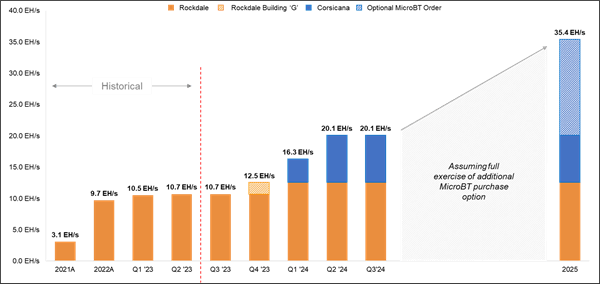

The company also announced a long-term purchase agreement with MicroBT, securing 33,280 next-generation miners “with an option to purchase an additional 66,560 miners on the same price and terms.” These new acquisitions are expected to add another 7.6 EH/s by mid-2024 and are designed specifically for immersion cooling while being manufactured in the United States.

Ultimately, the miner aims to increase its hash rate by 24.7 EHs to 35.4 EH/s by 2025 with the addition of the entire MicroBT miner order.

Offsetting BTC production with energy sales

In June 2023, Riot produced 460 Bitcoin, marking a decrease from the 757 Bitcoin mined in May 2023.

However, despite this reduction in mined Bitcoin and the subsequent drop in revenue, Riot employed its power strategy to generate significant revenue, approximately equivalent to $10 million. This strategy involved both power sales and demand response revenue, which together amounted to the equivalent of a “361 BTC” increase based on June’s average Bitcoin price.

Interestingly, June’s Bitcoin trading landscape saw most U.S. miners selling Bitcoin to capitalize on its price surge and secure profits. Riot, however, demonstrated prudence by selling only 400 Bitcoins, 33% less than the previous month. This decision reflects Riot’s confidence in its unique power strategy, which allowed the company to earn revenue without relying solely on Bitcoin sales.

During Texas’s June heatwave, Riot’s power strategy played a pivotal role. CEO Jason Les highlighted how the company made dynamic power usage decisions based on market indicators.

By actively participating in ERCOT’s various market programs, Riot generated $8.4 million in power sales and $1.6 million in demand response revenue. This strategic approach to power utilization not only provides Riot with a competitive advantage but also showcases its commitment to supporting the broader energy grid, especially during high-demand periods.

Navigating headwinds

Despite these positive strides, Riot has faced its share of challenges. A severe winter storm in Texas in Dec. 2022 caused significant damage to Building G, impacting the company’s hash rate growth. However, repairs are underway and expected to be completed by August, bringing the hash rate back to its full capacity.

A dip in revenue was reported from data center hosting, decreasing to $7.7 million from $9.8 million in the same period in 2022, and the quarter concluded with a net loss of $27.7 million, which, although significant, is substantially lower than the net loss of $353.6 million in Q2 2022.

The company’s Q2 2023 report presents a mixed bag of developments. While notable challenges such as a significant net loss and a decrease in Bitcoin’s average price did occur, Riot demonstrated resilience and a capacity for innovation.

Its strategic moves and partnerships and a strong emphasis on vertical integration imply a commitment to being a leader in Bitcoin mining technology and infrastructure.

Comments (No)