A 2023 H1 survey from Salesforce, which covered 6,058 financial service institution (FSI) customers worldwide, offered significant insights into sentiments surrounding artificial intelligence (AI), cryptocurrency, and the digital shift in the financial services industry.

According to the Salesforce Financial Services Report, the survey was conducted from March 7 to April 12, 2023, and encompassed respondents from 12 countries across five continents.

Interest in crypto from FSI customers.

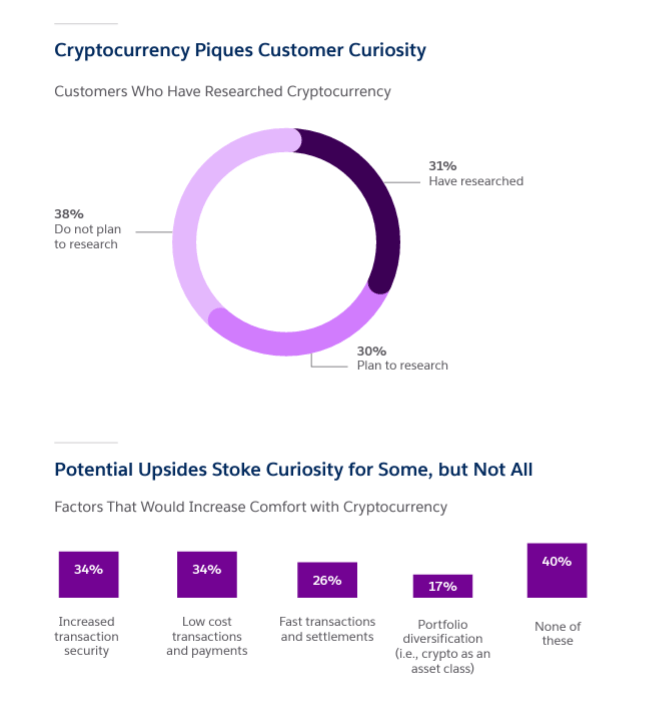

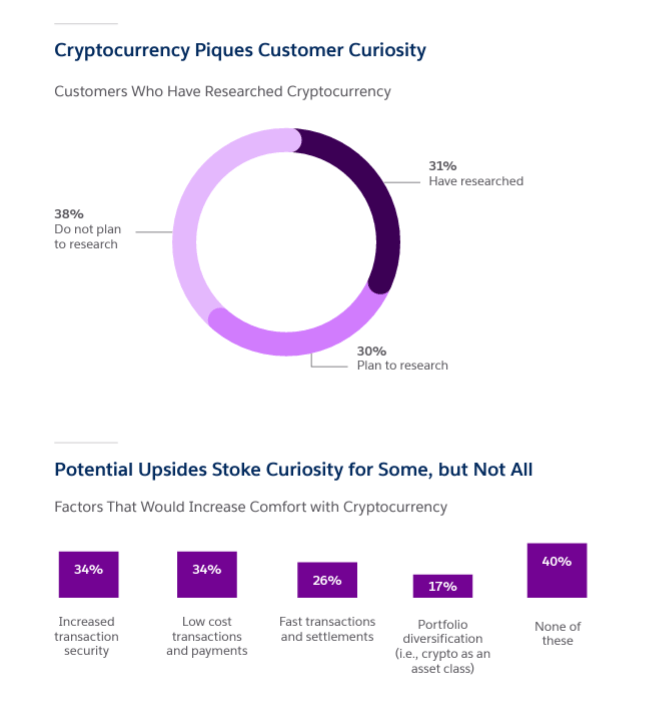

A noteworthy finding is that 61% of customers have either researched or plan to research cryptocurrency, highlighting a growing interest in digital currency. Despite two-thirds of customers expressing interest in digital currencies, only 29% have desired blockchain digital currency services from their financial institutions.

This may underscore a perceived gap in current FSI offerings, a discomfort with the emerging technology, or perhaps an indication there is a real appetite for self-custody, as the report showed that 60% of customers are comfortable with cryptocurrency.

The survey also found that 31% of customers have researched, and 30% plan to explore portfolio diversification, including crypto as an asset class. Despite its volatility, this data suggests a developing curiosity and acceptance of crypto as a valid part of a diversified portfolio.

AI is improving financial services.

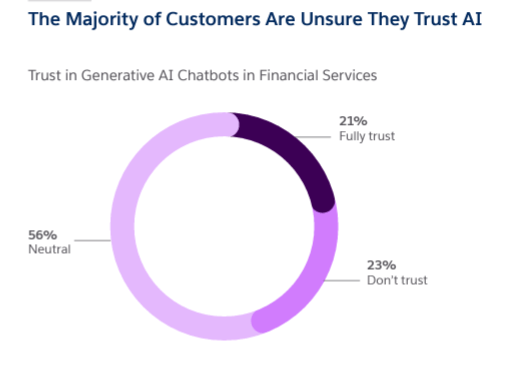

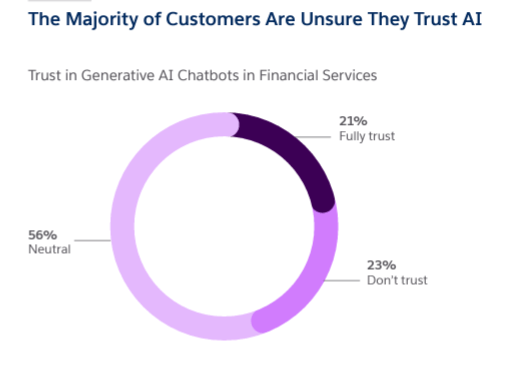

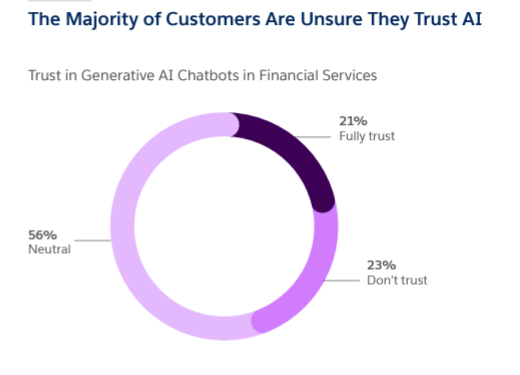

Generative AI has become a hot topic of interest, with consumers revealing uncertainty about trusting AI, specifically financial service chatbots powered by generative AI. This leaves room for potential improvement in the integration and intelligence of chatbots, which, according to the report, are currently a significant area of digital friction.

Only 21% of respondents “fully trust” AI Chatbots, while 56% were neutral. To give context to this data, many experiences will be based on older AI models rather than groundbreaking LLMs, such as the GPT-4 API, which was recently released to all customers. With the advent of the next wave of Chatbots, it will be interesting to see whether this metric improves and customers become more trusting of Chatbots powered by the latest generative AI technology.

The survey also revealed an expectation that AI could enhance financial transactions, with a significant share (46%) of the respondents expressing optimism about AI’s time-saving potential. However, 40% neither agreed nor disagreed with this sentiment, indicating that more work is needed to establish AI’s benefits in consumers’ minds.

Overall, the Salesforce report provides a snapshot of the shifting landscape in financial services, with consumers expressing a growing interest in blockchain technologies, cryptocurrency, and AI. It underscores the challenges and opportunities facing FSIs as they navigate the intersection of emerging technologies.

The majority of respondents were millennials making up 43% of respondents, followed by Gen X at 25%, Generation Boomers at 20%, and Gen Z at 12%.

Comments (No)