Brian Shroder, the president and CEO of Binance US, received a federal letter requesting the urgent disclosure of official documents that prove the exchange’s adherence to various investor-centric safety protocols. The request comes from a Subcommittee chairman under the United States House Committee on Oversight and Government Reform.

In the letter addressed to Shroder, Congressman Raja Krishnamoorthi from the Subcommittee on Economic and Consumer Policy highlighted the lack of participation from crypto exchanges in helping the US government curb financial fraud and protect investors, stating:

“I am concerned by the rapid growth of fraud and consumer abuse. I am also concerned by the apparent lack of action by cryptocurrency exchanges to protect consumers conducting transactions through their platforms.”

Krishnamoorthi showed skepticism in the vetting process that goes behind listing tokens on crypto exchanges, which ultimately increases the risks for the investors. Binance US, being a subsidiary of the biggest crypto exchange Binance, was reached out by the Subcommittee for producing various documents — in an attempt to help review the depth of their aforementioned concerns.

Binance US will require to produce all requested documents since it began operation and has been given a deadline of less than two weeks, Sept. 12, 2022, to produce the same, as shown below.

Speaking on behalf of the US Congress, Krishnamoorthi reiterated that crypto exchanges must take proactive measures to ensure investor safety “By implementing audit policies, requiring certain disclosures, delisting, and adopting other safety mechanisms.”

In addition to the documents, Shroder has also been asked to answer questions disclosing the tools and mechanisms implemented by the exchange to reduce risks, fraud and scams.

Related: Congress will likely decide the fate of crypto jurisdiction — Lummis staffer

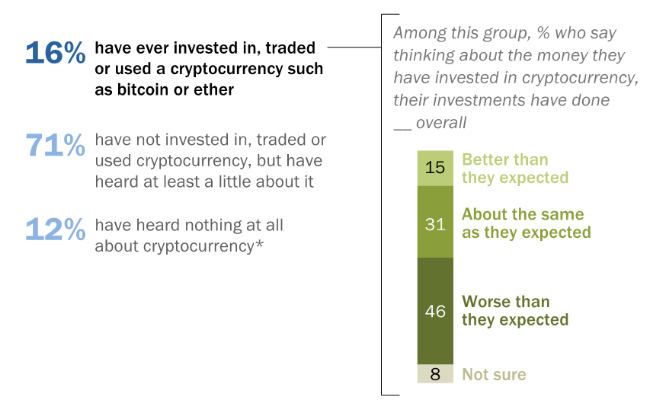

A recent survey revealed that 46% of adult crypto users in the United States witnessed loss in investments amid the ongoing crypto winter.

A vast majority of the respondents tried investing in cryptocurrency while looking for a “different way to invest,” and thought it was a “good way to make money.”

Comments (No)