The Ethereum Name Service (ENS) has reached a milestone of 2 million “.ETH” addresses minted. The landmark comes just three and half months after the service reached 1 million addresses.

ENS addresses allow users to link a human-readable domain ending in “.ETH” to their wallets. Domains such as “beer.eth” can be used to send crypto on compatible chains removing the need for QR codes or hard-to-remember public addresses. Users can purchase an NFT via ens.domains for 0.003ETH, which can then be traded or linked to a wallet to act as the deposit address.

2m ENS names created!! 🎉

it took 5 years to get to 1m names

then 3.5 months to get to 2m namesand we’re just getting started 🚀 pic.twitter.com/BFPUmjqzhB

— ens.eth (@ensdomains) August 17, 2022

According to data from Nansen, 92% of sales come from the ENS Registrar Controller, and 7.5% are sold on OpenSea. Many addresses were minted in February 2020, with several wallets minting over tens of thousands of addresses.

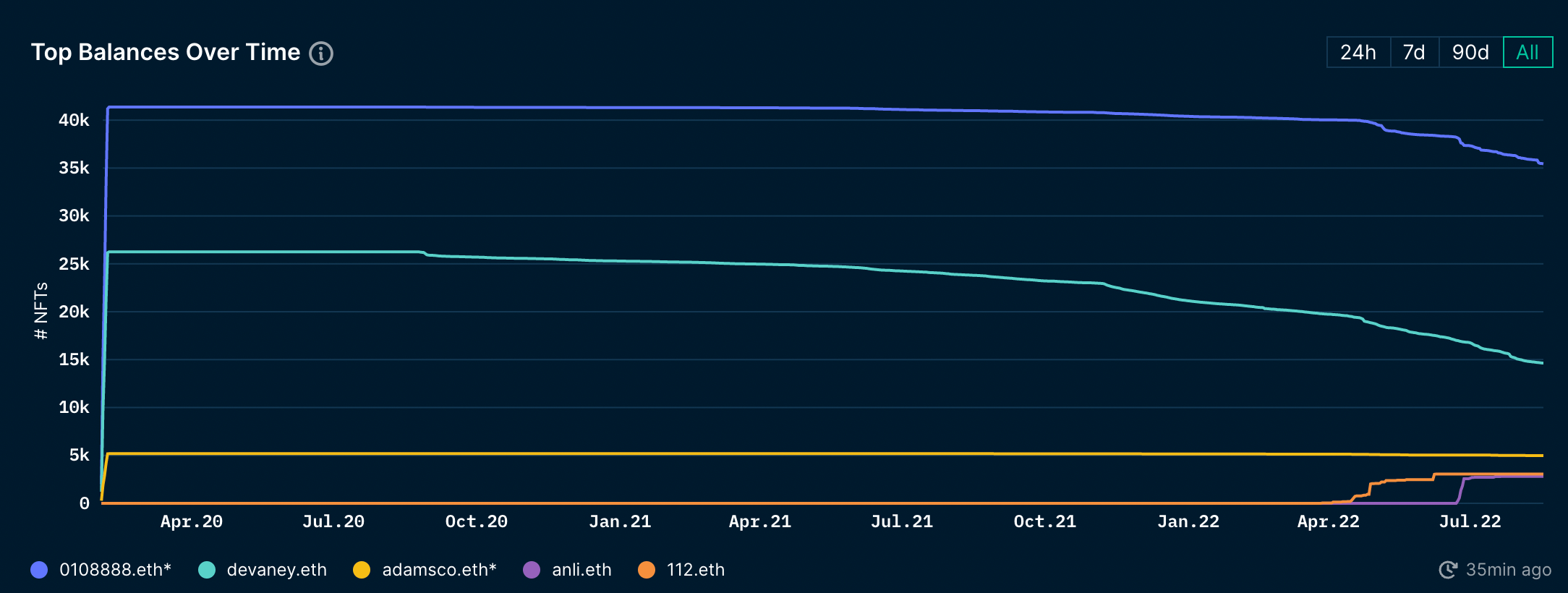

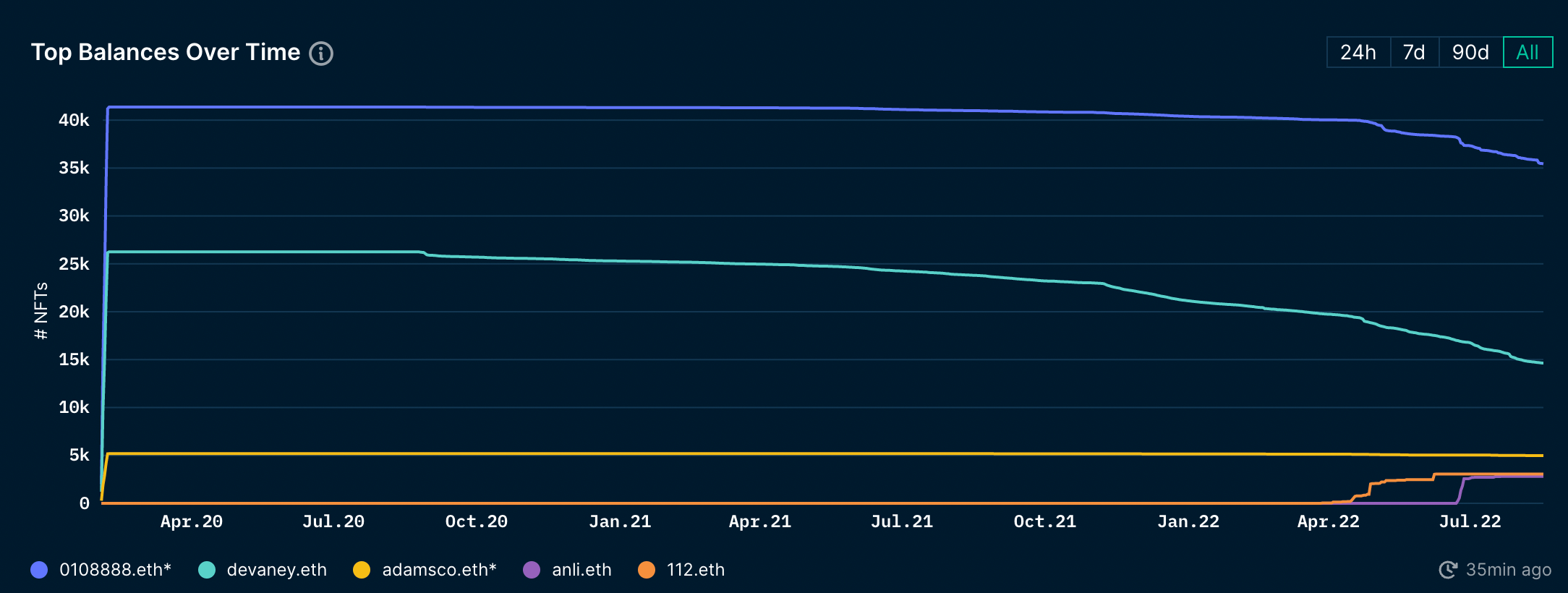

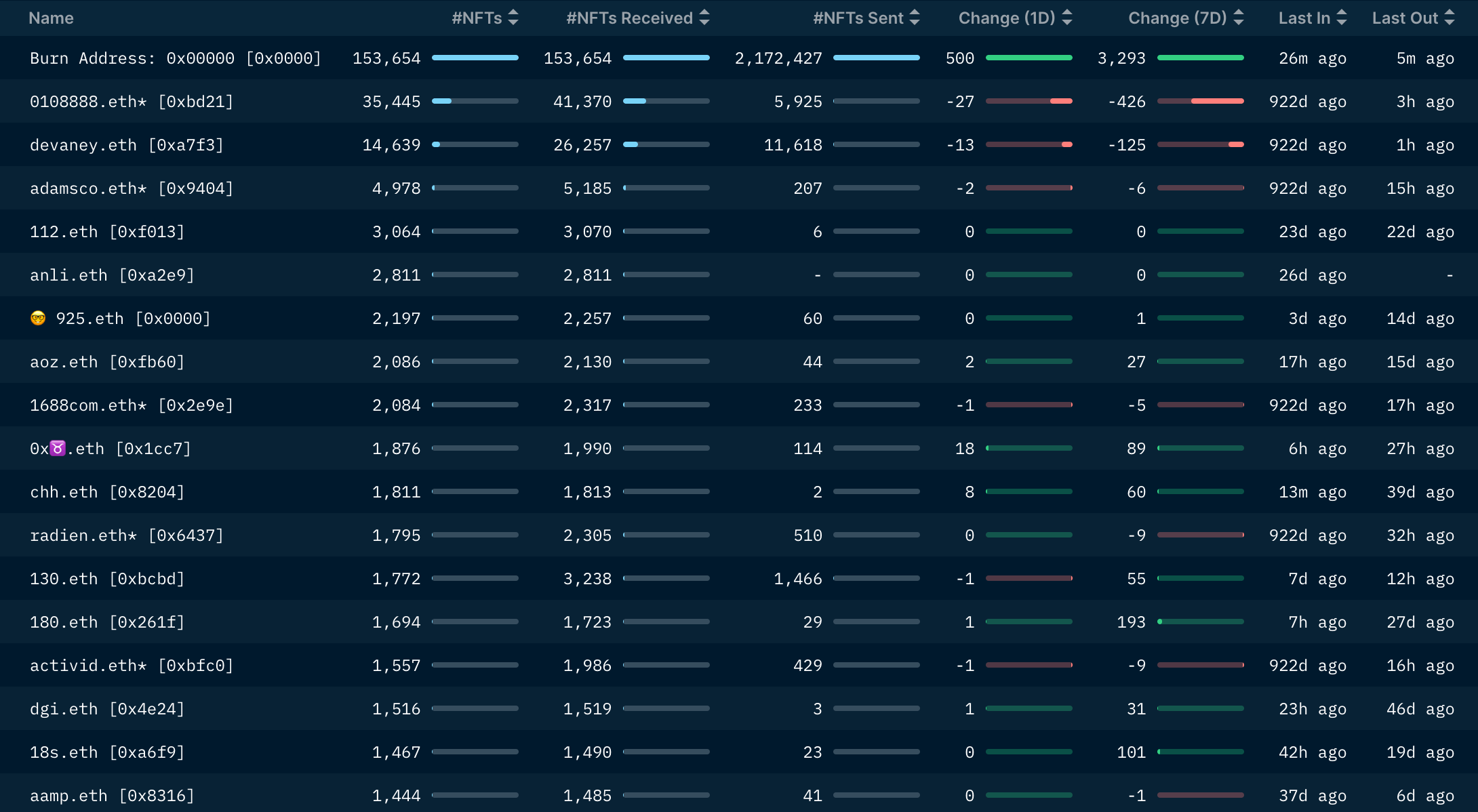

0108888. eth and devaney.eth minted 77.5k thousand addresses between them by February 12, 2020. However, both wallets are allowing the addresses to expire, as there’s been a decline in ENS addresses held since February 2022.

At 0.0017ETH per address (the original mint price), the total cost to mint the 77.5k addresses calculates to 131 ETH or $23,846 using the price of Ethereum from February 2020. From reviewing Etherscan data for each wallet, it seems none of these addresses have ever been sold.

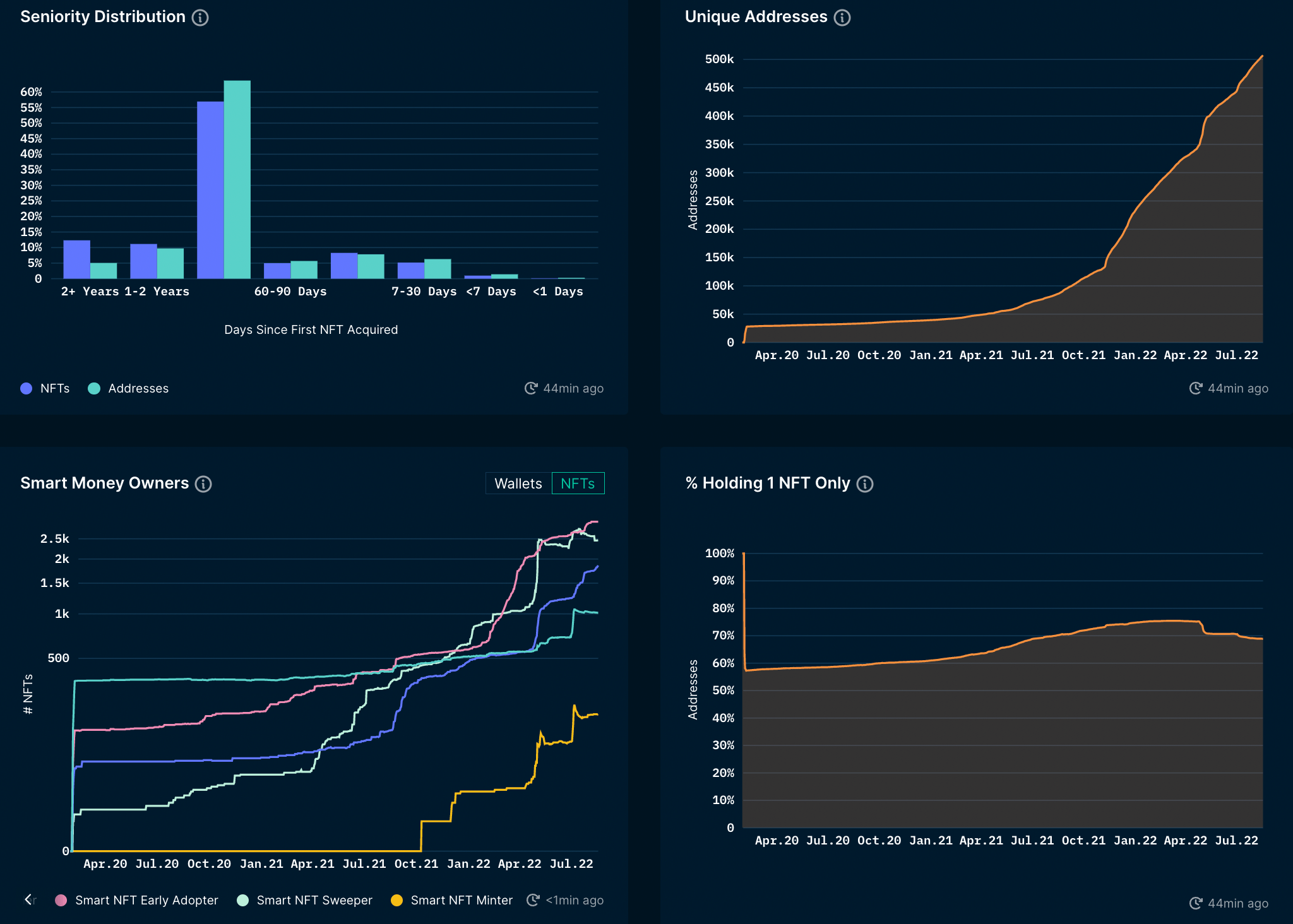

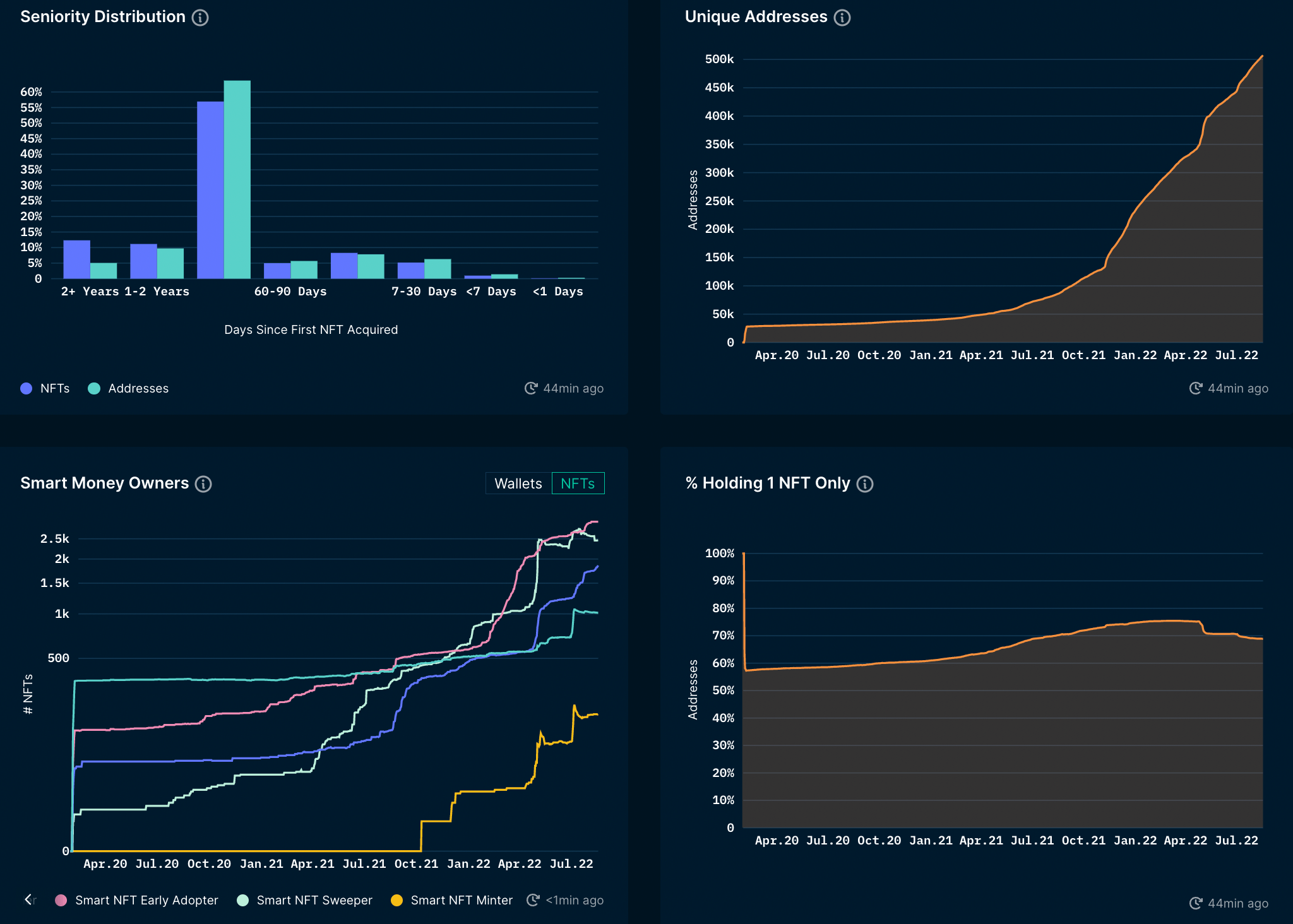

Aside from the outsized mints in early 2020, there has been a broad distribution of ENS addresses with 500k unique addresses. Further, over 60% of addresses have not moved in over 90s days suggesting owners are HODLing premium addresses or taking advantage of the utility of the NFTs by linking to a wallet address.

According to data from Nansen, roughly 70% of ENS address holders do not own any other NFTs. Most ENS owners are thus not interacting with the broader NFT marketplace. While tracked on platforms such as OpenSea and LooksRare, ENS volume is uncorrelated with the NFT market.

Another statistic tracked by Nansen is the flow of “smart money” in a given NFT project. Smart money, defined by wallets tagged as either high net worth, high volume, or a known, institutional entity, started minting ENS addresses in October 2021. Smart money volume has been surging since late 2021, with early NFT adopters owning the most significant number of addresses.

The table below showcases the top ENS address holders sorted by the number of NFTs in their wallets. As seen in the first row, the burn address holds 153k ENS addresses as “.ETH” domains are rented rather than owned. A user purchases the rights to use a specific “.ETH” domain for a period of time starting at one year.

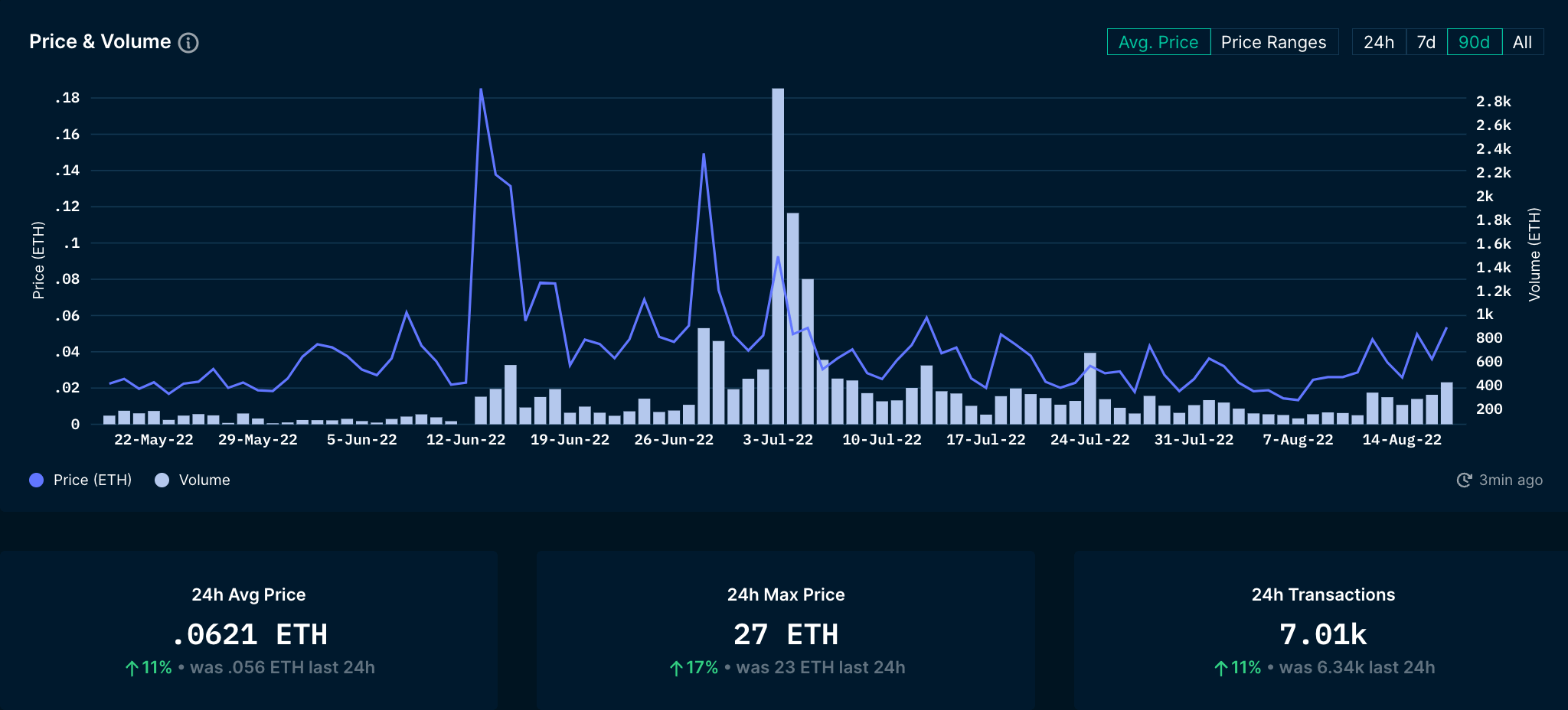

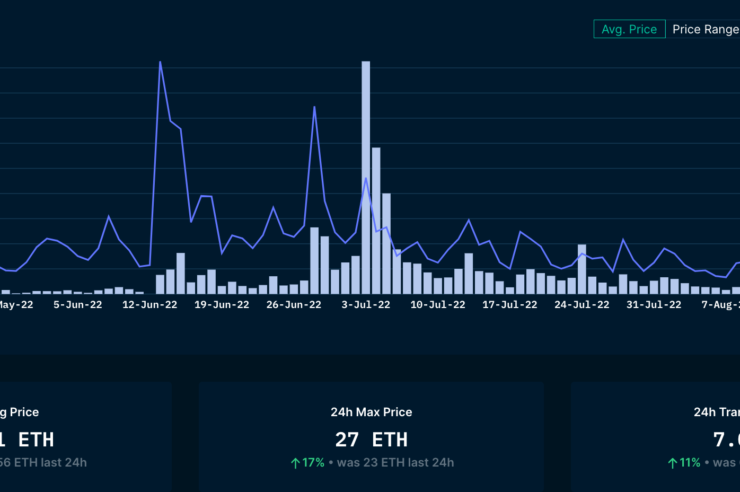

Volume across all NFT marketplaces spiked in July and has maintained a volume of 200 – 600 ETH per day ever since. Currently, the average sale price for an ENS address is 0.06 ETH, a 20x on the mint price.

ENS addresses can be used for multiple blockchains, including Ethereum, Bitcoin, Litecoin, and Doge. It can also be used to host IPFS websites and attach a profile picture for use across web3 sites and dApps. With many investors, brands, and celebrities jumping on the ENS bandwagon, the future is bright for the premier blockchain naming service. NFT utility is one of the biggest trends of 2022, and no NFT has a tremendous real-world utility than ENS.

Comments (No)