Macro Overview

Jackson Hole recap

When markets opened on the 29th of August, Fed Chair Powell provided most of the drama by saying that rates will continue to rise until inflation is brought under control. He pushed back on market expectations, which saw U.S. equities sink, short-term rates climb to their highest since mid-June and the two-year treasury yield hit its highest level since 2007.

The Fed was not the only central bank emphasizing its hawkishness. According to a Sept. 2 Reuters report, the ECB’s plan for a 75bps hike rate in its September meeting was backed by comments from Governing Council member Robert Holzmann, who said:

“50 basis points is the minimum for me… 75 basis points should be part of the debate.”

The comment sent the 2-year bund +35% higher.

Eurozone crisis reinforces case for 75bps

- Eurozone reported 9.1% CPI inflation on Aug. 31 — the highest on record. The eurozone has been reporting record levels of inflation for the last nine months, which has placed additional pressure on the ECB — making a 75bps hike most likely.

- Austria’s largest energy supplier Wien Energie is insolvent and requires €1.7 billion to remain liquid, according to local media. The Austrian Federal Government has to step in if it wants to save the company.

- Gas and electricity prices continue to get out of control for Europe, with citizens all over Europe struggling to meet both living and small business expenses. A knock-on effect could lead to fewer people dining out, which would result in restaurants struggling to stay afloat. If restaurants go under, commercial property owners with heavy exposure to the food business would follow, which would cause losses for lenders. As lenders struggle and potentially collapse as they did in 2008, so could sovereigns.

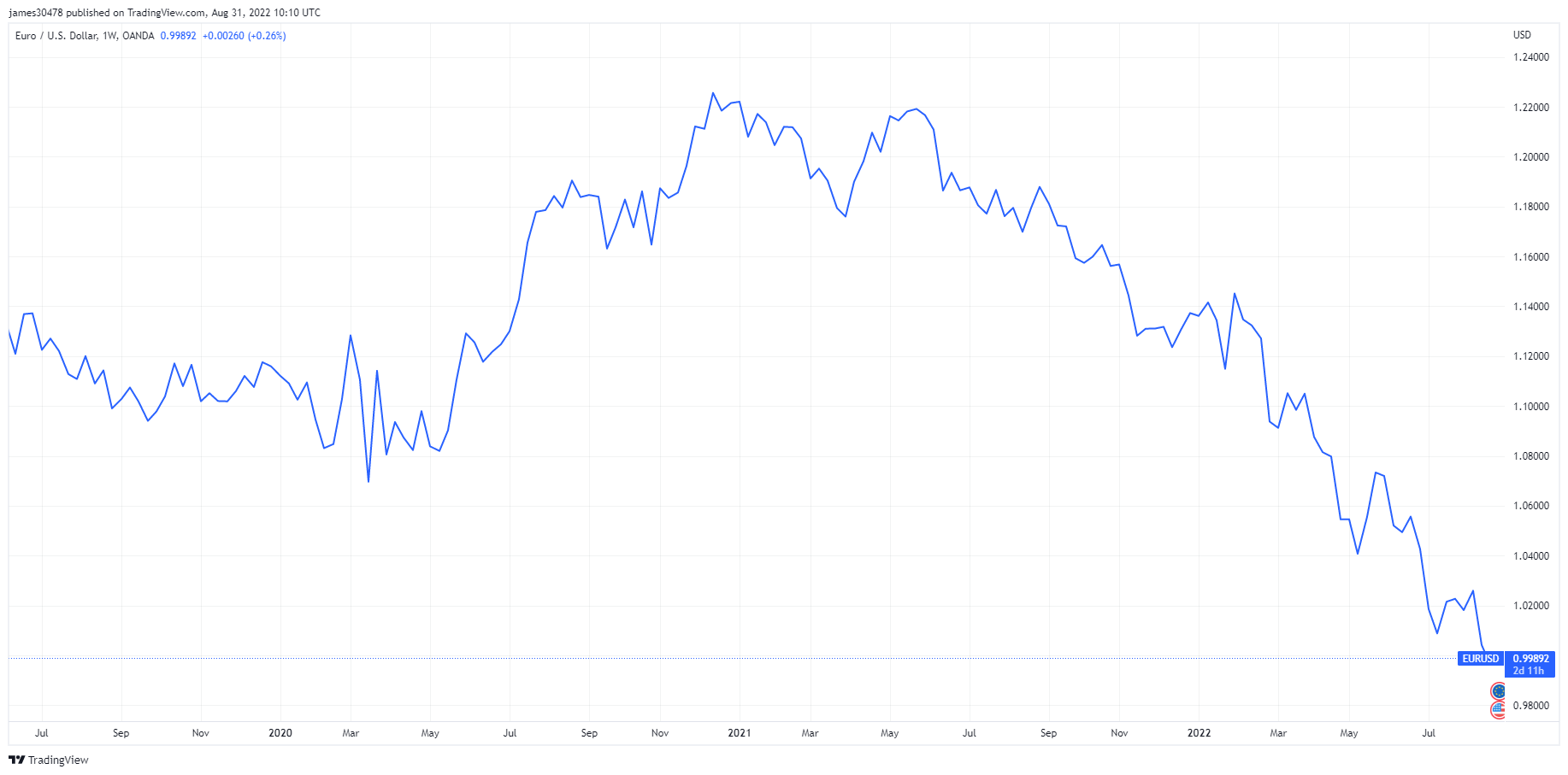

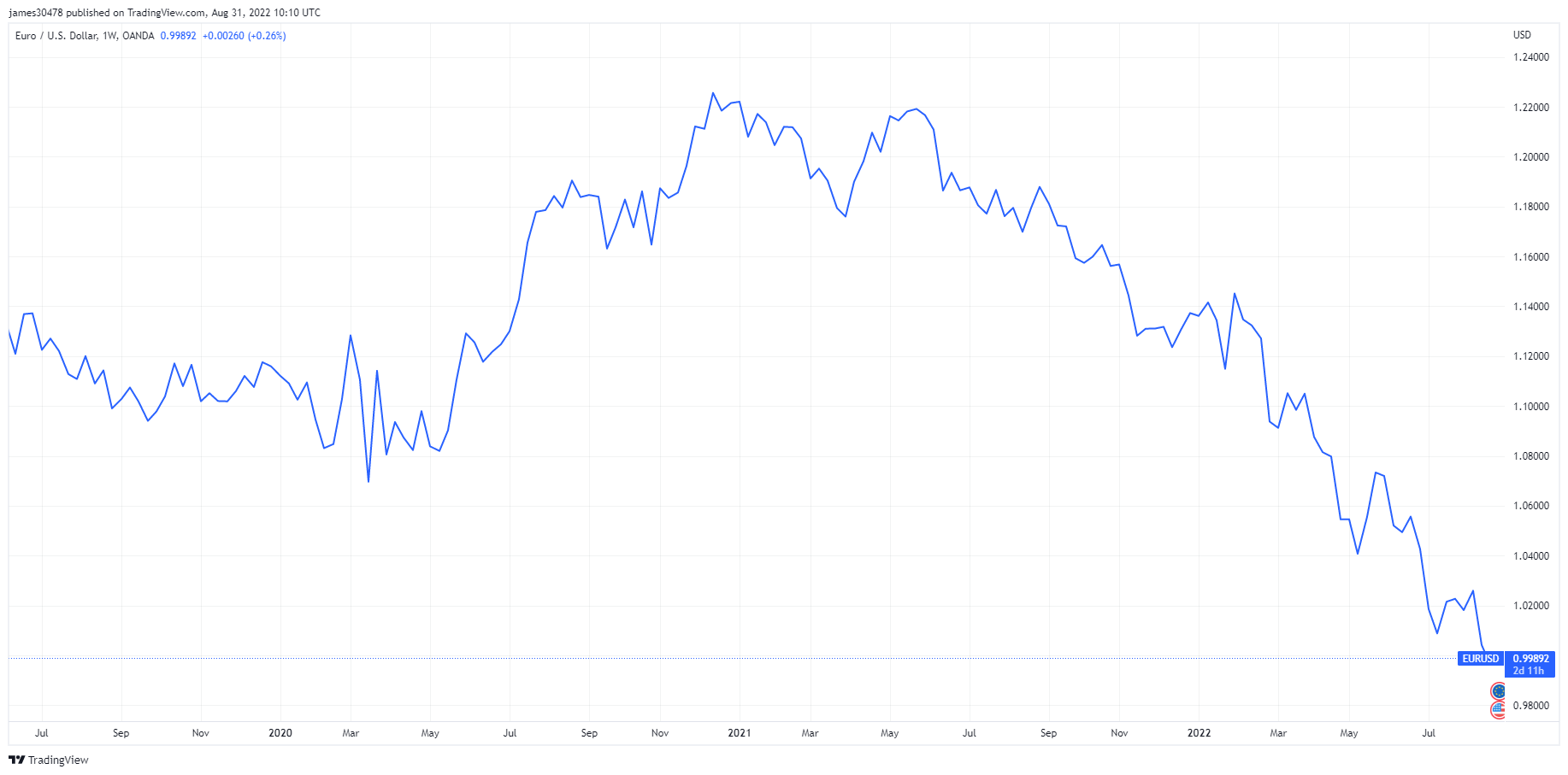

- Although the euro continues to tumble and is now firmly lost its parity with the dollar. The ECB is stuck between a rock and a hard place, down 16% from the beginning of January.

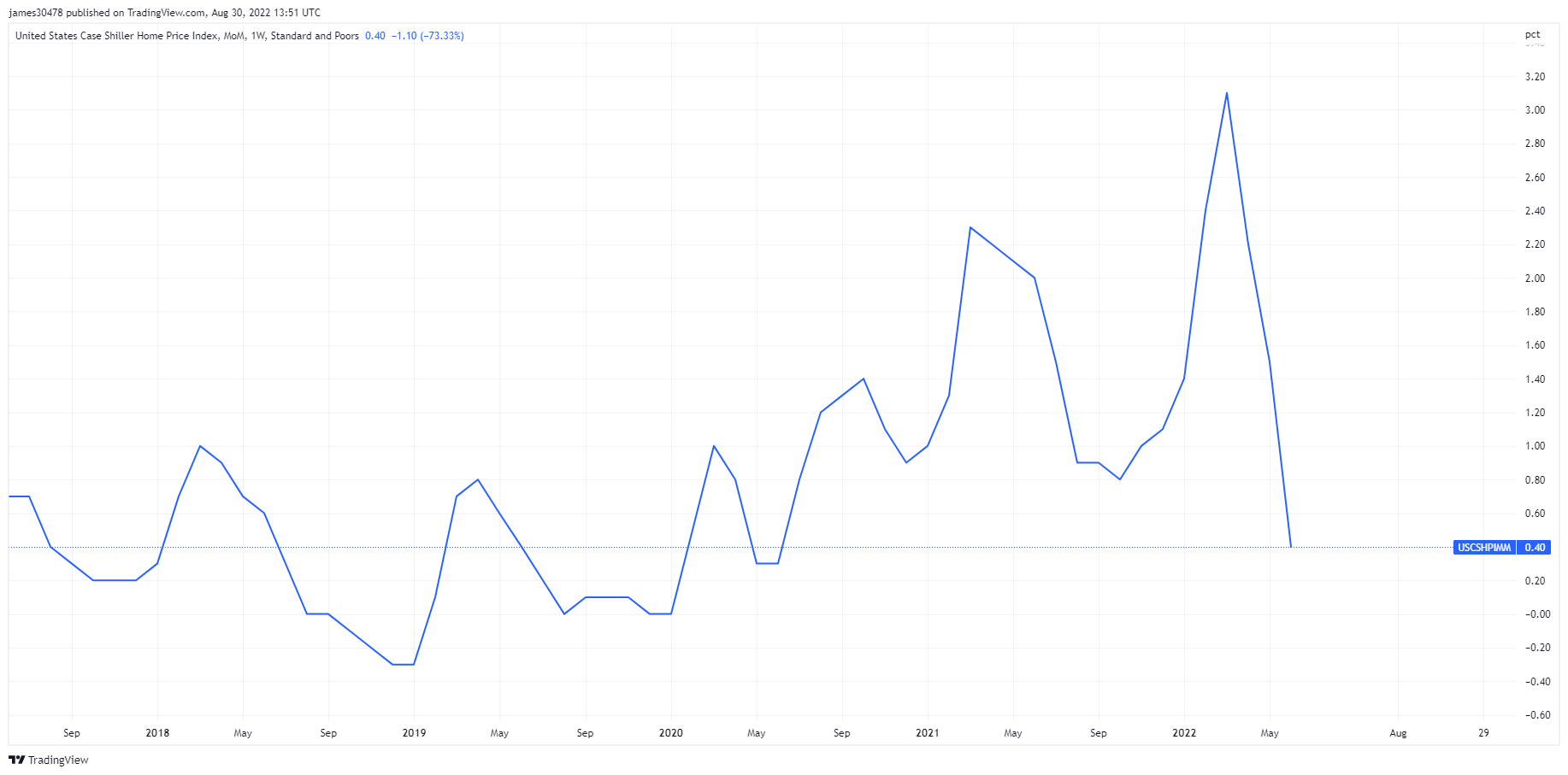

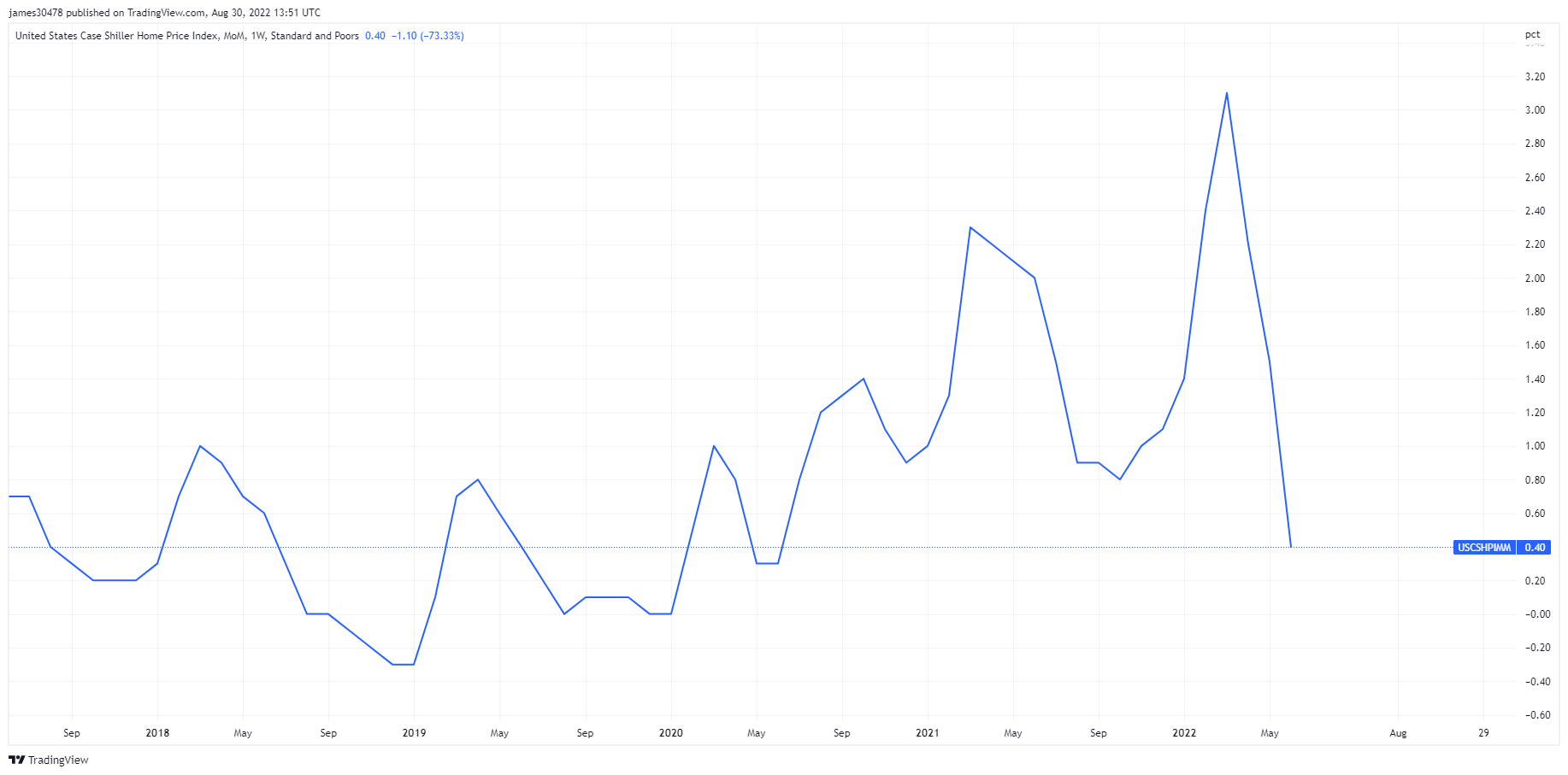

US house prices begin to tumble

House price gains are a thing of the past as the year-over-year rate of increase in the Case-Shiller house price index slowed to 18% in June from 19.9%. The decline is the largest percentage change since 2008.

However, more dynamic measures would show prices in decline. With mortgage rates almost 2x higher than a year ago and unsold inventory flooding the market, we should see a noticeable decline in September.

Correlations

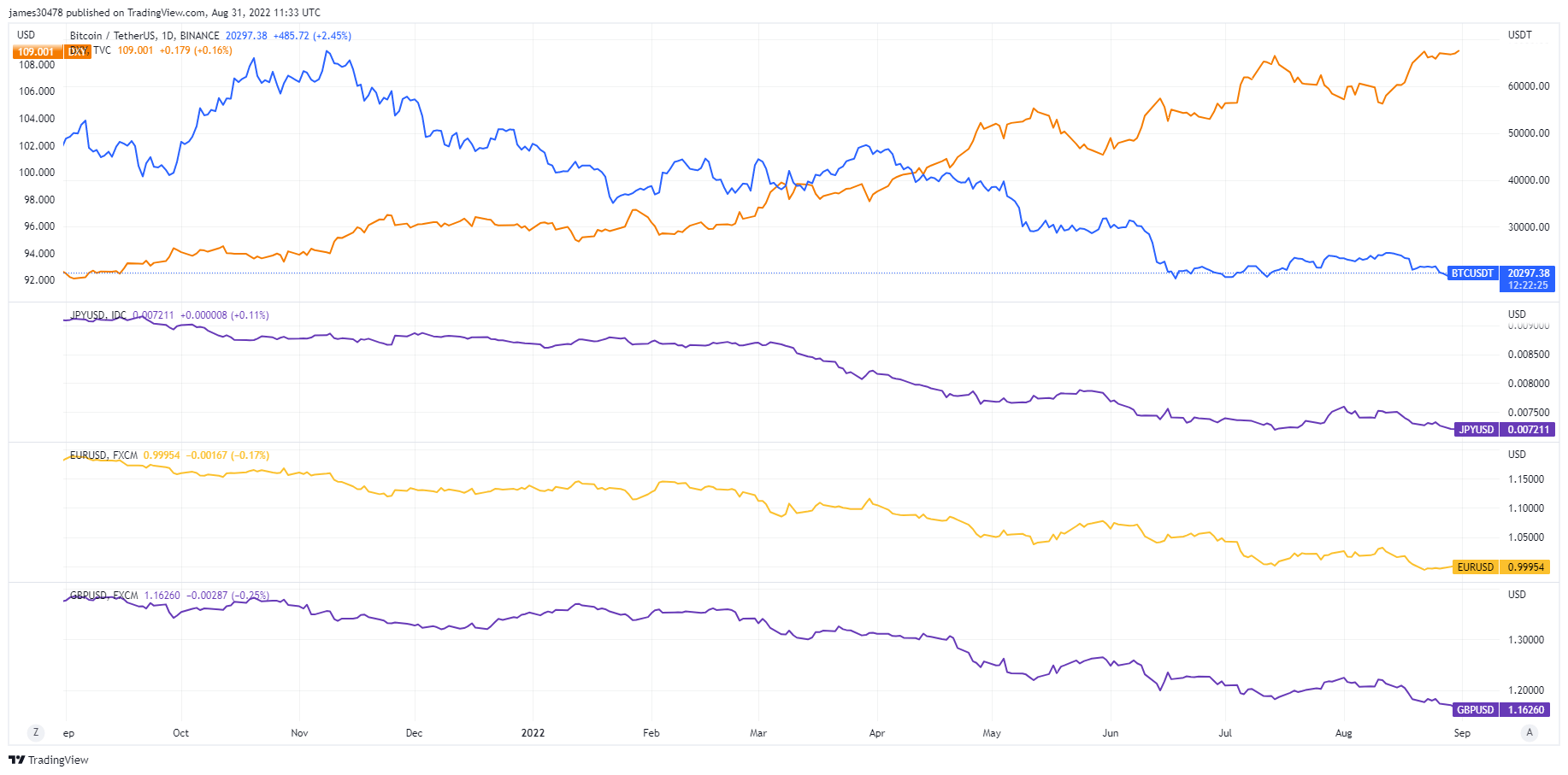

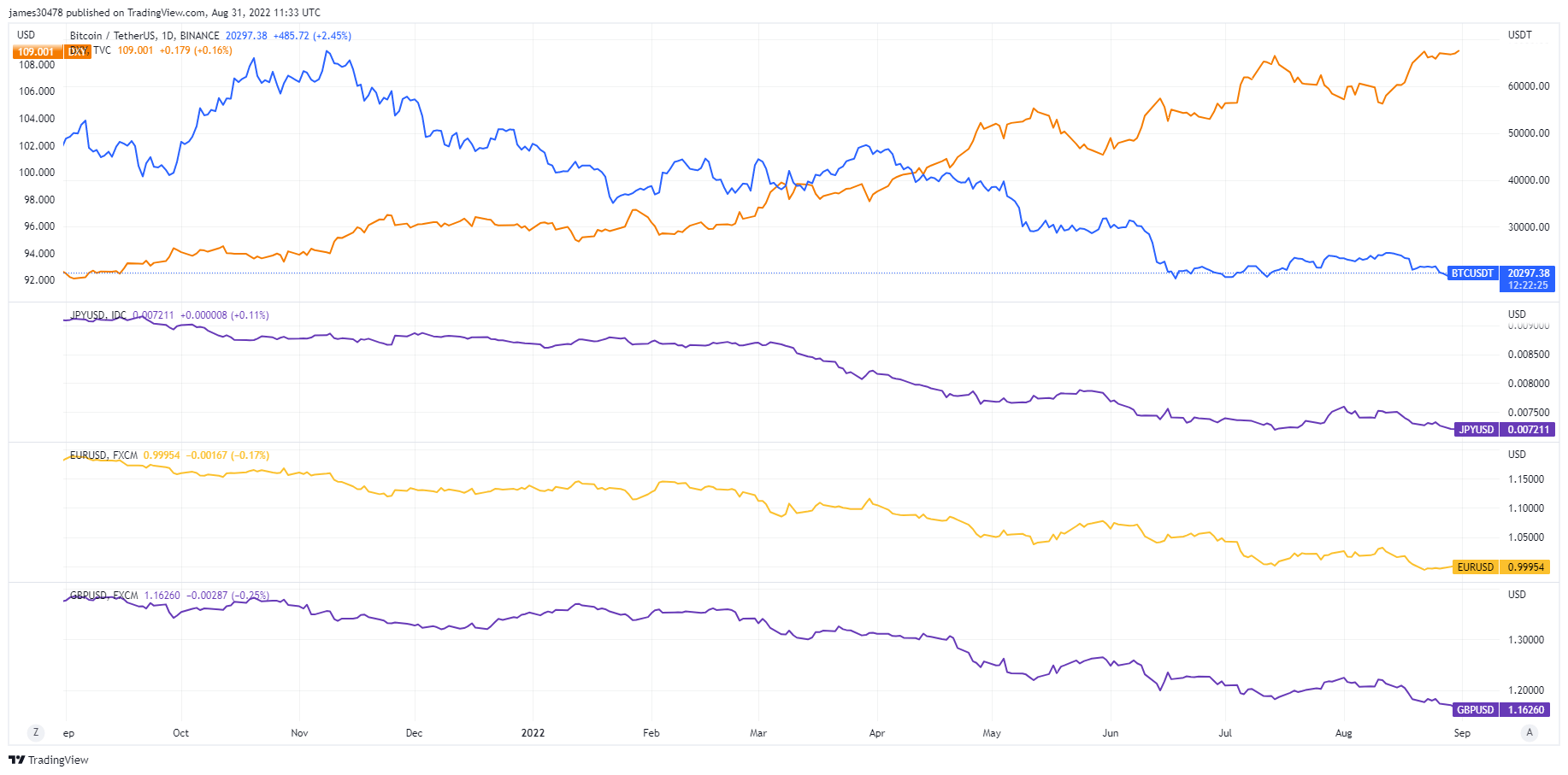

Euro, Sterling and Yen are all in decline as they find new Lows

From Aug. 29 to Sept. 4, the DXY edged towards a two-decade high at 109.6. As the DXY strengthens risk assets will continue to perform poorly with a continued divergence between the DXY and BTC.

Another catalyst for a strong USD has been the emergence of weaker currencies. As you can see below USD against the EUR, GBP, and JPY are trending towards new lows.

- The euro is 16% down year-to-date against the dollar, with Italian Treasury yields spiking, the ECB is introducing a new anti-fragmentation tool — Yield Curve Control — to ensure another debt crisis does not emerge. However, they are further devaluing the currency in the process.

- The Japanese Yen fell to a 24-year low due to the Bank of Japan’s yield curve control, which does not allow the 10-year Treasury to go above 0.25%. The drawdown is the worst since the Asian financial crisis in 1997.

- Sterling continues to sink lower and is currently standing at 1.15 — its lowest since 1985 excluding a 2-day panic during the pandemic.

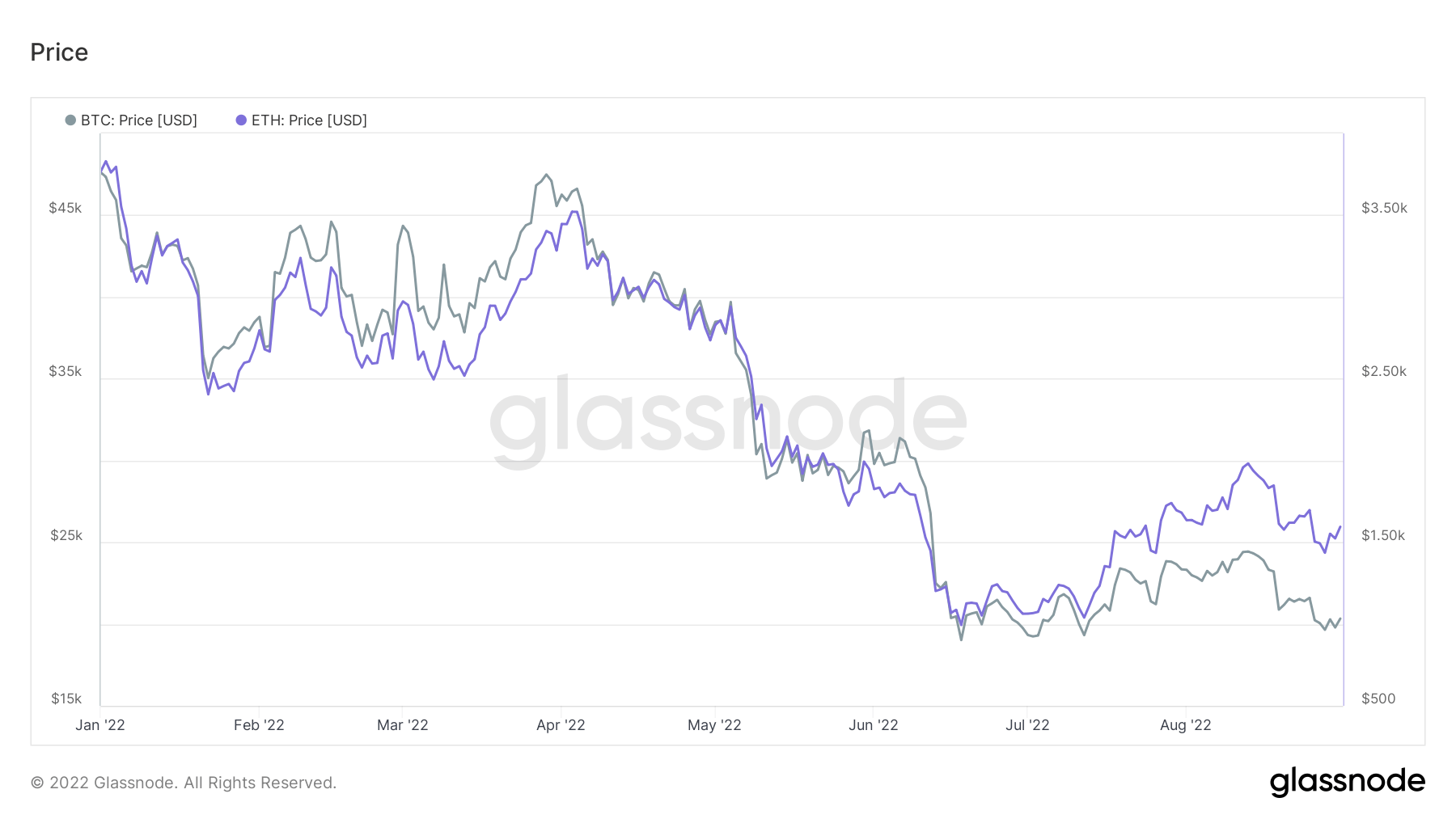

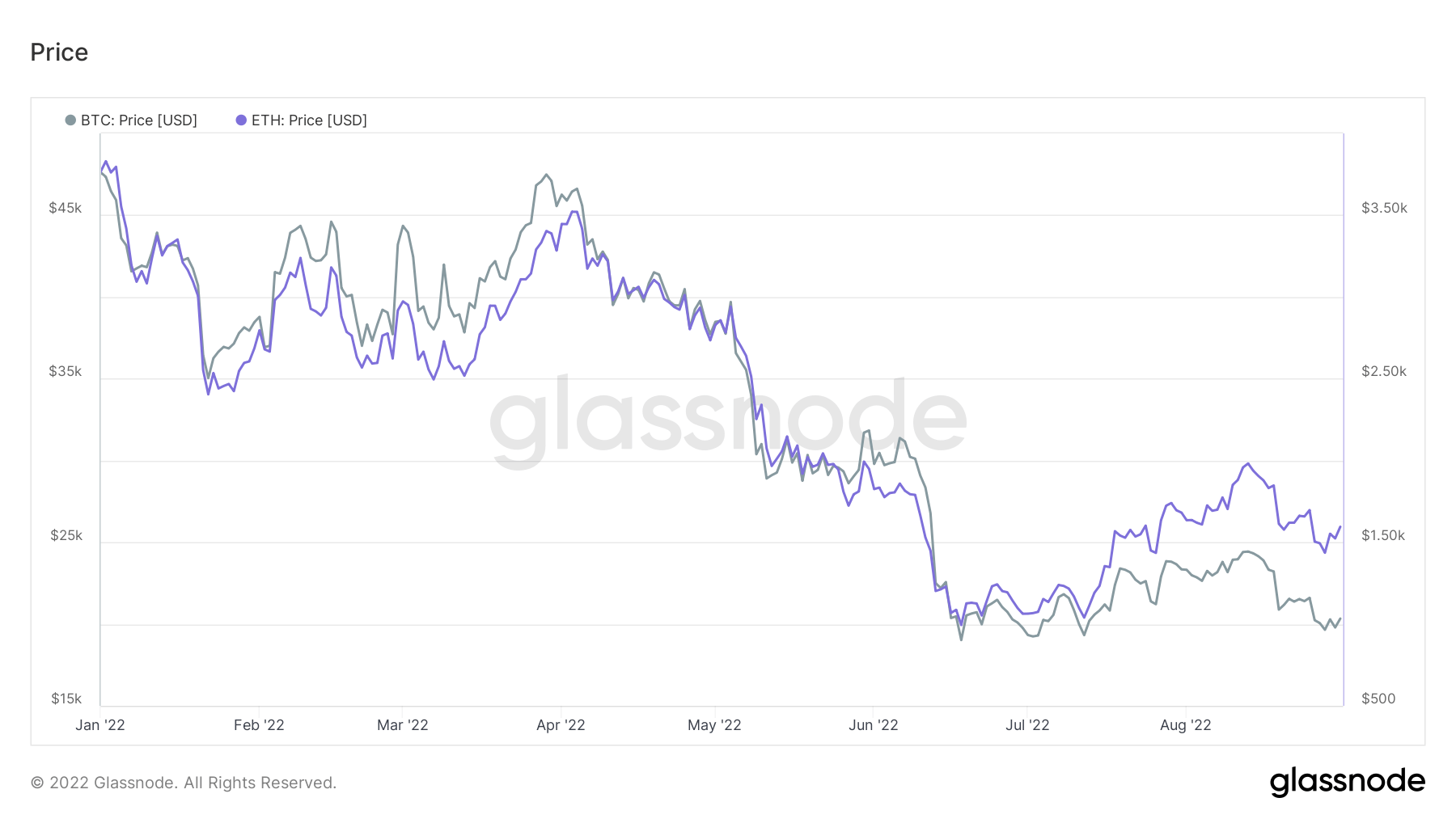

Spot to Futures correlation

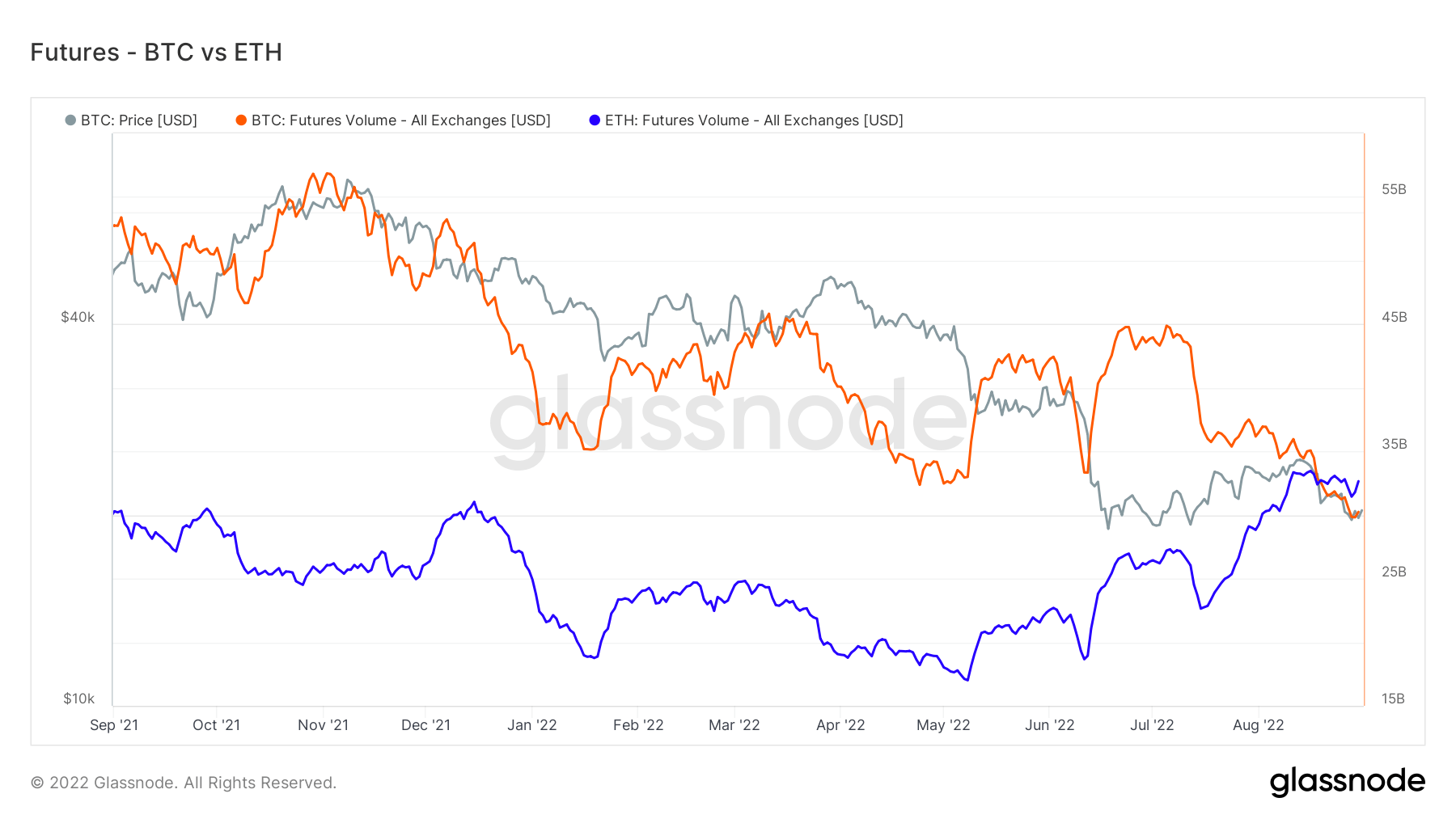

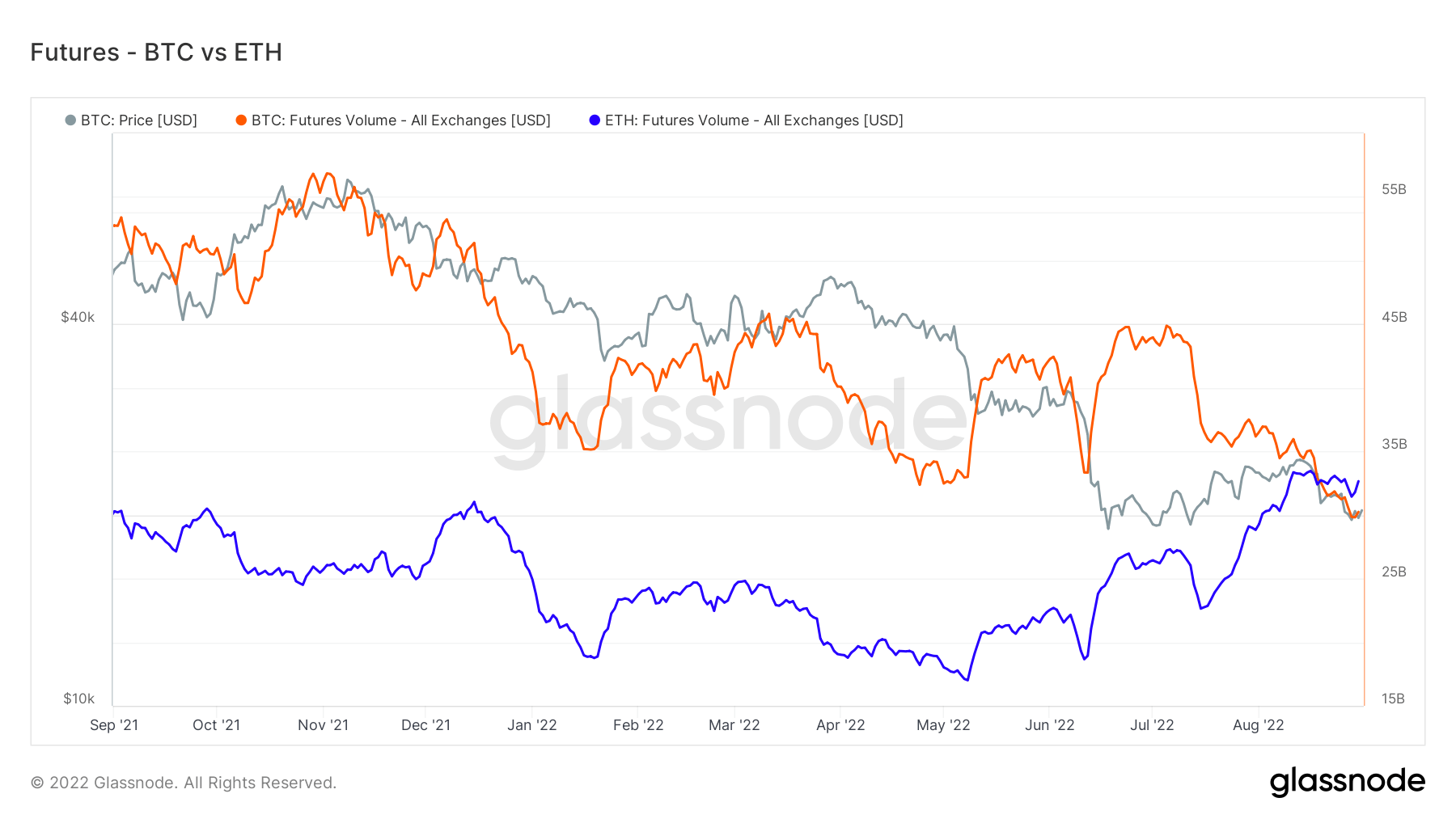

From the beginning of 2022, Bitcoin (BTC) and Ethereum (ETH) were joined at the hip in terms of price action; however, from mid to late June, ETH started to outperform BTC significantly due to the hype around the Merge.

A lot of speculators are heavily investing in the upcoming Merge through the derivatives avenue, which saw ETH almost hit $2,000 from a local bottom of roughly $900 in mid-June.

In mid-July, ETH futures volume stood at $23 billion and has since risen to over $32 billion, which contributed to ETH’s price discovery. We have highlighted in previous reports that the merge could be a “buy the rumor, sell the news” event.

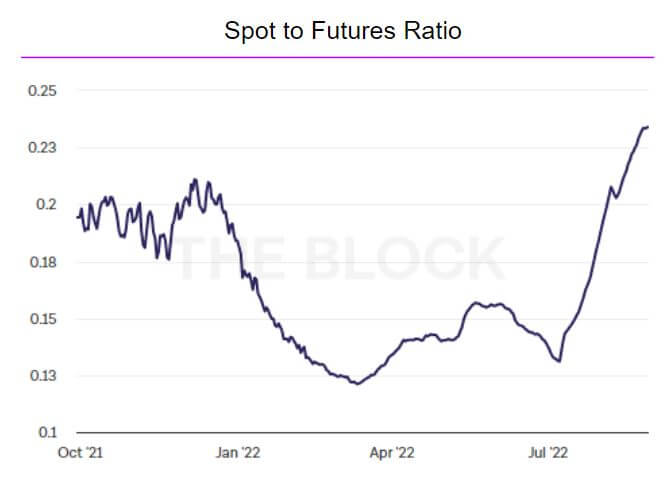

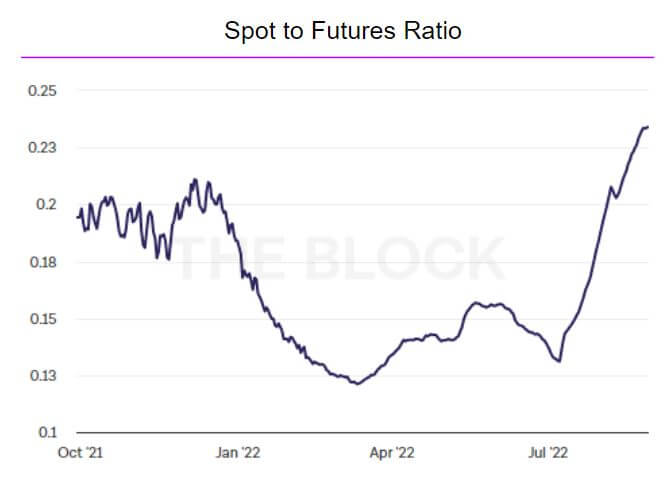

BTC futures volume has significantly declined and spot price action has been stronger than futures (0.24) over the past 30 days — which is a much healthier sign for the Bitcoin ecosystem.

Equities & Volatility Gauge

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States. S&P 500 3,924 -2.59% (7D)

The Nasdaq Stock Market is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. NASDAQ 12,075 -1.74% (7D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the coming 30 days. Investors use the VIX to measure the level of risk, fear, or stress in the market when making investment decisions. VIX 25 -0.11% (7D)

Nasdaq enters bear market

Equities have had a bad week since Aug. 29 due to supply chains breaking down, the cost of capital increasing and markets getting less efficient following the Jackson Hole meeting. Corporate profits are likely to suffer and equities likely to continue to perform poorly. Nasdaq is back in the bear market territory, down 20% from Aug. 1, while SPX is down 15% for the year. Markets have lost roughly 50% of the gains made during the summer rally.

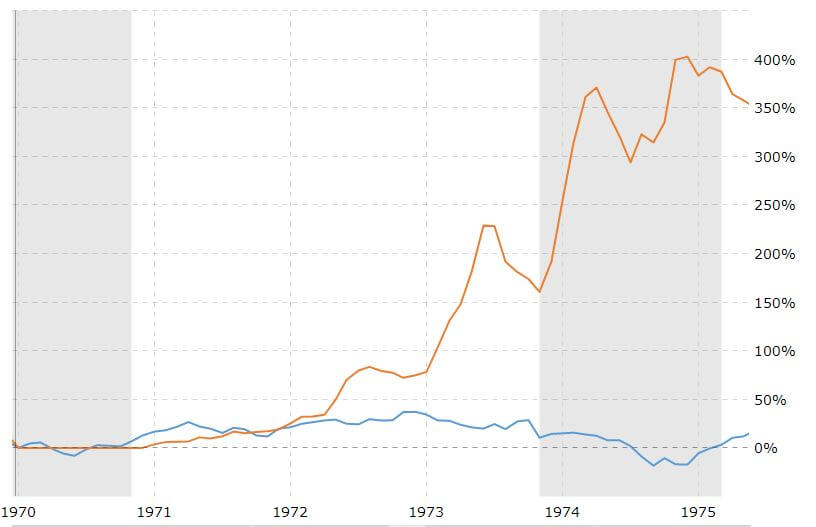

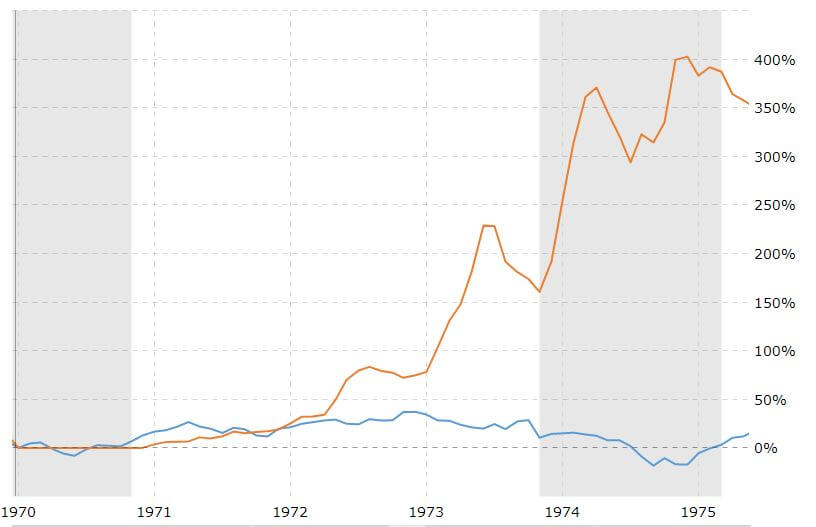

We are now in a period of stagflation, low to zero growth, and high inflation — a similar situation to the 1970s, when equities were reasonably flat for the first 5 years between 1970 and 1975.

However, gold’s performance was exceptional, climbing over 350%. With Bitcoin considered digital gold 2.0 it may perform as gold did in the 1970s during this stagflationary environment.

Commodities

The demand for gold is determined by the amount of gold in the central bank reserves, the value of the U.S. dollar, and the desire to hold gold as a hedge against inflation and currency devaluation, all help drive the price of the precious metal. Gold Price $1,734 -1.3% (7D)

Similar to most commodities, the silver price is determined by speculation and supply and demand. It is also affected by market conditions (large traders or investors and short selling), industrial, commercial, and consumer demand, hedge against financial stress, and gold prices. Silver Price $18 -4.2% (7D)

The price of oil, or the oil price, generally refers to the spot price of a barrel (159 litres) of benchmark crude oil. Crude Oil Price $88 -5.32% (7D)

Uncertainty around energy

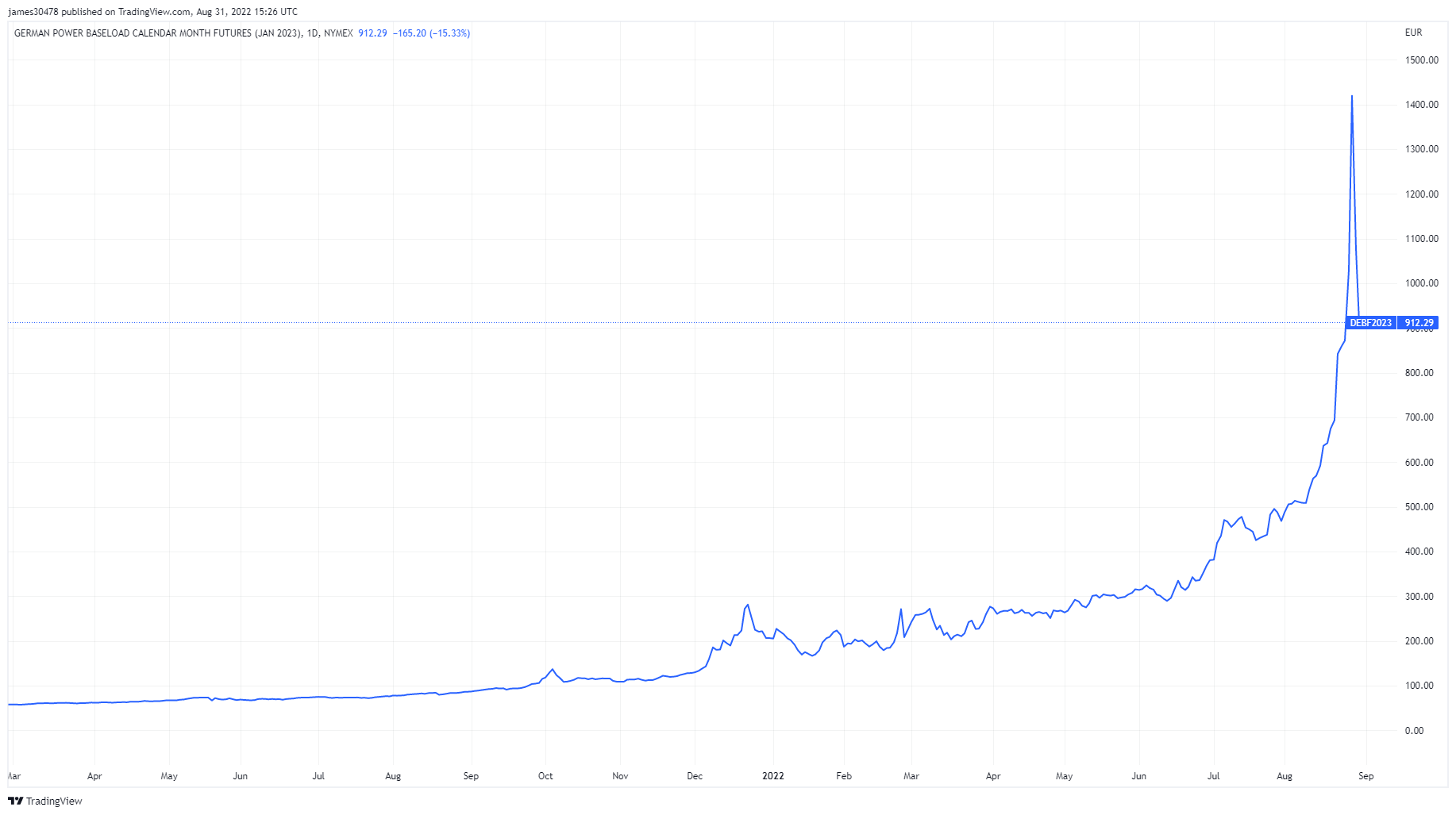

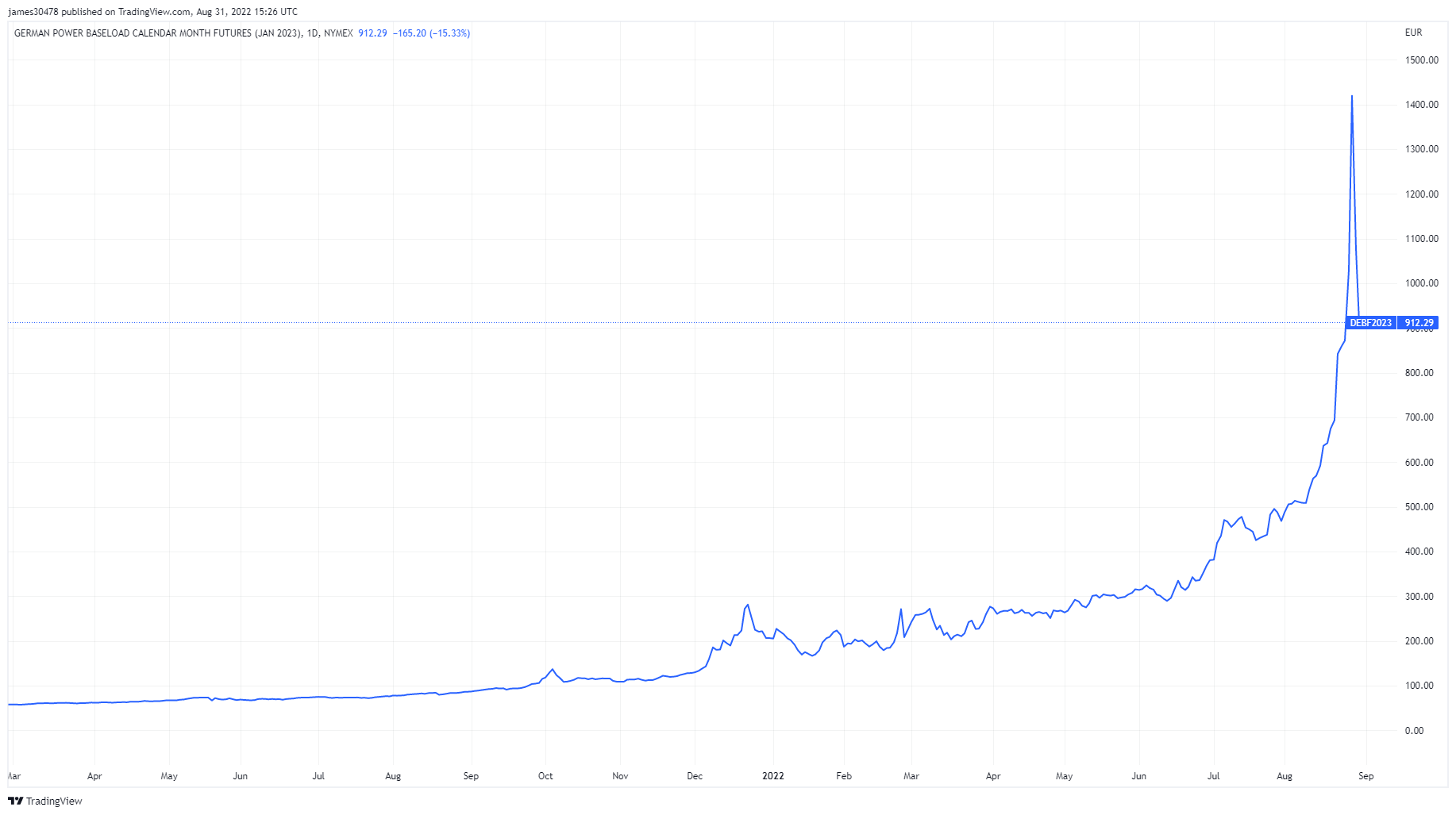

The major news in commodities comes from the energy futures market which is behaving like a meme stock and signaling that there might be trouble ahead. The eurozone is in a bit of a pickle, with record inflation, and a severely weakening currency but the triple threat is rising energy prices.

German Power 1 year ahead reached €1400 kWh, before drawing back down to just under €1,000, a 5x increase from January 2022. The futures market is signaling uncertainty and expecting the worst. When winter comes, rolling blackouts, factories shutting down and power shortages could become reality. Is the energy futures market perfectly reacting to a fear of collapse?

Gold and oil see heavy drops amid recession fears

The stronger the dollar gets the more likely there will be a wave of defaults leading to a debt crisis. Gold is meant to be a haven asset but is trading down over 5% year-to-date and fell below $1,700 on Sept. 1.

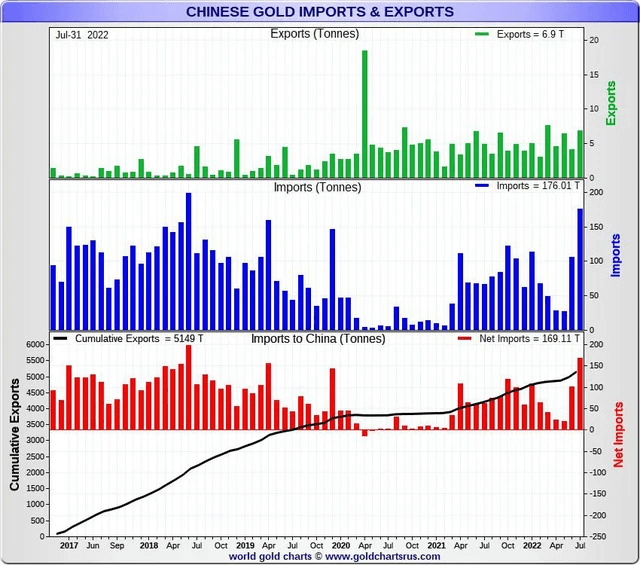

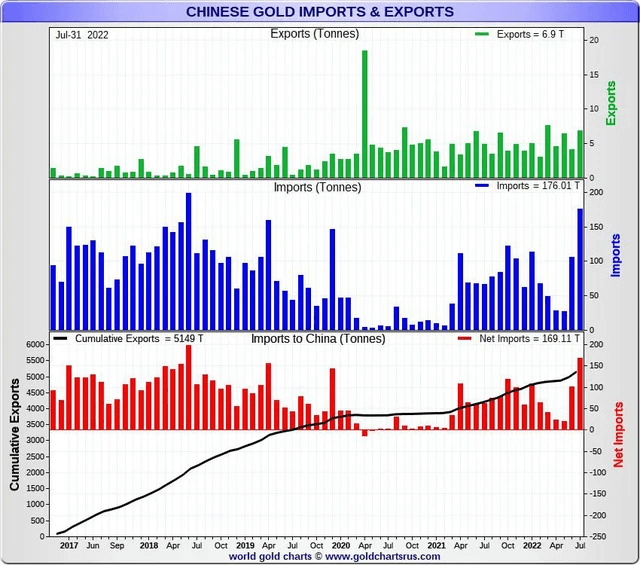

BRICS countries — Brazil, Russia, India, China, and South Africa — have been accumulating gold. Russian President Vladimir Putin has been extremely vocal in recent months, about the money printing by Western countries and how it hurts emerging market countries as they export their inflation to the weaker countries, while becoming net importers.

China net imported 169 tonnes of gold in July. In recent history, this has only been exceeded by one month in 2018. This helps to explain the huge outflows from Comex. BRICS are buying all the gold and the West is selling it at a discount.

Crude Oil continues to plummet amid recession fears, implying that no asset is safe in this global deleveraging event.

Rates & Currency

The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once every six months and pays the face value to the holder at maturity. 10Y Treasury Yield 3.1% 2.66% (7D)

The U.S. dollar index is a measure of the value of the U.S. dollar relative to a basket of foreign currencies. DXY 109 1.00% (7D)

US Dollar acts as a flight to safety

The U.S. Dollar (DXY) is the world’s reserve currency. The DXY continues to set new highs and is crushing other market currencies.

The DXY is the primary unit of account for trade worldwide. It is a measure of strength against many other fiat currencies such as the euro, CHF, yen, and the British pound. The DXY is currently trading around 109.

One of the main reasons for the strength of the U.S. dollar is the flight to safety. As investors become concerned with the policies of foreign central banks, and underlying economic strength they chose to move into U.S. the dollar.

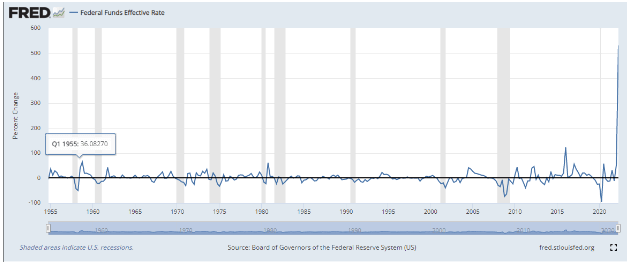

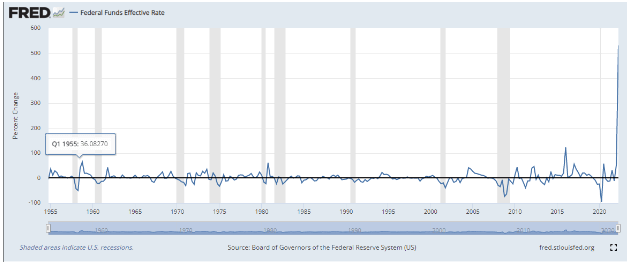

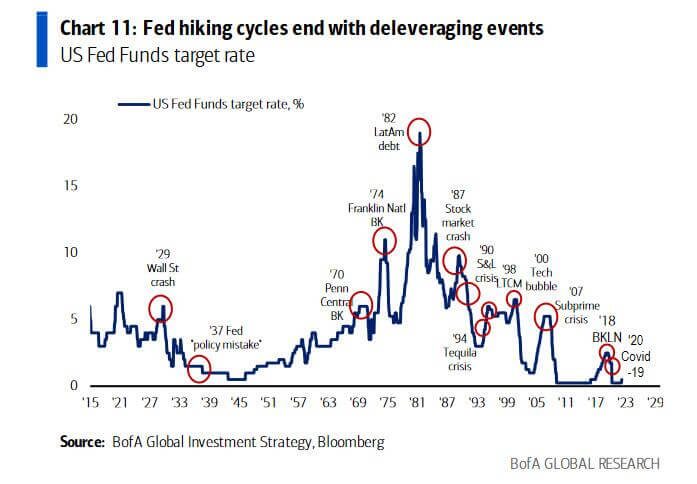

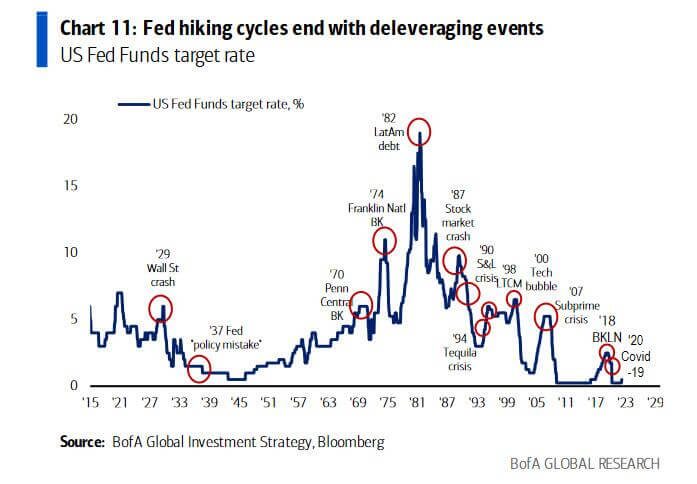

Additionally, we are seeing an increase in rate hikes by the federal reserve, setting its funds rate at 2.25% – 2.5% in July. We are witnessing the most aggressive one-year hawkish absolute change in the fed funds rate since records began, which shows the severity and quickness of these interest rate rises. The Federal Funds Rate is the interest rate banks charge each other to borrow or lend excess reserves overnight.

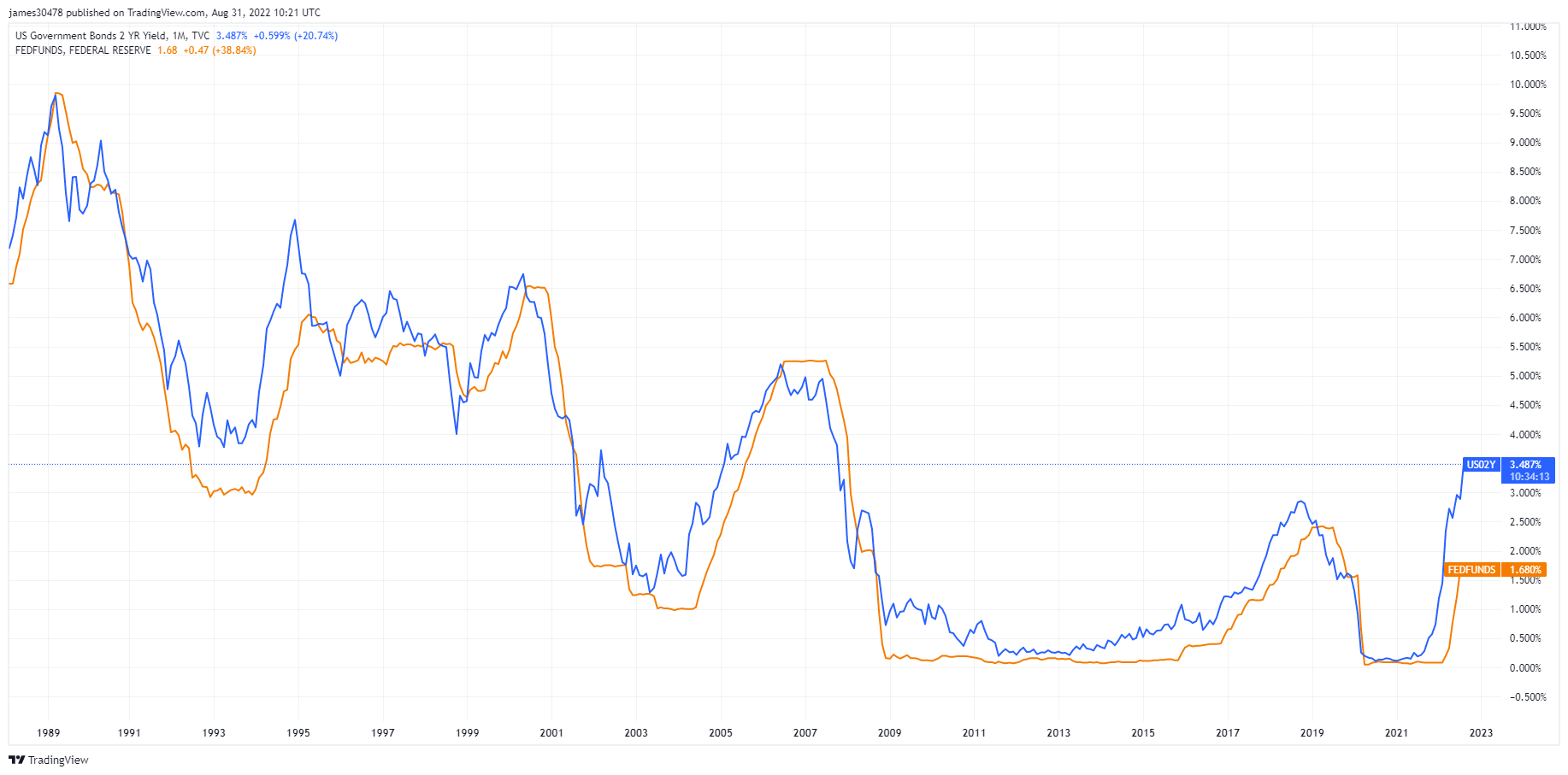

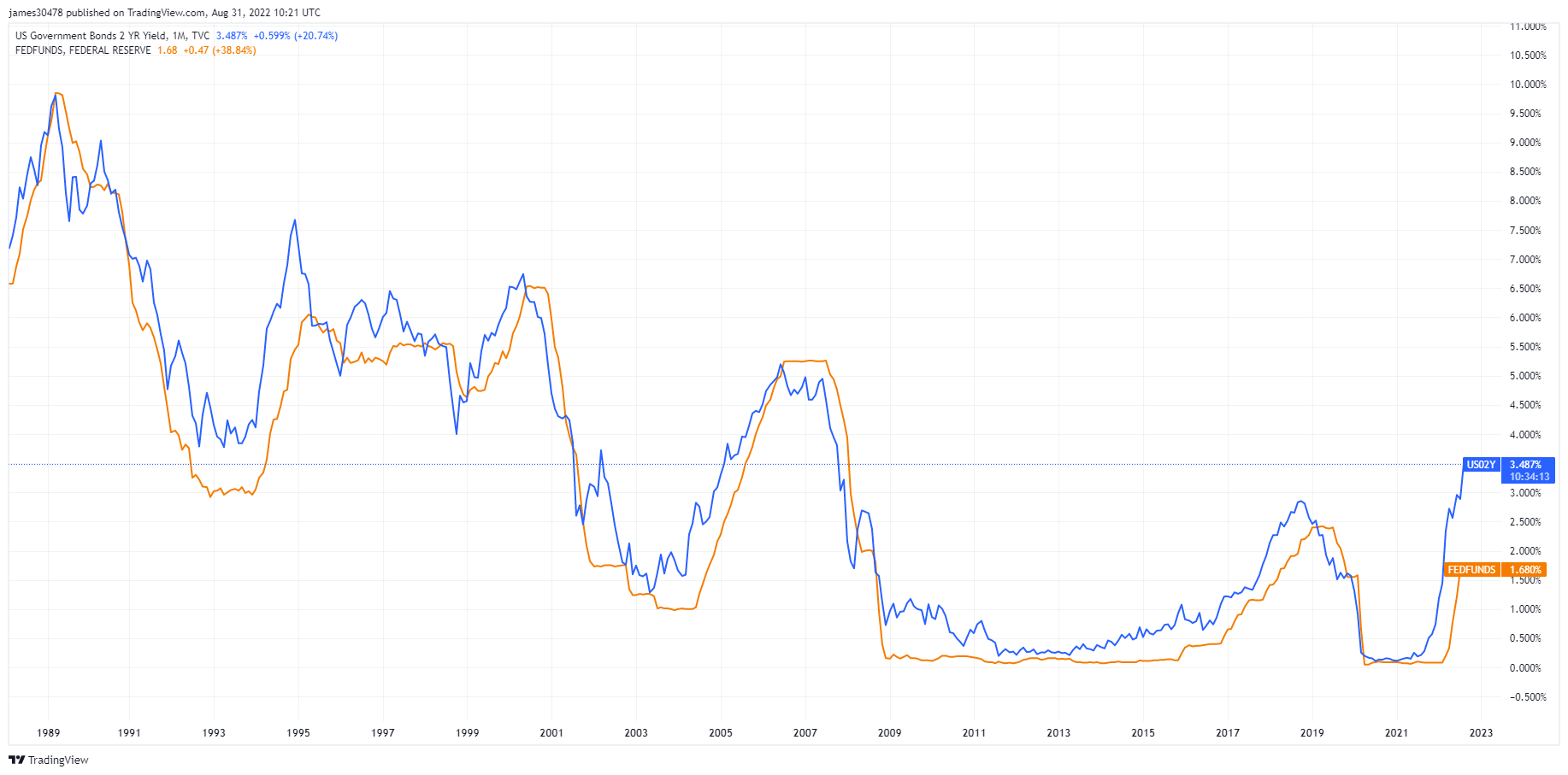

2-year treasury note highest since November 2007

The last time the 2–year treasury yield was 3.5% was on Nov. 15, 2007. Comparatively, the percentage was 0.20% on Sept. 2, 2021.

The bond market is telling the federal reserve that there’s plenty of room to raise rates. The 2-year treasury is experiencing its biggest disconnect from Fed funds in many years. The Fed is expected to continue raising interest rates until a deleveraging event occurs. Most hiking cycles end in a deleveraging event, and since 1982, we have set a higher low with the fed funds rate.

Debt levels are historically high, and if the 2-year treasury is any indication, getting beyond 3% will be a struggle. Since 1988, every time Fed funds met the 2-year treasury, the watchdog ended rate hikes in the cycle.

Bitcoin Overview

The price of Bitcoin (BTC) in USD. Bitcoin Price $19,860 0.54% (7D)

The price of Bitcoin multiplied the number of coins in circulation. Bitcoin Market Cap $379.8B 0.58% (7D)

The measure of Bitcoin’s total market cap against the larger cryptocurrency market cap. Bitcoin Dominance 39.67% -2.44% (7D)

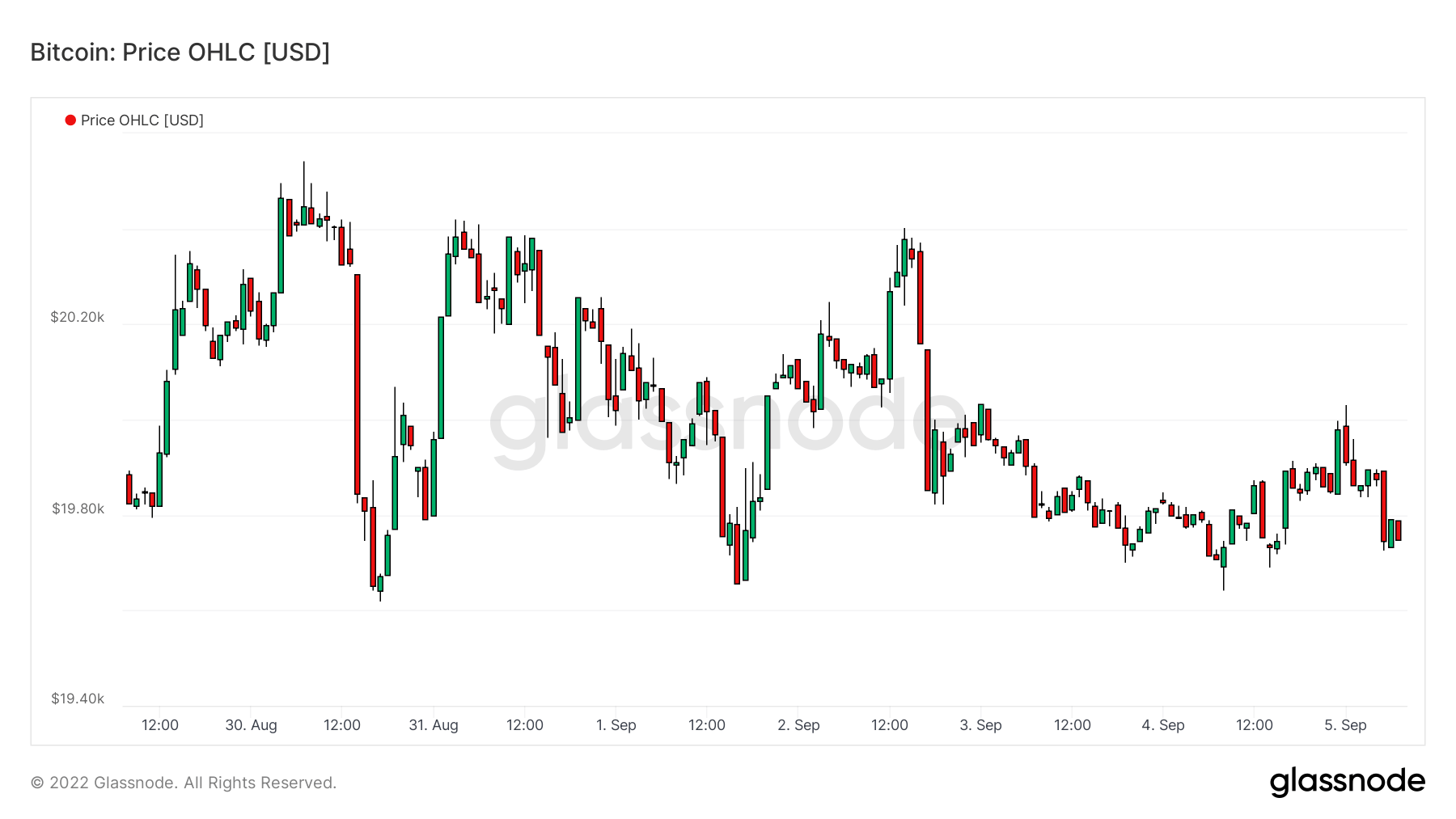

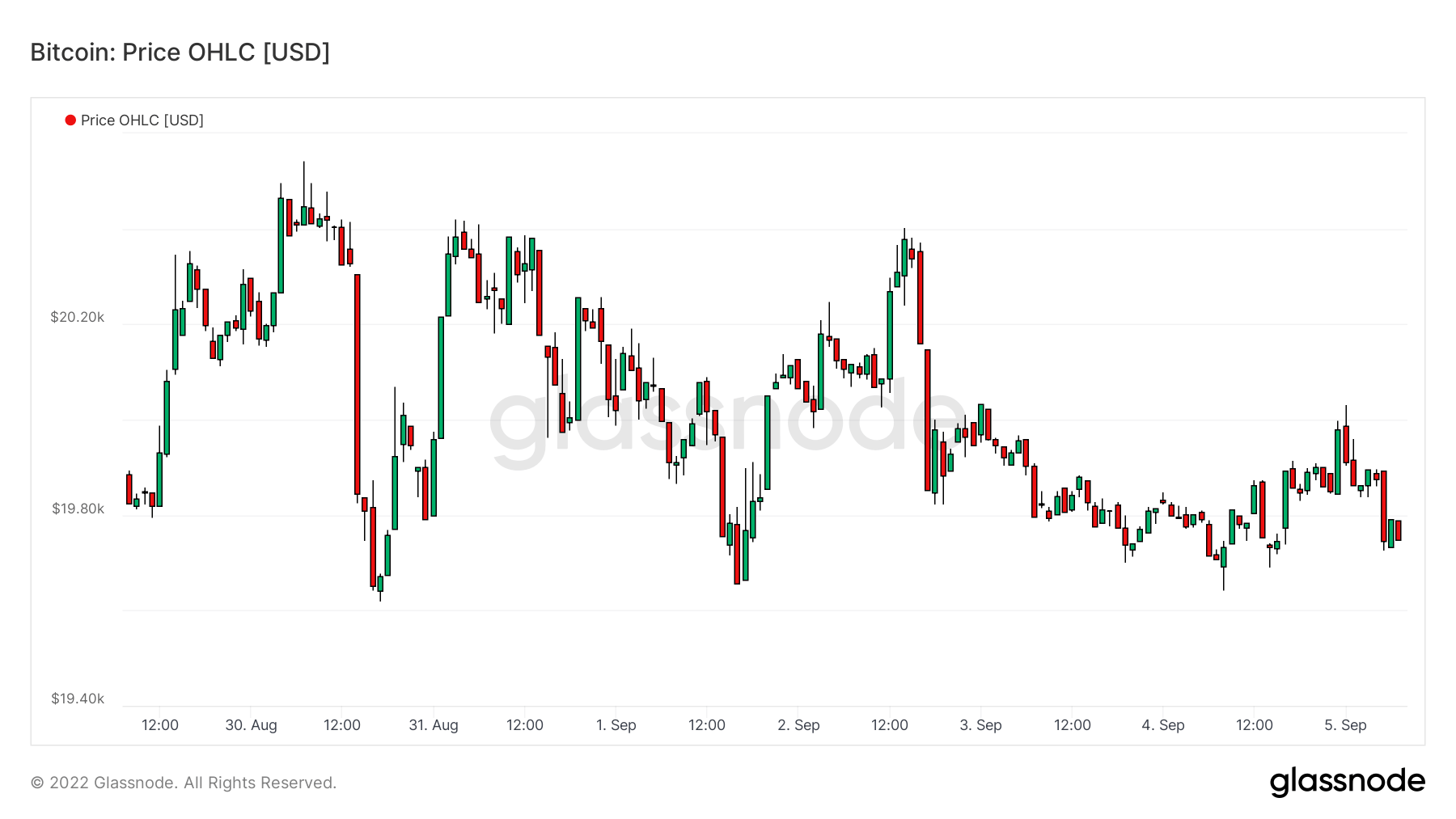

- Throughout the week Bitcoin has been flirting above and below the $20,000 price range and has turned it into resistance.

- Bitcoin has sat below the Realized Price (200 WMA) all week which is currently over $21,000

- Asia has been net accumulators this week which supports our thesis they are still the smart money

- Active Addresses and Entities continue to remain stagnant and stay within the bear market channel

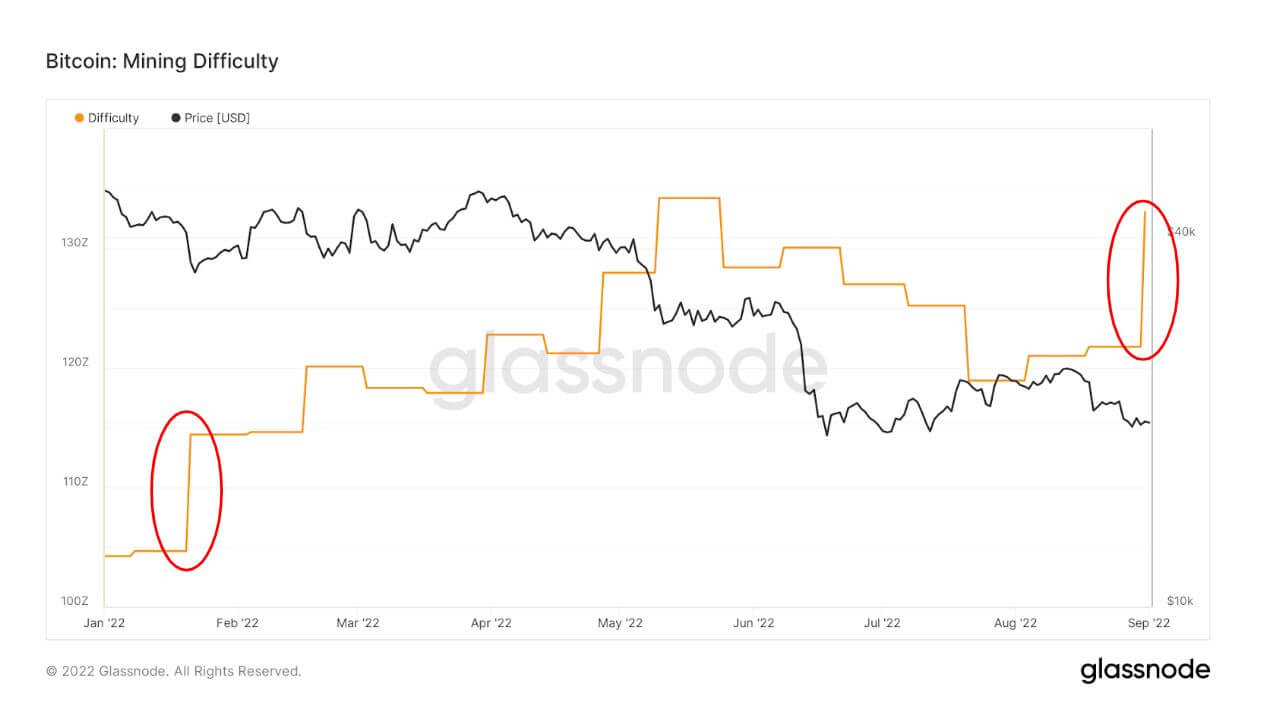

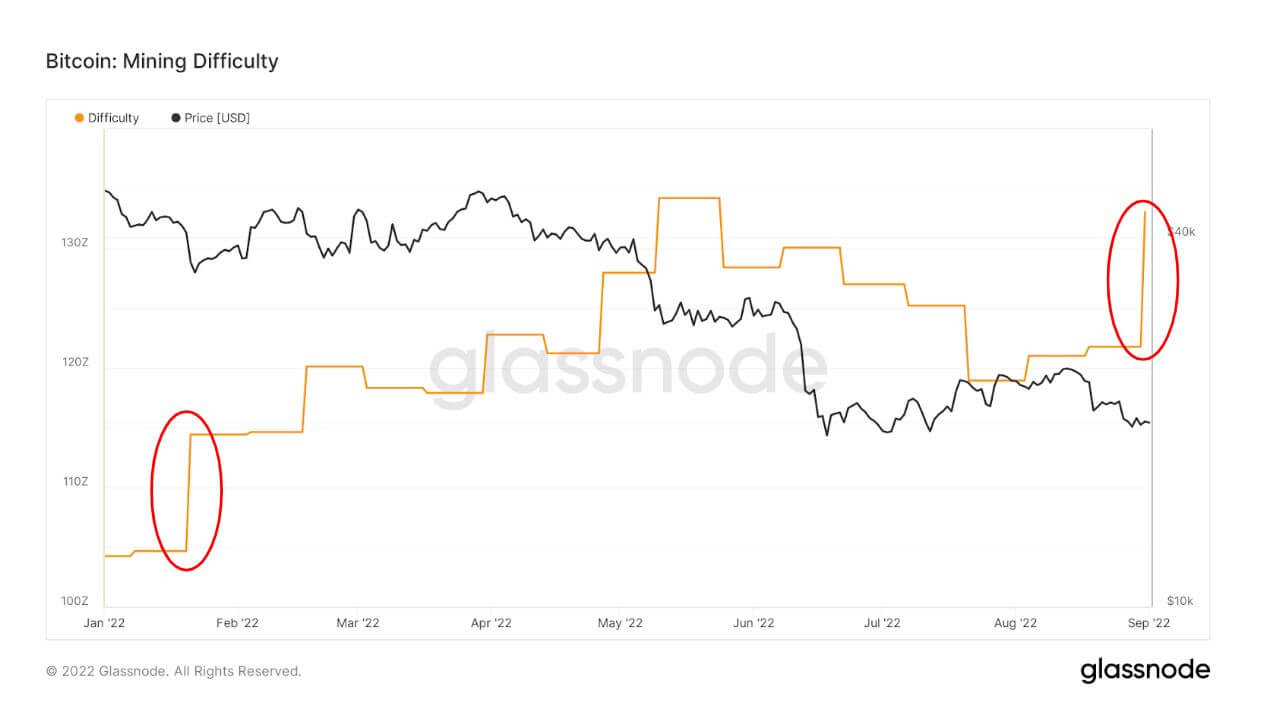

- Difficulty increased over 9% this week

- Whales are unloading Bitcoin at an aggressive rate

Addresses

Collection of core address metrics for the network.

The number of unique addresses that were active in the network either as a sender or receiver. Only addresses that were active in successful transactions are counted. Active Addresses 771,504 0.27% (7D)

The number of unique addresses that appeared for the first time in a transaction of the native coin in the network. New Addresses 2,777,380 2.78% (7D)

The number of unique addresses holding 1 BTC or less. Addresses with ≥ 1 BTC 900,681 0.16% (7D)

The number of unique addresses holding at least 1k BTC. Addresses with Balance ≤ 1k BTC 2,140 -0.37% (7D)

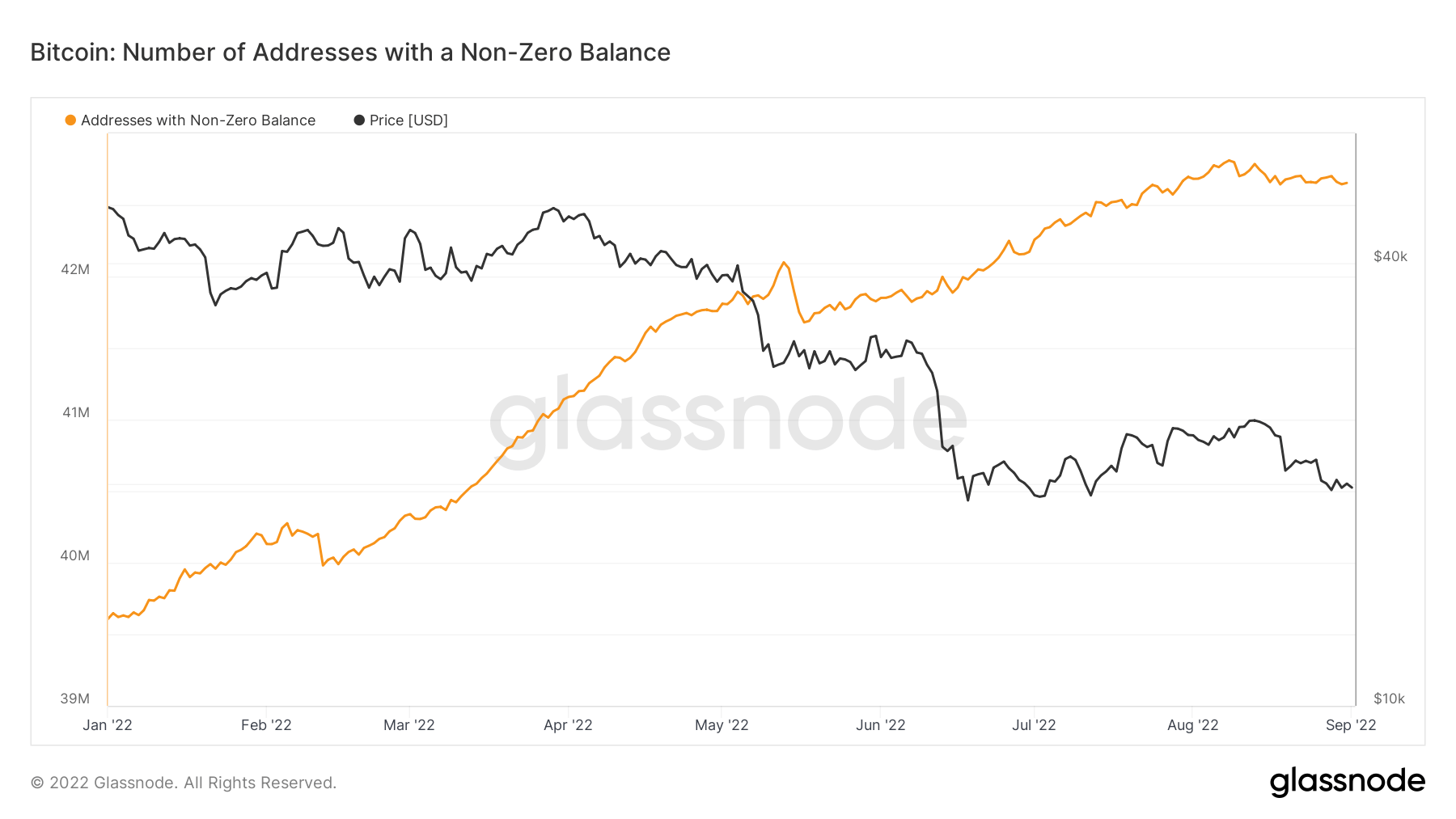

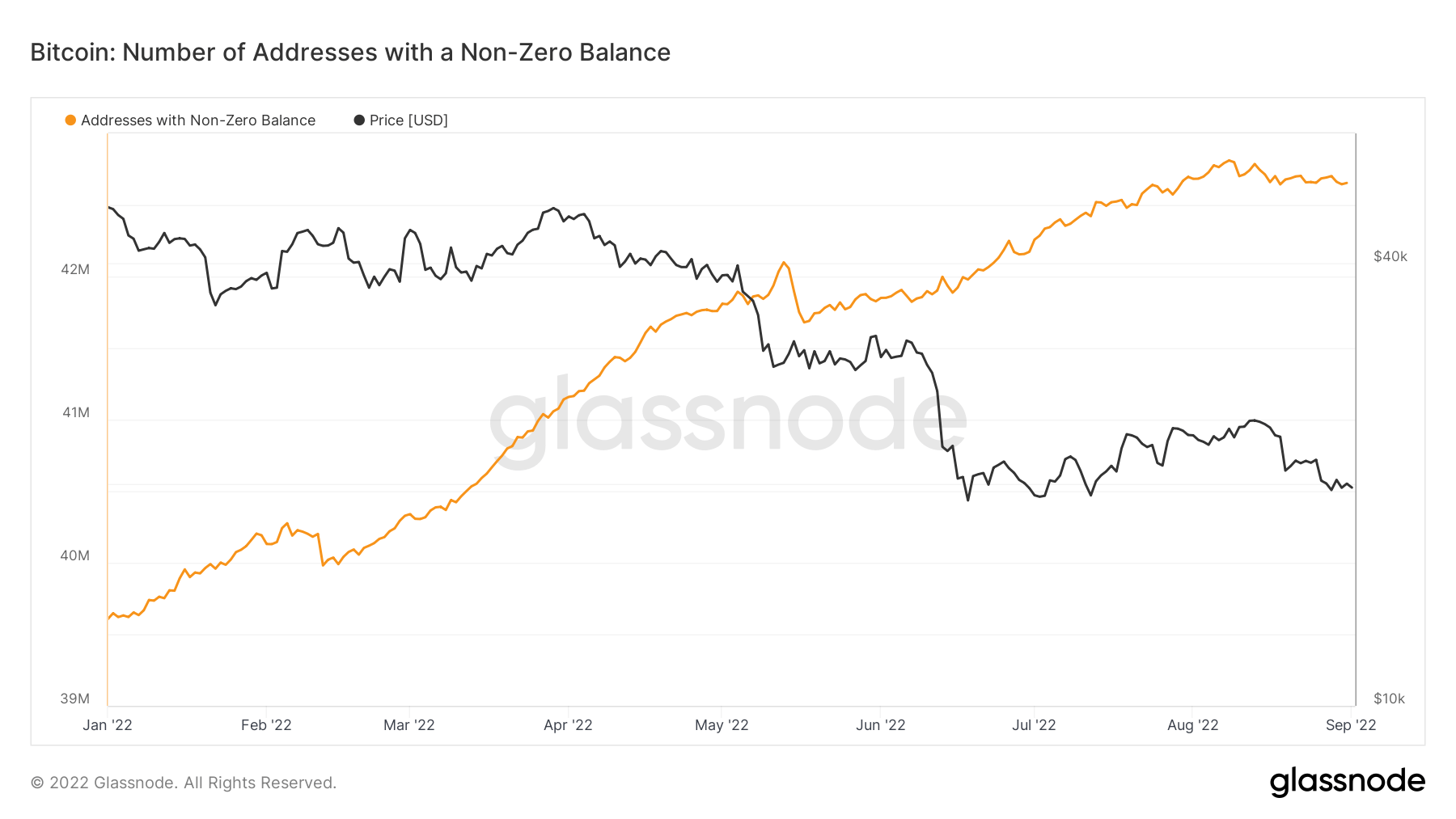

A muted week for addresses

A rather muted week from an active and new addresses perspective suggested that not many new participants entered the ecosystem over the week. The muted week is most likely a consequence of Bitcoin being in the midst of a bear market and a significant deleveraging process going on in the macro. New and active addresses have stayed rather flat which encompasses the broader trends of the year as well. One of the bright sparks this year were addressees with a non-zero balance accumulating at an extremely aggressive rate but that has tapered off in recent weeks.

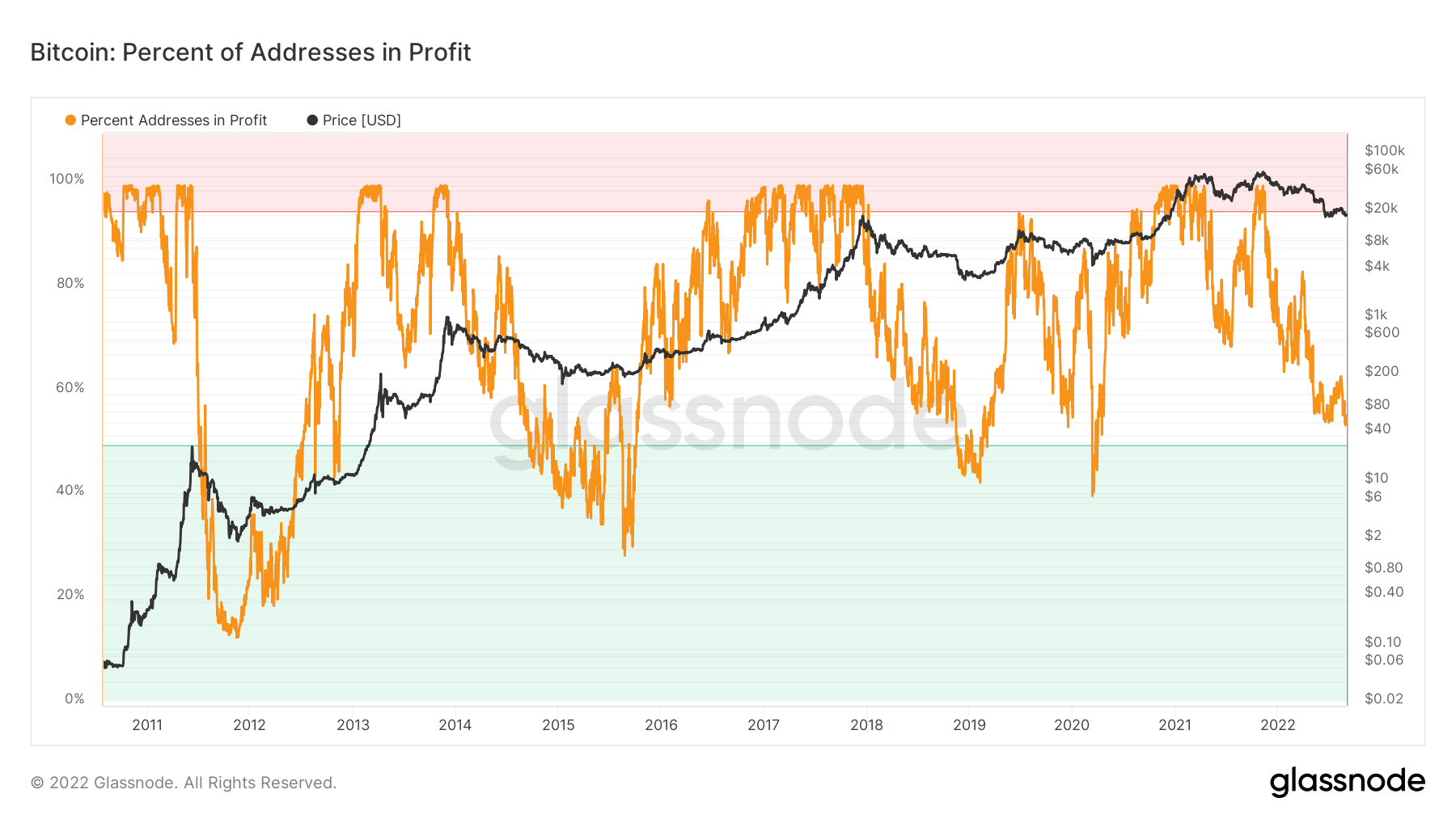

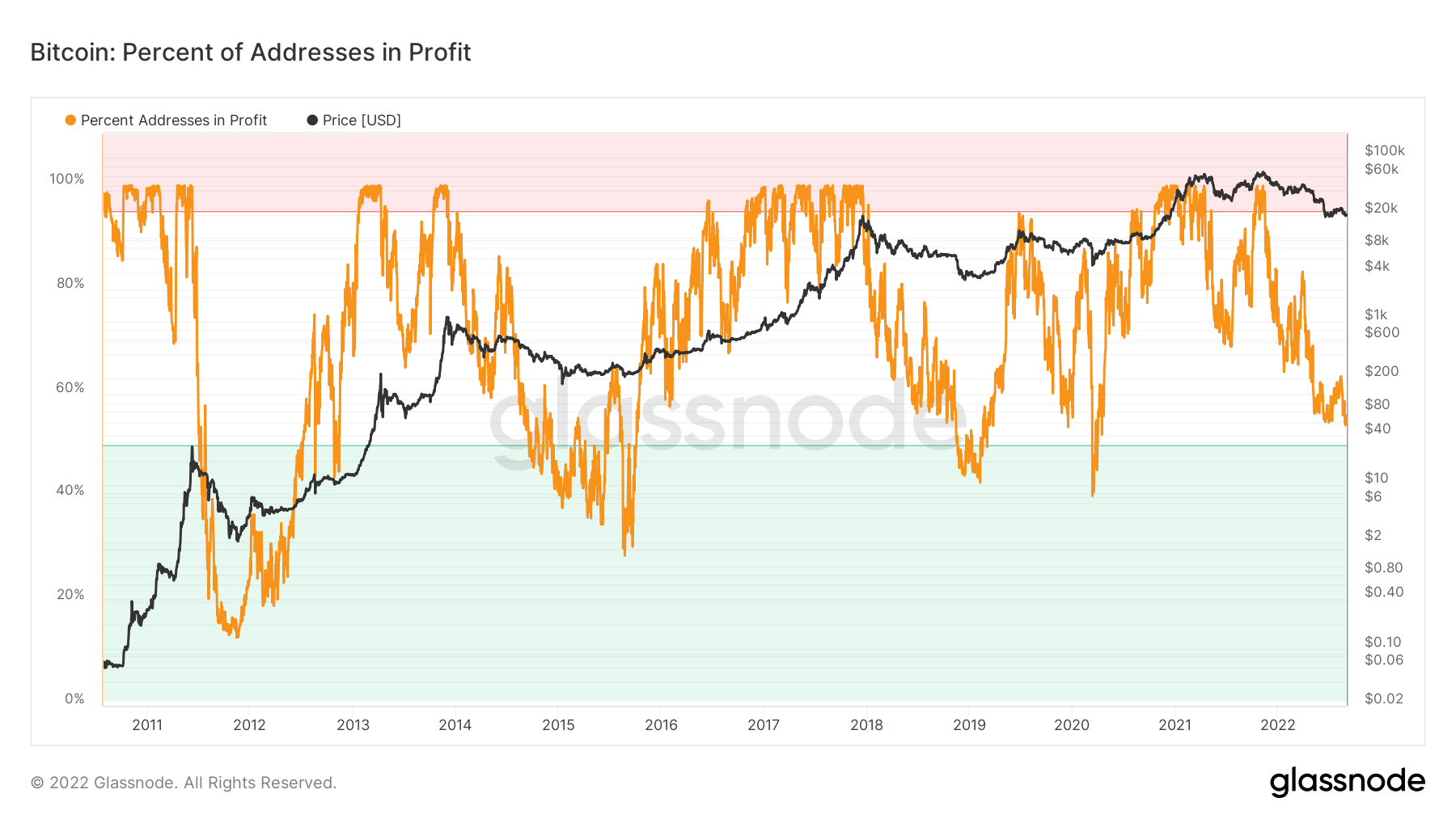

Addresses in Profit are still over 50% unlike any other bear market

The percentage of unique addresses whose funds have an average buy price that is lower than the current price. “Buy price” is here defined as the price at the time coins were transferred into an address. Every bear market cycle has seen addresses in profit drop below 50%, but we have generated a higher high after each cycle. Is this time different, or do we go lower? During the bear market lows;

- In 2012 – 13.5% of addresses were in profit

- In 2015 – 30.5% of addresses were in profit

- In 2019 – 42.9% of addresses were in profit

- In 2020 – 40.3% of addresses were in profit

- In 2022 – 53.9% of addresses were in profit

Entities

Entity-adjusted metrics use proprietary clustering algorithms to provide a more precise estimate of the actual number of users in the network and measure their activity.

The number of unique entities that were active either as a sender or receiver. Entities are defined as a cluster of addresses that are controlled by the same network entity and are estimated through advanced heuristics and Glassnode’s proprietary clustering algorithms. Active Entities 225,327 0.98% (7D)

The number of BTC in the Purpose Bitcoin ETF. Purpose ETF Holdings 23,792 0.11% (7D)

The number of unique entities holding at least 1k BTC. Number of Whales 1,712 -0.64% (7D)

The total amount of BTC held on OTC desk addresses. OTC Desk Holdings 4,034 BTC 3.01% (7D)

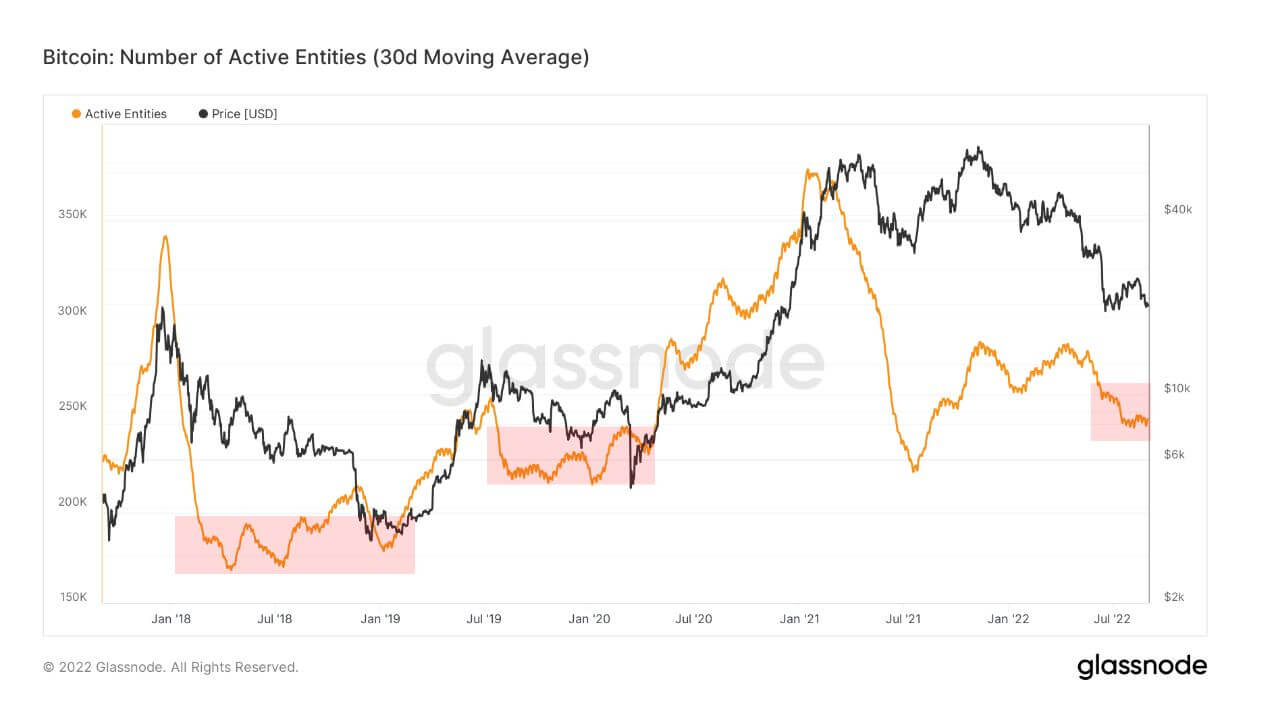

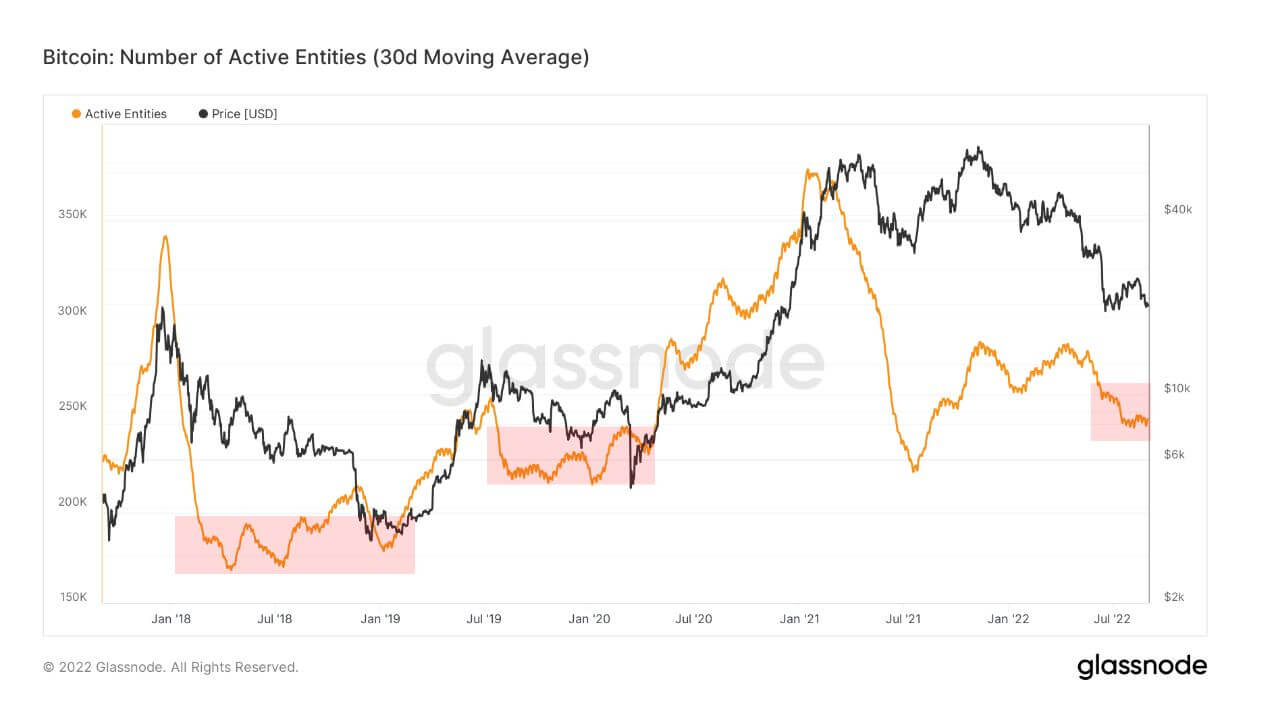

Active Entities continue to put in a higher high each bear market cycle

Active and new entities as a whole behave very similarly to addresses, it’s showing signs of a fundamental weakness in the ecosystem. The active entity is a good gauge to understand the daily users of Bitcoin, for the past few weeks we have been in this stagnant period, if Bitcoin were to fall further it would show severe weakness in user adoption. Most interestingly, in each bear market cycle, Bitcoin continues to put in a higher high of active users, which demonstrates more entities coming into the network and staying.

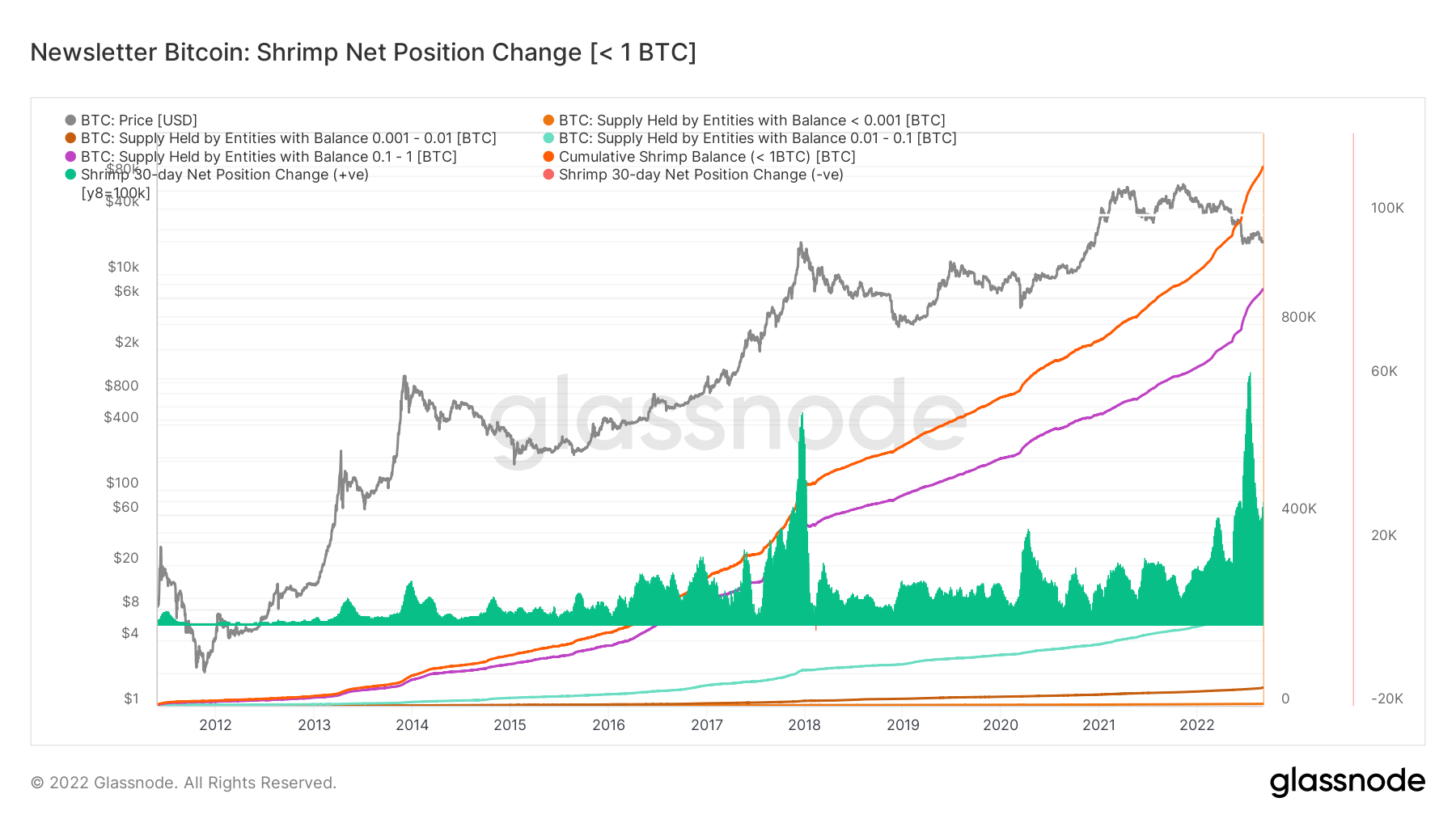

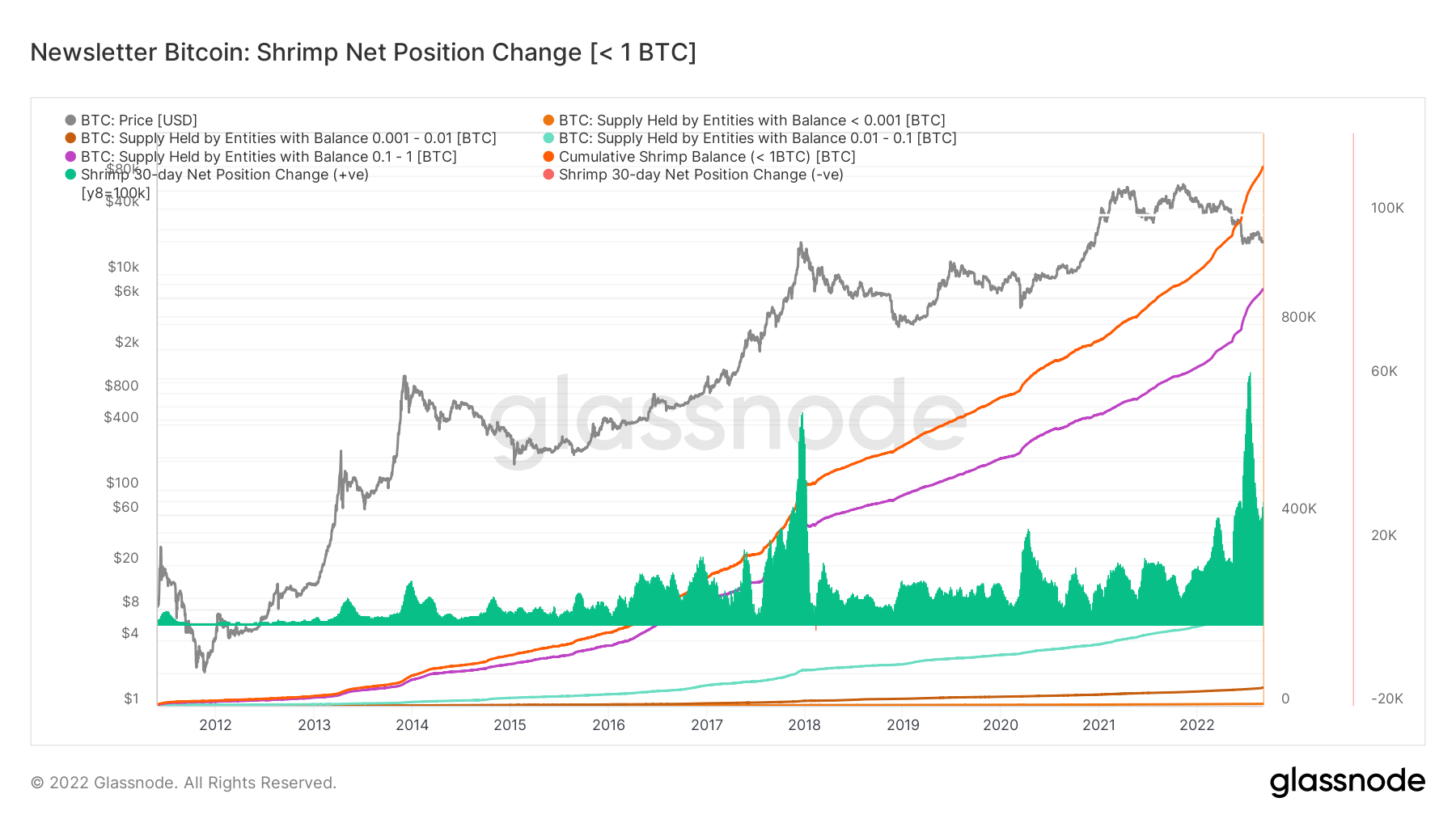

Shrimp cohorts continue to accumulate Bitcoin

Shrimps have been one of the most refreshing entities in the ecosystem for Bitcoin this year, their rate of growth has been nothing short of remarkable. Shrimps are defined as holding one or less Bitcoin, not only has this group seen exponential growth in terms of stacking Bitcoin but 2022 has been the year which has seen the greatest net position change surpassing 2017. Even with all the fear, uncertainty and doubt, they continue to accumulate and hold. It will be interesting to keep an eye on the shrimps with a recession on the horizon, Bitcoin is the most liquid asset to sell to pay off your fiat obligations.

Dervatives

A derivative is a contract between two parties which derives its value/price from an underlying asset. The most common types of derivatives are futures, options and swaps. It is a financial instrument which derives its value/price from the underlying assets.

The total amount of funds (USD Value) allocated in open futures contracts. Futures Open Interest $11.49B -1.69% (7D)

The total volume (USD Value) traded in futures contracts in the last 24 hours. Futures Volume $17.66B $-3.99 (7D)

The sum liquidated volume (USD Value) from short positions in futures contracts. Total Long Liquidations $63.95M $0 (7D)

The sum liquidated volume (USD Value) from long positions in futures contracts. Total Short Liquidations $37M $0 (7D)

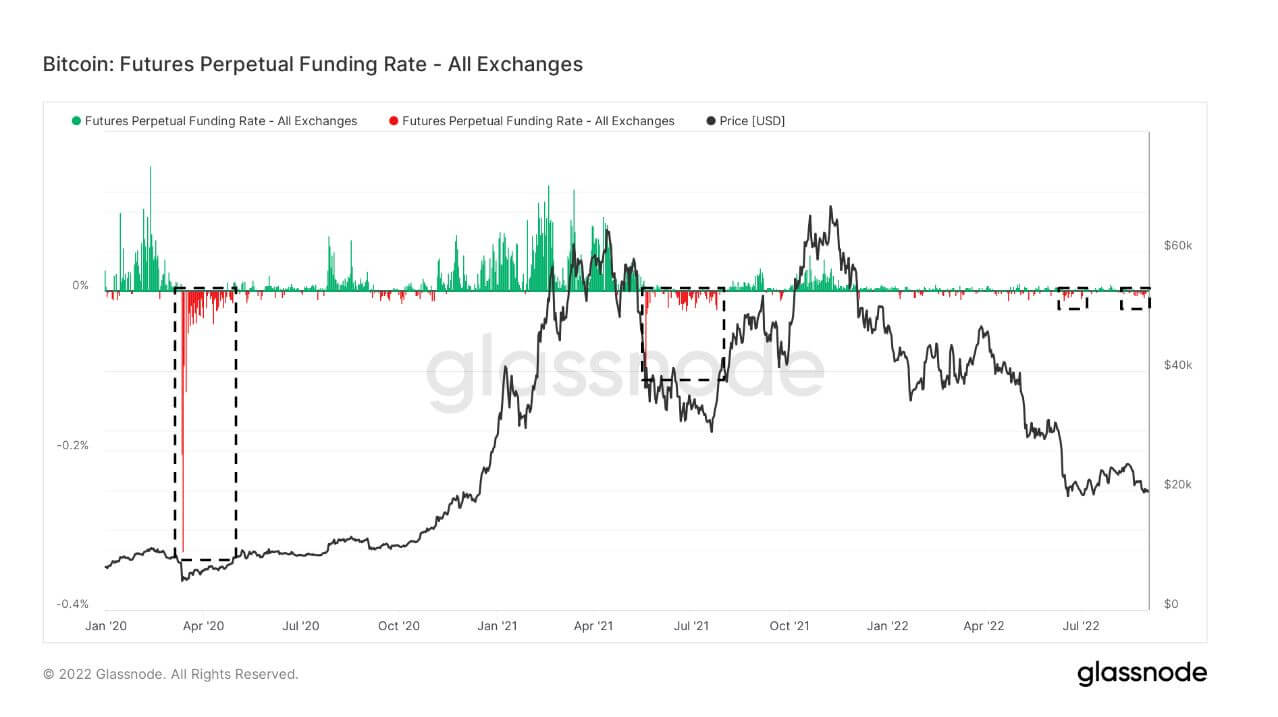

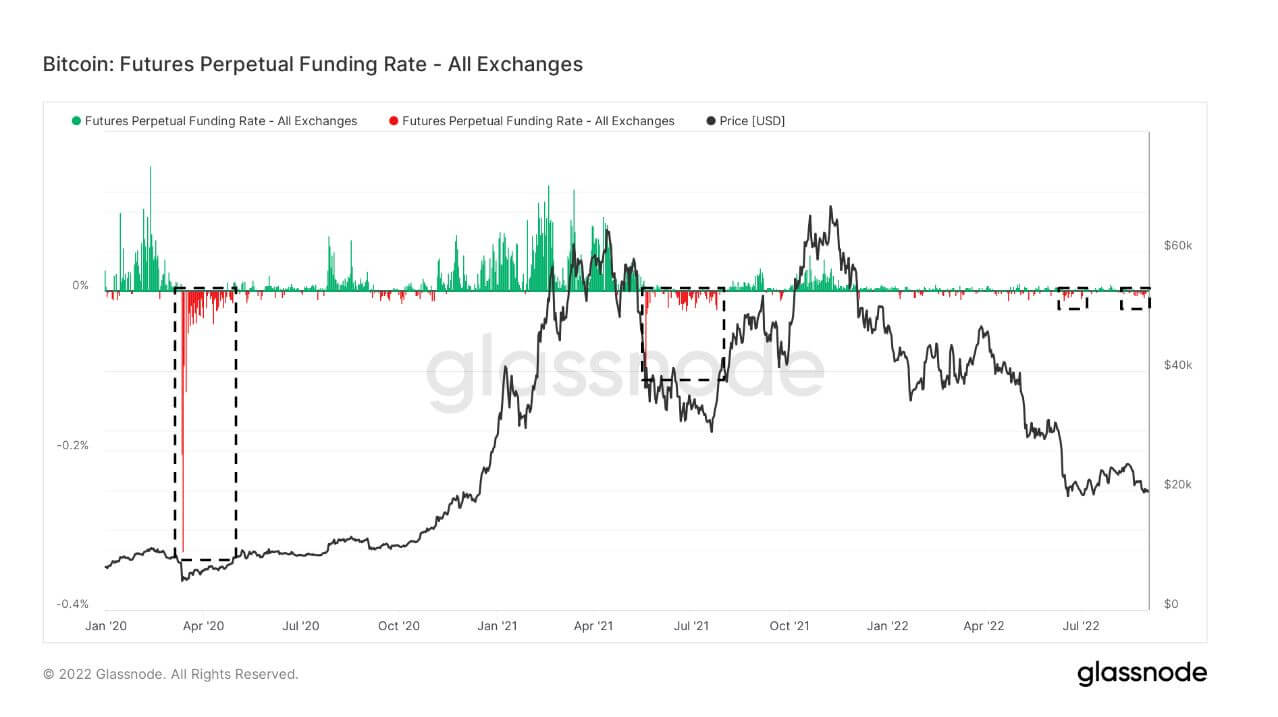

Shorts dictate the market whilst leverage continues to increase

Derivatives this week have been extremely eventful, we have seen a relentless amount of shorts in the futures perpetual funding rate, not seen since the lows in mid-June. Remember, the average funding rate (in %) is set by exchanges for perpetual futures contracts. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions. This is one of the metrics CryptoSlate looking for to confirm a cycle bottom, each cycle’s bottom is when shorts are relentless and bold.

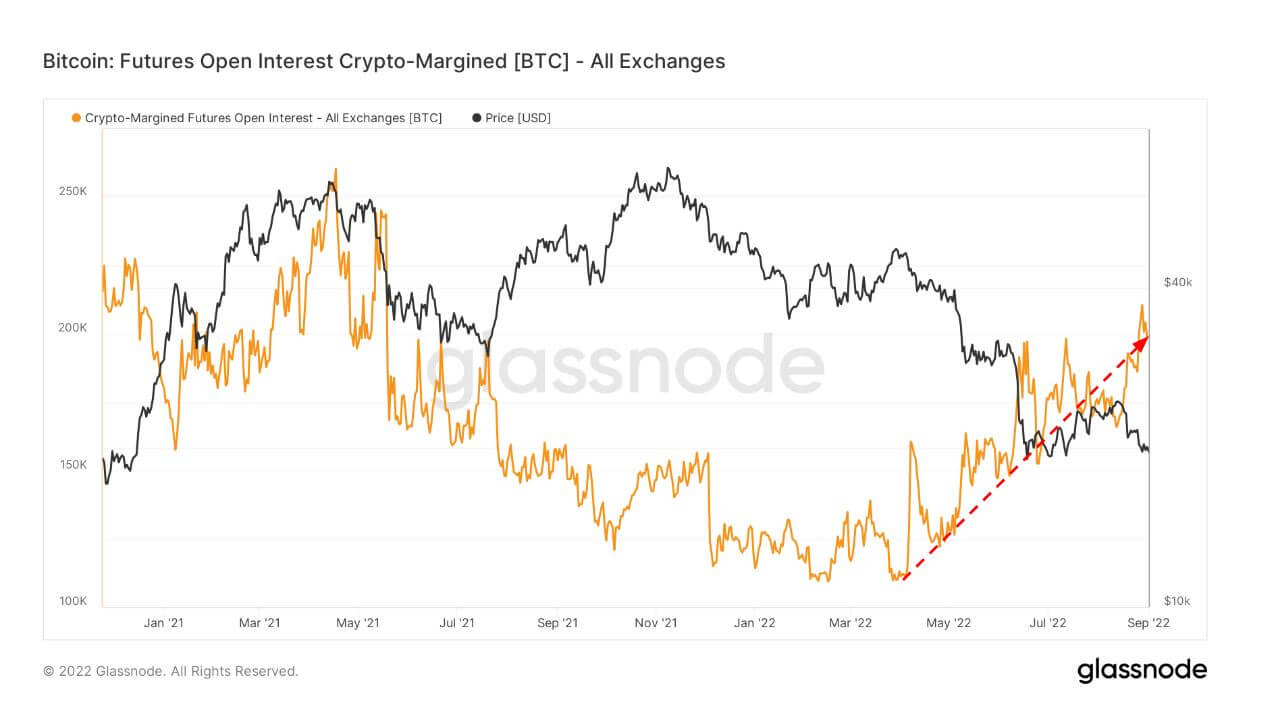

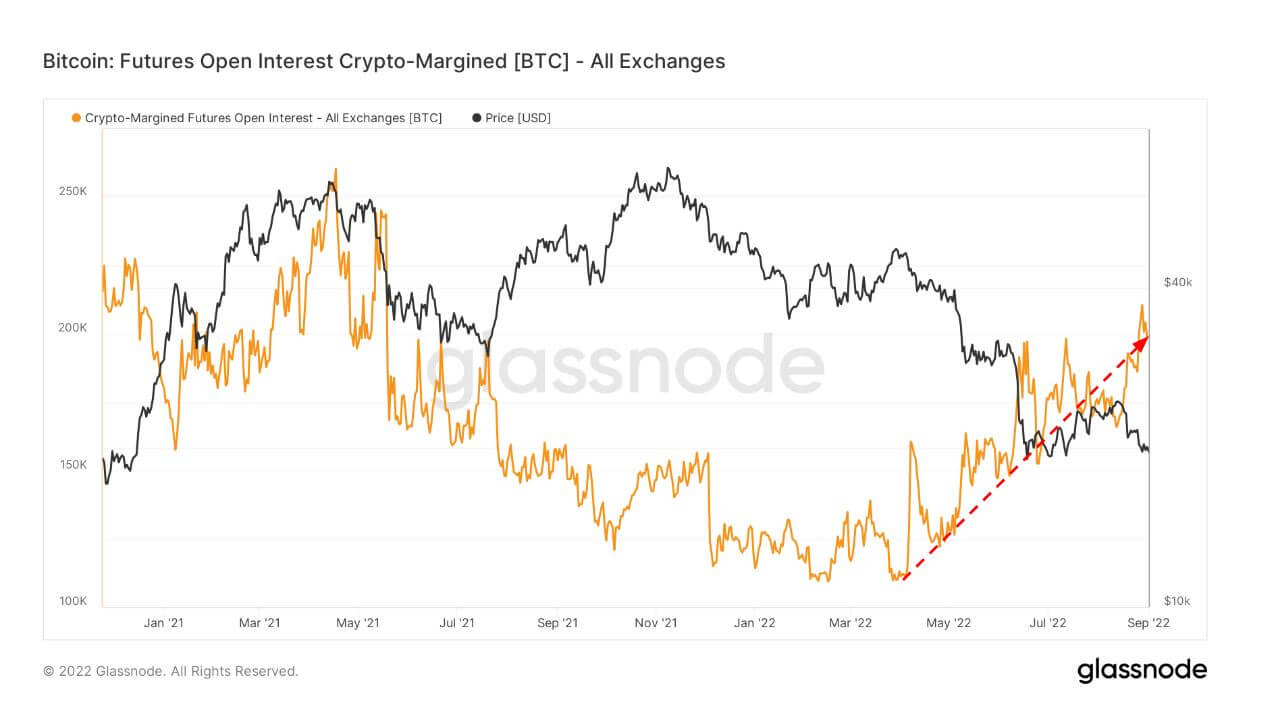

More appetite for risk

CryptoSlate is also seeing a lot more risk being taken which can be considered a good thing as there is a lot of cash sitting on the sidelines. Crypto-Margin Futures Open Interest is at similar levels to May 2021 of around 210 thousand BTC being used as collateral and has been working its way higher since the March bottom. This metric is defined as the total amount of futures contracts open interest that is margined in the native coin (e.g. BTC) and not in USD or stablecoin.

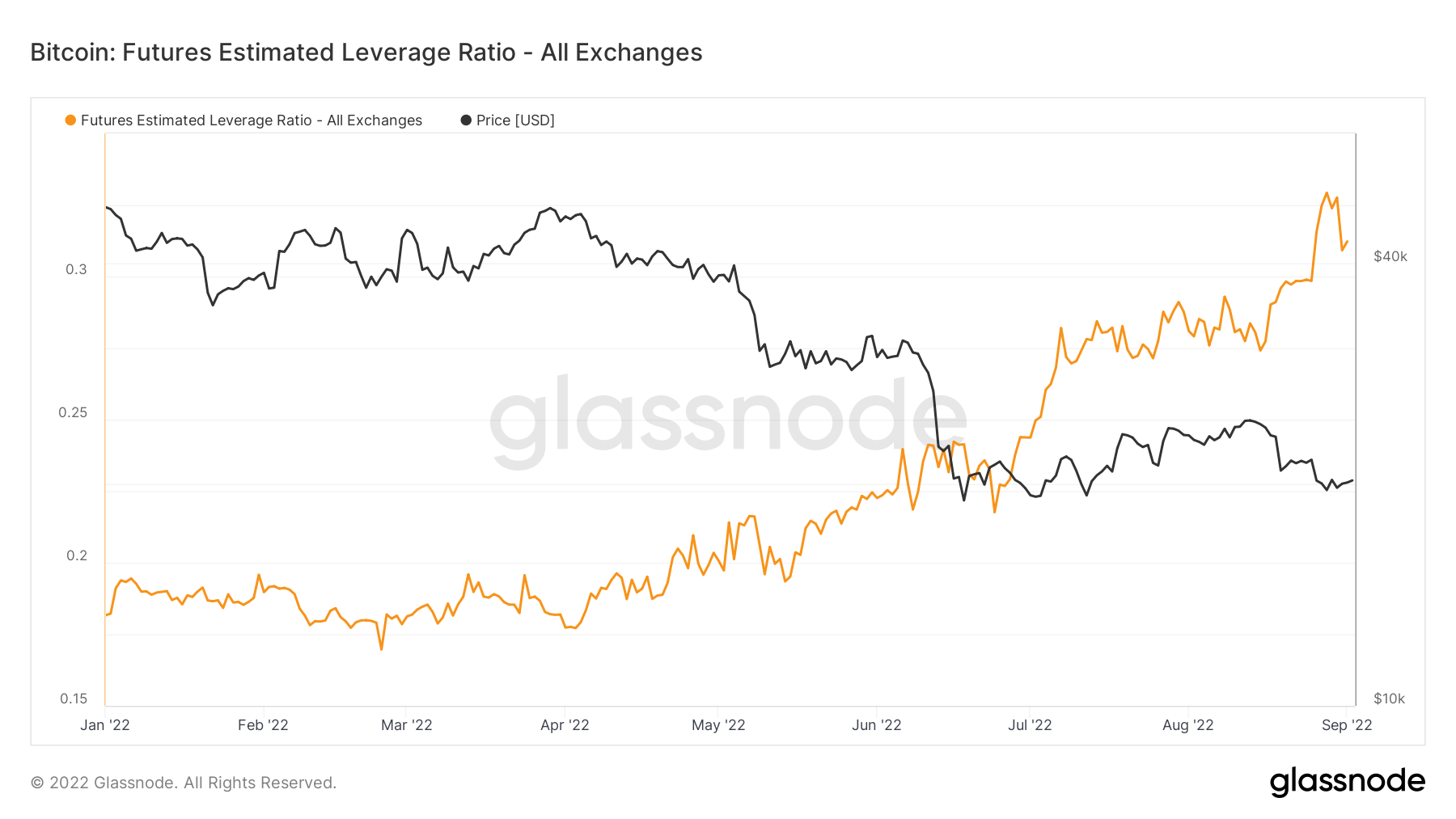

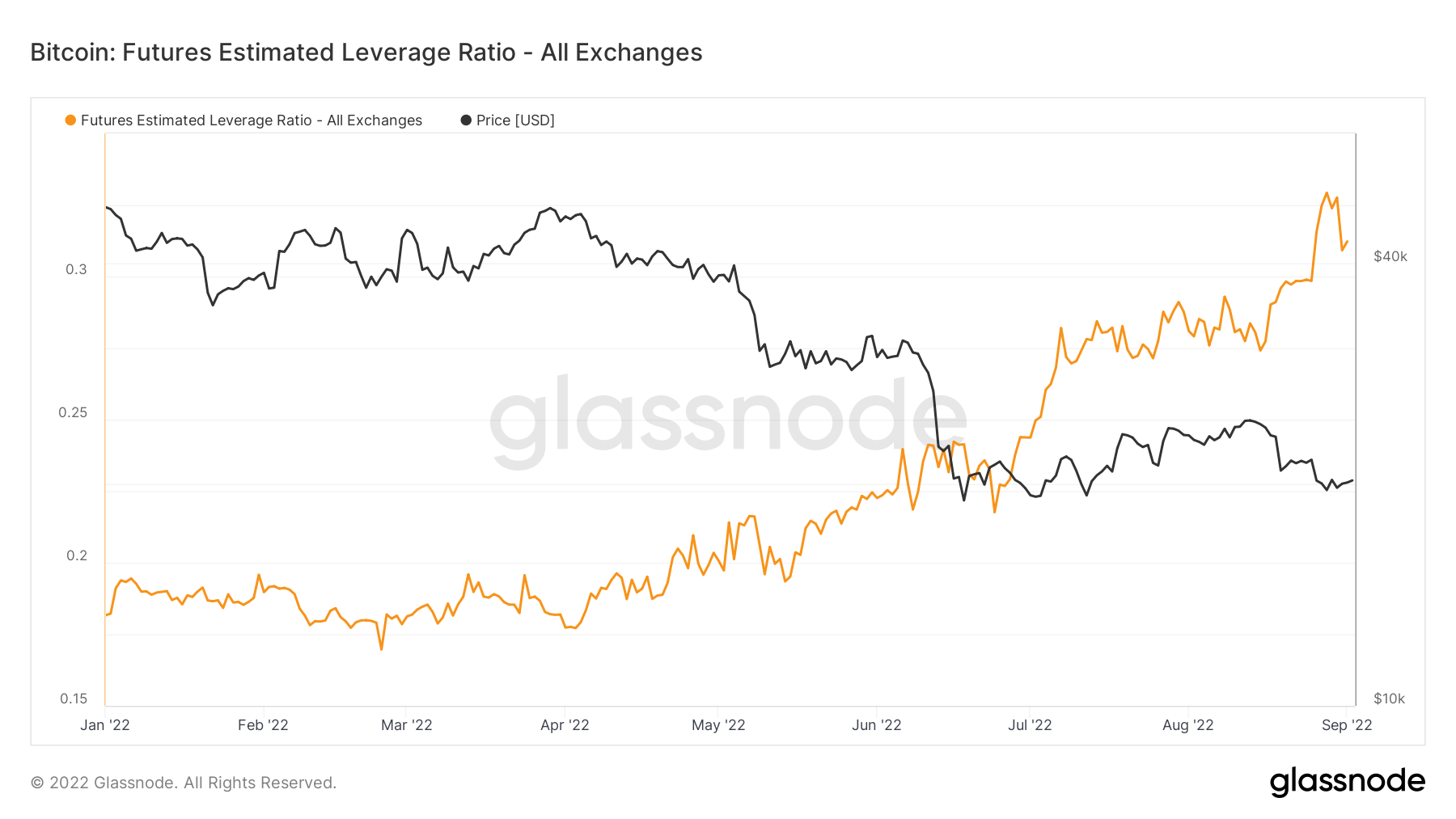

This also coincides with the most amount of leverage in the system, a significant uptick in Futures Estimated Leverage Ratio (ELR) in August. The ELR acts as an Indicator that measures the ratio between open contracts awaiting execution and the reserve of currencies on futures trading platforms. The graph shows the ELR has reached an all-time high of 0.32 — indicating the potential for high volatility should there be large price swings.

Miners

Overview of essential miner metrics related to hashing power, revenue, and block production.

The average estimated number of hashes per second produced by the miners in the network. Hash Rate 261 TH/s 27.94% (7D)

The current estimated number of hashes required to mine a block. Note: Bitcoin difficulty is often denoted as the relative difficulty with respect to the genesis block, which required approximately 2^32 hashes. For better comparison across blockchains, our values are denoted in raw hashes. Difficulty 133 T 109.92% (14D)

The total supply held in miner addresses. Miner Balance 1,833,866 BTC -0.21% (7D)

The total amount of coins transferred from miners to exchange wallets. Only direct transfers are counted. Miner Net Position Change -47,654 BTC -15,428 BTC (7D)

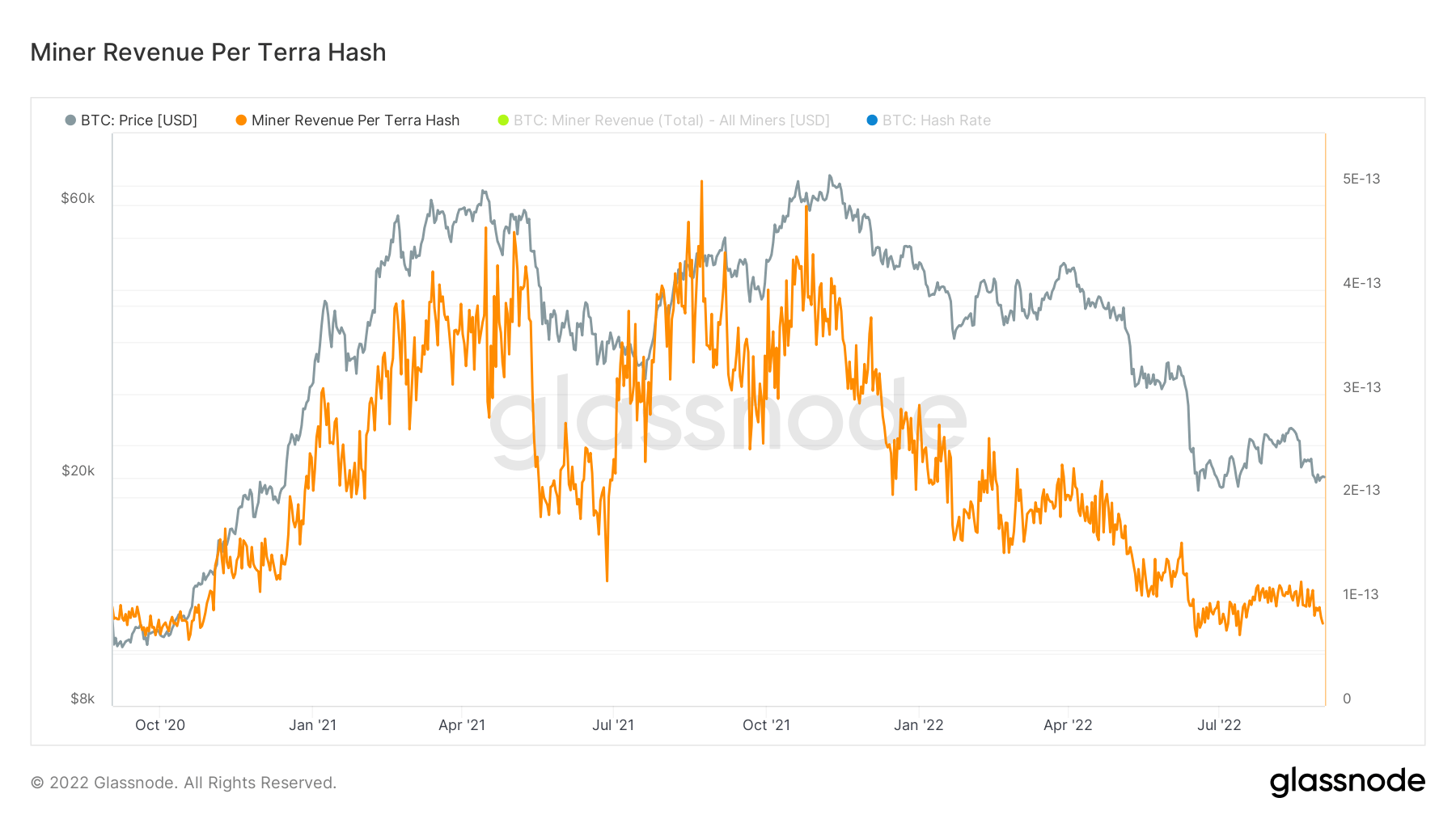

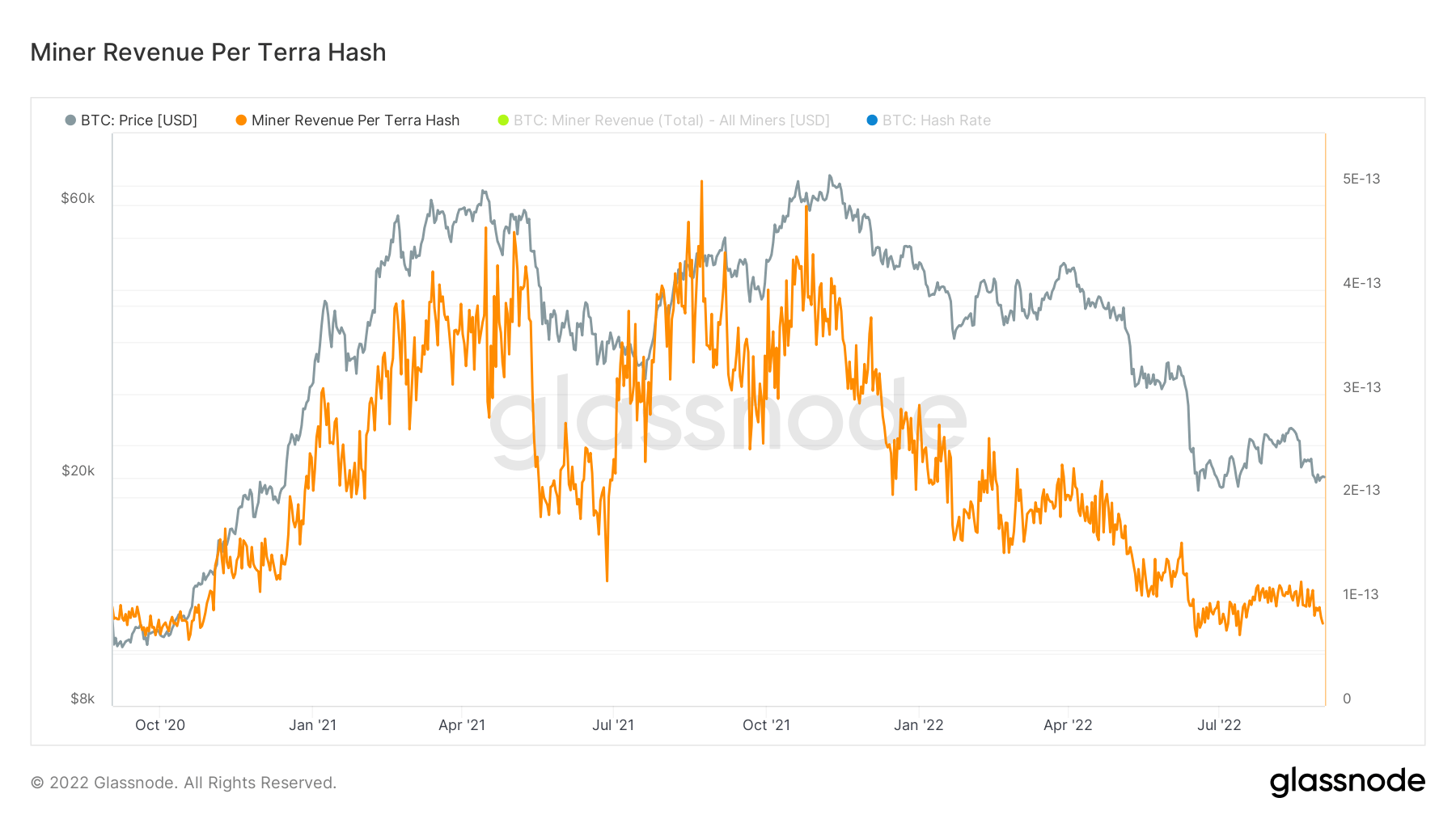

Second biggest increase for difficulty sees miner revenue continue to squeeze

Bitcoin mining difficulty increased this week by over 9% the biggest increase since January of this year, and is less than 1% away from its all time high. As hash price (miner revenue/TH) is approaching all time lows, as is normal in Bitcoin bear markets. Miner margins continue to squeeze, which is likely to result in narrower profit margins for the industry.

On-Chain Activity

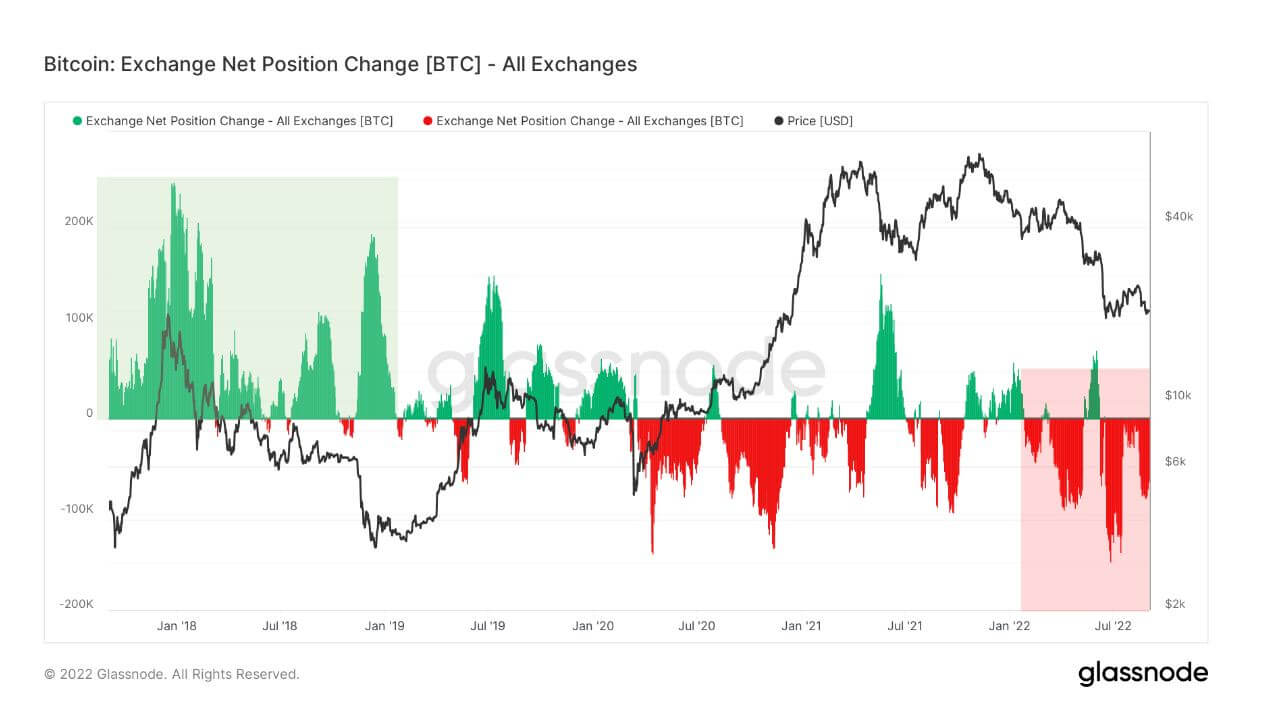

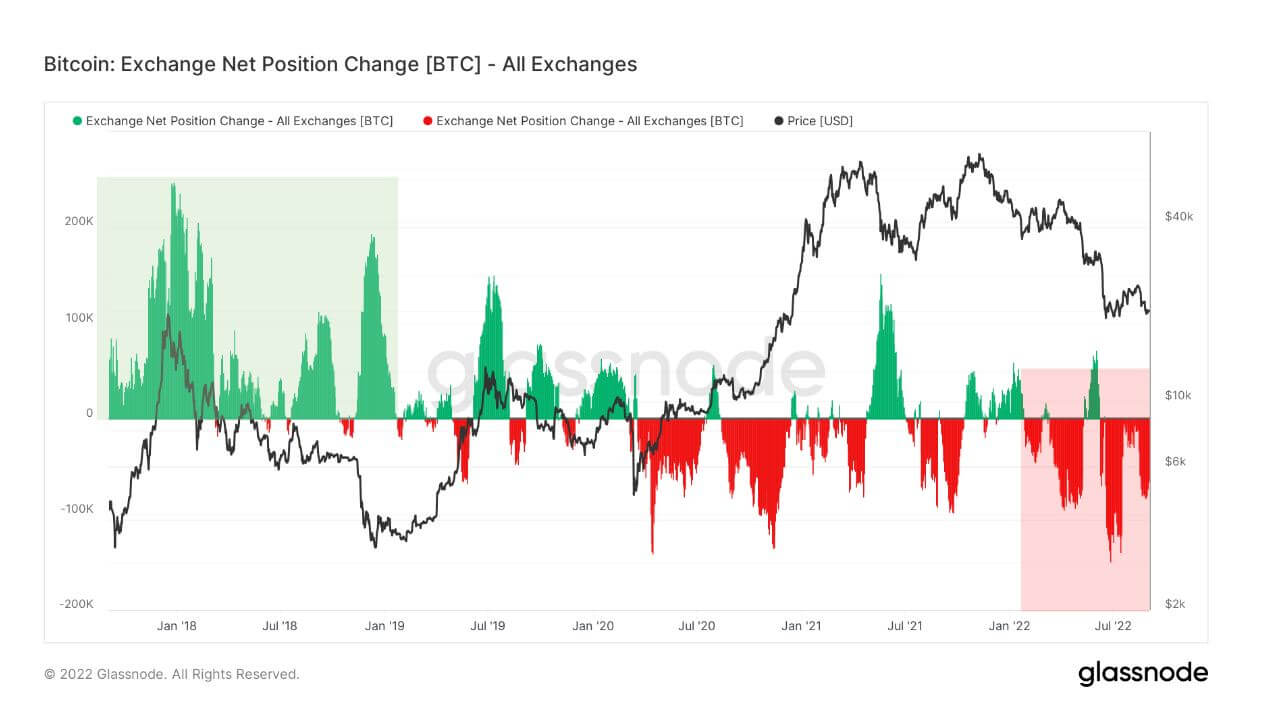

Collection of on–chain metrics related to centralized exchange activity.

The total amount of coins held on exchange addresses. Exchange Balance 2,344,809 BTC 17,491 BTC (7D)

The 30 day change of the supply held in exchange wallets. Exchange Net Position Change -404,157 BTC 125,374 BTC (30D)

The total amount of coins transferred from exchange addresses. Exchange Outflows Volume 221,105 BTC 32,258 BTC (7D)

The total amount of coins transferred to exchange addresses. Exchange Inflows Volume 238,610 BTC 58,332 BTC (7D)

The 2022 bear market is different to the 2018 bear market as demand is strong

During the 2018 bear market cycle, CryptoSlate can observe from the metric, Exchange Net Position Change a lot of inflows and deposits occurred including the cycle bottom. However, during this past week, demand has been extremely strong. Over $1 billion worth of Bitcoin has been withdrawn each day, which shows the appetite investors still seem to have. However, compared to the 2018 bear market cycle, saw an overwhelming amount of Bitcoin put back onto exchanges up over $3 billion leading up to the 2017 bull run peak.

FTX only has 17K Coins left on Exchanges

In recent weeks, outflows of BTC have occurred from FTX, which sees only 17 thousand BTC left on exchanges but starting the year with over 80 thousand BTC. Coinbase has also seen over 155 thousand BTC being pulled from exchanges this year, these are bullish long-term trends.

![Bitcoin: Balances on Exchanges [BTC]](https://cryptoslate.com/wp-content/uploads/2022/09/ftx.png)

![Bitcoin: Balances on Exchanges [BTC]](https://cryptoslate.com/wp-content/uploads/2022/09/ftx.png)

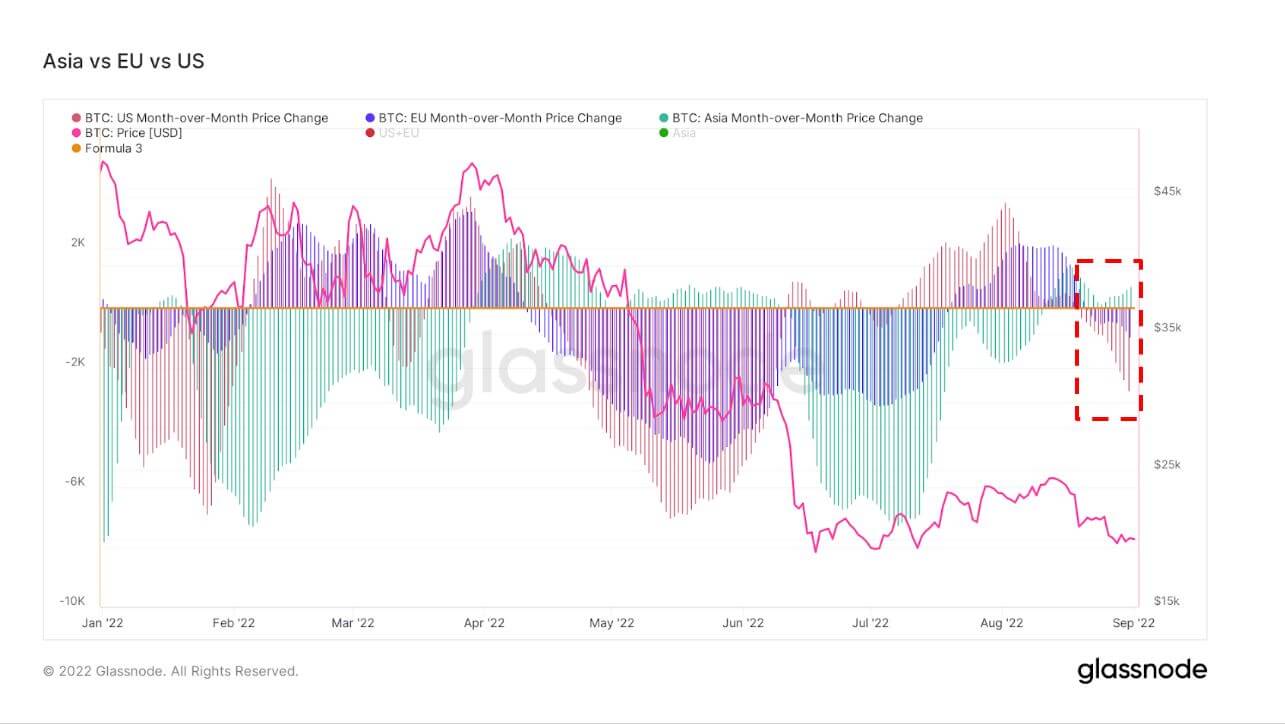

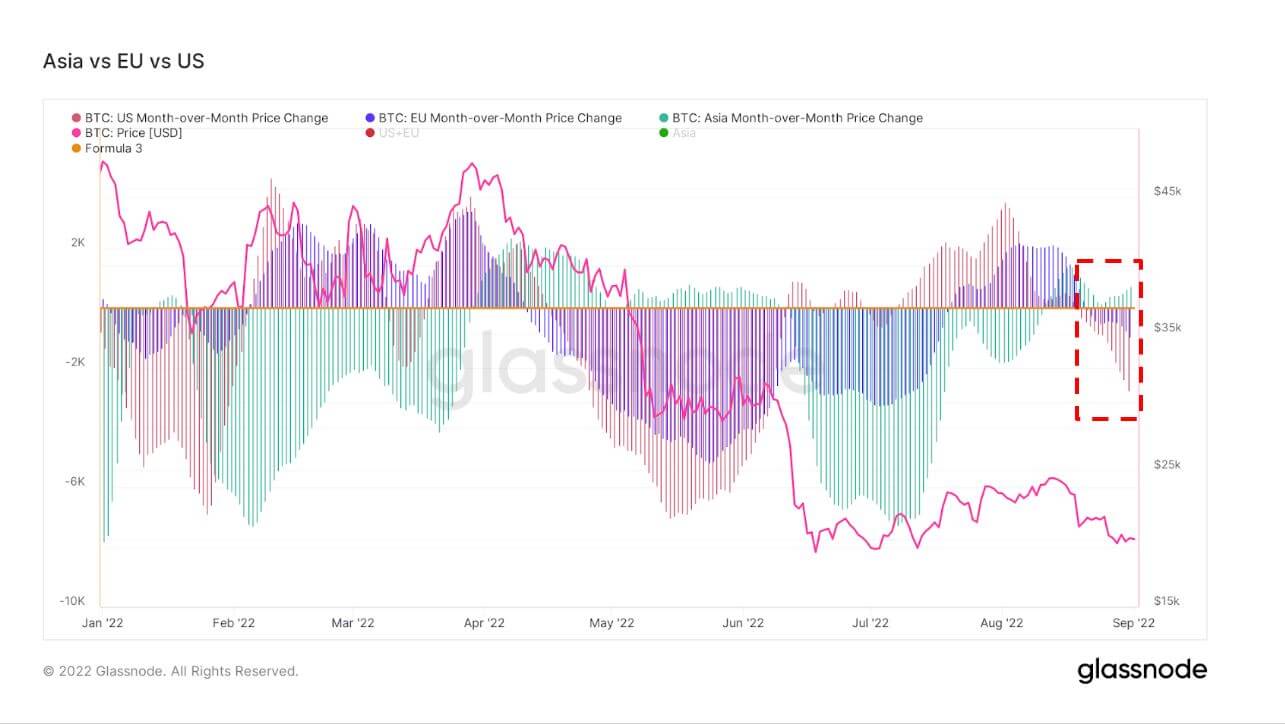

Geo Breakdown

Regional prices are constructed in a two-step process: First, price movements are assigned to regions based on working hours in the US, Europe, and Asia. Regional prices are then determined by calculating the cumulative sum of the price changes over time for each region.

This metric shows the 30-day change in the regional price set during Asia working hours, i.e. between 8am and 8pm China Standard Time (00:00-12:00 UTC). Asia 769 BTC 4,904 BTC (7D)

This metric shows the 30-day change in the regional price set during EU working hours, i.e. between 8am and 8pm Central European Time (07:00-19:00 UTC), respectively Central European Summer Time (06:00-18:00 UTC). Europe -11,453 BTC -8,144 BTC (7D)

This metric shows the 30-day change in the regional price set during US working hours, i.e. between 8am and 8pm Eastern Time (13:00-01:00 UTC), respectively Eastern Daylight Time (12:00-0:00 UTC). U.S. -18,854 BTC -6,261 BTC (7D)

Uncertainty causes fear for US & EU, buying opportunity for Asia

A lot of uncertainty is occurring in all markets and regions right now, and something we have alluded to in previous articles is Asia continuing to be the smart money, buying when prices are low and selling high. This week that trend continues, albeit reserved accumulation from Asia.

A new metric Glassnode released is the Year-over-Year Supply Change which aims to give an estimate for the year-over-year change in the share of the Bitcoin supply to be held/traded in Asia.

During the late 2021 bull run supply went negative (highlighted in red) and dropped as low as -4%. However, since the turn of the year, their share of supply has only grown due to suppressed prices being an opportunity to accumulate.

Layer-2

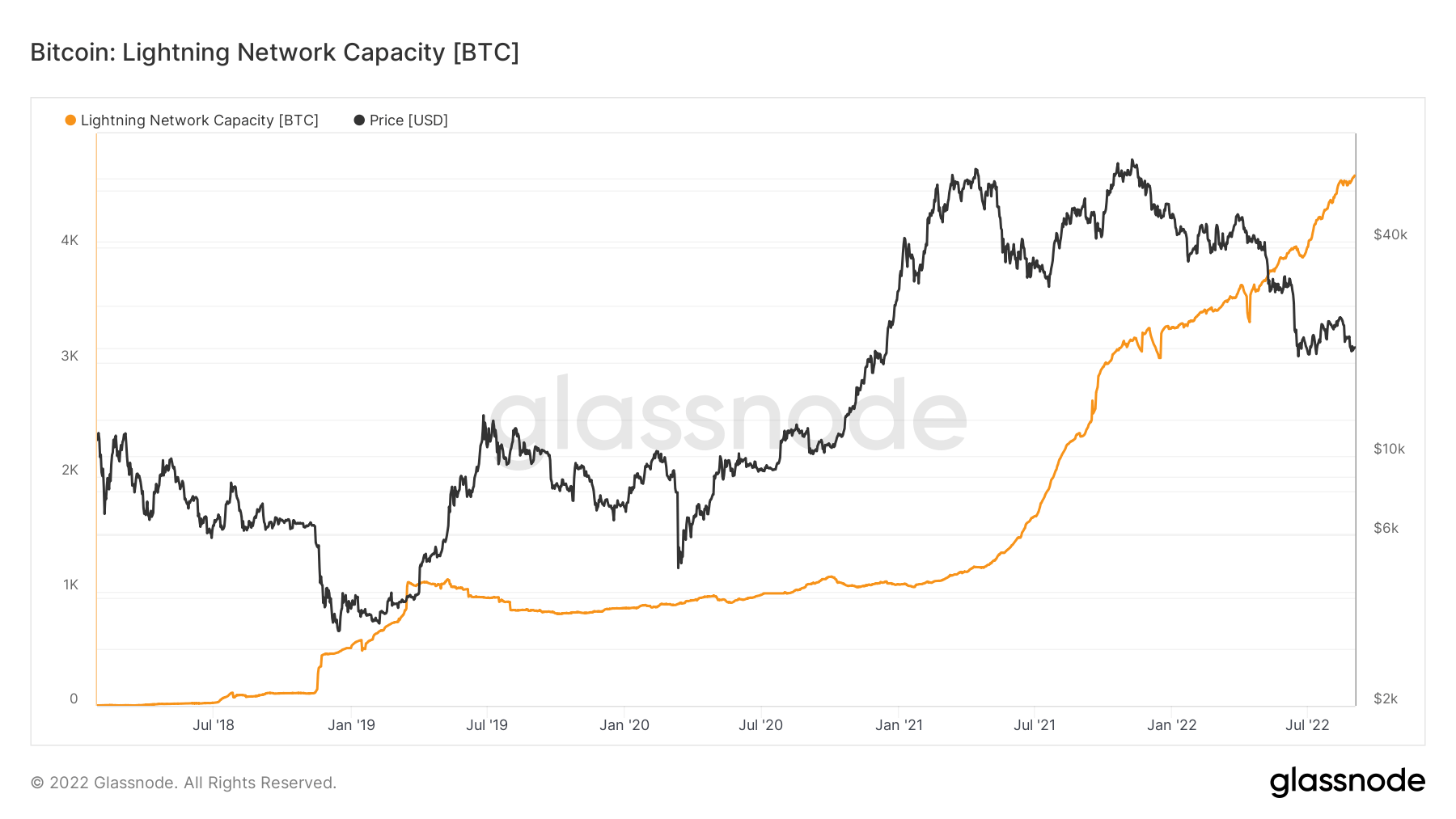

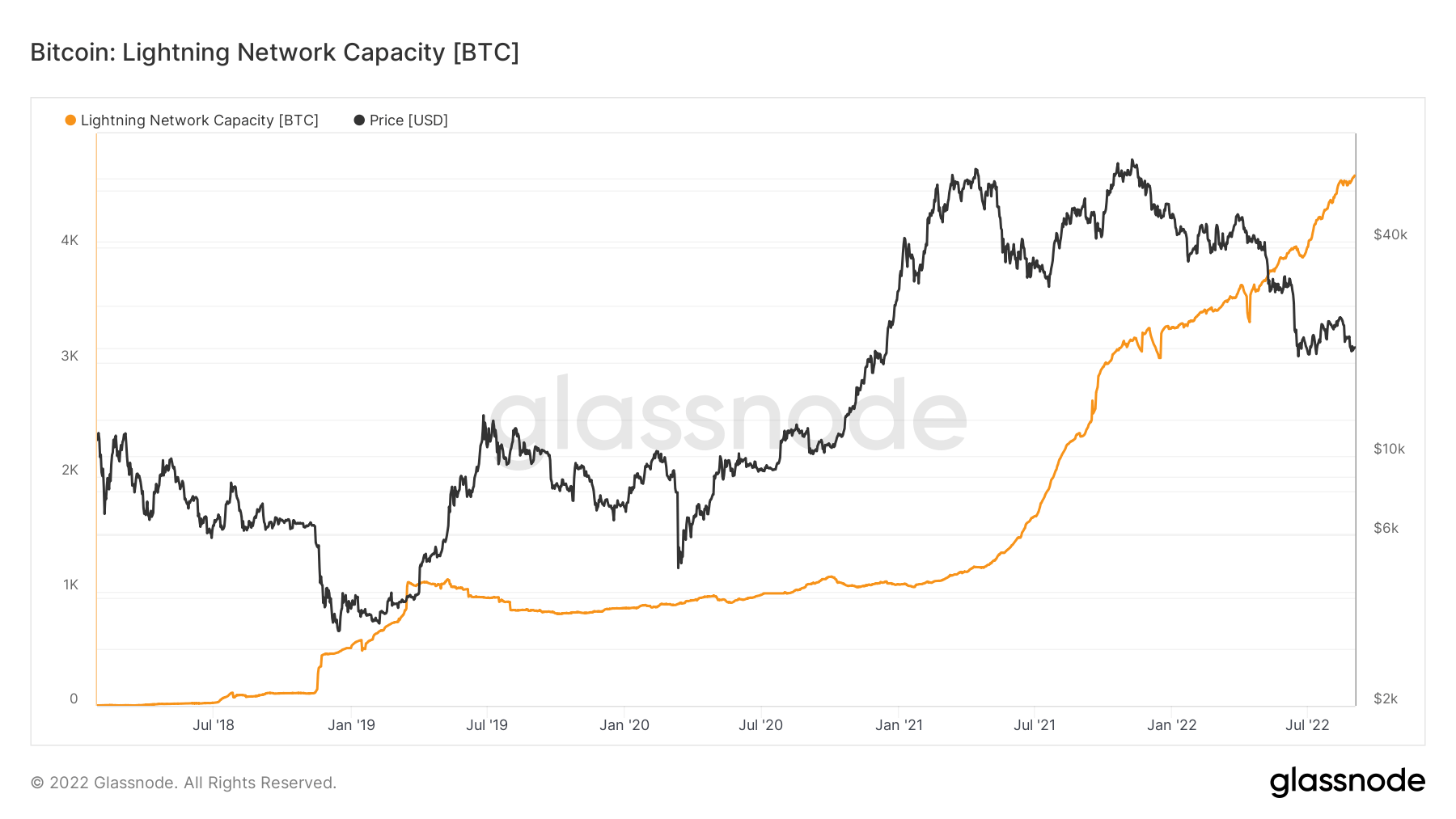

Secondary layers, such as the Lightning Network, exist on the Bitcoin blockchain and allows users to create payment channels where transactions can occur away from the main blockchain

The total amount of BTC locked in the Lightning Network. Lightning Capacity 4,683 BTC 2.12% (7D)

The number of Lightning Network nodes. No. of Nodes 17,479 0.22% (7D)

The number of public Lightning Network channels. No. of Channels 85,956 0.51% (7D)

Lightning Capacity hits all-time high

Lightning Network capacity in terms of Bitcoin adoption continues to increase and set a new all-time high of 4,631 BTC — a 4x growth in two years as capacity was roughly 1,000 BTC on Sept. 2, 2020.

Supply

The total amount of circulating supply held by different cohorts.

The total amount of circulating supply held by long term holders. Long Term Holder Supply 13.57M BTC 0.29% (7D)

The total amount of circulating supply held by short term holders. Short Term Holder Supply 3.19M BTC -1.51% (7D)

The percent of circulating supply that has not moved in at least 1 year. Supply Last Active 1+ Year Ago 66% 0.08% (7D)

The total supply held by illiquid entities. The liquidity of an entity is defined as the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is considered to be illiquid / liquid / highly liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively. Illiquid Supply 14.84M BTC 0.07% (7D)

Long-term holders continue to accumulate

Long-term holders (LTHs) have been increasing their holdings and hold an estimated 13.5 million BTC as of Sept. 5.. LTHs capitulated after the LUNA collapse but have now started to accumulate again.

in previous cycles LTHs bought when prices were suppressed and sold in the bull run, while short-term holders (STH) did the opposite. Data shows the same divergence is playing out again, with LTHs accumulating and STHs supply decreasing.

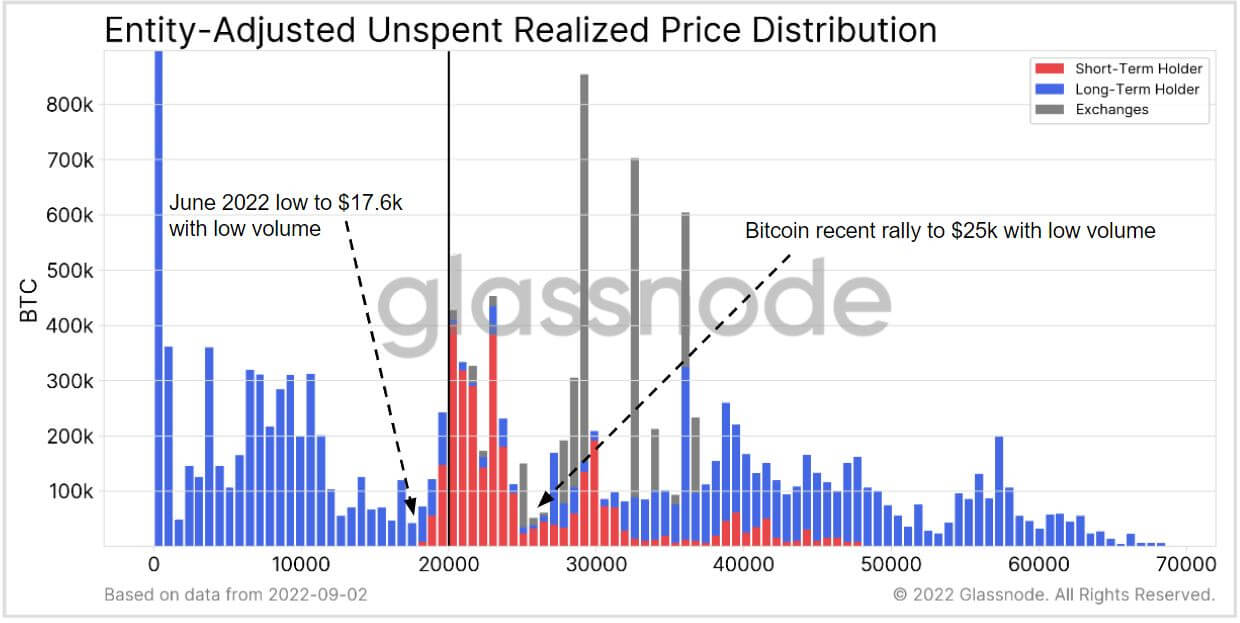

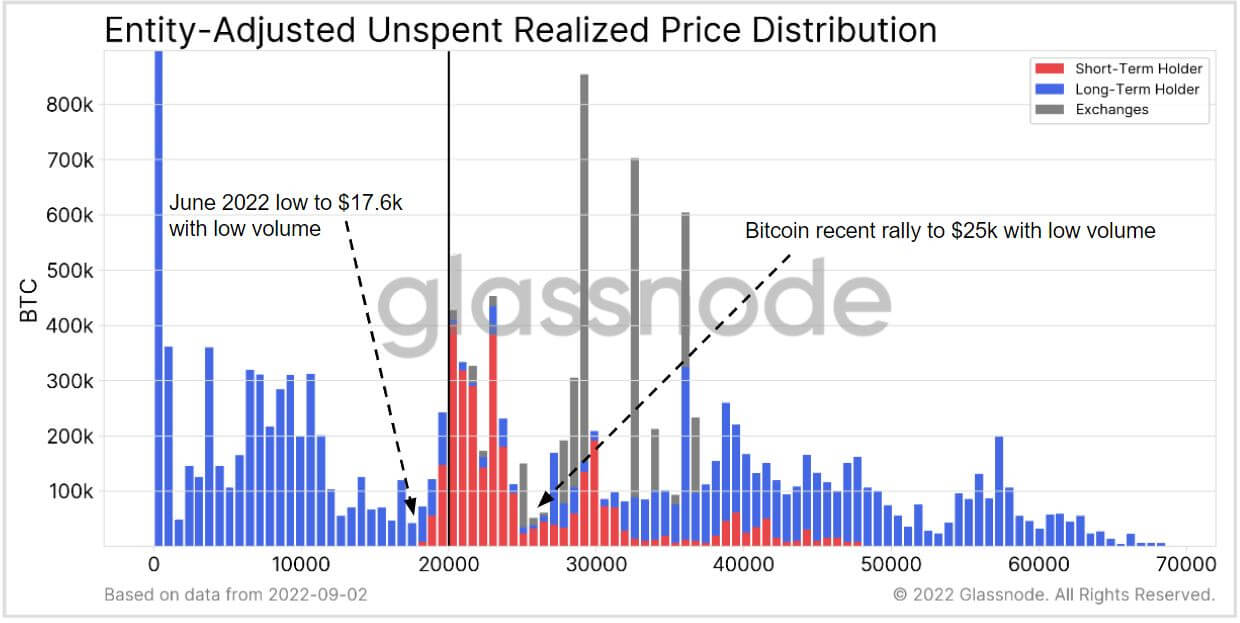

URPD Suggests Low Volume Below $20K

UTXO Realized Price Distribution (URPD) shows at which prices the current set of Bitcoin UTXOs were created, i.e. each bar shows the number of existing bitcoins that last moved within that specified price bucket.

Volume was very low when markets hit the $25,000 local resistance during the August rally. In addition, volume was also low when BTC fell to its June low of $17,600. URPD can be treated like a volume profile, with all the volume concentrated between these two areas which have been sucked up by short-term holders.

As time passes by we hope to see this volume change from STHs to LTHs and an increase in volume at these lower bound areas.

Cohorts

Breaks down relative behavior by various entities’ wallet.

SOPR – The Spent Output Profit Ratio (SOPR) is computed by dividing the realized value (in USD) divided by the value at creation (USD) of a spent output. Or simply: price sold / price paid. Long-term Holder SOPR 0.94 22.60% (7D)

Short Term Holder SOPR (STH-SOPR) is SOPR that takes into account only spent outputs younger than 155 days and serves as an indicator to assess the behaviour of short term investors. Short-term Holder SOPR 0.98 0.00% (7D)

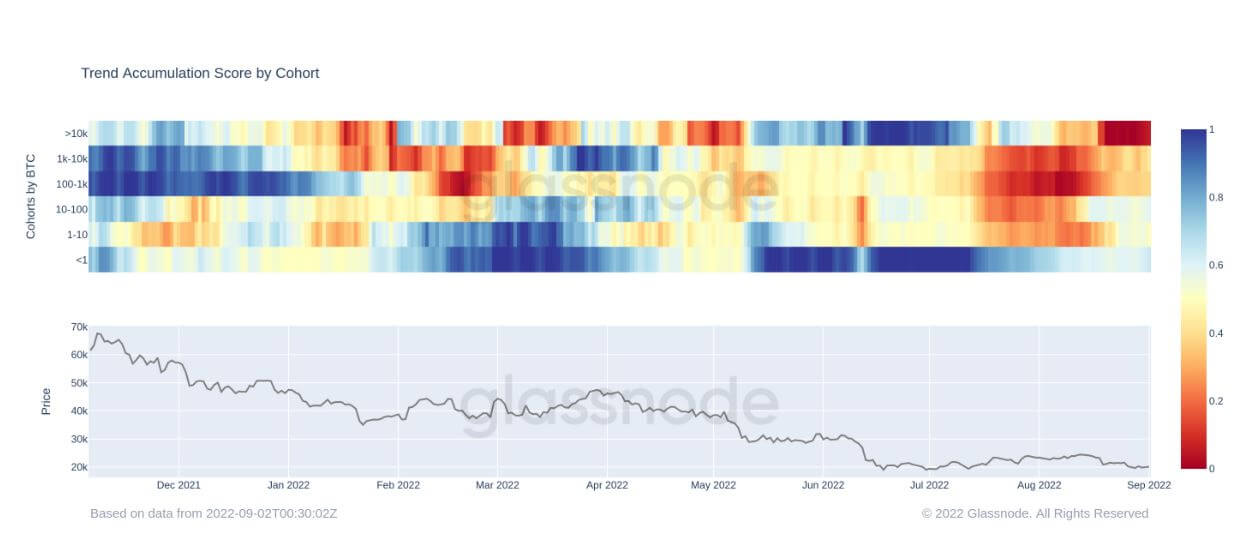

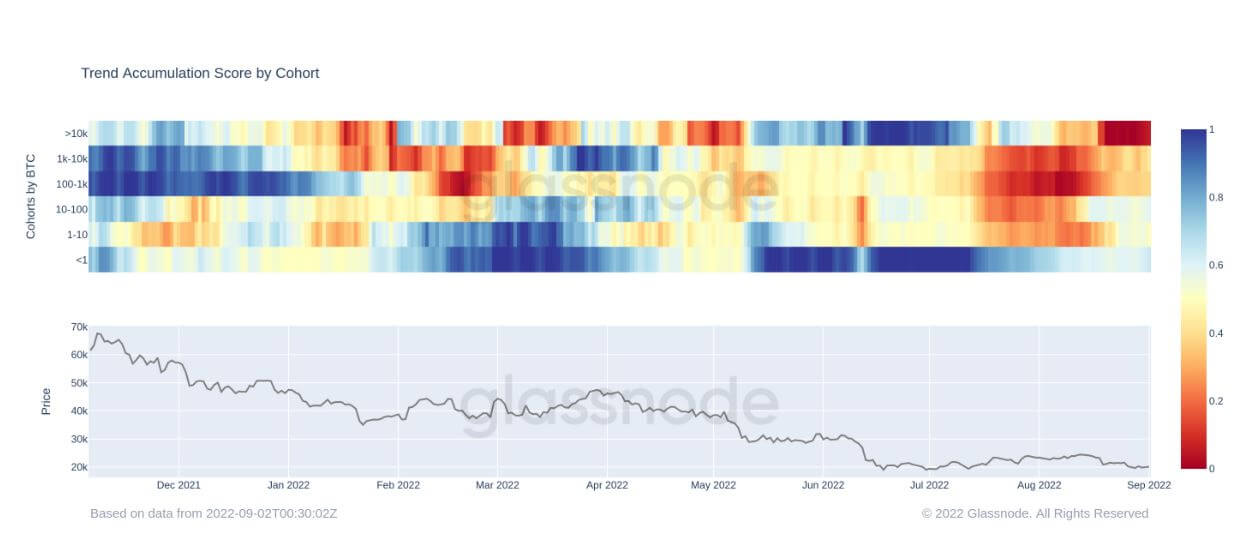

The Accumulation Trend Score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings. The scale of the Accumulation Trend Score represents both the size of the entities balance (their participation score), and the amount of new coins they have acquired/sold over the last month (their balance change score). An Accumulation Trend Score of closer to 1 indicates that on aggregate, larger entities (or a big part of the network) are accumulating, and a value closer to 0 indicates they are distributing or not accumulating. This provides insight into the balance size of market participants, and their accumulation behavior over the last month. Accumulation Trend Score 0.125 12400.00% (7D)

Whales are unloading

Accumulation Trend Score by Cohort breaks down the Accumulation Trend Score into the relative behaviour of various wallet cohorts.

The relative strength of the accumulation for each entity’s balance size is measured by both the size of the cohort, and the number of coins they have acquired over the last 15 days.

- A value closer to 1 indicates that participants in that cohort are accumulating coins.

- A value closer to 0 indicates that participants in that cohort are distributing coins.

- A list of entities including exchanges and miners, are excluded from the calculation.

Entities that have 10 thousand BTC or more have been distributing BTC at an aggressive rate, showing that whales have slowed their Bitcoin accumulation this month as they are in deep red, meaning they are massively net selling.

Other cohorts seem to be meandering around 0.5 which shows the uncertainty in the market, with investors unsure of accumulating or distributing.

Old whales moving over 5K Bitcoin

An interesting transaction occurred this week, with 7-10-year-old coins being spent almost 0.5% of the supply (roughly 5 thousand BTC), the second biggest spending from this cohort for over a year and a half. The last time this cohort spent big was in April at the peak price of $48,000 just before the Luna collapse.

These “OG Whales” have gained much experience and tend to sell or de-risk before major downsides. This cohort has seen many a “FUD”, multiple drawdowns, and fork wars. As we alluded to before, similar movements have not been good for Bitcoin’s price which is why whales are considered smart money.

Stablecoins

A type of cryptocurrency that is backed by reserve assets and therefore can offer price stability.

The total amount of coins held on exchange addresses. Stablecoin Exchange Balance $36.84B 3.8% (7D)

The total amount of USDC held on exchange addresses. USDC Exchange Balance $2.82B -1.76% (7D)

The total amount of USDT held on exchange addresses. USDT Exchange Balance $16.69B 3.8% (7D)

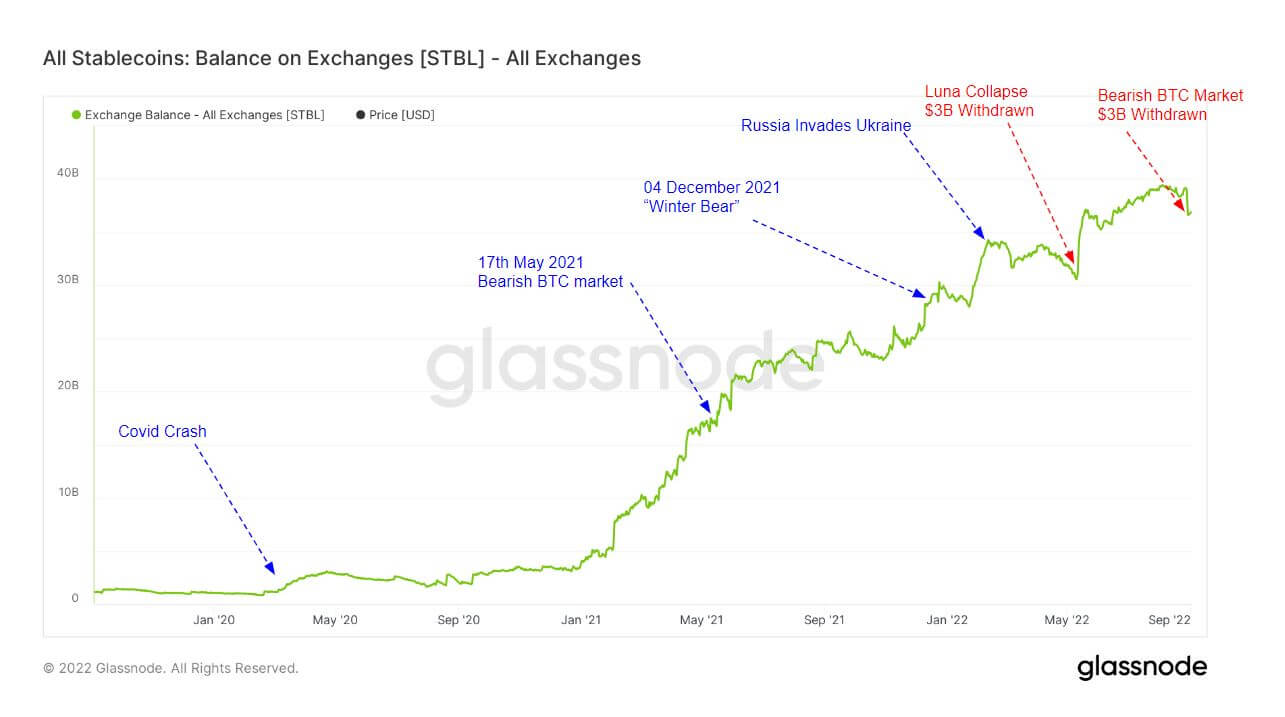

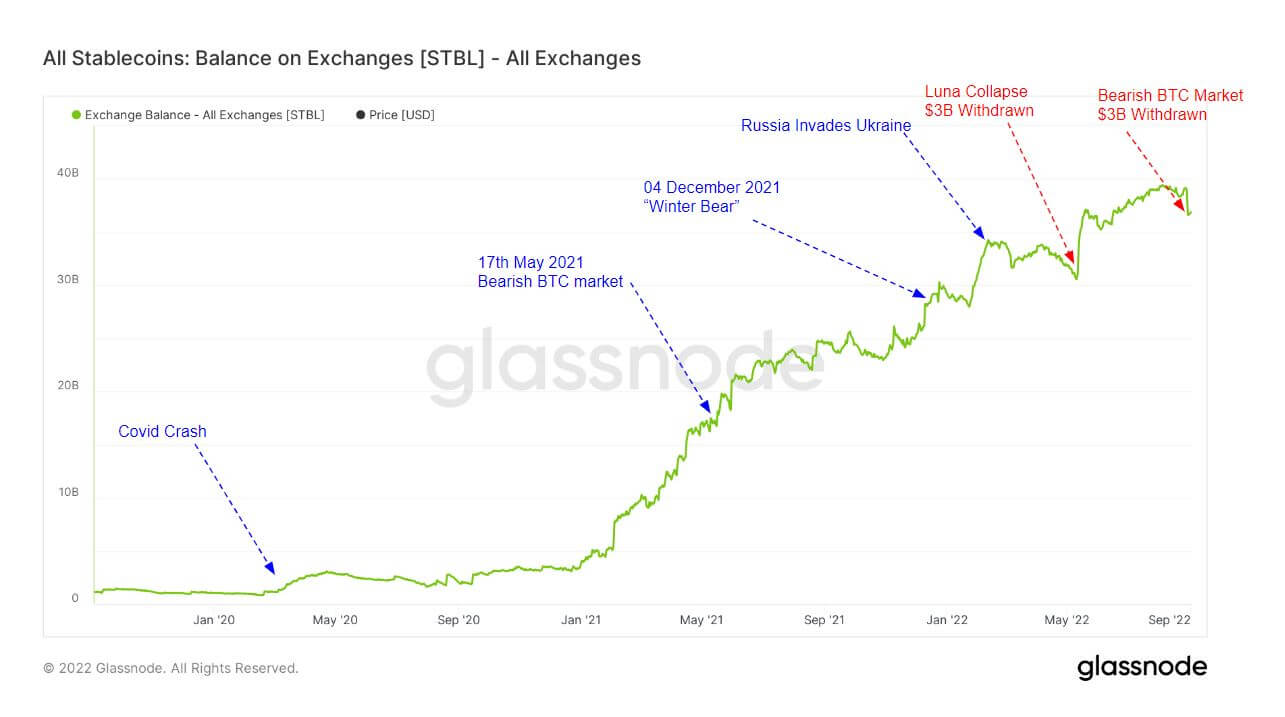

Over $40B in stablecoins ready to be spent

With over $40 billion in stablecoin sitting on exchanges waiting to be spent, a recovery could potentially materialize quickly in BTC. While billions in value available in stablecoin can be viewed as bullish for the entire crypto market — it does not mean that this value will flow directly back into BTC when the market goes risk-on again.

(*The chart above only accounts for the following Stablecoins: BUSD, GUSD, HSUD, DAI, USDP, EURS, SAI, sUSD, USDT, USDC)

$1B per day left Binance’s USDC hot wallets this week.

More than $3 billion in stablecoins was withdrawn from the balance on exchanges which is a considerable amount. The last time such an event occurred was during the collapse. Further analysis reveals that over $1 billion USDC left Binance hot wallets per day this week.

Comments (No)